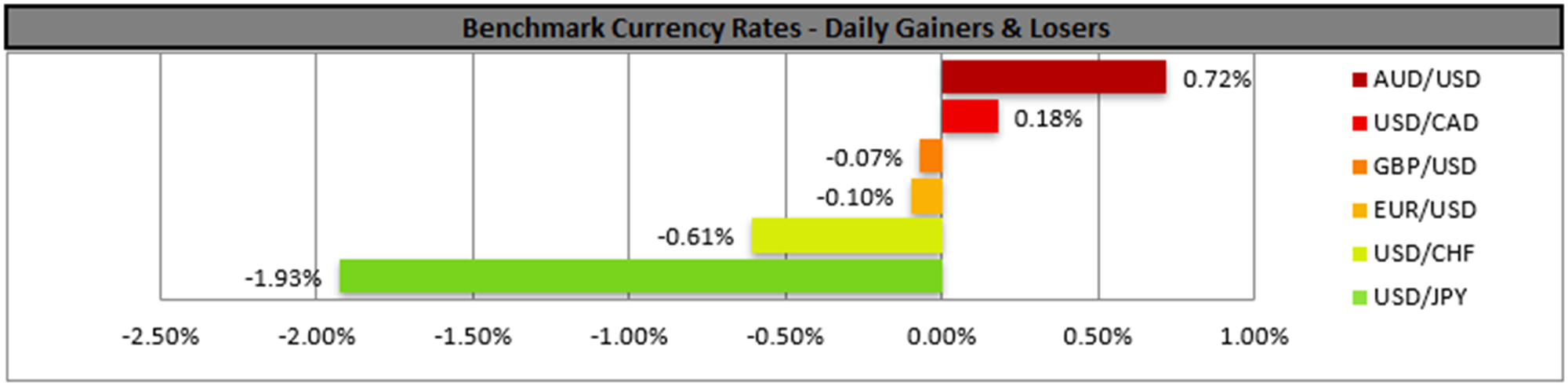

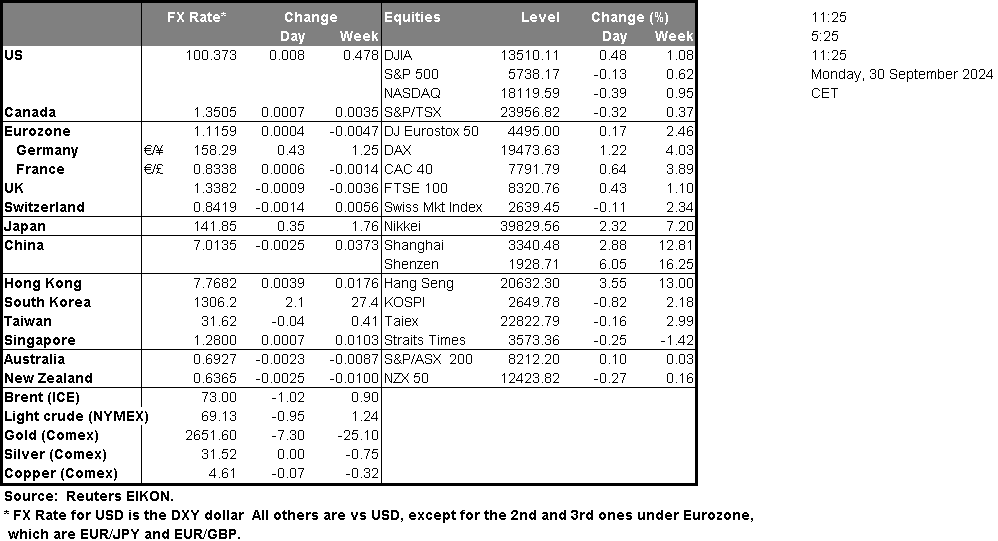

The USD edged lower on Friday against its counterparts as the headline PCE rate slowed down slightly more than expected implying further easing of inflationary pressures in the US economy. On the other hand, the core rate accelerated implying a relative persistence of inflation. Today we highlight the speech of Fed Chairman Powell, and should he verify the market’s dovish expectations we may see the USD slipping further and vice versa.

In Asia, JPY rallied on Friday and continued to strengthen during today’s Asian session, as Mr. Shigeru Ishiba, a former defence minister and erstwhile critic of aggressively easy policy won the leadership of the ruling Liberal Democratic Party, which controls parliament and will vote him into office. The news gives BoJ a free hand towards normalising its monetary policy.

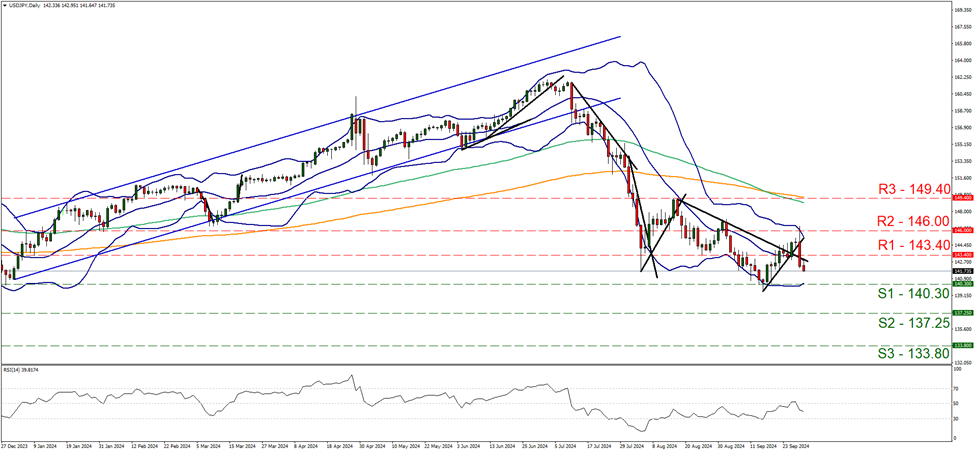

USD/JPY sunk on Friday breaking the 143.40 (R1) support line, now turned to resistance. We see the case for further bearish movements of the pair given that the RSI indicator dropped below the reading of 50, yet some signs of stabilisation were present during today’s Asian session. Should the bears maintain control over the pair, we may see it aiming if not breaking the 140.30 (S1) line. On the flip side, should the bulls take over, we may see the pair breaking the 143.40 (R1) resistance line and taking aim of the 146.00 (R2) level.

Furthermore we note that China’s September manufacturing PMI figures sent some mixed signals during today’s Asian session, yet the sector seems to continue to be in trouble, struggling for economic activity. After the easing of PBoC’s monetary policy market expectations are high also for fiscal support from the Chinese Government, which tend to support the Yuan, but also the Aussie given the close Sino-Australian economic ties.

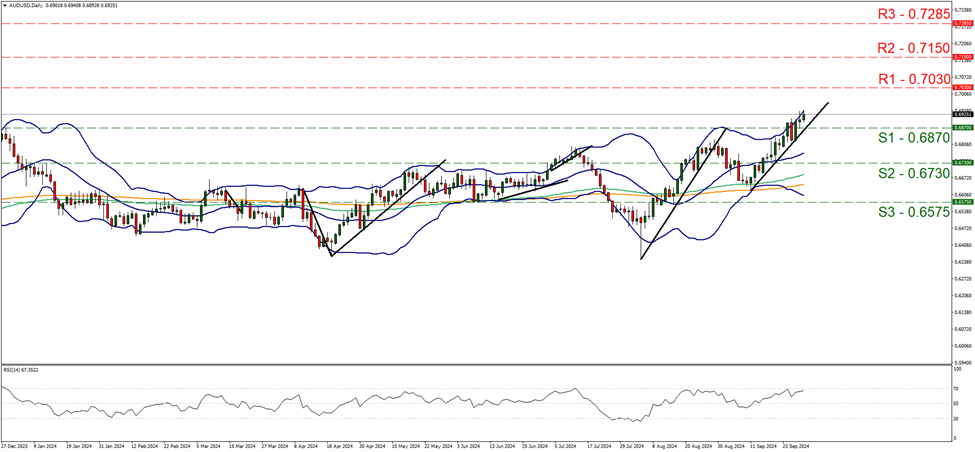

AUD/USD edged higher on Friday and during today’s Asian session, using the 0.6870 (S1) support line as a platform. We tend to maintain a bullish outlook for the pair as long aas the upward trendline guiding the pair since the 11 of September remains intact, yet the price action is flirting with the upper Bollinger band which could slow down the bulls. Should the buying interest be extended, we may see AUD/USD actively aiming for the 0.7030 (R1) line. On the flip side, should sellers be in charge of the pair’s direction, we may see it breaking the prementioned upward trend line, the 0.6870 (S1) line and taking aim of the 0.6730 (S2) level.

本日のその他の注目点

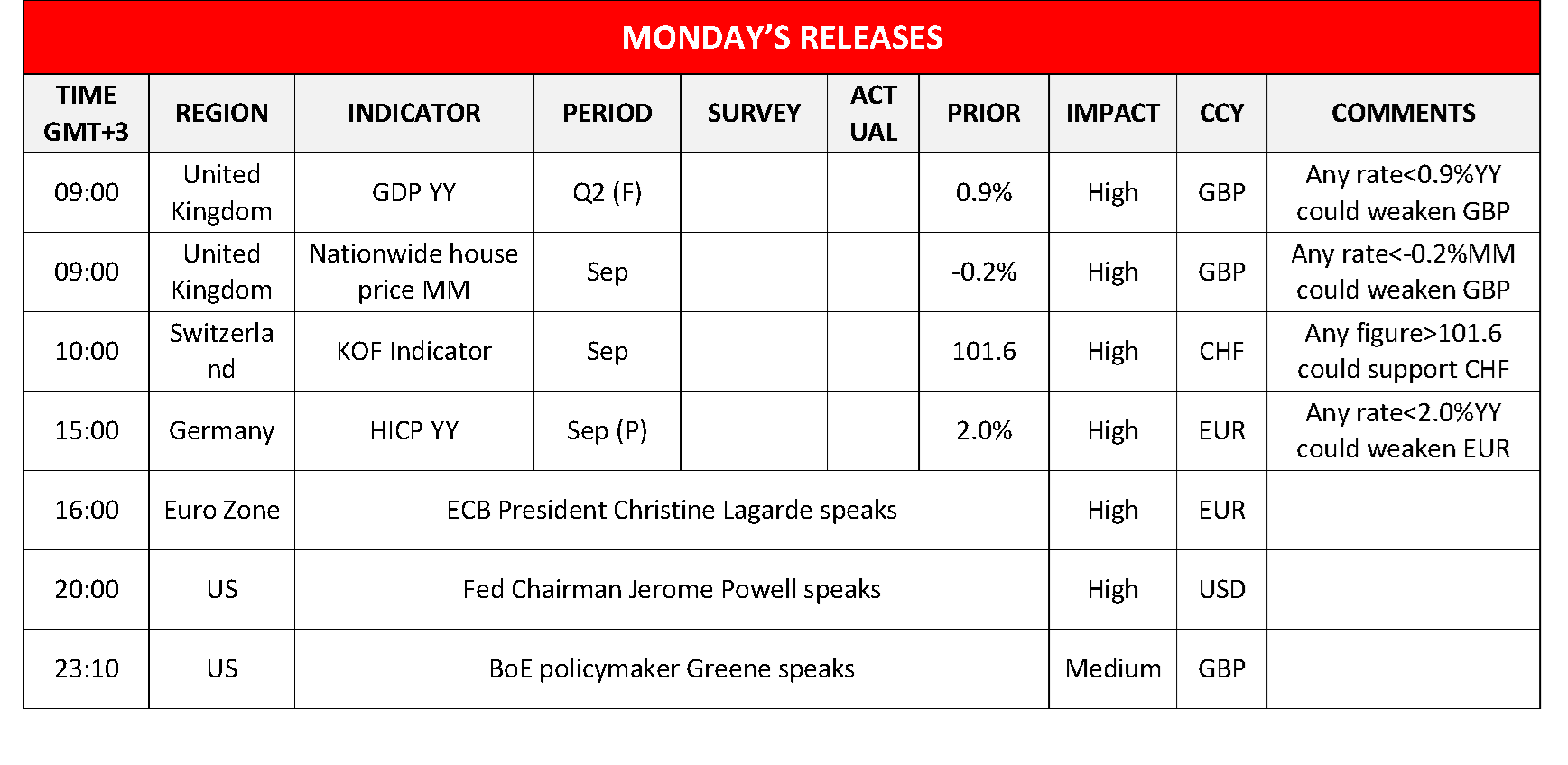

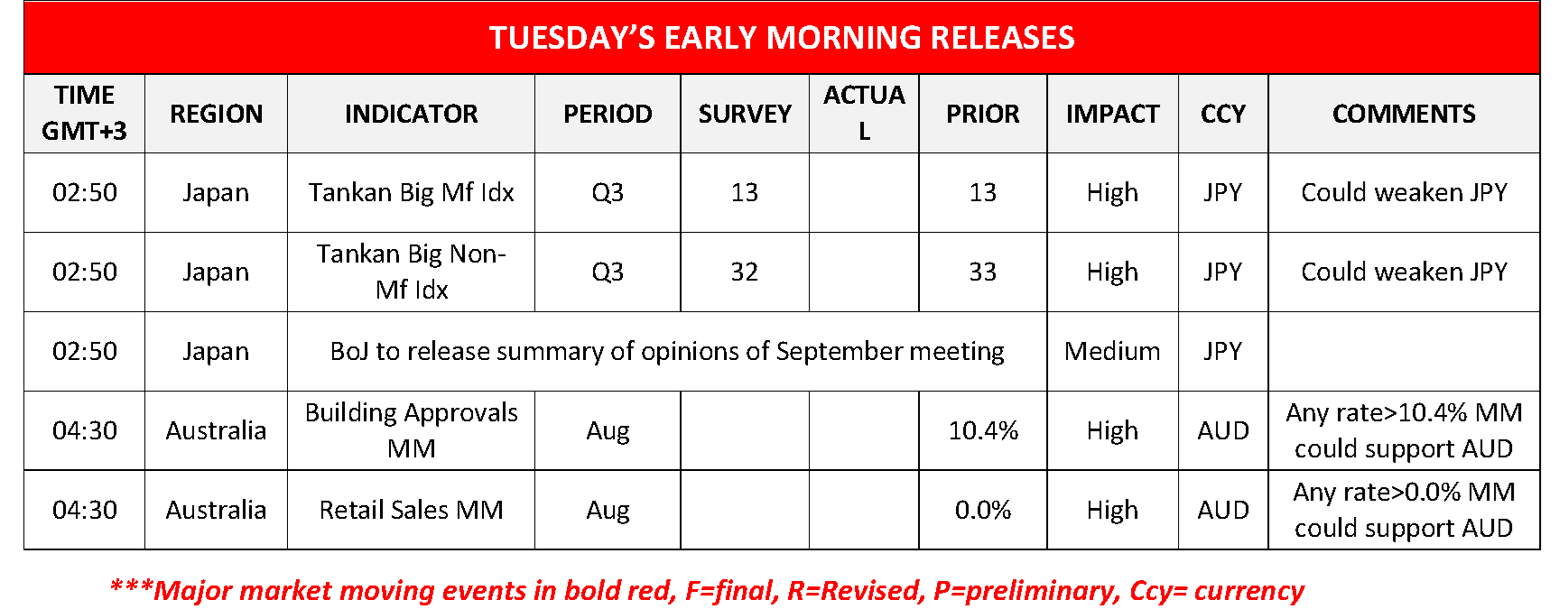

Today we get UK’s final GDP rates for Q2 and Nationwide House Prices for September, Switzerland’s KOF indicator for September and a bit later Germany’s preliminary HICP rate for the same month. On the monetary front, we note that ECB President Christine Lagarde and BoE policymaker Greene are scheduled to speak. During tomorrow’s Asian session, we get Japan’s Tankan indexes for Q3, BoJ is to release summary of opinions of September meeting and from Australia we get August’s building approvals and retail sales.

今週の指数発表

On Tuesday, we get Japan’s Tankan indexes for Q3, Australia’s retail sales and building approvals for August, the Czech Republic’s revised GDP rates for Q2, Eurozone’s preliminary HICP rate for September, Canada’s manufacturing PMI figure for September and from the US the ISM manufacturing PMI figure for September and August’s JOLTS job openings. On Wednesday, we get from the US, September’s ADP national employment figure while oil traders may be more interested in OPEC+’s ministerial panel. On Thursday we get Australia’s August trade data, Switzerland’s and Turkey’s CPI rates both being for September and from the US the ISM non-manufacturing PMI figure for the same month. On Friday we get the US employment report for September with its NFP figure.

USD/JPY Daily Chart

- Support: 140.30 (S1), 137.25 (S2), 133.80 (S3)

- Resistance: 143.40 (R1), 146.00 (R2), 149.40 (R3)

AUD/USD デイリーチャート

- Support: 0.6870 (S1), 0.6730 (S2), 0.6575 (S3)

- Resistance: 0.7030 (R1), 0.7150 (R2), 0.7285 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。