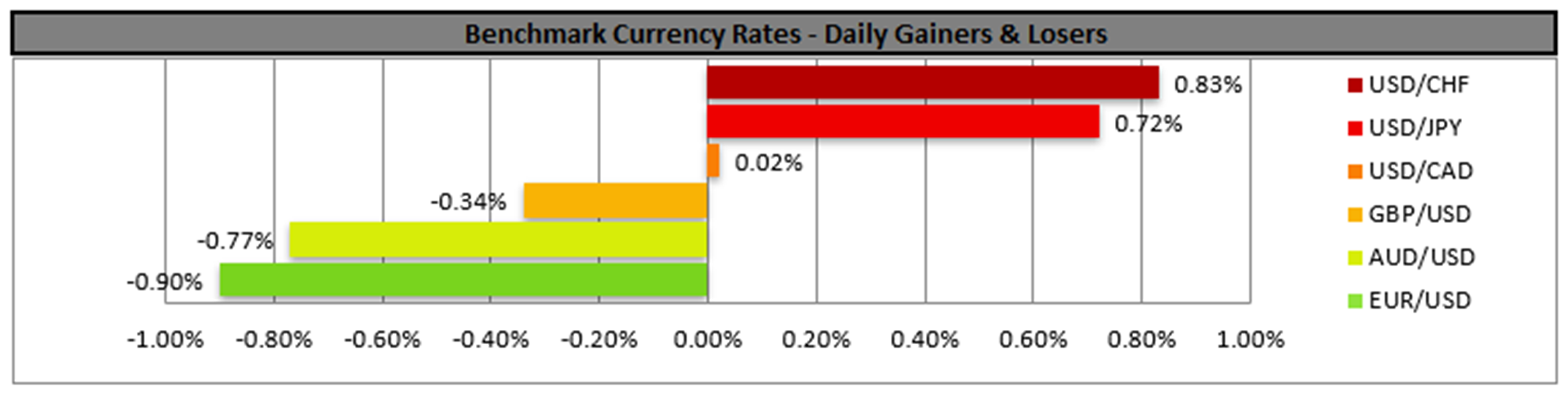

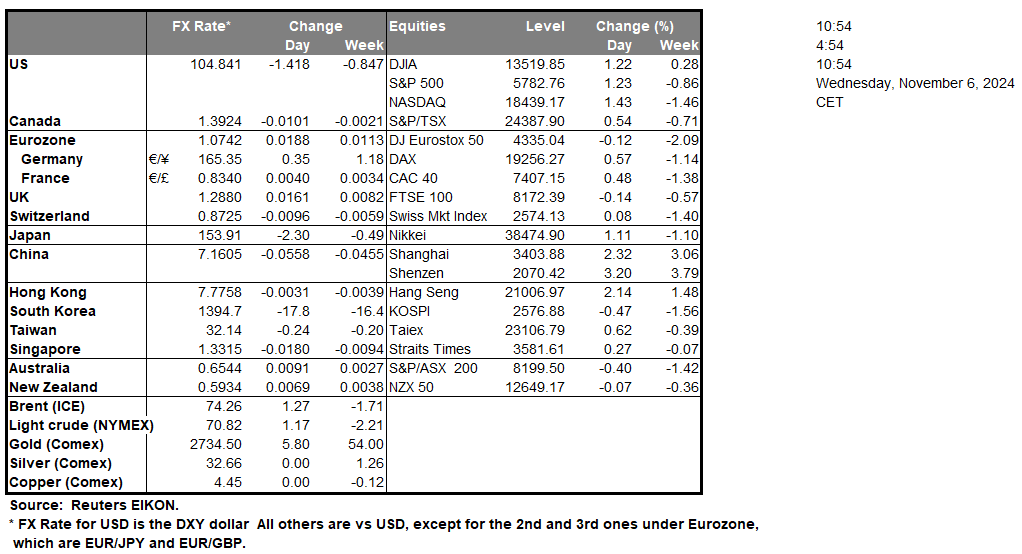

Donald J Trump is set to be the next President of the United States of America. In particular, Fox News has called the election in favour of Trump with numerous media outlets now also calling the state of Pennsylvania for Trump as well. As things currently stand, Trump has 266 electoral college votes to Harris’s 194 with Trump also leading in Michigan, Wisconsin and Arizona, thus effectively paving the way to the White House on January 6 for the Republicans. Furthermore, Reuters has called the race for the Senate, with the Republicans having gained two seats, effectively pushing them over the 50-member threshold required in order to control the Senate. Moreover, the Republican party has currently picked up 3 seats in the race of the House of Representatives, and should the Republicans take control over the House as well, it will be considered a Red sweep. Overall, the implications of a Trump victory have aided the greenback against its counterparts in addition the US Equities markets, which may benefit from Trump’s economic policies. In our view, we tend to agree that Trump will be the next President of the United States of America, yet we urge caution as the Fed’s interest rate decision is set to occur tomorrow. In particular, the majority of market participants are anticipating that the Fed may cut interest rates by 25bp, with FFF currently implying a roughly 98% probability for such a scenario to materialize. However, with Trump’s economic policies potentially increasing inflationary pressures, we would not be surprised to see the Fed urge caution and patience for future rate cuts by the bank. Moreover, Fed Chair Powell’s press conference will be closely watched as the assumptive President-elect has been vocal in his opinions about the current Fed Chair.

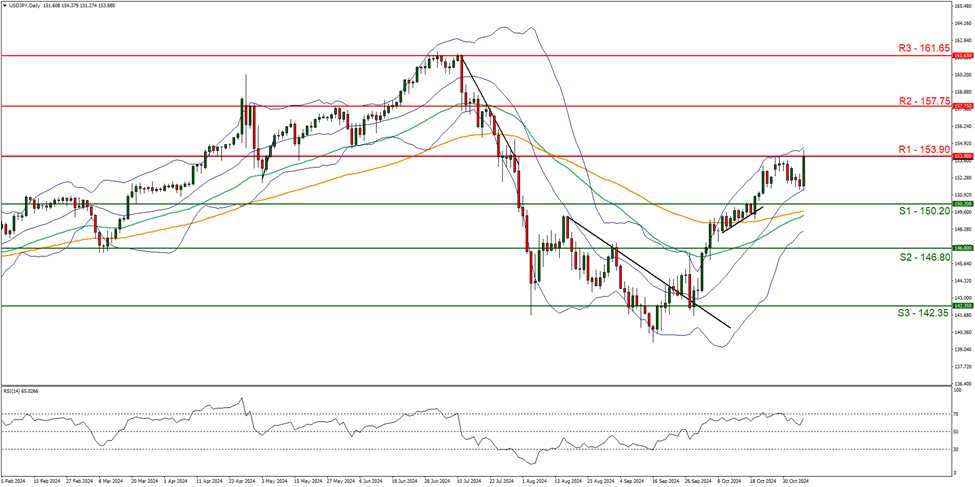

USD/JPY appears to be moving in an upwards fashion. We opt for a bullish outlook for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure of 65 , implying a bullish market sentiment, in addition to the fundamental issues we mentioned above in regards to a Trump Presidency. For our bullish outlook to continue we would require a clear break above the 153.90 (R1) resistance line with the next possible target for the bulls being the 1575.75 (R2) resistance level. On the flip side for a sideways bias we would require the pair to remain confined between the 150.20 (S1) support level and the 153.90 (R1) resistance line. Lastly, for a bearish outlook we would require a clear break below the 150.20 (S1) support line with the next possible target for the bears being the 146.80 (S2) support line.

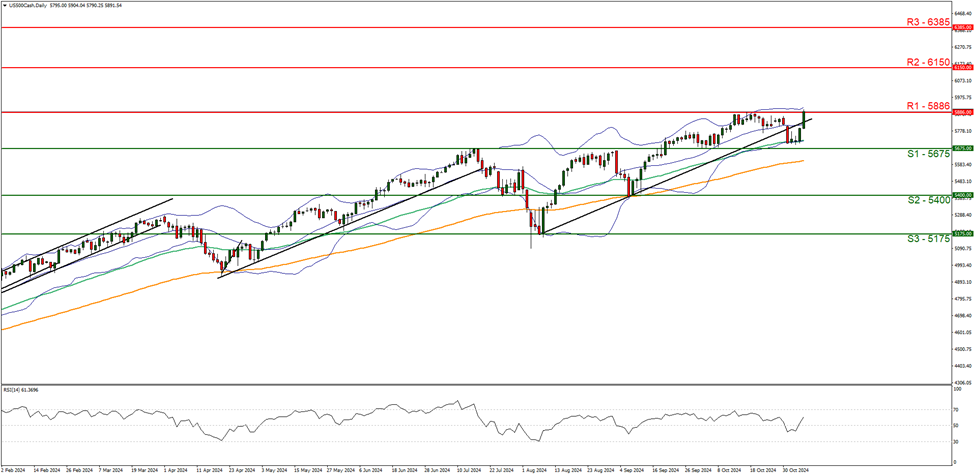

The S&P500 appears to be moving in an upwards fashion, with markets reacting positively to the presumptive President-elect Donald J Trump. We opt for a bullish outlook for the index and supporting our case is the RSI indicator below our chart which has sharply risen to the current reading of 60, implying a strong bullish market sentiment. For our bullish outlook to continue we would require a clear break above the 5886 (R1) resistance line with the next possible target for the bulls being the 6150 (R2) resistance level. On the flip side for a sideways bias we would require the pair to remain confined between the 5675 (S1) support level and the 5886 (R1) resistance line. Lastly, for a bearish outlook we would require a clear break below the 5675 (S1) support level with the next possible target for the bears being the 5400 (S2) support line.

その他の注目材料

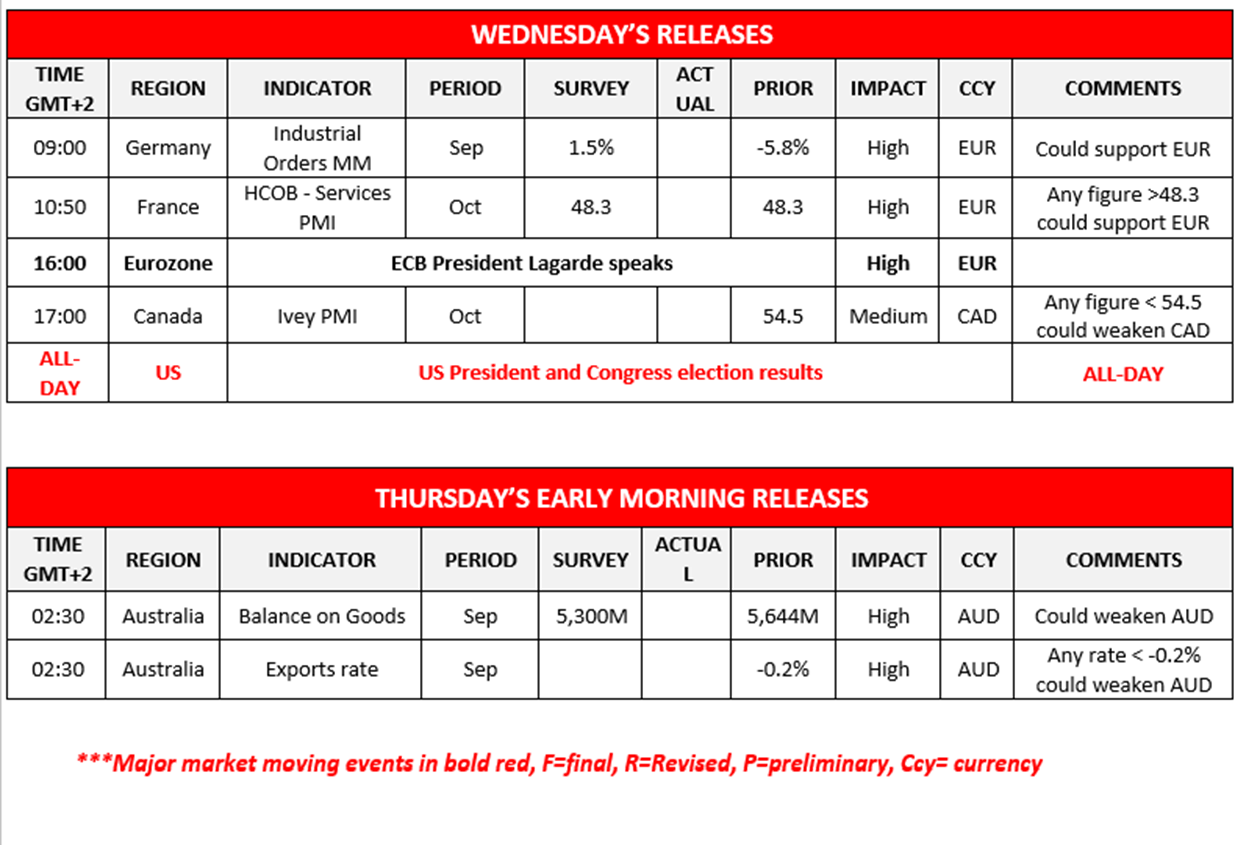

In today’s European session, we get Germany’s industrial orders rate for September and France’s HCOB services PMI figure for October. During the American session we get Canada’s Ivey PMI figure for October. In tomorrow’s Asian session we get Australia’s trade balance data for September. On a monetary level we note ECB President Lagarde’s speech. On a political level, the US elections are ongoing.

USD/JPY Daily Chart

- Support: 150.20 (S1), 146.80 (S2), 142.35 (S3)

- Resistance: 153.90 (R1), 157.75 (R2), 161.65 (R3)

US500 Daily Chart

- Support: 5675 (S1), 5400 (S2), 5175 (S3)

- Resistance: 5886 (R1), 6150 (R2), 6385 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。