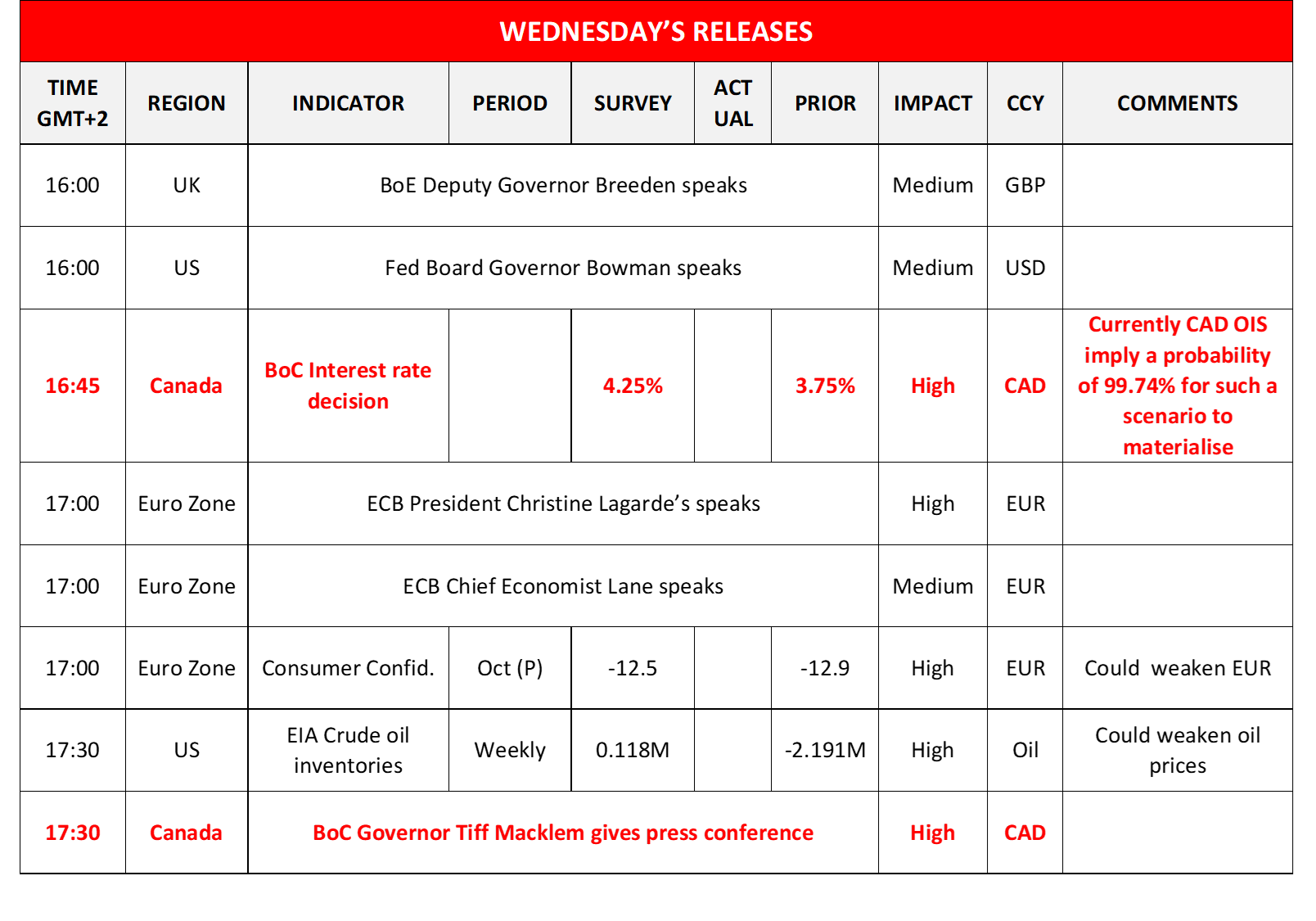

Loonie traders are expected to focus on BoC’s interest rate decision today. The bank is widely expected to deliver a 50 basis points rate cut, lowering the interest rate from 4.25% to 3.75%. CAD OIS imply a probability for the bank to do so of 91.8%, while they also imply that more rate cuts in the following meetings are expected by the market. Hence for a bearish reaction of the Loonie the bank has to verify the market expectations and probably then some. Hence, should the bank deliver the 50 basis points rate cut and signal in its accompanying statement and BoC Governor Macklem’s press conference a readiness to proceed with more rate cuts we may see CAD bears renewing their influence over the Loonie, yet that may be as dovish as the bank can go. A different market reaction could be caused should the bank proceed with the expected double rate cut, yet at the same time imply a possible moderation of the rate cutting path, which could support the Loonie. A scenario that could provide asymmetric support for the CAD would be if the bank surprises the markets by delivering a 25 basis points rate cut and thus forcing the market to reposition itself.

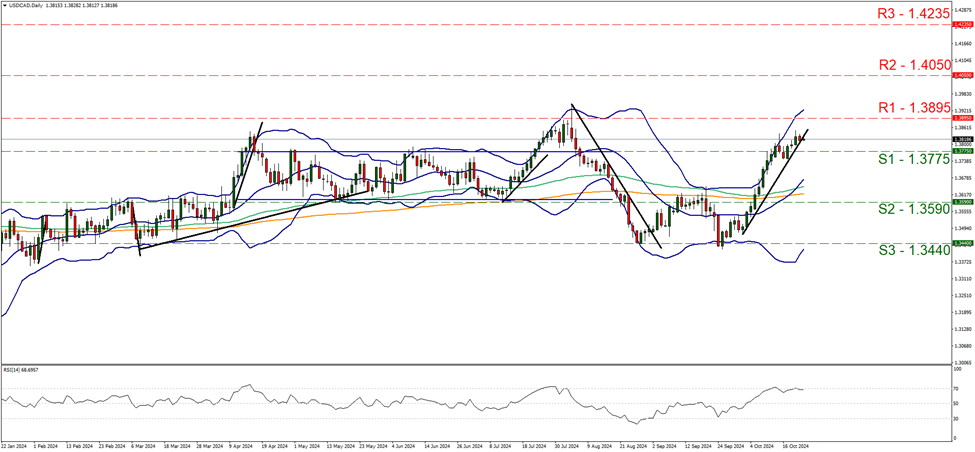

USD/CAD seems to have halted its advance higher yesterday, remaining in the midst of the corridor formed between the 1.3775 (S1) support line and the 1.3895 (R1) resistance level. In its stabilisation the pair seems to be putting the upward trendline since the 2 of October to the test, hence the USD/CAD seems to be in a make or break position. On the other hand the RSI indicator remains near the reading of 70, implying that the strong bullish sentiment of the market is still present, yet at the same time may suggest that the pair is nearing overbought levels and may be ripe for a correction lower. Should the bulls maintain control over the pair, we may see USD/CAD breaking the 1.3895 (R1) resistance line and thus paving the way for the 1.4050 (R2) resistance base. On the flip side, should the bears find a chance and take over, we may see the pair initially breaking the prementioned downward trendline in a first signal that the upward motion has been interrupted, breaking also the 1.3775 (S1) support level and start aiming for the 1.3590 (S2) support hurdle.

Across the pond, the EUR also continued to weaken against the USD and GBP and its hard case to be made for EUR bulls on a fundamental and macroeconomic level. Especially on a monetary policy level, the EUR seems to be suffering as the ECB’s dovish intentions are obvious. Also, media report that ECB policymakers are debating whether interest rates need to escape neutral territory and move to a more supportive level. Such intentions may be even more dovish than what the market expected and could weigh on the EUR.

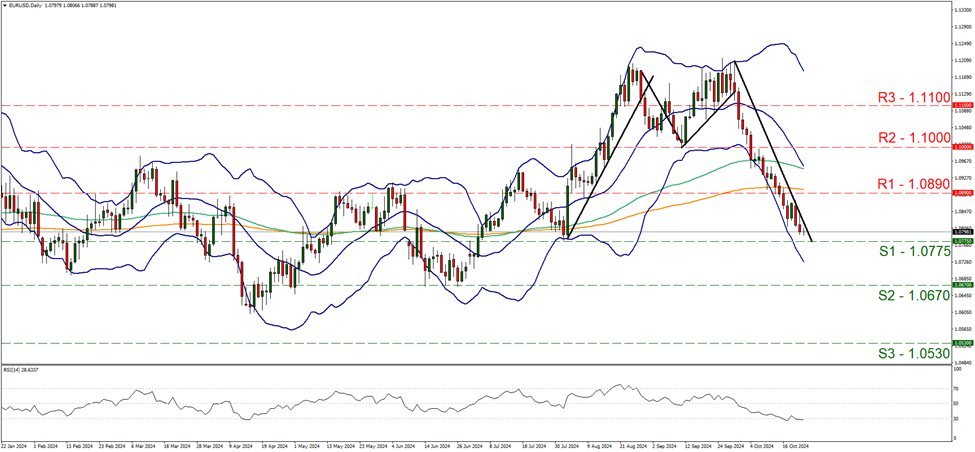

EUR/USD continued its downward trajectory aiming for the 1.0775 (S1) support line. We tend to maintain our bearish outlook for the pair as long as the downward trendline guiding the pair since the 30 of September remains intact. Please note that the RSI indicator remains continues to run along the reading of 30, highlighting the continuance of the strong bearish sentiment of the market for the pair, yet at the same time may imply that the pair is at oversold levels and may correct higher. Also the M formation seems that is nearing its completion, leaving the question of the pairs’ future direction in a limbo. Yet the price action seems to have still some distance from the lower Bollinger band, implying that there is still some room for the bears to advance. Should the bears maintain control over EUR/USD, we may see the pair breaking the 1.0775 (S1) support line and start aiming for the 1.0670 (S2) level. In the remote scenario of the bulls taking control over the pair, we may see EUR/USD reversing course clearly breaking the prementioned downward trendline and continue to break the 1.0890 (S1) line, thus putting the 1.1000 (S2) barrier in its sights.

その他の注目材料

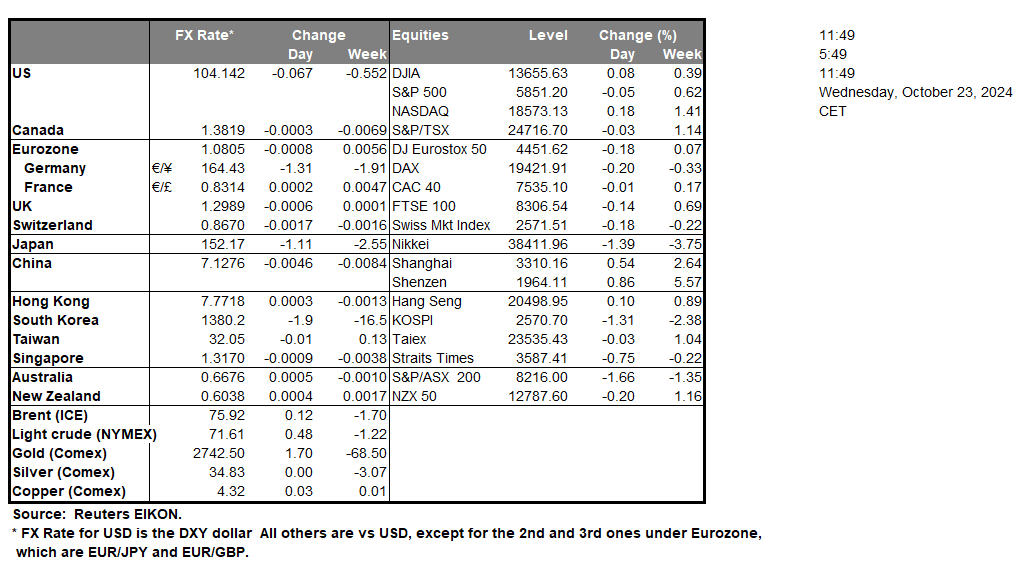

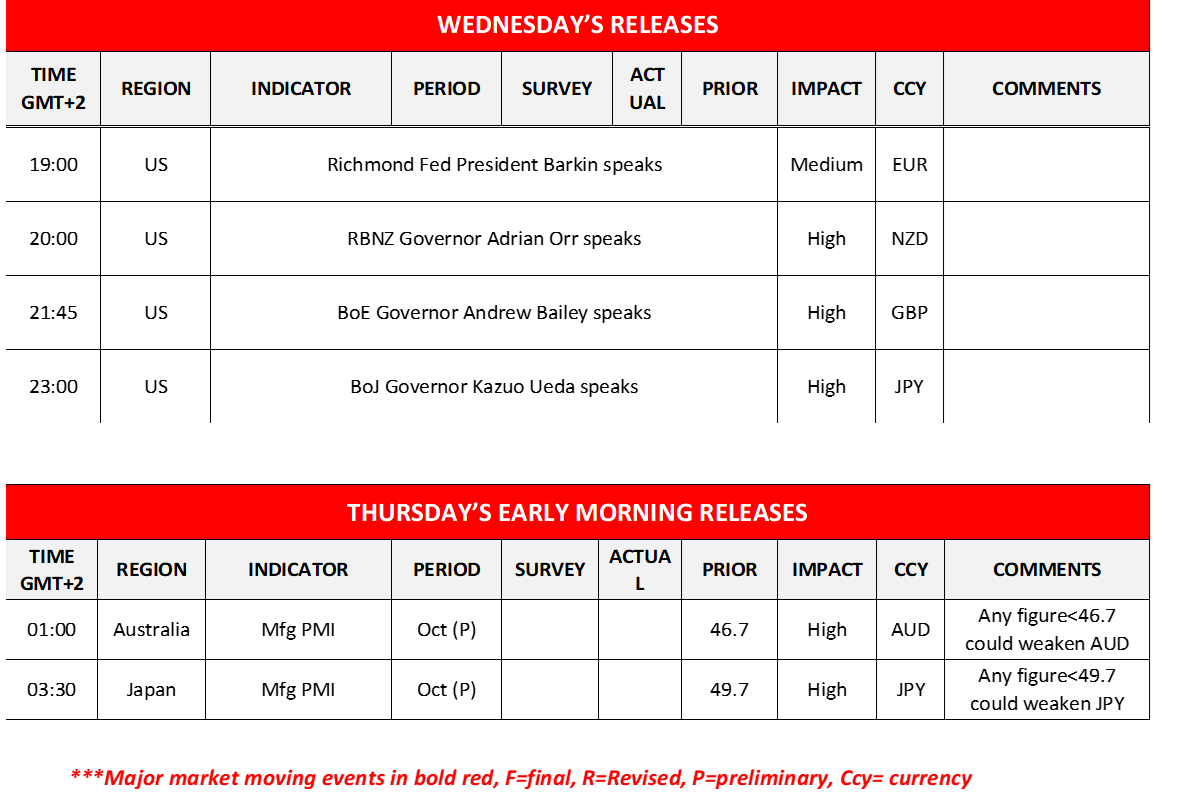

Today, we get Eurozone’s preliminary October consumer confidence and the weekly EIA crude oil inventories figure. In tomorrow’s Asian session, we get Australia’s and Japan’s preliminary PMI figures for October.

USD/CAD Daily Chart

- Support: 1.3775 (S1), 1.3590 (S2), 1.3440 (S3)

- Resistance: 1.3895 (R1), 1.4050 (R2), 1.4235 (R3)

EUR/USD デイリーチャート

- Support: 1.0775 (S1), 1.0670 (S2), 1.0530 (S3)

- Resistance: 1.0890 (R1), 1.1000 (R2), 1.1100 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。