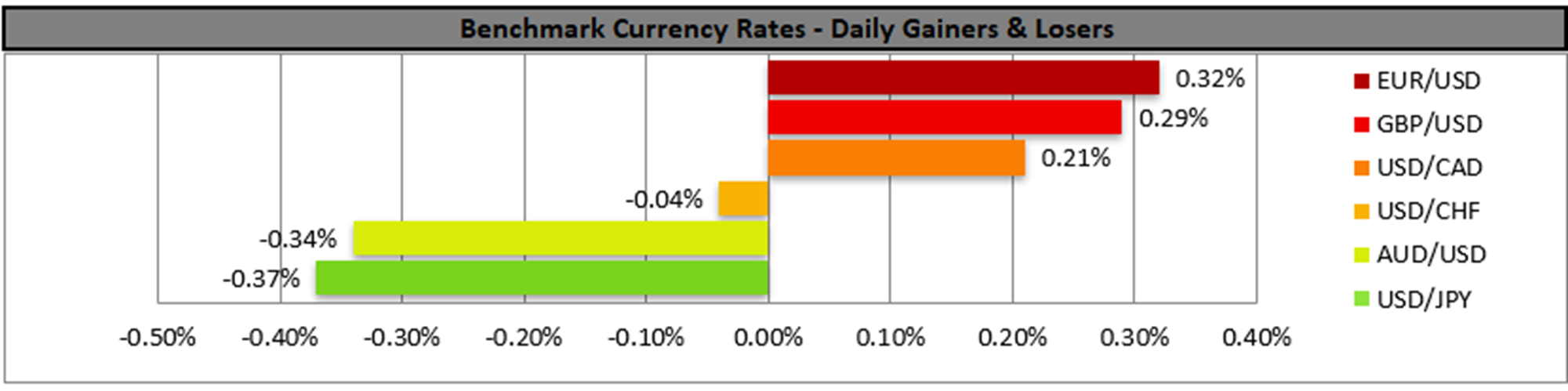

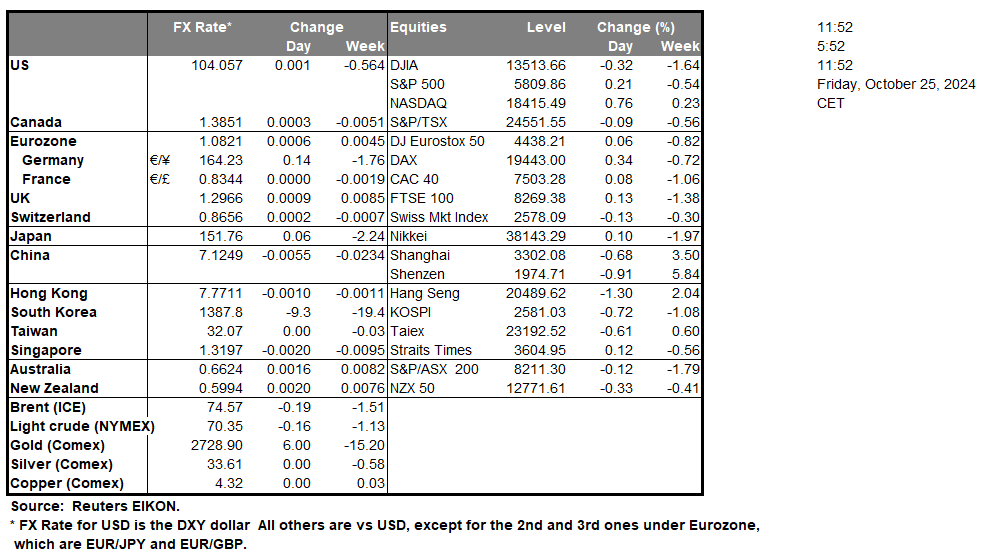

JPY is about to end the week in the reds against the USD, GBP and EUR in a wider sign of weakness. Political uncertainty seems to be high given the elections in Japan over the weekend. The importance of the elections may also rely in the assumption that the outcome could affect also BoJ’s efforts to normalise its monetary policy. It should be noted that the ruling Liberal Democratic Party’s (LDP) long-standing dominance may be shaken, yet seems set to survive the elections. Nevertheless should the LDP lose points in the elections some uncertainty may arise and the party may harden its stance, exercising pressure on BoJ to abandon its rate hiking plans. Hence the conjunction of fundamental uncertainty both on a political and monetary level, tends to cause JPY to wobble. Furthermore, Tokyo’s CPI rates slowed down beyond market expectations, and given the density of the megacity’s population, the release underscores the tendency for inflationary pressures to ease in the Japanese economy, providing more headwinds for BoJ’s intentions to hike rates in the future.

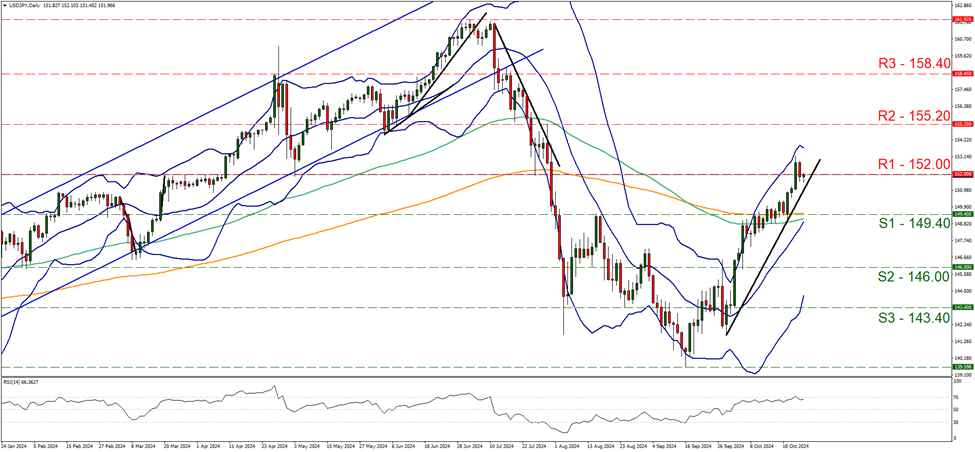

USD/JPY corrected lower yesterday breaking the 152.00 (R1) support line, now turned to resistance. Nevertheless we maintain our bullish outlook for the pair as long as the upward trendline guiding the pair since the 3rd of October remains intact. Furthermore we note that the RSI Indicator remains near the reading of 70 implying the presence of a bullish predisposition of the market for the pair. Should the bulls remain in control as expected, we may see USD/JPY breaking the 152.00 (R1) resistance line and aiming for the 155.20 (R2) resistance level. Should the bears take over, we may see the pair renewing yesterday’s selling interest, breaking the prementioned upward trendline in a first signal that the upward movement has been interrupted, and proceed to aim if not reach the 149.40 (S1) support base.

Last but not least we note the strengthening of the EUR. The release of the preliminary PMI figures for October surprised EUR traders. After the release of a lower-than-expected Services PMI figure for France which weighed on the EUR, Germany’s manufacturing sector PMI figure, improved, implying that the contraction of economic activity may have not been as wide as expected supporting the common currency. We tend to see the case for the EUR being supported fundamentally, as the macroeconomic outlook improved somewhat. On the monetary front, ECB policymakers maintain their rate-cutting intentions yet seem to want to avoid a double rate cut, which may also prove to be supportive for the single currency.

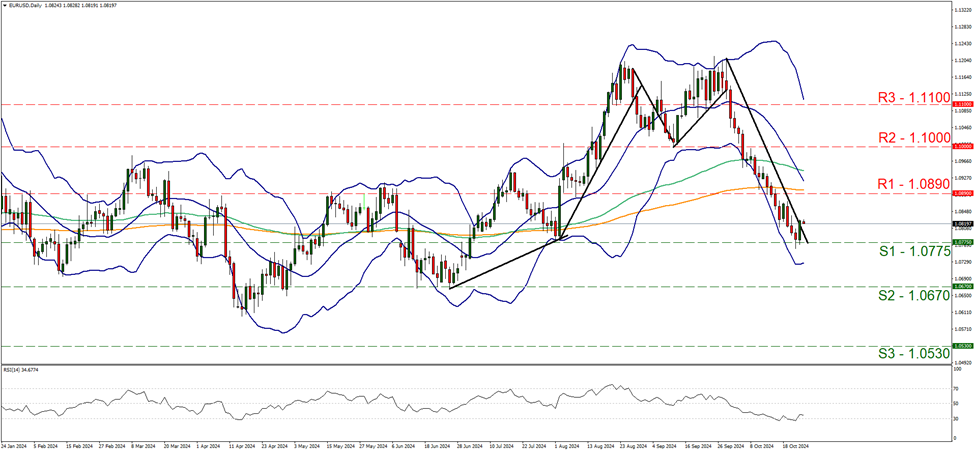

On a technical level we note that EUR/USD bounced on the 1.0775 (S1) support line yesterday. In its upward movement, the pair broke the downward trendline guiding the pair since the 30 of September, hence we switch our bearish outlook in favour of a sideways motion bias initially. Please note though that the RSI indicator despite moving higher is still at relatively low levels hence some bearish tendencies could be present. For a bearish outlook though we would require the pair to form a lower trough thus it would have to break the 1.0775 (S1) support line and start aiming for the 1.0670 (S2) support level. Should the bulls gain control over the pair we see EUR/USD aiming if not breaching the 1.0890 (R1) resistance line.

その他の注目材料

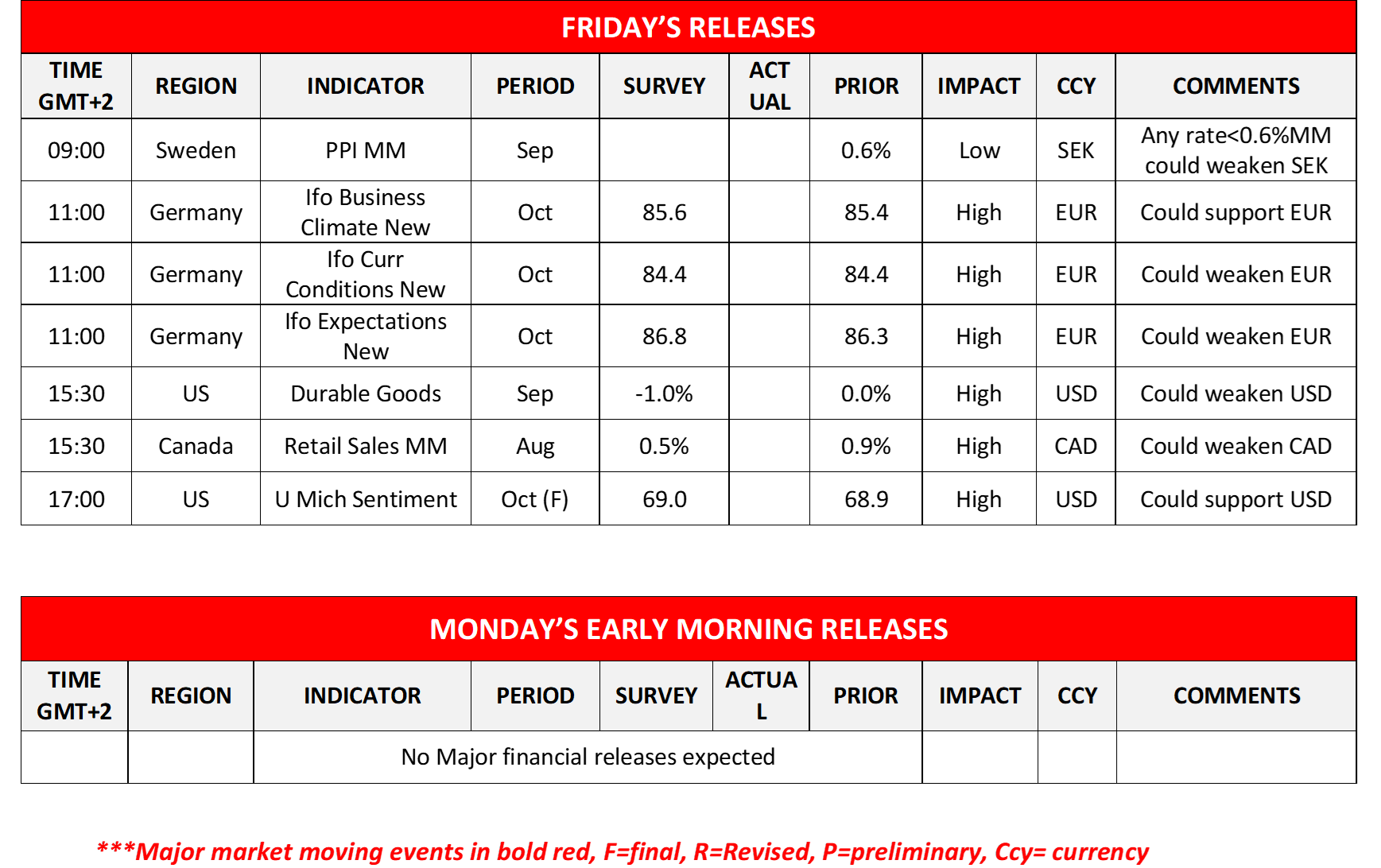

Today in the European session, we get Sweden’s PPI rate for September and Germany’s Ifo indicators for October. In the American session, from the US we get September’s durable goods growth rates and the final University of Michigan consumer sentiment for October. Loonie traders are expected to keep a close eye on the release of Canada’s retail sales for August, after BoC’s double rate cut, which was delivered on Wednesday. A possible slowdown of the headline rate as expected or even more could weigh on the Loonie as it could imply that the average Canadian consumer is less willing and/or able to spend in the Canadian economy, hence the release could also enhance BoC’s dovish stance.

USD/JPY Daily Chart

- Support: 149.40 (S1), 146.00 (S2), 143.40 (S3)

- Resistance: 152.00 (R1), 155.20 (R2), 158.40 (R3)

EUR/USD デイリーチャート

- Support: 1.0775 (S1), 1.0670 (S2), 1.0530 (S3)

- Resistance: 1.0890 (R1), 1.1000 (R2), 1.1100 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。