The common currency gained against its counterparts yesterday as the ECB cut rates as expected, yet resisted the idea of another rate cut in the October reading. The bank stated in its that “The Governing Council will continue to follow a data-dependent and meeting-by-meeting approach to determining the appropriate level and duration of restriction” blurring the waters somewhat in regards to its intentions. On a macroeconomic level the bank tended to paint a rather gloomy picture for the outlook of Eurozone’s economy, with slow growth and a slight persistence of inflationary pressures. Overall, the bank’s stance tended to reinforce the market’s expectations for a break in the bank’s rate-cutting path in October thus supporting the EUR.

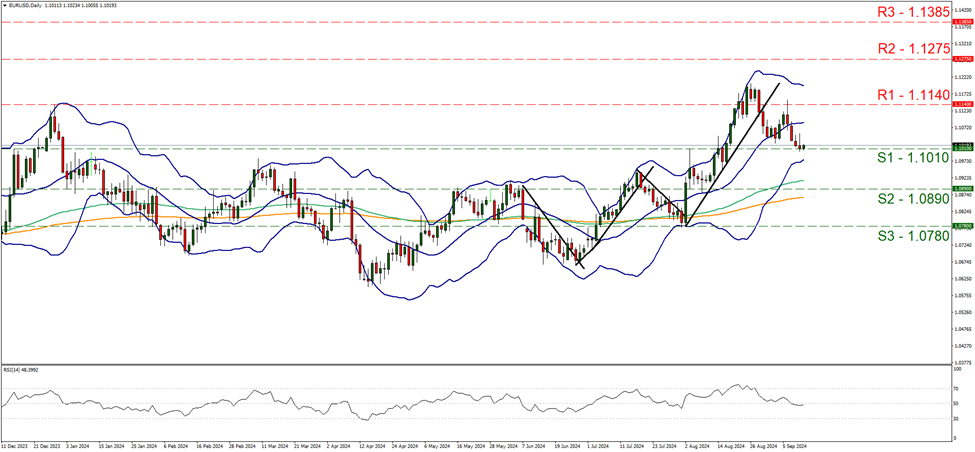

EUR/USD rose yesterday after bouncing on the 1.1010 (S1) support line. The pair’s movement tended to verify our bias for a sideways, hence we tend to maintain it for the time being. The RSI indicator rose and is currently above the reading of 50, yet currently remains unconvincing regarding any bullish tendencies of market participants. Should yesterday’s buying interest be extended and evolve into a bullish outlook we may see the pair breaking the 1.1140 (R1) resistance line, thus paving the way for the 1.1275 (R2) resistance level. Should the bears take over, we may see the pair reversing yesterday’s gains and breaking the 1.1010 (S1) support line clearly and start aiming for the 1.0890 (S2) support level.

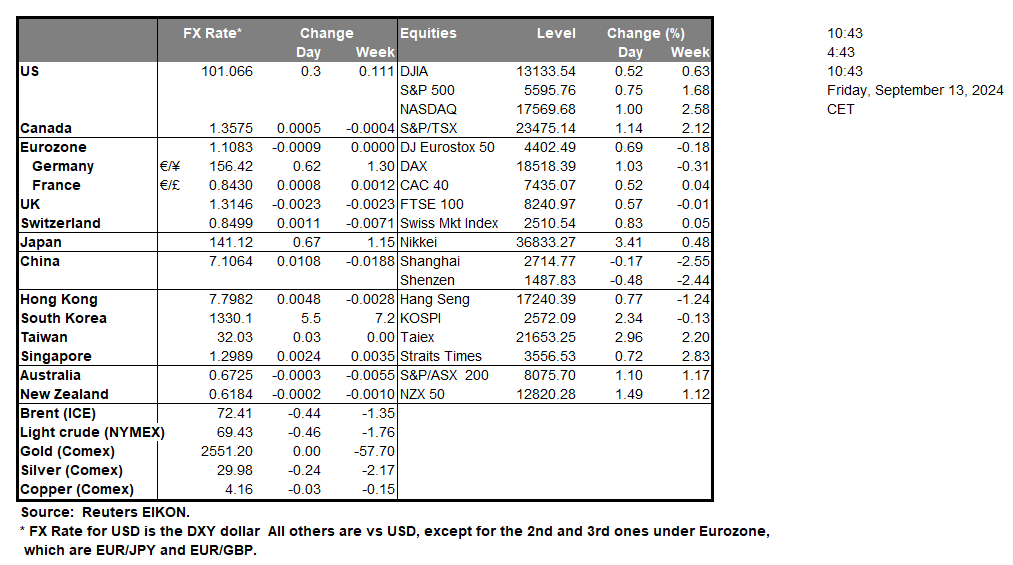

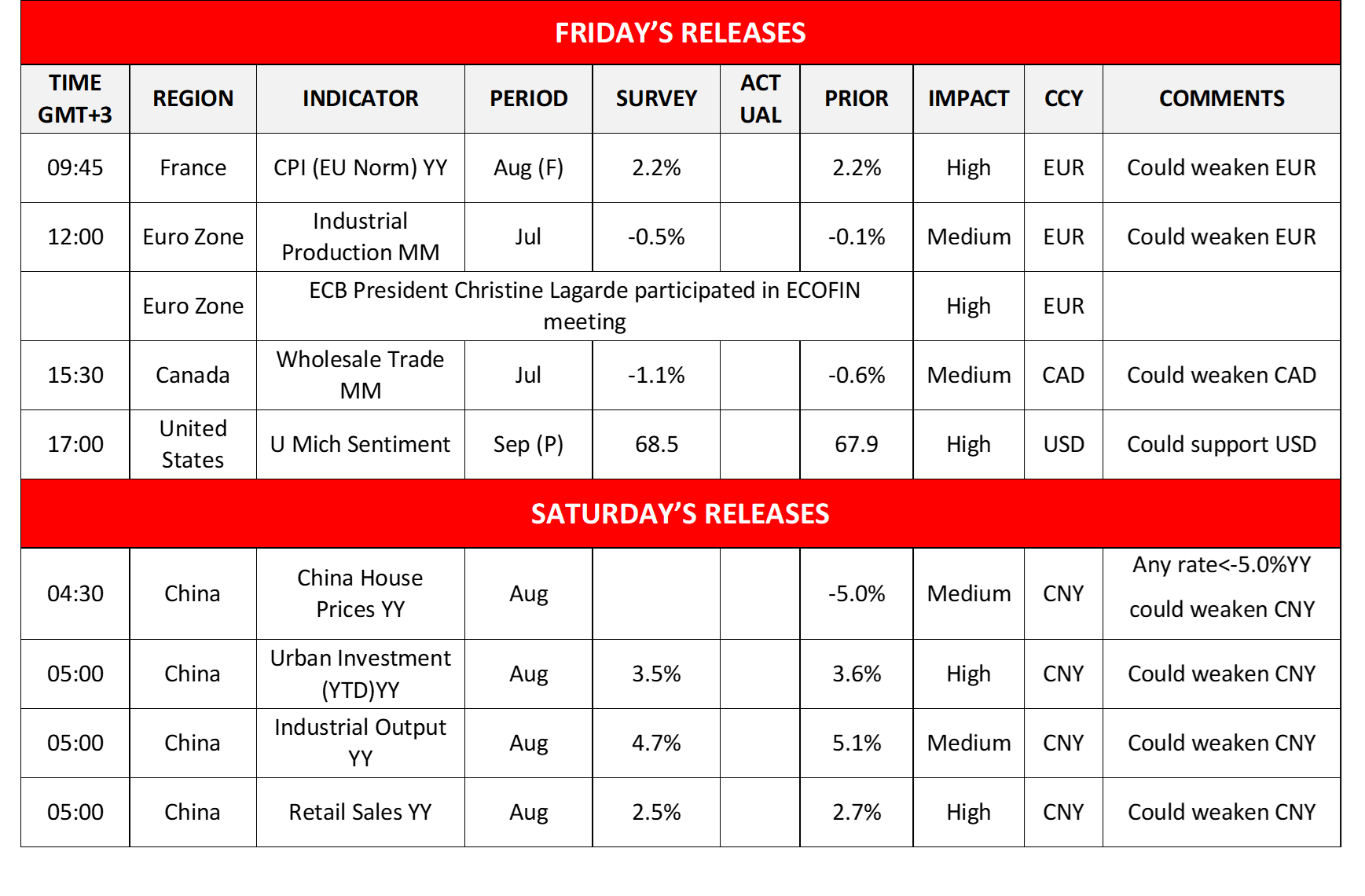

The USD edged lower against its counterparts yesterday, as August’s PPI rates slowed beyond market expectations on a headline level, while on a core level slowed less than what the market expected. The market’s attention now turns towards the Fed’s interest rate decision next Wednesday, and the market expects the bank to deliver a 25-basis points rate cut the first in years. Today in the American session, we get the preliminary US University of Michigan Consumer Confidence for September and should the indicator’s reading rise, we may see the USD getting some support as it would imply a wider degree of optimism on behalf of the average US consumer.

Despite markets being closed on Saturday, we note the release of China’s House prices, Urban investment, industrial output and retail sales growth rates all being for August. The rates are expected to slow down uniformly and should the actual rates meet their respective forecasts or slow down more than expected, market worries for the outlook of the Chinese economy may intensify, which in turn may cause the market to be more cautious oriented at Monday’s opening, thus weighing on riskier assets such as equities and commodity currencies, especially the Aussie given the close Sino-Australian economic ties.

AUD/USD edged higher yesterday and during today’s Asian session tested the 0.6730 (R1) resistance line. The RSI indicator remained just above the reading of 50, implying a relative indecisiveness on behalf of market participants regarding the pair’s direction. Hence for the time being we tend to expect the pair to remain a sideways motion. For a bullish outlook we would require the pair to break the 0.6730 (R1) resistance line and take aim of the 0.6870 (R2) resistance level. Should the pair come under the dominance of the bears we may see AUD/USD dropping relenting yesterday’s gains and actively aiming if not reaching the 0.6575 (S1) support line, yet such a scenario seems to be remote currently.

その他の注目材料

Today in the European session, we get France’s final HICP rate for August and Euro Zone’s industrial output for July, while ECB President Christine Lagarde participates in the ECOFIN meeting. In the American session, we get Canada’s wholesale trade for July.

EUR/USD デイリーチャート

- Support: 1.1010 (S1), 1.0890 (S2), 1.0780 (S3)

- Resistance: 1.1140 (R1), 1.1275 (R2), 1.1385 (R3)

USD/JPY Daily Chart

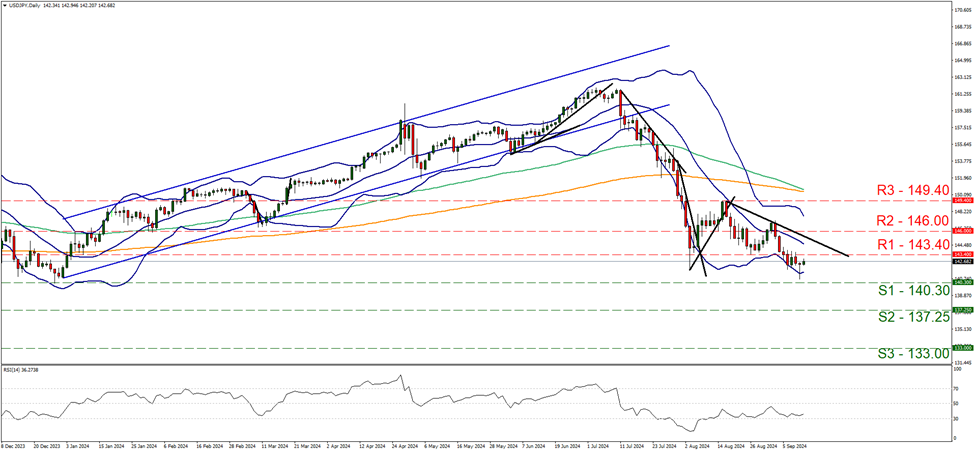

- Support: 140.30 (S1), 137.25 (S2), 133.00 (S3)

- Resistance: 143.40 (R1), 146.00 (R2), 149.40 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。