US stock markets moved higher since our last report last week. Today we are to focus on the impact of the Fed’s interest rate decision, yet also have a look at Volkswagen, Visa the recent allegations made by Google against Microsoft and for a rounder view conclude the report with a technical analysis of US 500’s daily chart.

The Fed’s interest rate decision

The main event for Equities traders last week was the Fed’s interest rate decision, in which the Fed cut interest rates by 50 basis points, marking the start of the Fed’s rate-cutting cycle. In turn, the Fed’s decision to cut interest rates by 50bp, may in turn ease the tight financial conditions surrounding the US economy and could also boost economic activity. Therefore, as financial conditions begin to ease and consumer spending in the US economy ticks up, it may increase profits and revenues for companies and as a result, provide support for their stock prices as well. Overall, the rate cut appears to have been well received by the US Equities markets with the S&P500 and Dow Jones 30 forming new all-time highs this week. However, the US consumer confidence figure for September which acts as a leading indicator of consumer spending in the US economy, came in lower than expected which may cast some doubt over our aforementioned scenario. Nonetheless, should Fed policymakers re-iterate calls for further rate cuts by the end of the year, it may aid the US equities markets. Whereas, should policymakers showcase a hesitation for further rate cuts, it could weigh on the US equities markets.

Volkswagen gears up for its labour union battle.

Volkswagen executives are preparing to meet with labour union leaders today, after the company announced plans to potentially close plants in Germany and ended agreements earlier this month which had safeguarded employment at six of its plants in western Germany since the mid-1990’s. The recent actions and statements by Volkswagen’s executives appear to have caused unrest amongst the company’s workers which are represented by IG Metall, the largest industrial labour union in Europe. In particular, IG Metall has threatened to go on strike from the start of December, whilst insisting on a 7% pay rise according to a report by Reuters. Overall, the recent headwinds faced by the company and its apparent desire to embark on a cost-cutting program could lead to stiff resistance against the demands made by IG Metal and thus we would not be surprised to see the labour union go on strike. In conclusion, should Volkswagen’s management fail to reach an agreement with the labour union, it could weigh on the company’s stock price.

Visa (#VISA) in the DOJ’s crosshairs

The DOJ announced earlier on today that it would be suing Visa (#VISA) over its exclusionary and anticompetitive conduct which undermines choice and innovation in payment and imposes enormous costs on consumers, merchants and the American economy, according to a press release. The DOJ’s antitrust lawsuit against Visa alleges that the company maintains a monopoly over debit network markets by using its dominance to thwart the growth of its existing competitors, whilst preventing others from developing new and innovative alternatives. The allegations thrown by the DOJ against Visa could potentially weigh on the company’s stock price, as should they be found guilty the repercussions could inadvertently lead to a reduction in revenue and profit for the company.

Google (#GOOG) lodges formal complaint against Microsoft (#MSFT)

Google according to various media outlets has filed a formal complaint against Microsoft to the EU’s top antitrust regulator. According to the WSJ, Google accuses Microsoft of abusing its market power in enterprise software to push businesses to use its Azure cloud platform. In the event that the EU’s top antitrust regulator decides to investigate Microsoft (#MSFT), it could weigh on the company’s stock price as the EU has shown a willingness to go after tech giants and impose hefty fines along the way. In particular, when the commission ruled against Apple in March, they stated that “the fine must be sufficient to deter Apple from repeating the present or a similar infringement; and to deter other companies of a similar size and with similar resources from committing the same or a similar infringement”. In conclusion, should the EU’s antitrust regulator decide to go after Microsoft, it may weigh on Microsoft’s stock price.

テクニカル分析

US500 Cash Daily Chart

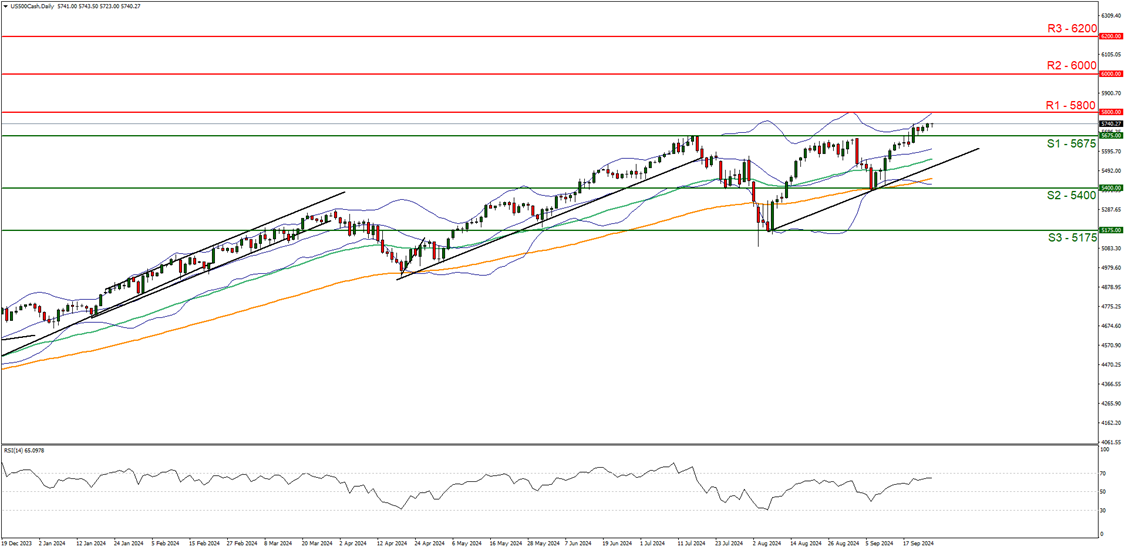

- Support: 5675 (S1), 5400 (S2), 5175 (S3)

- Resistance: 5800 (R1), 6000 (R2), 6200 (R3)

S&P 500 edged higher yesterday and is currently in the process of forming a new all-time high figure. We opt for a bullish outlook for the index and supporting our case is the upwards-moving trendline which was incepted on the 8 of August, in addition to the RSI indicator below our chart which currently registers a figure above 60, implying a bullish market sentiment. For our bullish outlook to continue we would require a clear break above the potential resistance level of 5800 (R1) with the next potential target for the bulls being the 6000 (R2) resistance line. On the flip side, for a bearish outlook we would require a clear break below the 5675 (S1) support line with the next possible target for the bears being the 5400 (S2) support level. Lastly, for a sideways bias, we would require the index’s price to remain confined between the 5675 (S1) support line and the 5800 (R1) potential resistance level.

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。