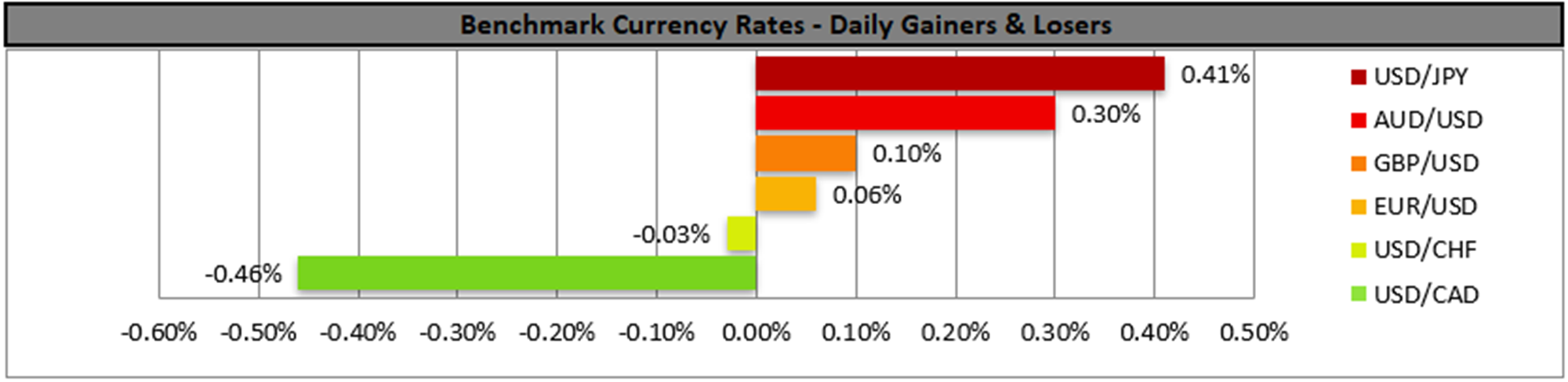

The USD edged lower against its counterparts yesterday with the USD Index reaching a one-week low, yet the downward motion seems to have been temporarily halted in today’s Asian session. We expect the USD to continue to be moved primarily by fundamentals given the low number of high-impact financial releases for the US. On the monetary front the Fed seems to be in no hurry to cut rates, which may prove to be supportive for the USD, while the Trump trade traction seems to have eased, yet US President-elect Donald Trump could create mayhem in the markets at any given moment.

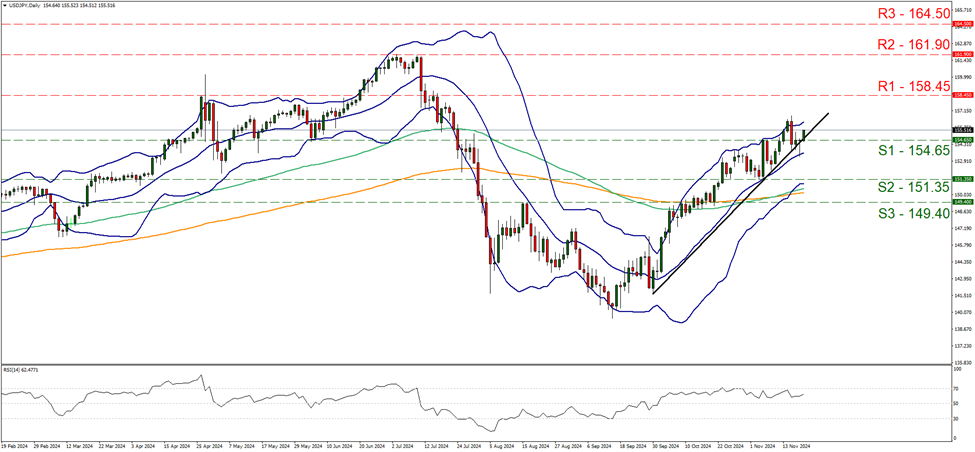

Against the JPY, the USD strengthened as USD/JPY lifted from the 154.65 (S1) support line. In its upward movement the pair practically verified once again the upward trendline guiding the pair since the 30 of September, hence our bullish outlook is preserved for the time being. Also please note that the RSI indicator remains between the readings of 50 and 70, implying a bullish predisposition of the market for the pair. Should the bulls maintain control we expect a higher peak than the last one on the 15 of November, to be formed and set the next target USD/JPY bulls at the 158.45 (R1) resistance line. A bearish outlook at the current stage seems to be remote and for its adoption we would require the pair to reverse direction break the prementioned upward trendline in a first signal that the upward movement has been interrupted, break the 154.65 (S1) support line and start aiming for the 151.35 (S2) support level.

As for US stock markets we turn our attention to the mega-market cap high-tech company NVIDIA, which is to release its earnings report next Wednesday. Overall expectations for the EPS and revenue figures seem to be improving the company’s economic outlook and if realised or surpass forecasts, we may see the company’s share price getting some support. We also intend to keep a close eye on the company’s forward guidance.

North of the US border the Loonie was supported by the release of Canada’s CPI rates for October, which showed an unexpected acceleration of both the headline and core rate. The acceleration may ease the dovishness of the BoC, yet for the time being we note that the market’s wide expectations for another rate cut in the December meeting remain unchanged.

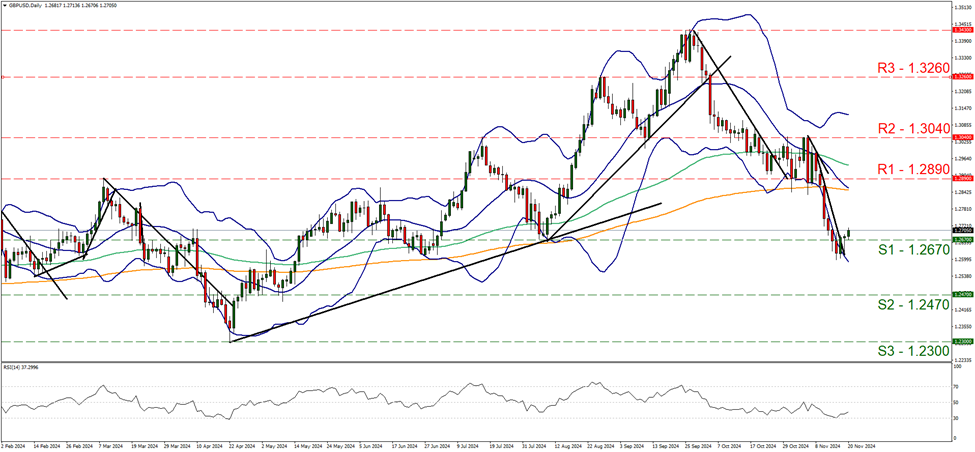

Across the Atlantic the pound got renewed support during today’s early European session, as the UK October CPI rates accelerated beyond market expectations both at a core and headline level. We see the case for the release altering BoE’s agenda possibly reinforcing any intentions for extensive easing of the monetary policy and note that the market’s expectations for the bank to remain on hold in the December meeting are dominant.

On a technical level, cable found renewed support, lifting from the 1.2670 (S1) support line. Yet the upward movement tends to remain unconvincing and given that the pair’s price action on Monday, has broken the downward trendline guiding it since the 6 of November, we maintain a bias for a sideways motion. Should the bears renew their dominance over the pair’s direction breaking the 1.2670 (S1) support line and taking aim of the 1.2470 (S2) support level. Should the bulls be in charge of GBP/USD’s direction we may see the pair aiming if not reaching the 1.2890 (R1) resistance line.

その他の注目材料

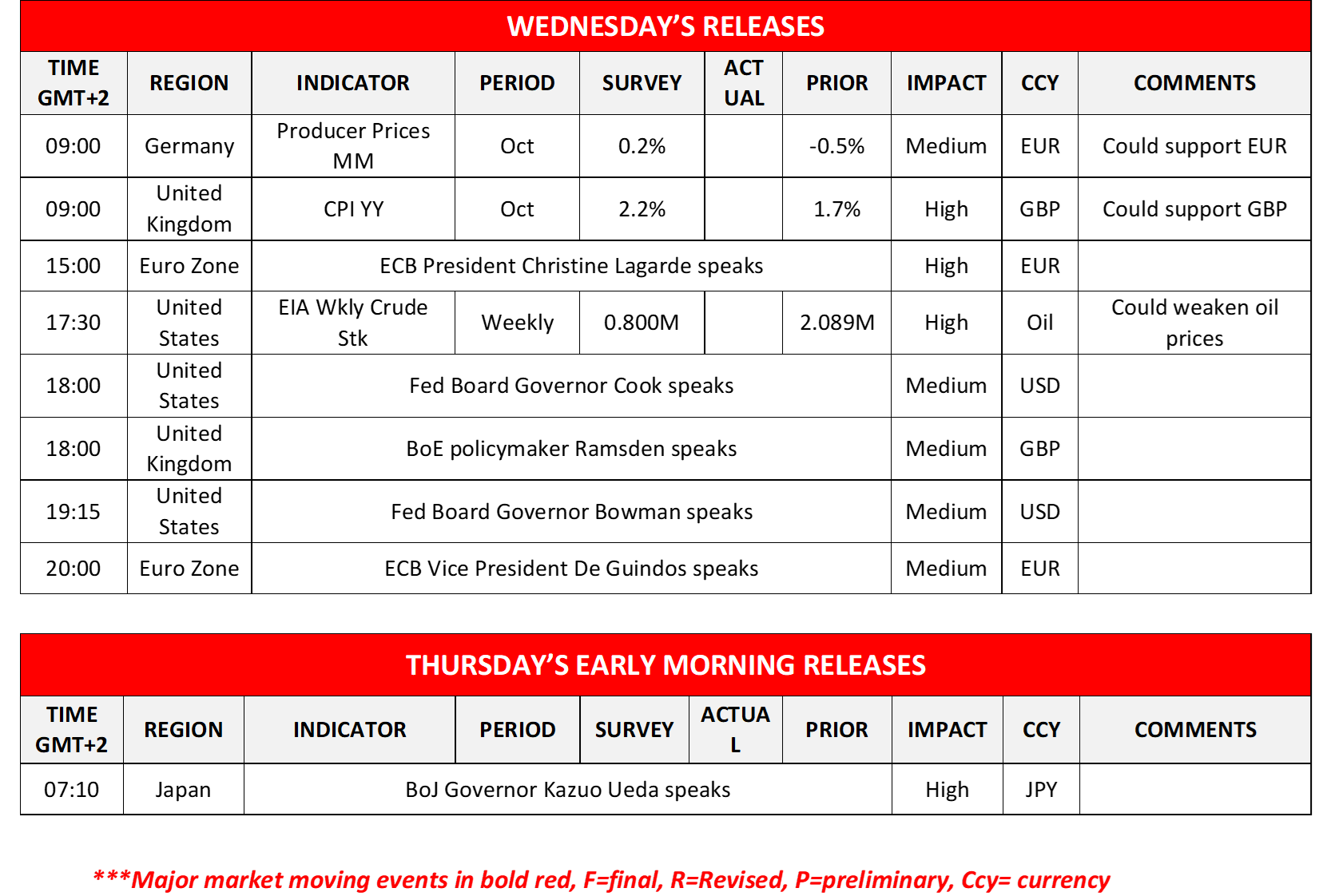

Today we note the release of the UK’s CPI rates for October, Germany’s PPI rates for October and for oil traders the release of the US EIA weekly crude oil inventories figure. On the monetary front, ECB President Christine Lagarde, Fed Board Governor Cook, BoE policymaker Ramsden, Fed Board Governor Bowman, ECB Vice President De Guindos are scheduled to speak and during tomorrow’s Asian session from Japan, BoJ Governor Ueda is scheduled to make statements.

USD/JPY Daily Chart

- Support: 154.65 (S1), 151.35 (S2), 149.40 (S3)

- Resistance: 158.45 (R1), 161.90 (R2), 164.50 (R3)

GBP/USD Daily Chart

- Support: 1.2670 (S1), 1.2470 (S2), 1.2300 (S3)

- Resistance: 1.2890 (R1), 1.3040 (R2), 1.3260 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。