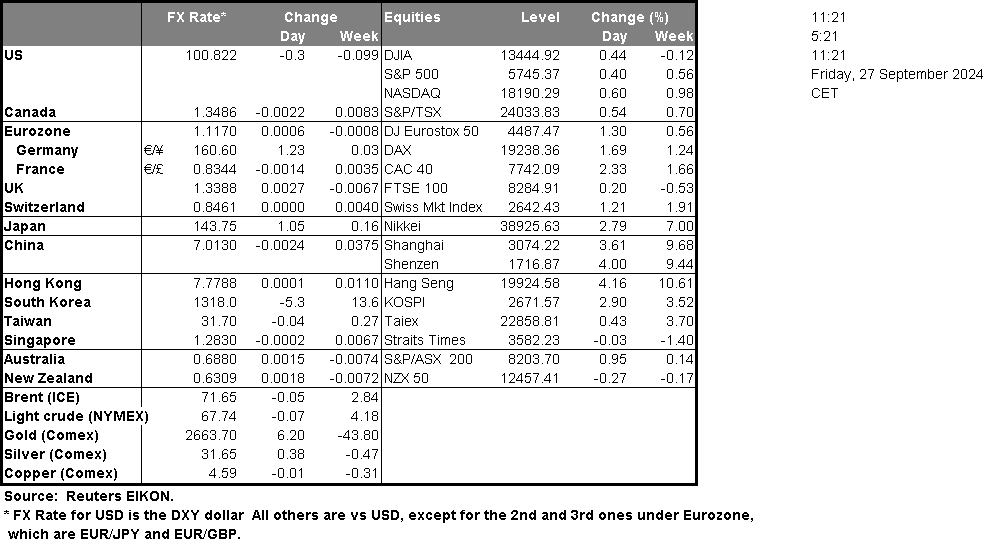

The USD edged higher yesterday, against its counterparts yet tends to show some signs of stabilisation. Market expectations for the path of the USD seem to continue to revolve around the Fed’s intentions and rate-cutting path. Aby signs confirming the market’s extensive dovish expectations could weigh on the greenback and vice versa. Today we note the release of the US Core and headline PCE rates for August. Should the rates slow down further implying further easing of inflationary pressures in the US economy, we may see the USD slipping as it would exercise more pressure on the Fed to continue cutting rates at a fast pace, while a possible failure of the rates to slow down could allow the USD to rise.

Across the pond, EUR traders may prefer to focus on Eurozone’s Sentiment indicators for September. The market sentiment for the common currency is heavy, and market expectations for another rate cut by the ECB are intensifying. At the same time the economic outlook of the EUR area is darkening, especially for Germany which is the economic locomotive of the zone.

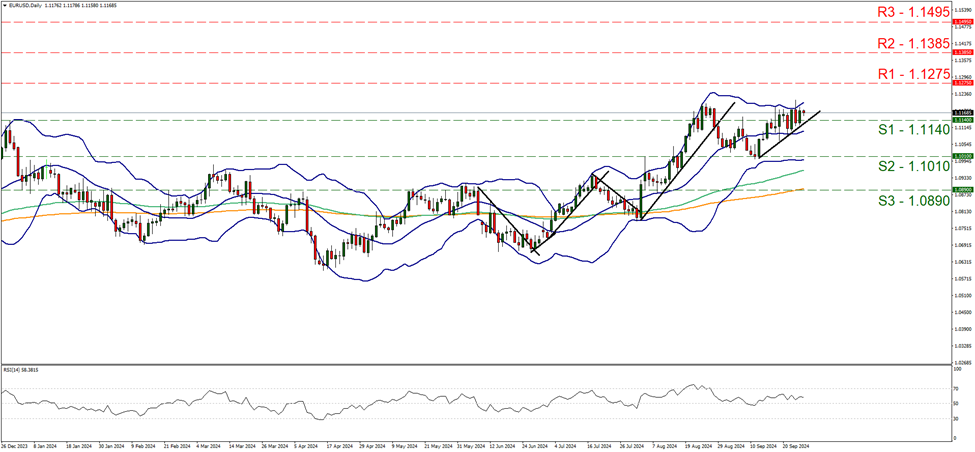

Against the EUR, the USD edged lower yesterday, yet EUR/USD seems to correct lower during today’s Asian and early European session which could put the 1.1140 (S1) support line to the test. The RSI indicator remains above the reading of 50, yet remains unconvincing for any bullish tendencies for the pair among market participants. On the other hand the upward trendline guiding the pair since the 12 of September, remains intact, hence the bullish outlook tends to remains, but some signs of stabilisation seem to be present. Should the bulls maintain control over the pair we may see EUR/USD aiming if not breaking the 1.1275 (R1) resistance line. Should the bears take over, we may see the pair breaking the 1.1140 (S1) support line clearly, breaking the prementioned upward trendline signalling the interruption of the upward movement and taking aim if not breaking the 1.1010 (S2) support level.

North of the US border, we note the release of Canada’s GDP rate for July and should the rate escape stagnation levels, showing growth for the Canadian economy could support for the Loonie. Lonie traders on the other hand may also continue keeping an eye out for oil prices given their wide drop over the past two days. Should the bearish tendencies for oil prices be maintained we may see the CAD losing ground given Canada’s status as a major oil producing country.

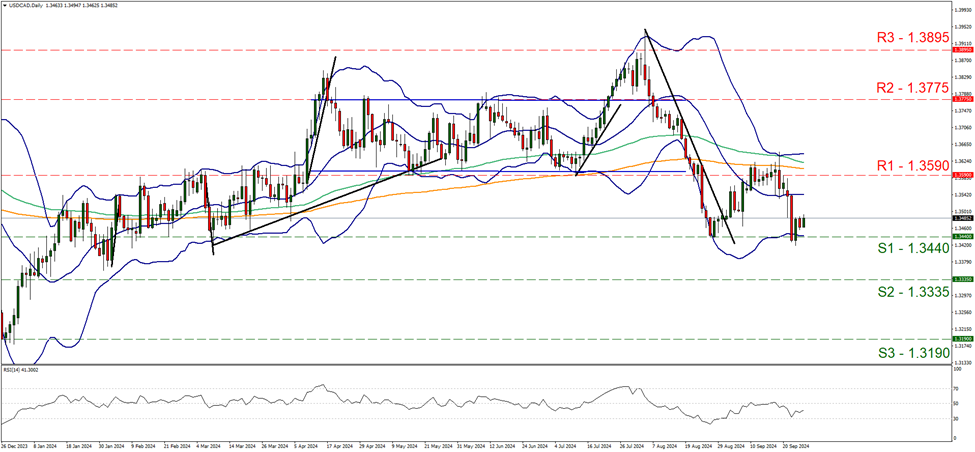

USD/CAD edged lower yesterday yet remained slightly above the 1.3440 (S1) support line, yet relented any losses during today’s Asian session. The RSI indicator is edging higher yet remains below the reading of 50 implying the presence of a bearish predisposition of the market for the pair. Should the bears regain control over the pair, we may see USD/CAD breaking the 1.3440 (S1) support line and aim for the 1.3335 (S2) support level. Should the bulls take over, we may see USD/CAD aiming if not breaking the 1.3335 (S2) support level.

Also, we note the strengthening of the JPY in the late Asian session. The fundamental issue underpinning JPY’s strengthening may be related to the political scene of Japan. Up until now the market was pricing in the possibility of Ms. Takaichi winning the leadership of the Liberal Democratic Party (LDP) and becoming the next Prime Minister of Japan. Please note that Ms. Takaichi was against hiking rates by BoJ which tended to weigh on JPY on a political level. Yet the market was taken by surprise as Mr. Ishiba won the leadership of the LDP which could imply a free hand for BoJ to continue hiking rates and thus supporting JPY.

本日のその他の注目点

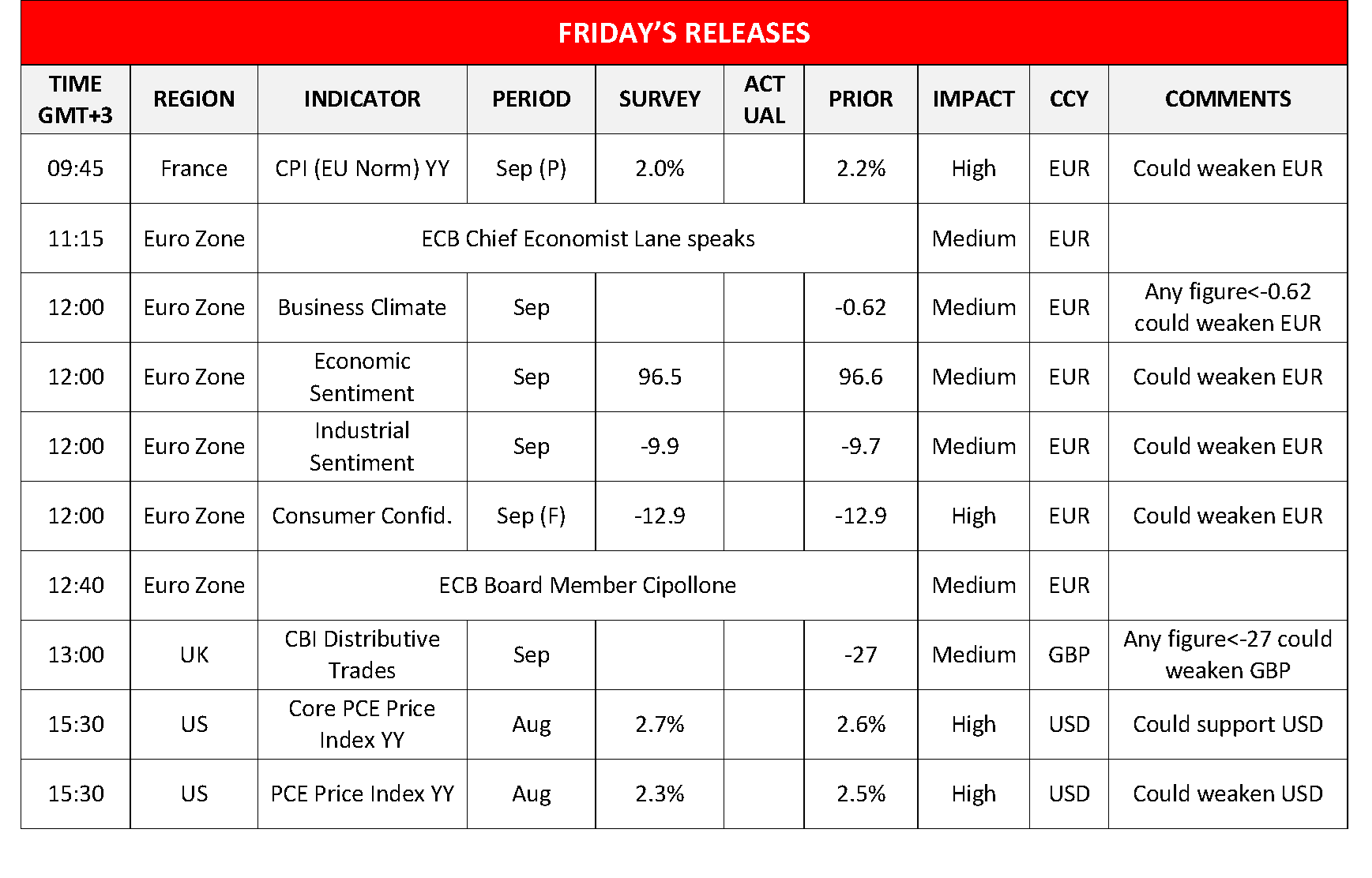

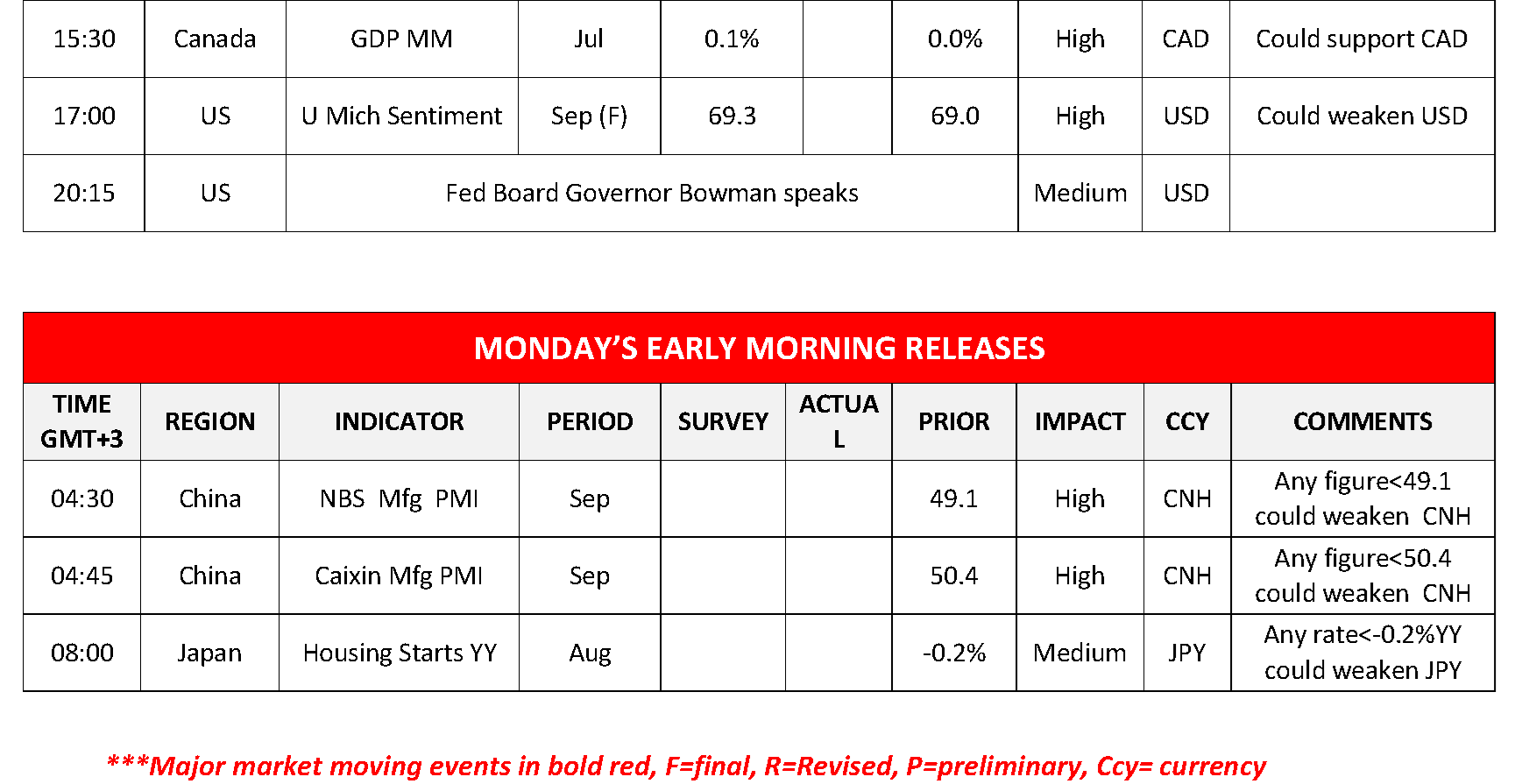

Today we get UK’s CBI distributive trades indicator and the final UoM consumer sentiment both for September, while Fed Board Governor Bowman speaks. During Monday’s Asian session, we get China’s NBS and Caixin PMI figures for September and Japan’s Housing starts for August.

EUR/USD デイリーチャート

- Support: 1.1140 (S1), 1.1010 (S2), 1.0890 (S3)

- Resistance: 1.1275 (R1), 1.1385 (R2), 1.1495 (R3)

USD/CAD Daily Chart

- Support: 1.3440 (S1), 1.3335 (S2), 1.3190 (S3)

- Resistance: 1.3590 (R1), 1.3775 (R2), 1.3895 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。