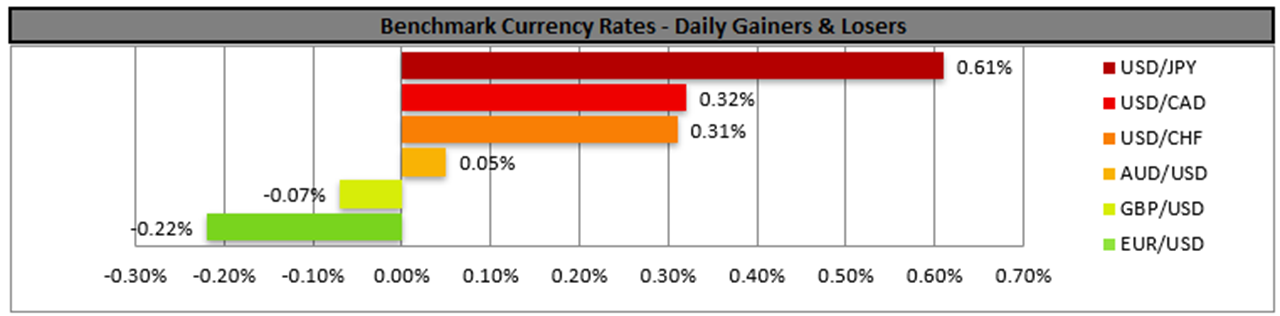

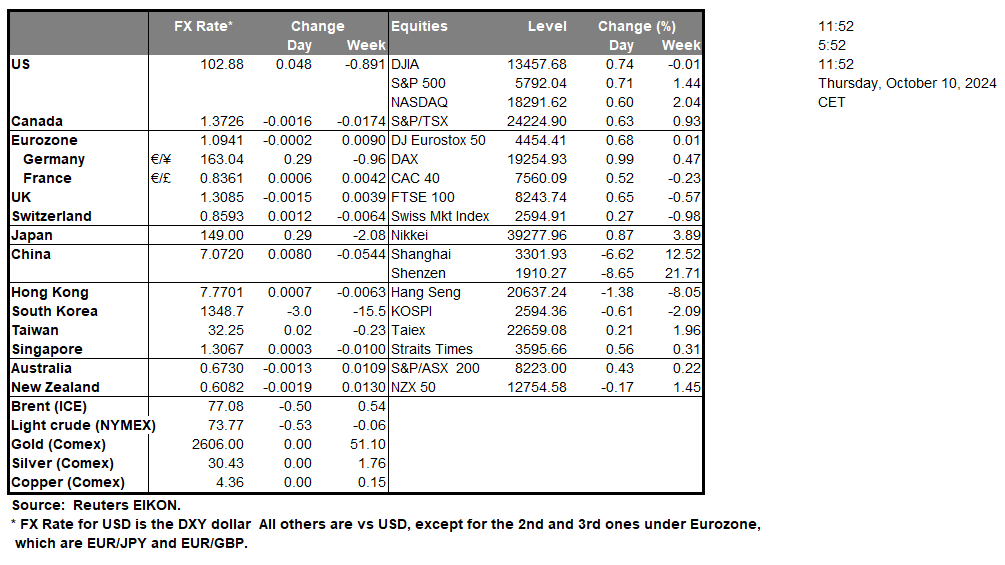

The USD gained against its counterparts yesterday, as the Fed’s September meeting minutes proved to be more hawkish than what the market expected. It’s characteristic that most of the Fed policymakers agreed that monthly inflation reports align and are consistent with inflation returning sustainably to the 2% target. Overall, the release did not alter the market’s expectations for the bank to proceed with two 25 basis points rate cuts until the end of the year, thus providing some slight support for the USD at the release and the following minutes. In a slightly more hawkish tone, San Francisco Fed President Daly stated yesterday that she expects the bank to proceed with one or two more rate cuts until the end of the year. Today we expect the markets to closely watch the speeches of Richmond Fed President Barkin and New York Fed President Williams for any further clues regarding the Fed’s intentions.

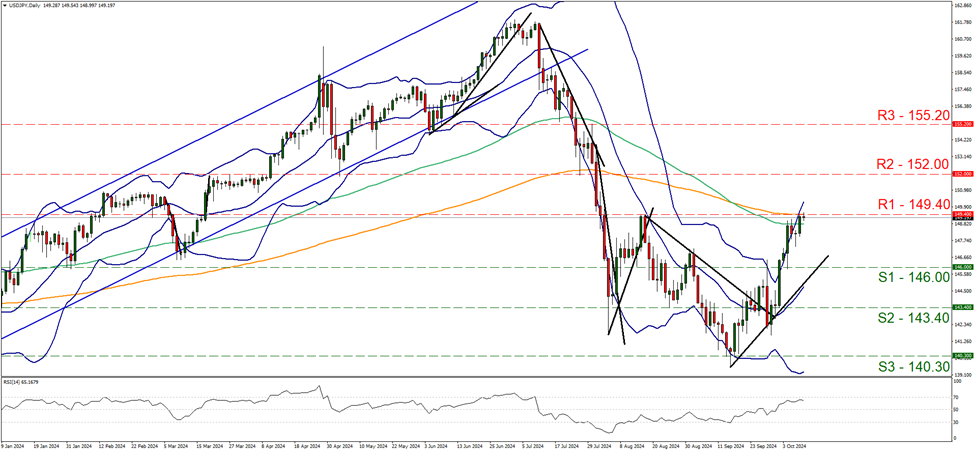

On a technical level the USD gained against the JPY forcing USD/JPY even higher and the pair is currently testing the 149.40 (R1) resistance line. We see the case for the upward motion to be maintained yet the US CPI rates release could alter the pair’s direction. Also note that the RSI indicator remains at relatively high levels, which tends to imply a bullish market sentiment for USD/JPY. Should the bulls maintain control as expected, we may see the pair breaking the 149.40 (R1) resistance line, thus opening the gates for the 152.00 (R2) level. A bearish outlook seems currently to be remote, yet we note some hesitancy of the pair to break the R1, which could reverse the upward movement, yet for a bearish outlook to emerge we would require the pair to clearly break the 146.00 (S1) support line.

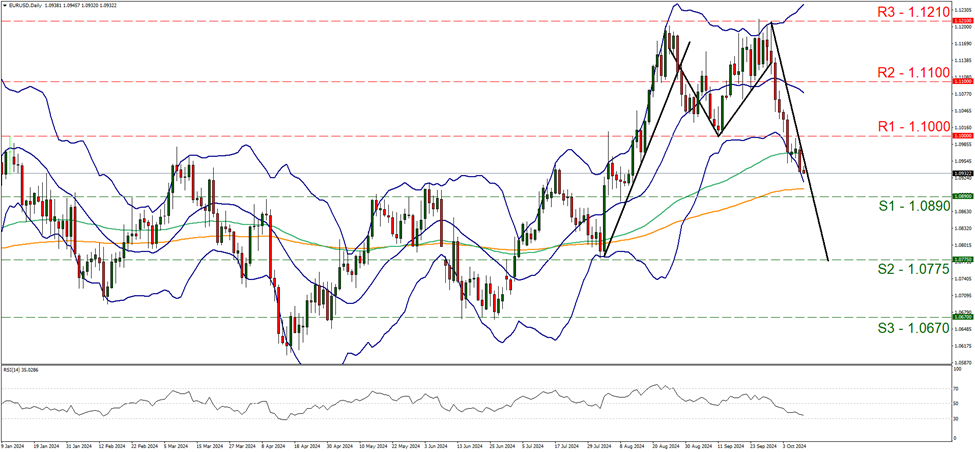

In the European theatre, we note that EUR/USD continued to drop yesterday, yet shows some stabilisation during today’s Asian and early European sessions. For the time being we tend to maintain a bearish outlook for the pair as long as the downward trendline incepted since the 30 of September, remains intact. We note that the idea of a double top formation seems to be gaining traction and is also implying further downward motion for the pair. Also the RSI indicator is nearing the reading of 30, implying a strong bearish sentiment of the market for the pair. Should the bears continue to lead the pair we may see EUR/USD breaking the 1.0890 (S1) support line and thus pave the way for the 1.0775 (S2) support base. For a bullish outlook we would require the pair to reverse direction, break the prementioned downward trendline in a first signal that the downward motion has been interrupted and continue to break the 1.1000 (R1) resistance line clearly.

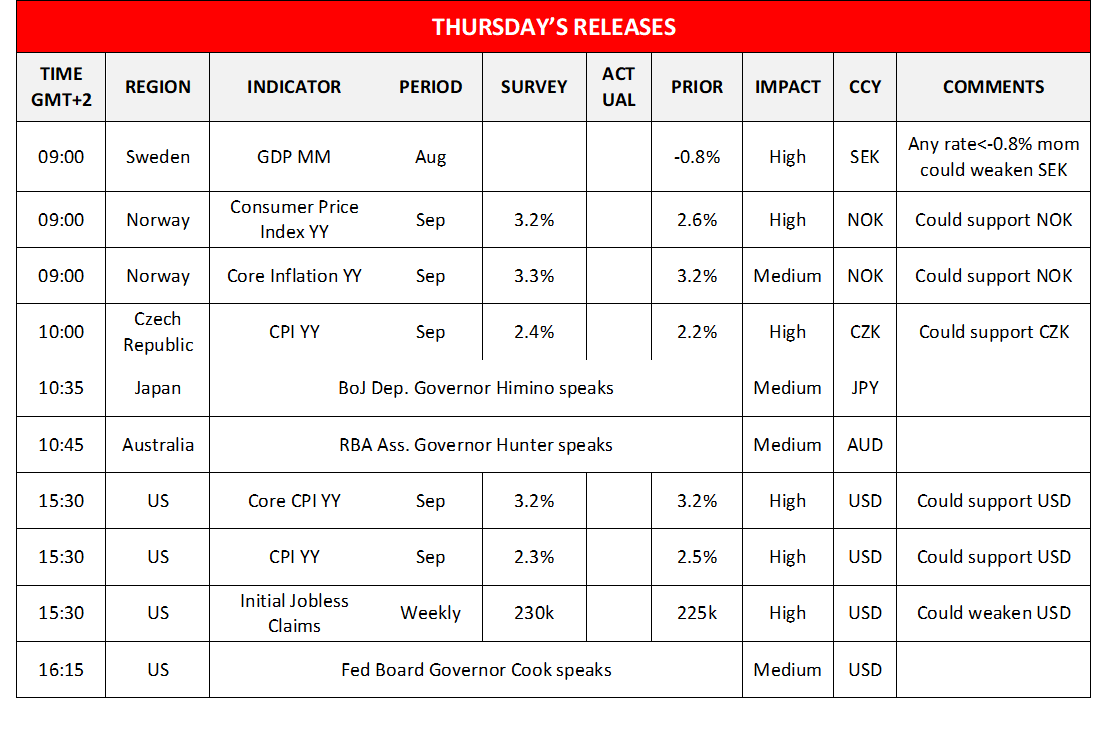

The main issue of the day though is expected to be the release of the US CPI rates for September. The headline rate is expected to slow down to 2.3% yoy if compared to August’s 2.5% yoy. Such a release would be consistent with the expectations for further easing of inflationary pressures in the US economy and could weigh on the USD. On the flip side though the core rate is expected to remain unchanged at 3.2% yoy, implying a resilience of inflationary pressures in the US economy at a core level, and thus support the USD as it would contradict the narrative as expressed by the headline rate. We expect the release to have wider ripple effects, beyond the FX market should the actual rates differ substantially from the prognosis, they could affect also US stock markets and gold’s price as they could shift the market’s expectations for the Fed’s intentions. Should the rates fail to substantially slow down, we may see the release weighing on US stock markets and gold’s price and vice versa.

その他の注目材料

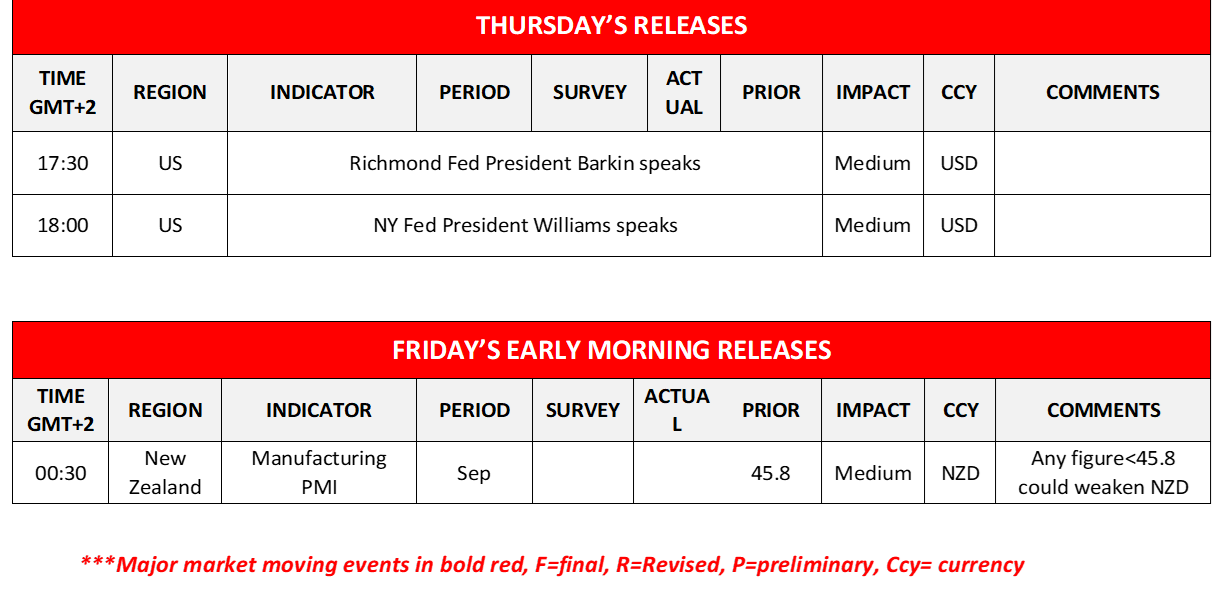

In today’s European session, we get Sweden’s August GDP rate, Norway’s and the Czech Republic’s September CPI rates, while BoJ Dep. Governor Himino and RBA Ass. Governor Hunter are scheduled to speak. Later we get the US weekly initial jobless claims figure.

USD/JPY Daily Chart

- Support: 146.00 (S1), 143.40 (S2), 140.30 (S3)

- Resistance: 149.40 (R1), 152.00 (R2), 155.20 (R3)

EUR/USD デイリーチャート

- Support: 1.0890 (S1), 1.0775 (S2), 1.0670 (S3)

- Resistance: 1.1000 (R1), 1.1100 (R2), 1.1210 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。