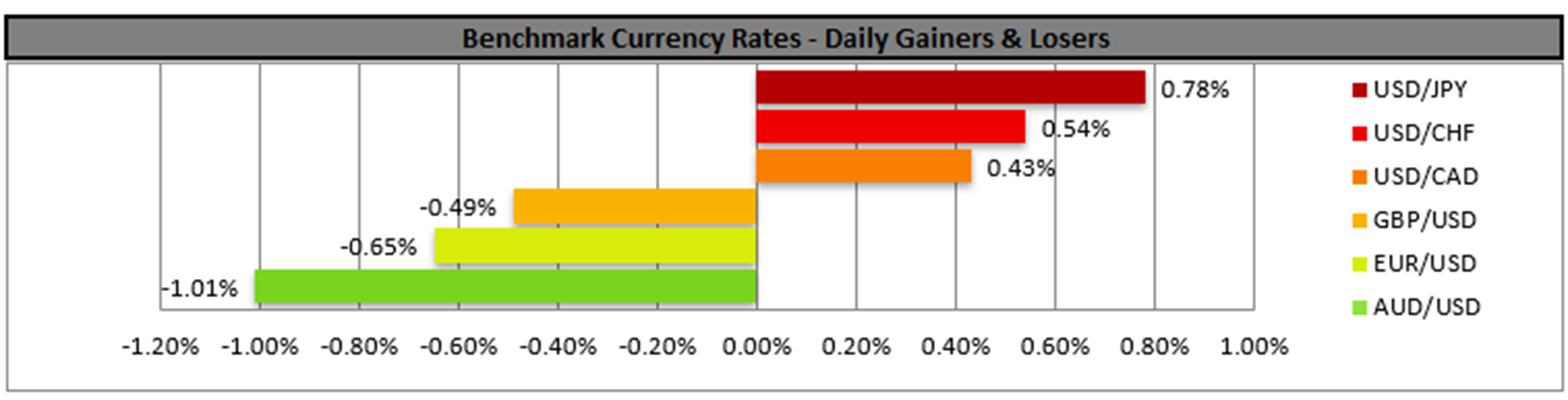

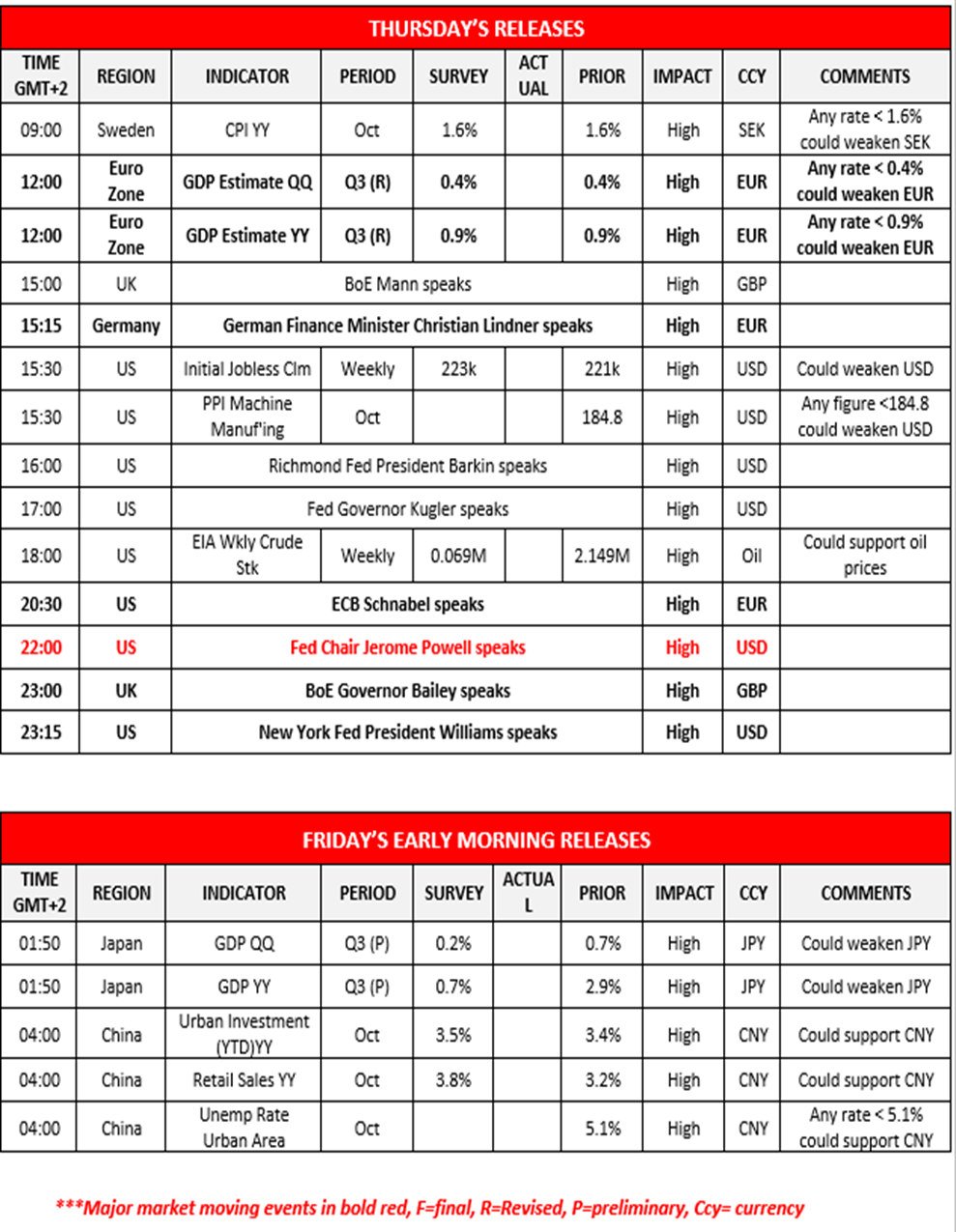

The US CPI rates came in as expected during yesterday’s American session, and thus despite the acceleration of the headline CPI rate on yoy level for October, market expectations for a 25bp rate cut by the Fed in their December meeting, have risen with FFF currently implying an 81.8% probability for such a scenario to materialize. Yet, we would like to note that Fed Chair Powell is set to speak later on today, and thus should the Fed Chair’s comments be interpreted as hawkish in nature, it could lead to increased volatility in the markets. On the flip side should Fed Chair Powell’s comments be interpreted as dovish, it may weigh on the dollar. In our view, we have already stated our concerns about the possible inflationary aspects of the incoming administration’s economic policies and thus we would not be surprised to see Fed Chair Powell opt for a more cautionary tale during his remarks later on today in regards to the market’s inflation expectations.

On a political level, President-Elect Trump has officially confirmed the nomination of Senator Marco Rubio as the new Secretary of State for the incoming administration. The appointment in our opinion, is a confirmation of Trump’s isolationist trade policies and a willingness to commit to tariffs on Chinese goods.In Asia, Australia’s employment data for October was released earlier on today, with the unemployment rate remaining steady at 4.1%, whereas the employment change figure came in lower than expected which may imply some weakening of the Australian labour market and thus could weigh on the AUD.

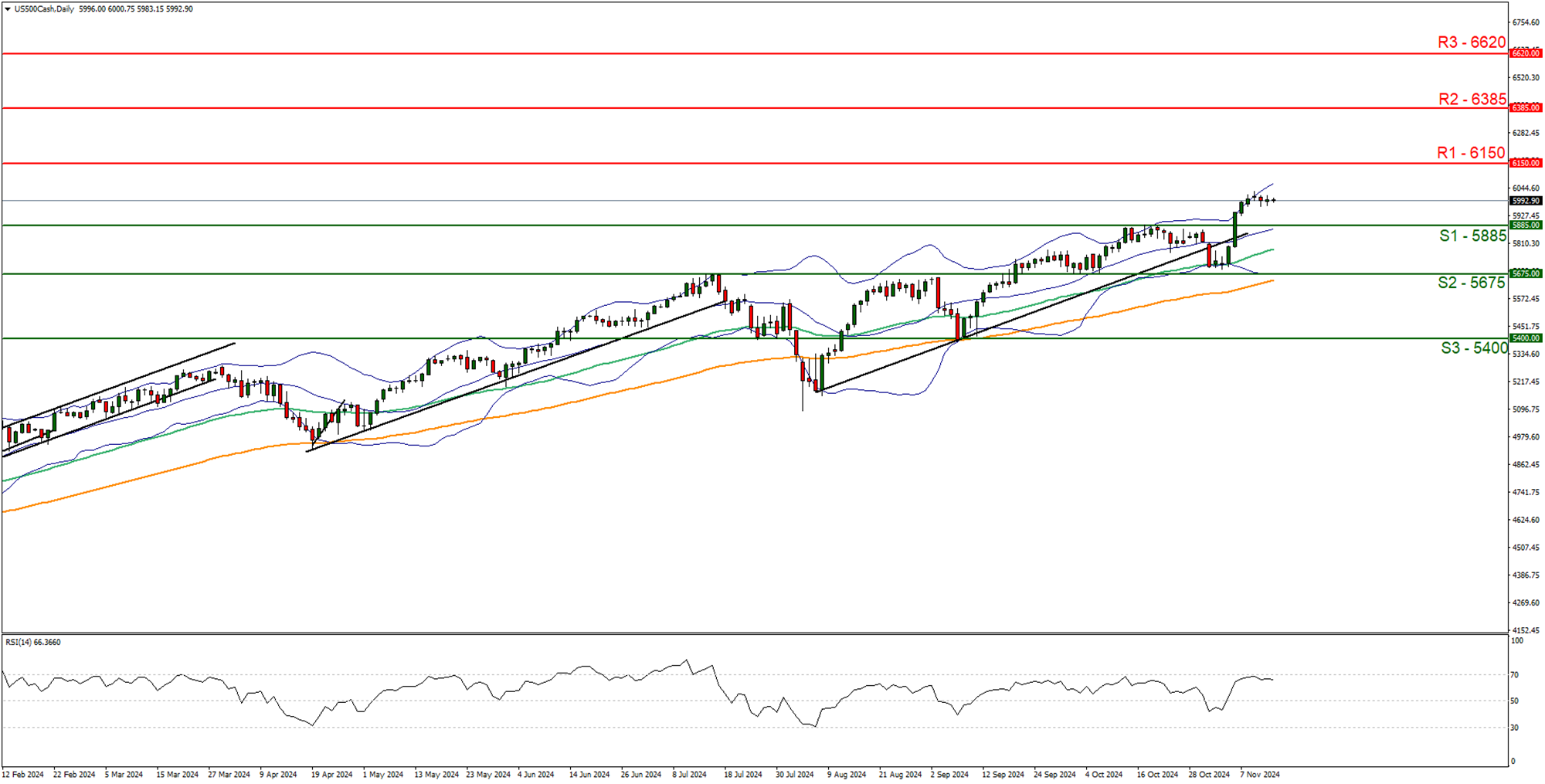

利 S&P500 appears to be moving an upwards fashion overall, yet may be due a retracement to lower ground. We opt for a bullish outlook for the index and supporting our case is the RSI indicator below our chart which currently registers a figure above 60, implying a bullish market sentiment. For our bullish outlook we would require a break above the potential 6150 (R1) resistance level with the next possible target for the bulls being the 6385 (R1) resistance level. On the flip side for a bearish outlook, we would require a break below the 5885 (S1) support level, with the next possible target for the bears being the 5675 (S2) support level. Lastly, for a sideways bias, we would require the index to fail to break below the 5885 (S1) support level and remain confined between the aforementioned S1 support level and the 6150 (R1) resistance line.

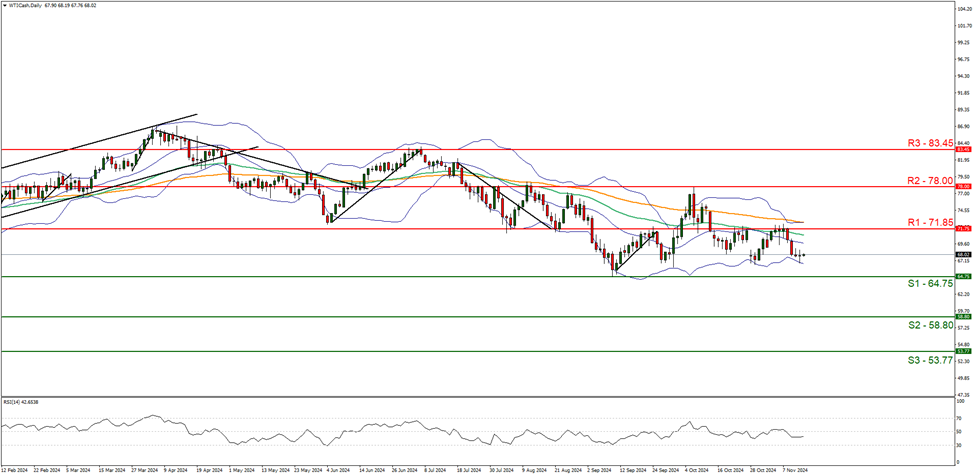

WTICash appears to be moving in a sideways fashion. We opt for a sideways bias and supporting our case is the narrowing of the Bollinger bands which imply low market volatility in addition to the RSI indicator below our chart which despite currently registering a figure near 40, which appears to be in line with our current sideways bias, with the bears potentially moving to test our 64.75 (S1) support level. Nonetheless, for our sideways bias, we would require the commodity to remain confined between the 64.75 (S1) support level and the 71.85 (R1) resistance line. On the flip side for a bearish outlook, we would require a clear break below the 64.75 (S1) support level, with the next possible target for the bears being the 58.80 (S2) support line. Lastly, for a bullish outlook we would require a clear break above the 71.85 (R1) resistance line with the next possible target for the bulls being the 78.00 (R2) resistance level.

その他の注目材料

Today we get France’s unemployment rate for Q3, the US CPI rates for October and the API weekly crude oil inventories figure. In tomorrow’s Asian session, we get Australia’s employment data for October. On the monetary front, we get the Riskbank’s November meeting minutes, and speeches by BoE Mann, Dallas Fed President Logan, St Louis Fed President Musalem and Kansas City Fed President Schmid. In tomorrow’s Asian session, RBA Governor Bullock is set to speak.

US500 Daily Chart

- Support: 5885 (S1), 5675 (S2), 5400 (S3)

- Resistance: 6150 (R1), 6385 (R2), 6620 (R3)

WTICash Daily Chart

- Support: 64.75 (S1), 58.80 (S2), 53.77 (S3)

- Resistance: 71.80 (R1), 78.00 (R2), 83.45 (R3)

もしこの記事に関して一般的なご質問やコメントがある場合は、reseach_team@ironfx.com宛で弊社のリサーチチームへ直接メールで連絡してください。 research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。