Major US stock market indexes appear to be moving in a downwards fashion for the past two days yet are still near their all-time high figures. In today’s report we intend to focus on the implications of the US elections, McDonald’s but also discuss the recent earnings releases of Starbucks and conclude the fundamentals with the expected earnings report releases in the coming week. The report is to be concluded with a technical analysis of S&P 500’s daily chart.

US Elections incoming

As of today, we are less than two weeks away from the US Presidential elections which will see the incumbent Vice President Harris (D) take on former President Trump (R) in a race that remains too close to call. In particular, the lead that Vice President Harris appears to have had over the former President in the key swing states appears to have withered down to less than 1%, with some recent polls giving former President Trump a slight lead in certain swing states. However, the two candidates appear to be neck and neck on numerous fronts and thus no clear-cut winner has emerged as we enter the final stages of the US election cycle. Nonetheless, the improved possibility of a Republican President in the White House could potentially provide support for US stock markets, as former President Trump (R) has vowed to extend corporate tax cuts signed into law during his first term which are set to phase out in 2025, per ABC news. Yet, with the race being this close, a second level of uncertainty appears to be taking place, and this is in regards as to which political party will be able to win a majority in both the House and the Senate or if they will each take control of one legislative branch of the US Congress. Moreover, should the elections be decided by a narrow margin we may see Trump or Harris contesting the results which could prolong the entire process. Overall, the increased uncertainty surrounding the US presidential elections alongside the elections for the US Congress, could increase volatility in the US Equities markets. Furthermore, should there fail to be a clear-cut victor, the uncertainty that may ensue could weigh on the US stock markets and vice versa.

McDonalds (#MCD) hamburger linked to E.coli outbreak

The US Centre for Disease Control (CDC) announced on Tuesday, that an E.coli outbreak was linked to McDonald’s famous Quarter Pounder hamburger. The E.coli outbreak per a report from Yahoo Finance, has resulted in the death of one individual and the hospitalization of 10 individuals with “most sick people are reporting eating Quarter Pounder hamburgers from McDonald’s…” per the CDC’s report. Following the announcement by the CDC, McDonald’s announced that it would be removing the particular hamburger from restaurants in the impacted area, including Colorado, Kansas, Utah and Wyoming as well as portions of Idaho, Iowa, Missouri, Montana, Nebraska, Nevada, New Mexico and Oklahama. The announcement by McDonald’s and the report by the CDC that the company has been linked to the E.coli outbreak appears to have weighed on the company’s stock price. In conclusion, should the CDC’s investigation uncover further food ingredients that may have been linked to the E.coli outbreak in the US, it could further weigh on the company’s stock price in the future. On the flip side, should the investigation conclude that no further food ingredients have been contaminated, it could provide some relief for the company’s stock price.

Starbucks (#SBUX) earnings disappoint

Starbucks (#SBUX) released their preliminary Q4 earnings report , with their earnings per share coming in lower than expected at 0.8 versus 1.03 and revenue come in also lower than expected at 9.1 billion versus the expected figure of 9.38 billion. Furthermore, the company stated that “The company’s results were primarily driven by softness in North America’s revenues in the quarter, specifically a 6% decline in U.S. comparable store sales, driven by a 10% decline in comparable transactions”. The disappointed earnings report appears to have led to the following comments by Starbucks CEO Niccol that “we need to fundamentally change our strategy, so we can get back to growth”. Overall, the disappointing earnings result may weigh on the company’s stock price, yet the interesting aspect of the company’s report was the comment that “given the company’s CEO transition coupled with the current state of the business, guidance will be suspended for the full fiscal year 2025”. The decision to suspend the company’s forward guidance may be of concern for investors and thus could further weigh on the company’s stock price.

Earnings Season continues

The earnings season is full swing and we note the release of the earnings reports of Visa (#V) , McDonalds (#MCD) and Google (#GOOG) on Tuesday, whereas on Wednesday we get Meta (#FB) and Microsoft (#MSFT). On Thursday we note Intel (#INTC), Amazon (#AMZN), Apple (#AAPL) and lastly on Friday we get Airbnb (#ABNB) and Exxon Mobil (#XOM).

テクニカル分析

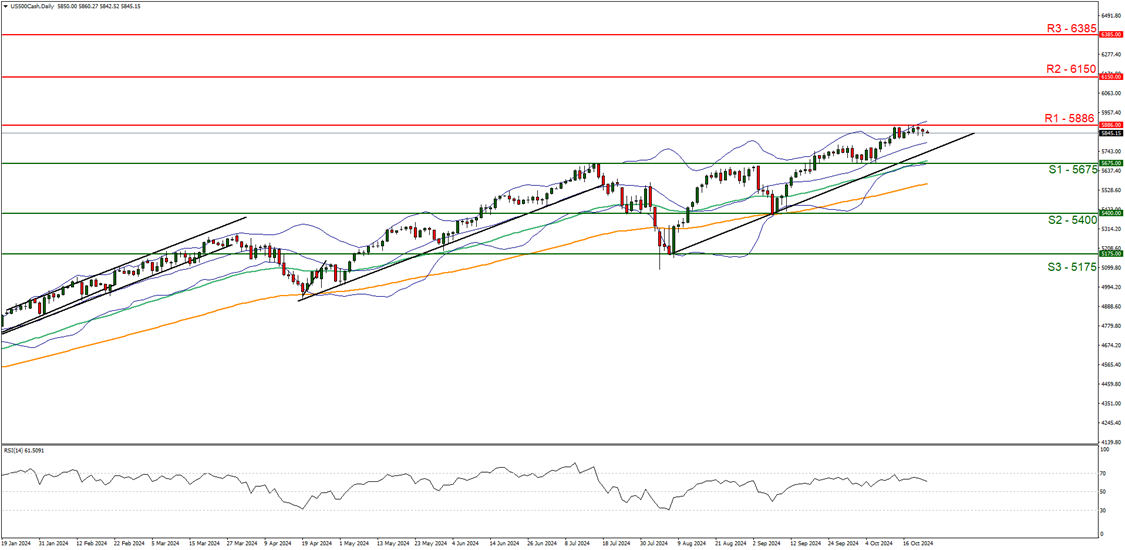

US500 Daily Chart

- Support: 5675 (S1), 5400 (S2), 5175 (S3)

- Resistance: 5886 (R1), 6150 (R2), 6385 (R3)

The US500 appears to be moving in an upwards fashion, yet some signs appear to be emerging that the bulls may be losing some steam. Nonetheless, we opt for a bullish outlook for the index and supporting our case is the RSI indicator below our chart which currently registers a figure above 60 implying a bullish market sentiment, in addition to the upwards moving trendline which was incepted on the 8 of August. For our bullish outlook to continue, we would require a clear break above the 5886 (R1) resistance line with the next possible target for the bulls being the 6150 (R2) resistance level. On the flip side for a sideways bias we would require the index to remain confined between the 5675 (S1) support level and the 5886 (R1) resistance line. Lastly, for a bearish outlook we would require a clear break below the 5675 (S1) support level with the next possible target for the bears being the 5400 (S2) support line.

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。