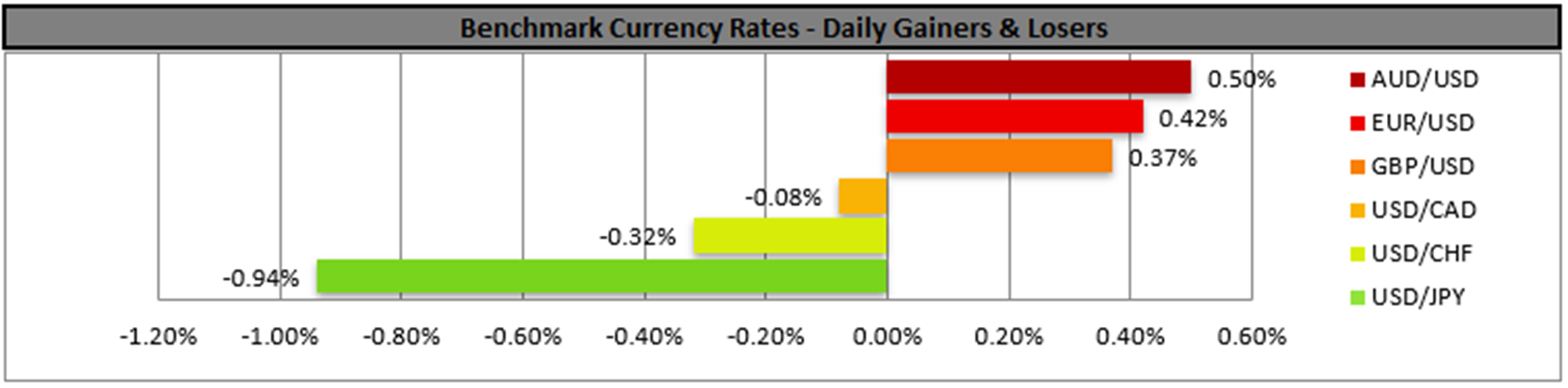

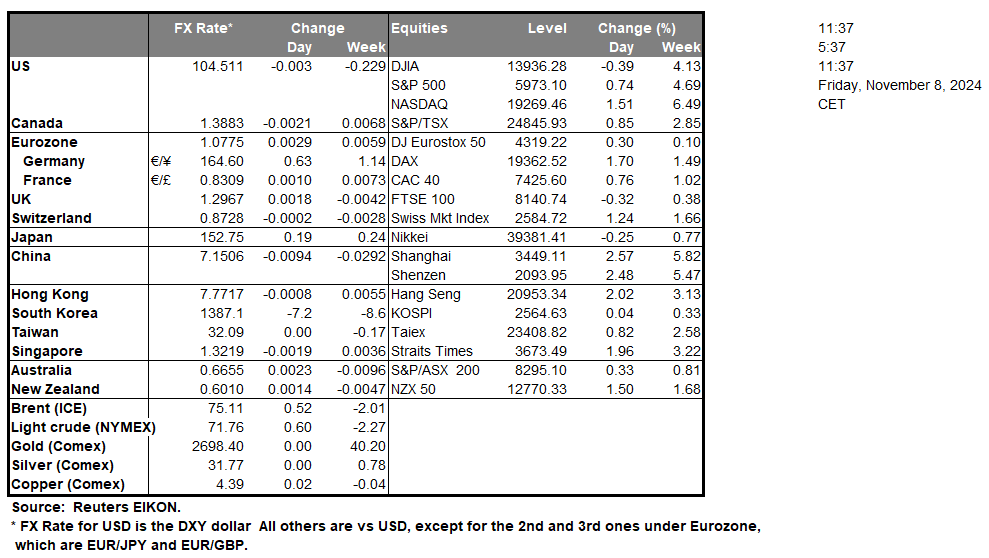

The USD edged lower yesterday against its counterparts, relenting some of the gains made by the election of Donald Trump as President of the US. It should be noted that the greenback lost ground despite the Fed cutting rates as expected yet may have been more hawkish than expected in its forward guidance. In its , the bank removed the line stating that “the Committee has gained greater confidence that inflation is moving sustainably toward 2 percent“. The removal may be interpreted as a signal that we may see renewed inflationary pressures, causing the bank to slow down its rate-cutting path. Yet Fed Chairman Powell seemed to dismiss such an assumption in his press conference. Furthermore, we highlight that the bank seems determined to defend its independence from the newly elected US President, as the Fed Chairman clearly stated that he would not resign if asked for by Donald Trump.

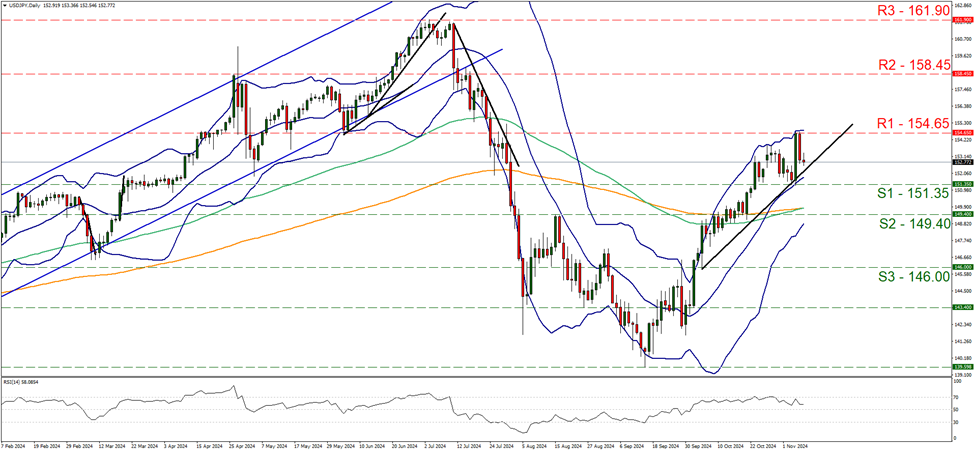

USD/JPY hit a ceiling at the 154.65 (R1) resistance line and edged lower. Despite the correction lower, we tend to maintain our bullish outlook as the upward trendline guiding the pair for the past month remains intact. Furthermore also note that the RSI indicator despite correcting lower is still between the readings of 50 and 70, implying a bullish predisposition on behalf of market participants. Should the bulls maintain control over the pair we may see USD/JPY bouncing on the upward trendline and breaking the 154.65 (R1) resistance line, forming a higher peak, while even higher we note the 158.45 (R2) resistance hurdle. A bearish outlook seems to be remote currently, yet for it to occur, we would require the pair to break the prementioned upward trendline in a first signal that the upward movement has been interrupted, but also the pair has to break the 151.35 (S1) support base, aiming of the 149.40 (S2) support level.

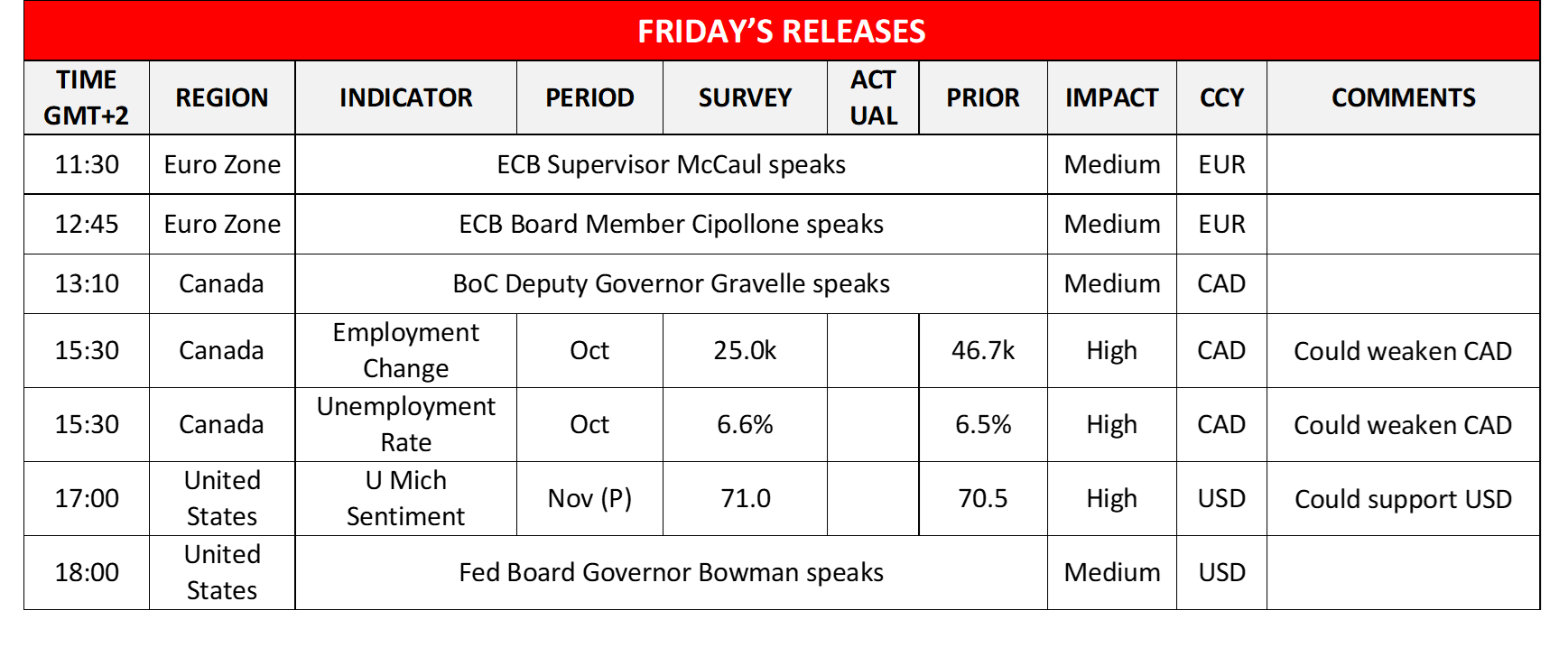

North of the US border, Loonie traders are bracing for Canada to release October’s employment data, in today’s early American session. The unemployment rate is expected to tick up to 6.6% and the prognosis for the employment change figure is to drop to 25k, if compared to September 46.7k. Should the actual rates and figures meet their respective forecasts, we may see the Loonie slipping as the data would be pointing towards further easing of the Canadian employment market, which in turn may intensify the dovishness of BoC. On a monetary level, we note the speech of BoC deputy Governor Gravelle in the late European session and should he allow for some dovish signals, the CAD could slip as the market’s expectations for a double rate cut in BoC’s next meeting could be enhanced.

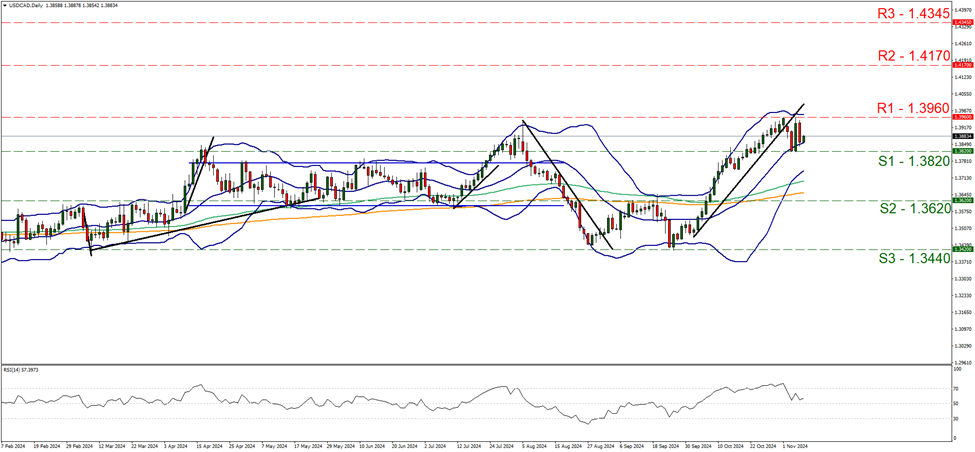

USD/CAD corrected lower yesterday and remained well within the boundaries set by the 1.3960 (R1) resistance line and the 1.3820 (S1) support line. We tend to maintain a bias for a sideways motion between the prementioned levels, for the time being. The RSI indicator remains above but close to the reading of 50, implying a relative indecisiveness on behalf of the market for the pair’s direction, while the Bollinger bands are narrowing, implying less volatility for the pair, which could allow the range-bound movement to be maintained. Yet the direction of the pair may alter depending on Canada’s employment data for October and USD fundamentals. Should the bulls take over, we may see the pair breaking the 1.3960 (R1) resistance line, aiming for the 1.4170 (R2) resistance level. Should the bears be in charge of USD/CAD’s direction, we may see the pair, breaking the 1.3820 (S1) support line and aiming for the 1.3620 (S2) support level.

その他の注目材料

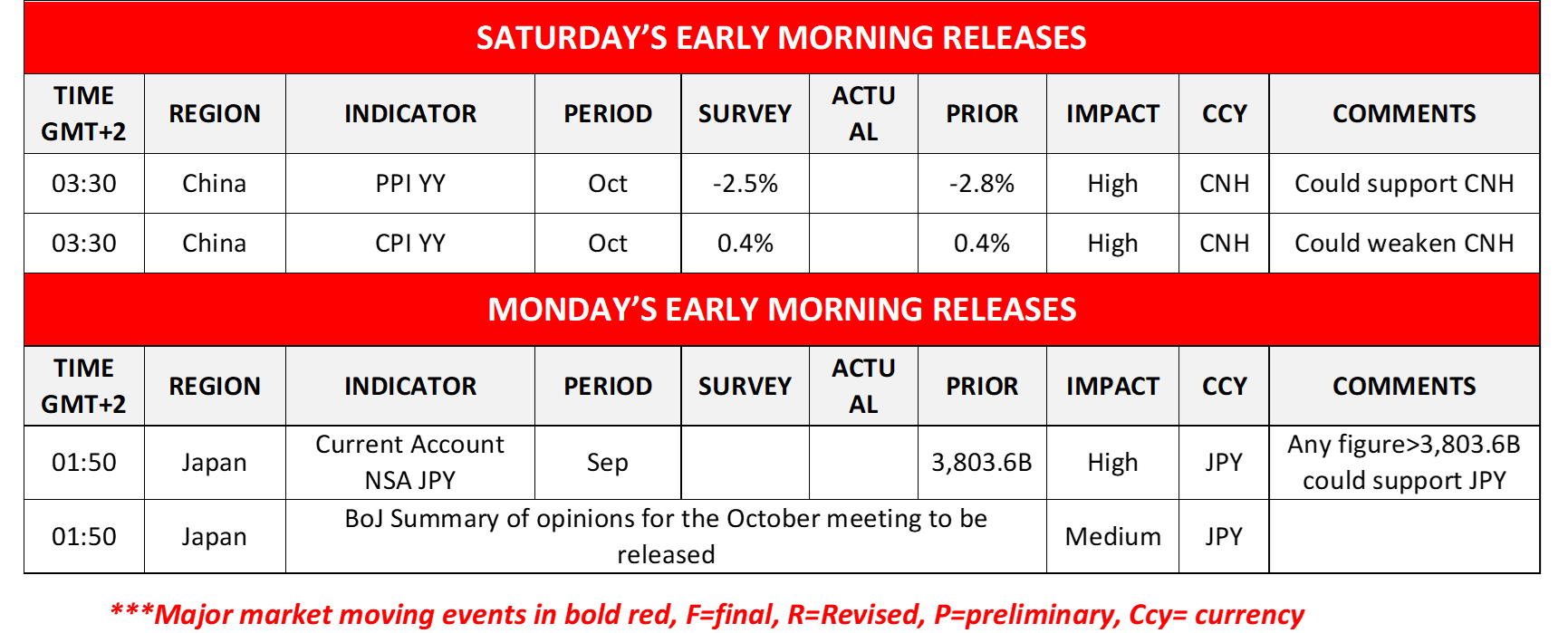

Today we get Canada’s October employment data and from the US the preliminary University of Michigan consumer sentiment for November. On the monetary front, we note that ECB Supervisor McCaul, ECB Board Member Cipollone, BoC Deputy Governor Gravelle and Fed Board Governor Bowman are scheduled to speak. Tomorrow, Saturday, China’s October inflation metrics are to be released and on Monday’s Asian session we get Japan’s September current account balance, while BoJ is to release the summary of opinions for the October meeting.

USD/JPY Daily Chart

- Support: 151.35 (S1), 149.40 (S2), 146.00 (S3)

- Resistance: 154.65 (R1), 158.45 (R2), 161.90 (R3)

USD/CAD Daily Chart

- Support: 1.3820 (S1), 1.3620 (S2), 1.3440 (S3)

- Resistance: 1.3960 (R1), 1.4170 (R2), 1.4345 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。