Major US stock market indexes appear to be moving in an upwards fashion as we near the end of 2024. Today we are to discuss Intel’s recent troubles, the recent announcements by China and the upcoming US employment data on Friday. For a rounder view we are to conclude the report with a technical analysis of S&P 500’s daily chart.

Intel ousts CEO

Intel’s (#INTC) has ousted it’s CEO Pat Gelsinger after the board lost confidence in the CEO’s plans to turn around the troubled chipmaker according to a report by Bloomberg. The decision according to the aforementioned report, was made when Gelsinger met with the board to discuss the company’s progress on winning back market share and narrowing the gap with Nvidia (#NVIDIA), which appears to have left the board unsatisfied which in turn resulted in his resignation. Nonetheless, the company now faces a difficult choice as they search for a new CEO, who would be facing a significant challenge ahead just like their predecessor. Overall the market reaction to Gelsinger stepping down, appears to have weighed on the company’s stock price and thus should the company’s CEO pick fail to satisfy investors, it could further weigh on Intel’s stock price. Whereas, should the company appoint a CEO which inspires confidence to investors, it may have the opposite effect. Yet we should note that the search for a CEO has just begun and with numerous names being floated around as potential successors, it may be difficult to gauge the impact of each candidate on the stock price, until the list has narrowed down. In conclusion, our view is that Intel requires a CEO who has the technical know-how and industry credibility to lead the chipmaker to greener pastures.

Tit-for-Tat as China warns against US chips

China has banned shipments to the US of several minerals and metals which are used in semiconductor manufacturing and military applications, in an apparent retaliation from Beijing following new export controls from Washington. Moreover per the FT, the China Semiconductor Industry Association, stated that “US chip products are no longer safe or reliable and relevant Chinese industries should be cautious in procuring US chips”. The statement by the association may reflect the Chinese’s governments desire to retaliate against the US, in a move that could impact sales in China from NVIDIA(#NVIDIA) and Intel (#INTC). In turn, we would not be surprised to see China and the US sizing up to one another, as the incoming administration has made it clear that tariffs are coming. Thus, with tit-for-tat measures, companies who are reliant on sales in China, such as Nvidia (#NVIDIA) and Intel (#INTC) could see their stock prices being negatively impacted.

US Employment Data due out on Friday

The US employment data for November is set to be released this Friday and as always, the NFP and Unemployment rate may take center stage. The expectations by economists are for the Non-Farm-Payrolls figure to come in at 202k , vastly exceeding last month’s disappointing figure of 12k, and for the unemployment rate to tick up to 4.2% from 4.1%. Setting aside the NFP figure, the expected uptick in the unemployment rate may amplify calls for the Fed to cut interest rates in their last meeting of the year, as it may imply a loosening labour market. Moreover, the US employment data could also dictate the narrative emerging from Fed policymakers leading up to their meeting on the 17 of December and thus could have ripple effects in the following week as well. However, should the unemployment rate come in as expected it may aid US Equities markets under the guise of a more dovish Fed, which may be expected by market participants to further ease the financial conditions surrounding the US economy. On the other hand, should the unemployment rate come in lower than expected, implying a resilient labour market, it may heighten worries about the Fed maintaining interest at their current levels for a prolonged period of time. In turn, such a scenario could weigh on US Equities market. Overall, as we have stated before, the final employment data for the year may set the tone heading into next year and thus any deviations and their positive or negative implications on the US Equities markets may be amplified by market participants.

テクニカル分析

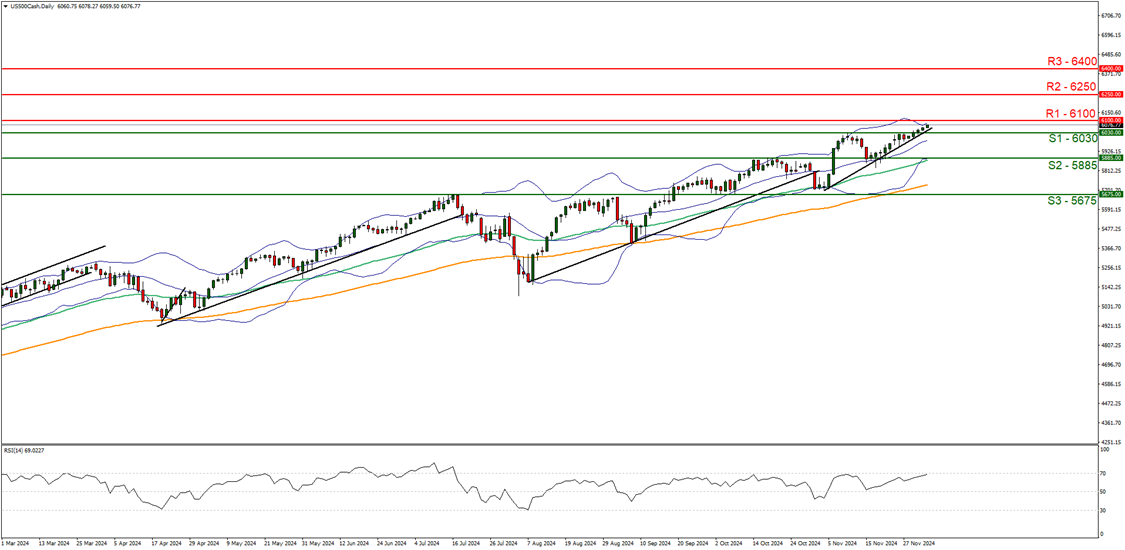

US500 Daily Chart

- Support: 6030 (S1), 5885 (S2), 5675 (S3)

- Resistance: 6100 (R1), 6250 (R2), 6400 (R3)

For US equities we note that the index continues to form new-all time highs, and appears to be moving in an upwards fashion as we near the end of 2024. We opt for a bullish outlook for the index and supporting our case is the RSI indicator which currently registers a figure just shy of 70, implying a strong bullish market sentiment in addition to the upwards moving trendline which was incepted on the 4 of November. For our bullish outlook to continue we would require a clear break above the potential 6100 (R1) resistance level, with the next possible target for the bulls being the 6250 (R2) resistance line. On the flip side, for a bearish outlook we would require a clear break below the 6030 (S1) support level, in addition to a clean break below our aforementioned upwards moving trendline with the next possible target for the bears being the 5885 (S2) support line. Lastly, the case for a sideways bias is impractical as our S1 support level and the R1 resistance line are fairly close to one another. Nonetheless, for a sideways bias we would require the index to remain confined between the six thousand and thirty support level and the six thousand one hundred possible resistance line.

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。