NZD took a hit by RBNZ’s in today’s Asian session, yet seems to be currently stabilizing. The bank cut rates by 50 basis points as was expected and seems to be prepared to cut rates further should there be no surprises. We see the case for the dovish outlook of RBNZ to weigh on the Kiwi on a monetary policy level.

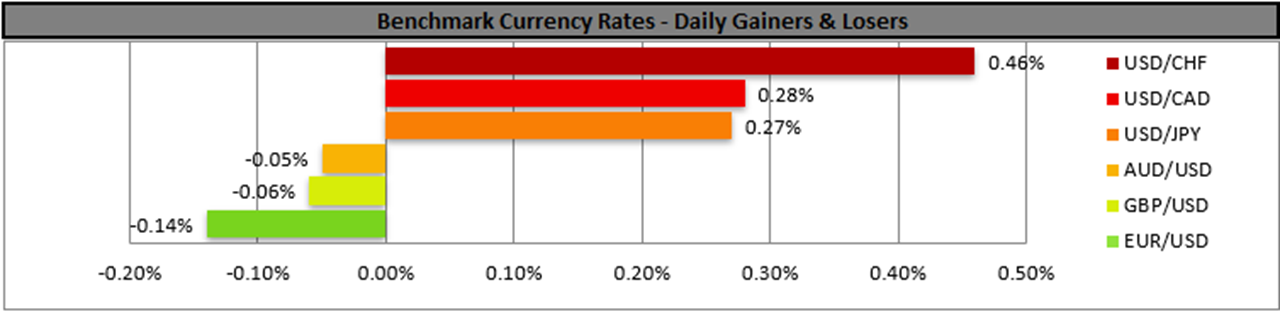

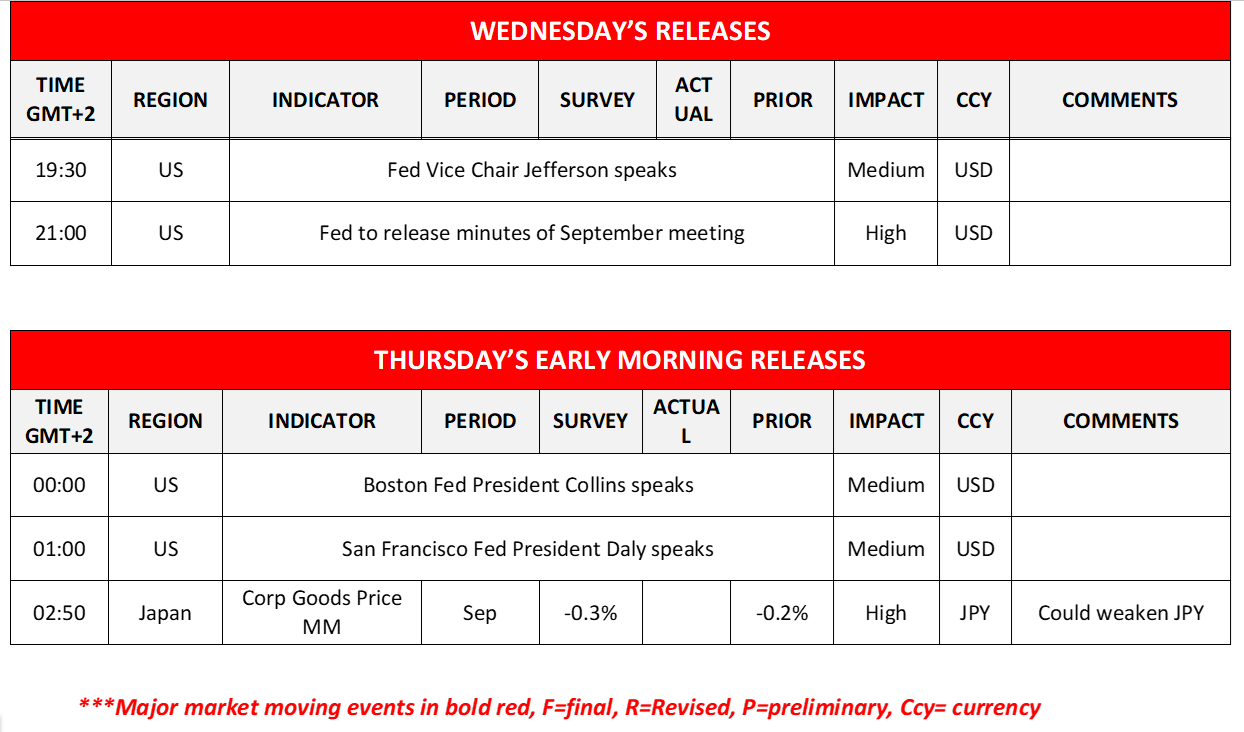

The USD on the other hand edged higher against its counterparts during today’s Asian session, yet amidst low volatility in the FX market. We continue to see the market expectations for the Fed’s intentions as may be the main factor behind the USD’s direction and before the release of the September US CPI rates tomorrow we highlight the release of the Fed’s September meeting minutes in today’s late American session. Should the document show an unwillingness on behalf of Fed policymakers to proceed with extensive rate cuts, opting for a more moderated monetary policy easing path we may see the USD getting some support as the market’s expectations for two 25 basis points rate cuts until the end of the year could be enhanced.

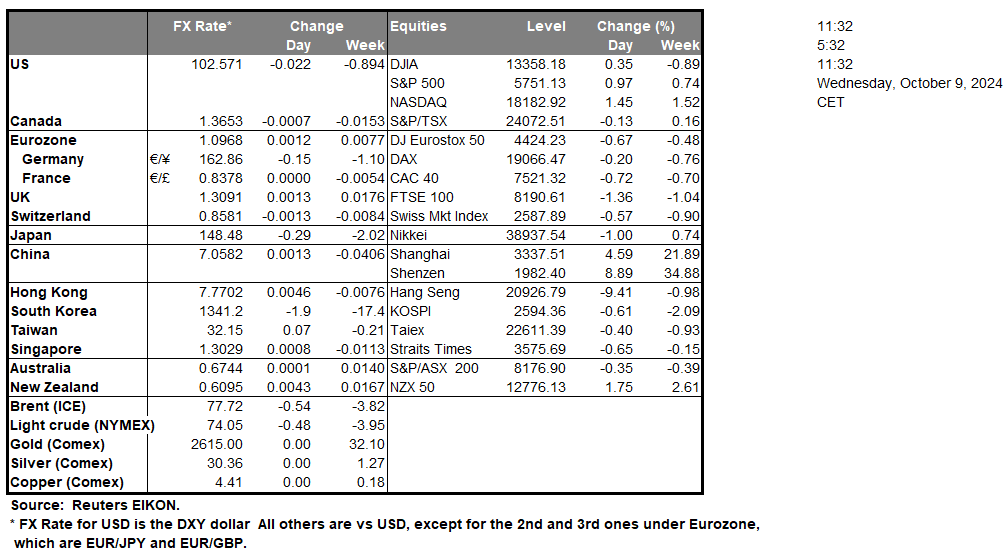

Yet the release may have an effect also on US stock markets, which were on the rise yesterday in a sign of a more risk-oriented market sentiment. It’s characteristic that S&P 500 neared record high levels once again, while Tech shares seem to have benefited the most with NVIDIA leading the way. On the flip side, news that the US DoJ is considering whether Google should be broken up may weigh on Alphabet’s share price on a fundamental level.

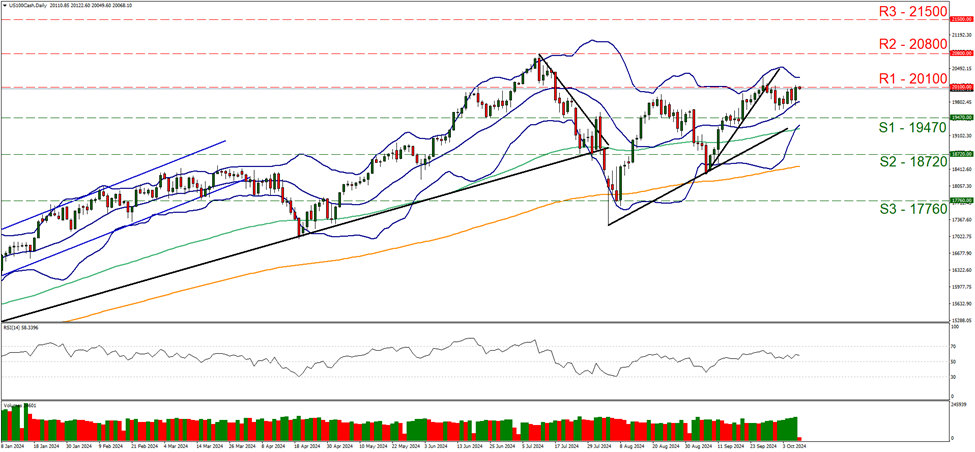

Nasdaq was on the rise yesterday, yet hit a ceiling on the 20100 (R1) resistance line. We tend to maintain a sideways movement bias for the index just below the 20100 (R1) resistance line, yet bullish tendencies seem to be present for the index as the RSI indicator is above the reading of 50. For a bullish outlook, we would require the index’s price action to clearly break the 20100 (R1) resistance line and start aiming for the 20800 (R2) resistance level. Should the bears take over, we may see the index’s priceaction relenting yesterday’s gains and reaching if not breaking the 19470 (S1) support line.

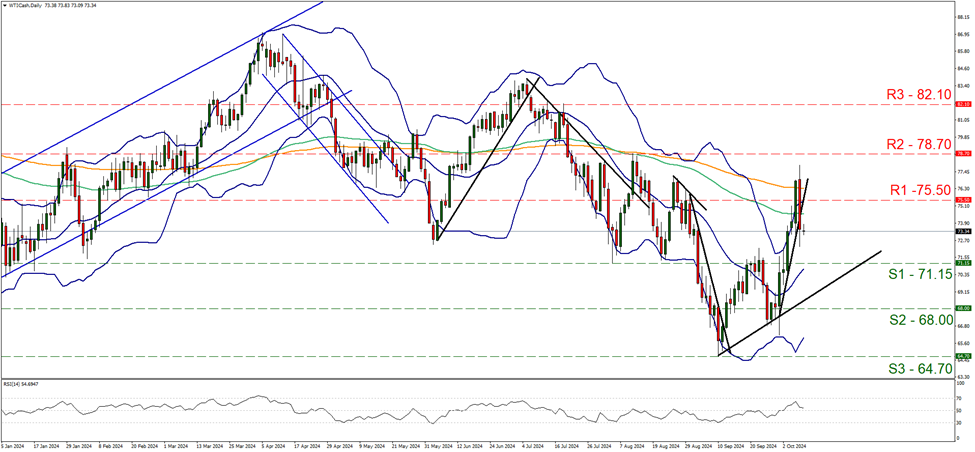

Lastly on the commodities front, we note the drop of oil prices yesterday. Main reason cited by media, was the potentiality of a ceasefire, yet we still see a high degree of uncertainty to that scenario. The market reaction though highlighted how the Israeli-Palestinian conflict has a firm grip on the fundamentals of the oil market. Furthermore, we note that API reported a massive rise of US oil inventories of 10.9 million barrels, in a sign of a slack in the US oil market, which may have also weighed on oil prices, while EIA’s release is expected to be closely watched by the markets. Meanwhile, EIA lowered its oil demand expectations while the hurricanes about to hit the Florida coast may have an adverse effect on local oil production.

WTI’s price action dropped yesterday breaking the 75.50 (R1) support line, now turned to resistance. The commodity’s price in its drop broke the upward trendline guiding it since the 1 of October, hence we abandon our bullish outlook and expect some temporary stabilisation of WTI’s price action, possibly between the 75.50 (R1) resistance line and the 71.15 (S1) support level. For the bullish outlook to be rejuvenated, we would require the commodity’s price to form a higher peak than yesterday’s, hence WTI’s price action has to reach if not break the 78.70 (R2) resistance barrier. For a bearish outlook we would require WTI’s price action to break the 71.15 (S1) support line and aim for the 68.00 (S2) support base.

その他の注目材料

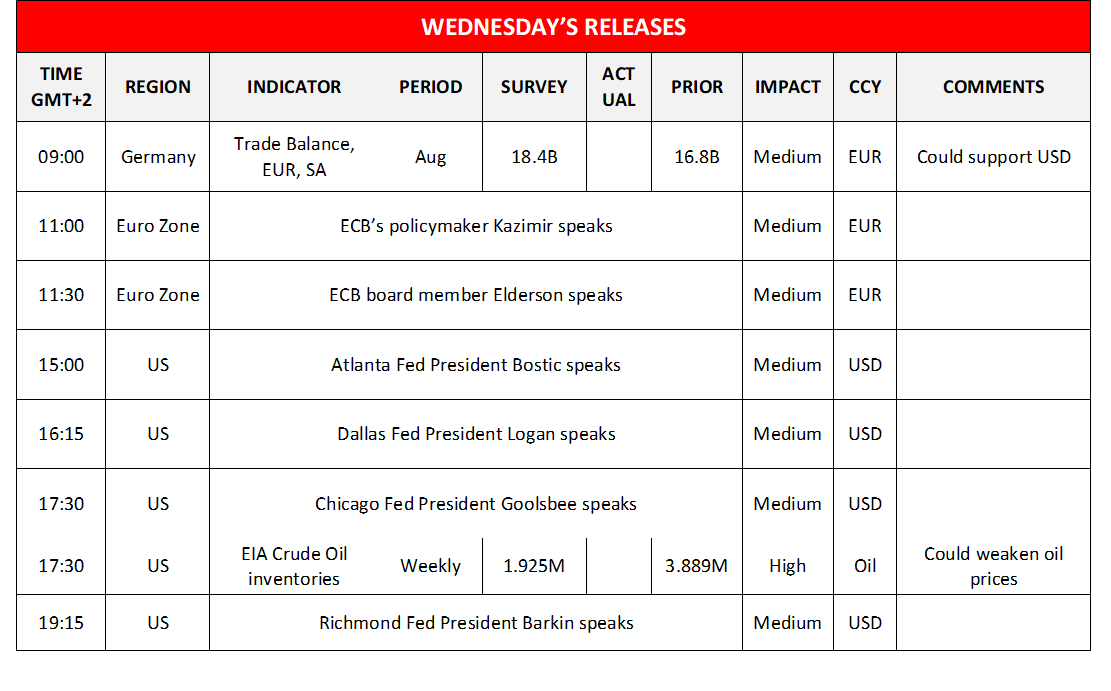

In today’s calendar we note that we get Germany’s trade data for August and tomorrow Japan’s Corporate Goods Prices growth rates for September, while a number of ECB and Fed policymakers are scheduled to speak and could sway the markets.

US 100 Cash Daily Chart

- Support: 19470 (S1), 18720 (S2), 17760 (S3)

- Resistance: 20100 (R1), 20800 (R2), 21500 (R3)

WTI Daily Chart

- Support: 71.15 (S1), 68.00 (S2), 64.70 (S3)

Resistance: 75.50 (R1), 78.70 (R2), 82.10 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。