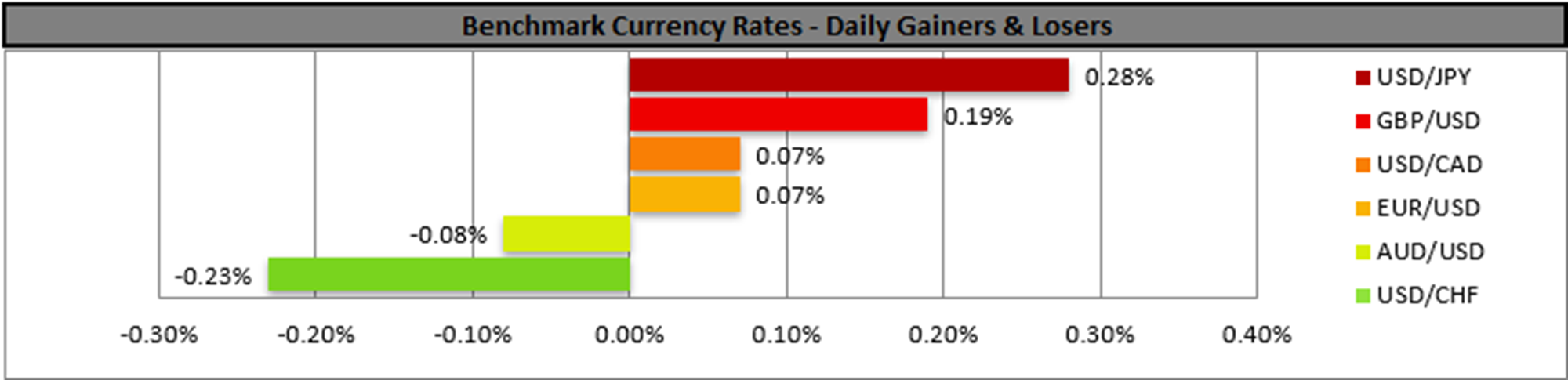

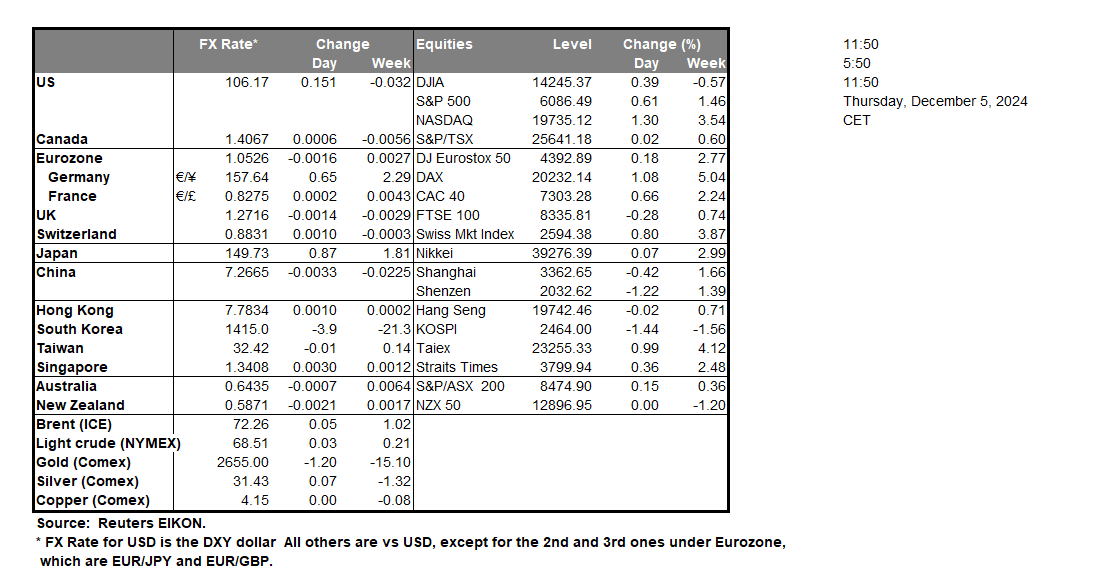

The USD edged lower against its counterparts yesterday and during today’s Asian session. In yesterday’s American session, the ADP national employment figure came in lower than expected for November implying a looser US employment market, just ahead of the release of November’s US employment report with its NFP figure. As for economic activity in the US economy despite the factory orders growth rate accelerating for October, the ISM non-manufacturing PMI figure dropped beyond expectations, signaling a substantial slowdown in the expansion of economic activity in the US services sector. On the monetary front, Fed Chairman Powell highlighted yesterday that the US economy is “remarkably strong“ and that the Fed can “afford to be more cautious as it lowers rates”, in a more hawkish note. The Fed Chairman also looked confident for the independence of the Fed under Trump, while also supporting the idea that Bitcoin is not antagonizing the Dollar but acts more like a digital gold, which may have attributed to Bitcoin’s rise. Yet the main issue pushing the crypto’s price over the $100k mark may have been Trump’s intentions to appoint Paul Atkins, a vocal crypto advocate, as head of the SEC. Overall we see the case for further deregulation of the markets with special favoring of the crypto market, supporting cryptos.

Elsewhere in the FX market we note that in Japan, BoJ Board Member Nakamura expressed some caution regarding the bank’s rate-hiking path. The issue could weigh on the JPY as it contradicts market expectations for the Bank to deliver a rate hike of 25 basis points in the December meeting.

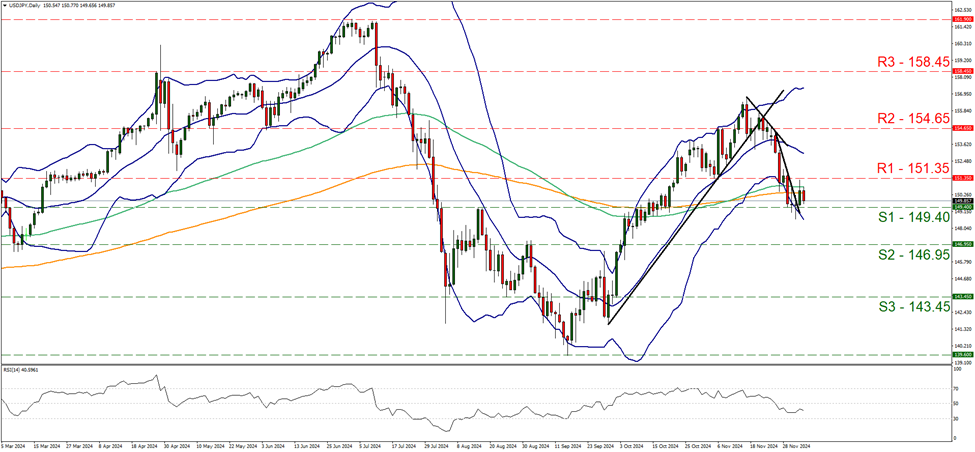

On a technical level, USD/JPY yesterday verified the boundaries of its sideways motion between the 151.35 (R1) resistance line and the 149.40 (S1) support level. Hence we maintain our bias for the sideways motion to continue within the prementioned boundaries. The RSI indicator remains below the reading of 50, implying possibly a bearish predisposition of market participants for the pair. For a bearish outlook we would require the pair to break the 149.40 (S1) line clearly and start aiming for the 146.95 (S2) level. Should the bulls take over, we may see USD/JPY, breaking the 151.35 (R1) level, opening the gates for the 154.65 (R2) base.

In Europe, the political instability in France seems to be deepening as the French government collapsed yesterday, plunging the Euro Zone as a whole, into deeper political chaos. We may see the political instability in the Euro Zone, given that the German government also collapsed last month, weighing on the EUR.

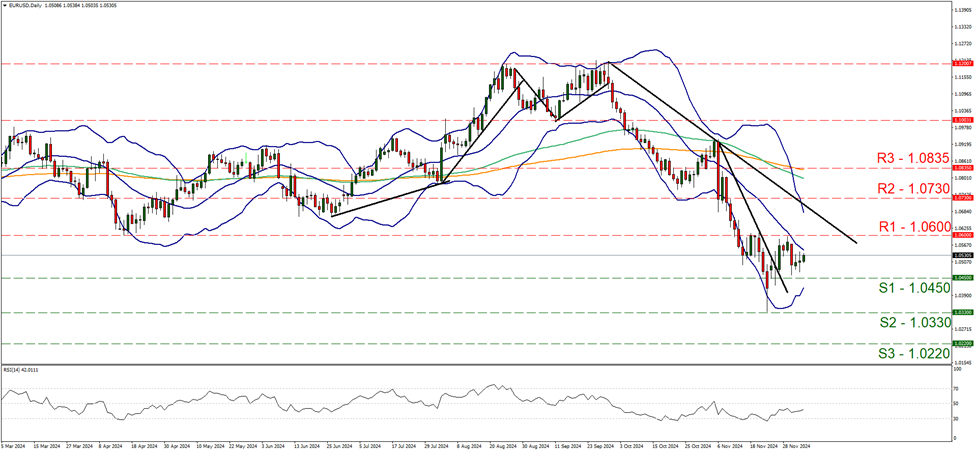

We recalibrated EUR/USD’s resistance and support levels to better reflect the possible targets to the upside and downward of the pair’s price action. For the time being we note that EUR/USD remains well between the 1.0600 (R1) resistance line and the 1.0450 (S1) support level, despite some slight upward movement in the past three days. As long as the prementioned levels are respected by the pair’s price action we tend to expect he rangebound motion to be maintained. On the other hand the RSI indicator remains below the reading of 50, implying the residue of a bearish sentiment among market participants for the pair. Should the bears take over, we may see the pair breaking the 1.0450 (S1) support line and aiming for the 1.0330 (S2) support level. If the bulls take over, we may see EUR/USD not breaching the 1.2845 (R1) resistance level and taking aim of the 1.0730 (R2) resistance barrier.

その他の注目材料

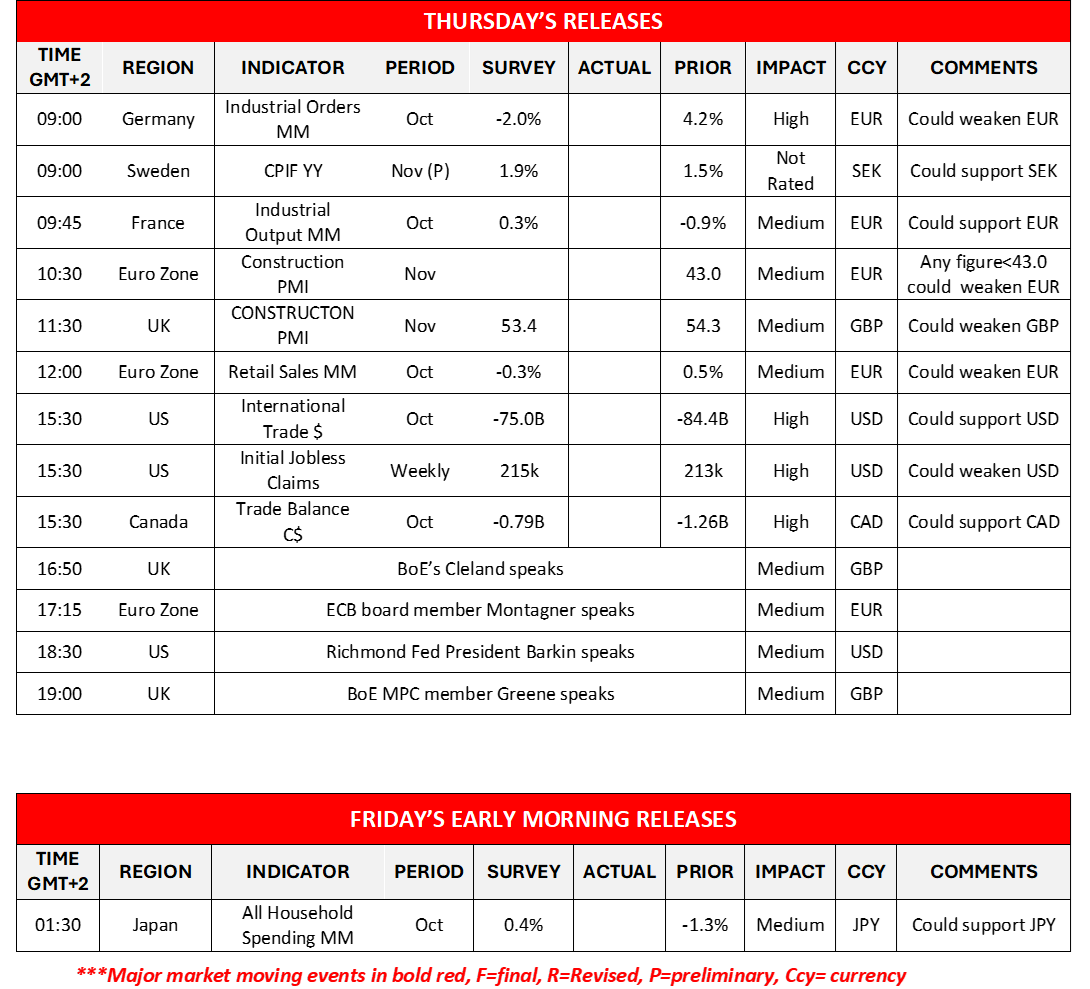

Today, in the European session, we note the release of Germany’s October industrial orders, Sweden’s preliminary CPI rates for November, France’s industrial output for October, UK’s and Euro Zone’s construction PMI figures for November and Euro Zone’s retail sales for October. In the American session, we note the release of the US and Canada’s trade balance for October and the US weekly initial jobless claims figure.

USD/JPY Daily Chart

- Support: 149.40 (S1), 146.95 (S2), 143.45 (S3)

- Resistance: 151.35 (R1), 154.65 (R2), 158.45 (R3)

EUR/USD デイリーチャート

- Support: 1.0450 (S1), 1.0330 (S2), 1.0220 (S3)

- Resistance: 1.0600 (R1), 1.0730 (R2), 1.0835 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。