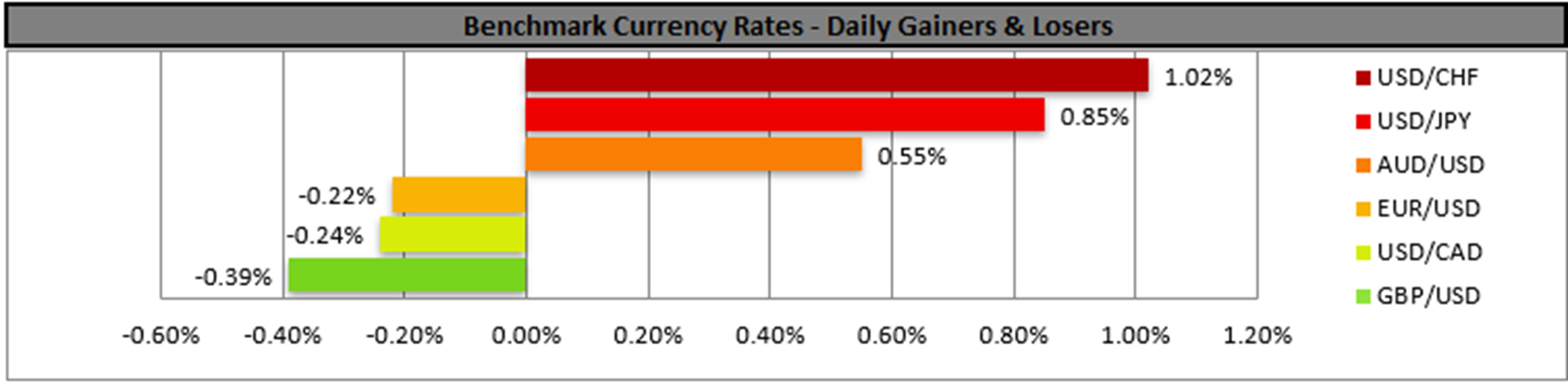

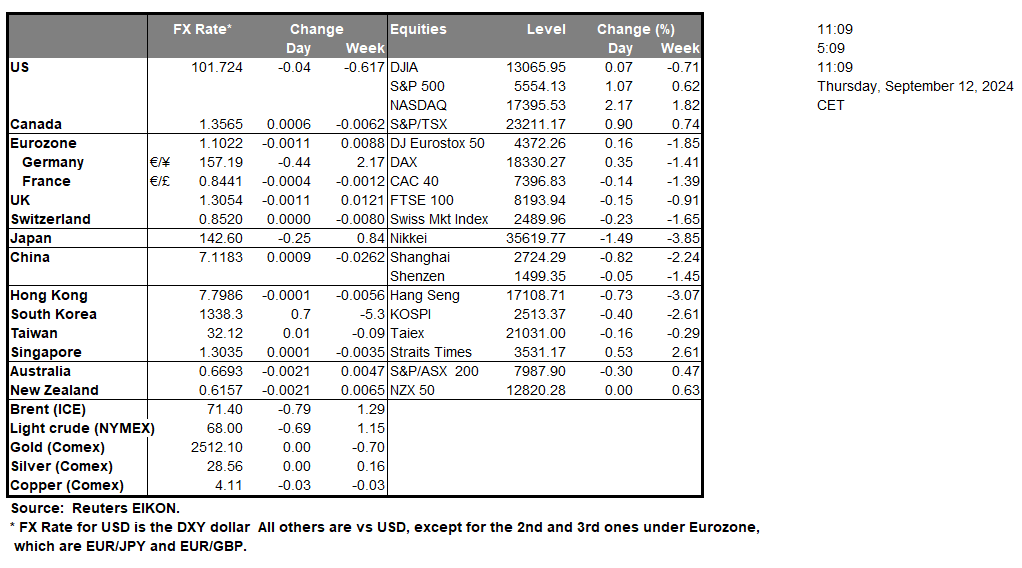

The USD edged higher yesterday as the release of the US August CPI rates. The headline rate slowed down as expected reaching 2.5% yoy, yet on a month-on-month level, the rate remained unchanged. We also note that the rate on a core level remained unchanged at 3.2% yoy while on a month-on-month level even accelerated a bit. The resilience of the Core CPI rates tended to ease market expectations for the Fed to proceed with outsized rate cuts in the coming months. Despite the release, US stock markets ended their day in the greens, while gold’s price edged a bit lower. Today, we highlight the release of the US PPI rates for August and should the rates reinforce the market’s perception for a resilience of inflationary pressures in the US economy we may see the USD gaining further ground and at the same time weigh on US stock markets as it could allow the Fed to delay any double rate cut.

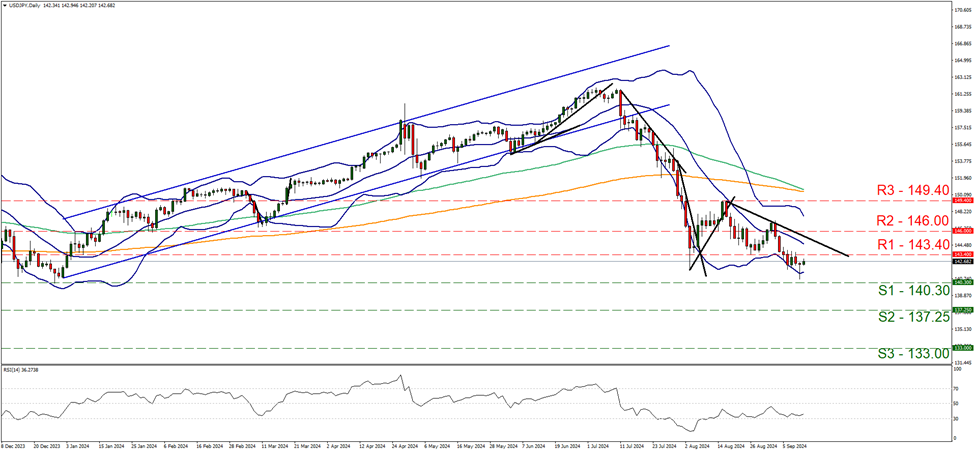

On a technical level, we note that USD/JPY remained relatively stable yesterday near the 143.40 (R1) resistance line. We tend to maintain a bearish outlook for the pair, as long as the downward trendline guiding the pair since the 16 of August remains intact and also given that the RSI indicator remains just above the reading of 30, implying a bearish sentiment on behalf of market participants for the pair. On the flip side, Should the selling interest be extended, we may see the pair breaking the 140.30 (S1) support line and start aiming for the 137.25 (S2) support base. For a bullish outlook we would require the pair to rise, break the 143.40 (R1) resistance line and continue to break the prementioned downward trendline signalling an interruption of the pair’s downward motion, aiming for the 146.00 (R2) resistance level.

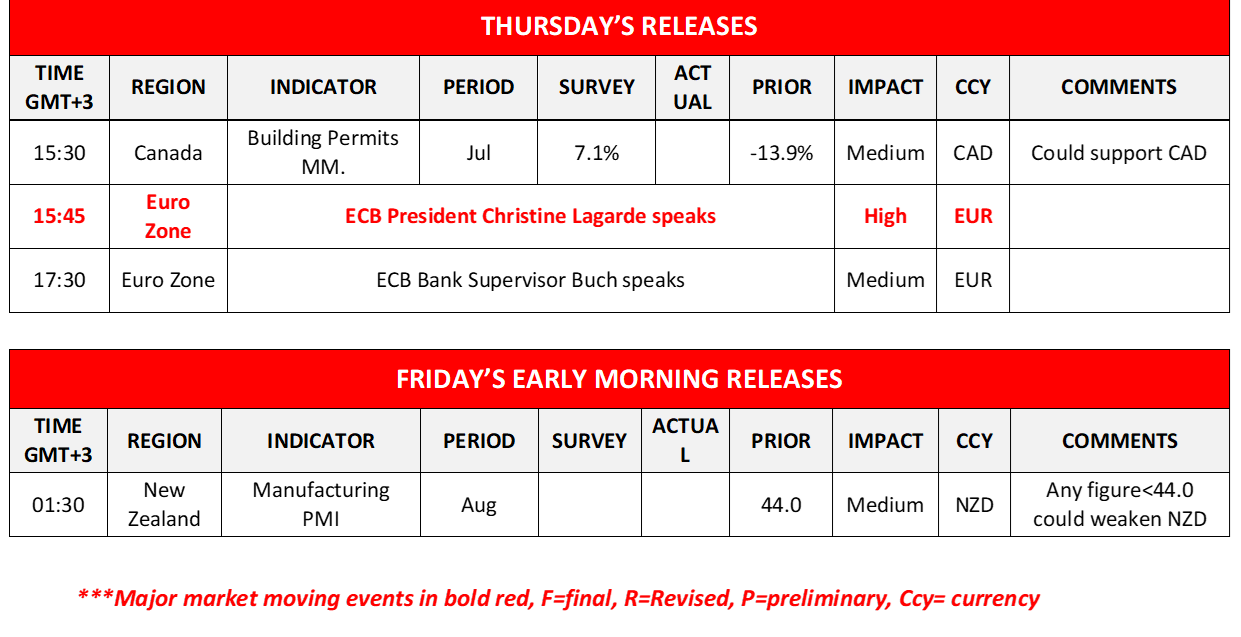

Across the pond, ECB is widely expected to cut both the deposit rate by 25 basis points and deliver an even wider rate cut for the refinancing rate. EUROIS imply a probability of 99% for such a scenario to materialise, rendering the interest rate part of the decision as an open and shut case. The market also seems to expect that the bank will remain on hold in the October meeting and deliver another rate cut in December. Hence, the market’s attention may turn towards ECB’s accompanying statement and especially ECB President Lagarde’s press conference a bit later. Bearing in mind that the market expects at least one more rate cut until the end of the year should the accompanying statement and/or Lagarde’s press conference maintain a dovish tone, enhancing the market’s expectations for more rate cuts we may see the common currency weakening as the market may have to reposition itself.

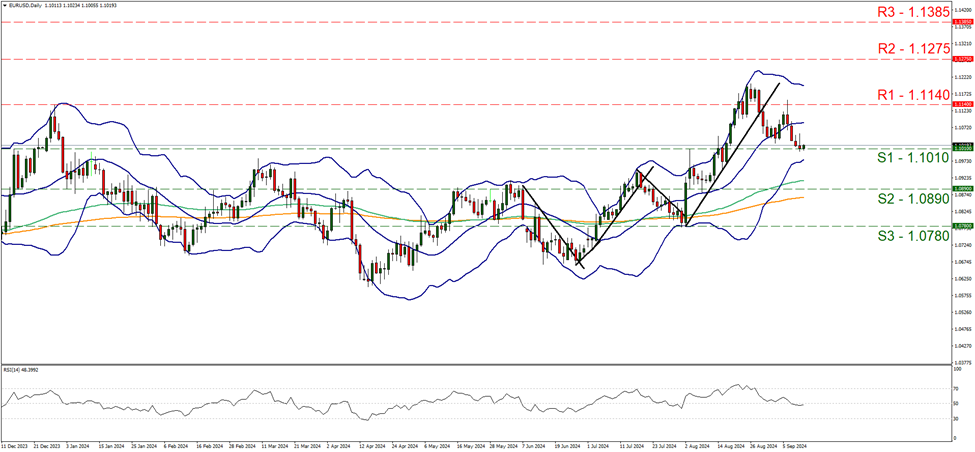

EUR/USD stabilised somewhat yesterday continuing to tease the 1.1010 (S1) support line. We tend to maintain our bias for the sideways motion of the pair given also that the RSI indicator remained near the reading of 50, implying a continuation of the market’s indecisiveness. Should the bulls take over, we may see the pair reversing direction, breaking the 1.1140 (R1) resistance line and thus open the gates for the 1.1275 (R2) resistance barrier. Yet the pair seems to be forming lower peaks and lower lows and should the bears manage to dominate the pair’s direction we may see EUR/USD breaking the 1.1010 (S1) support line, with the next possible target for the bears being set at the 1.0890 (S2) support hurdle.

その他の注目材料

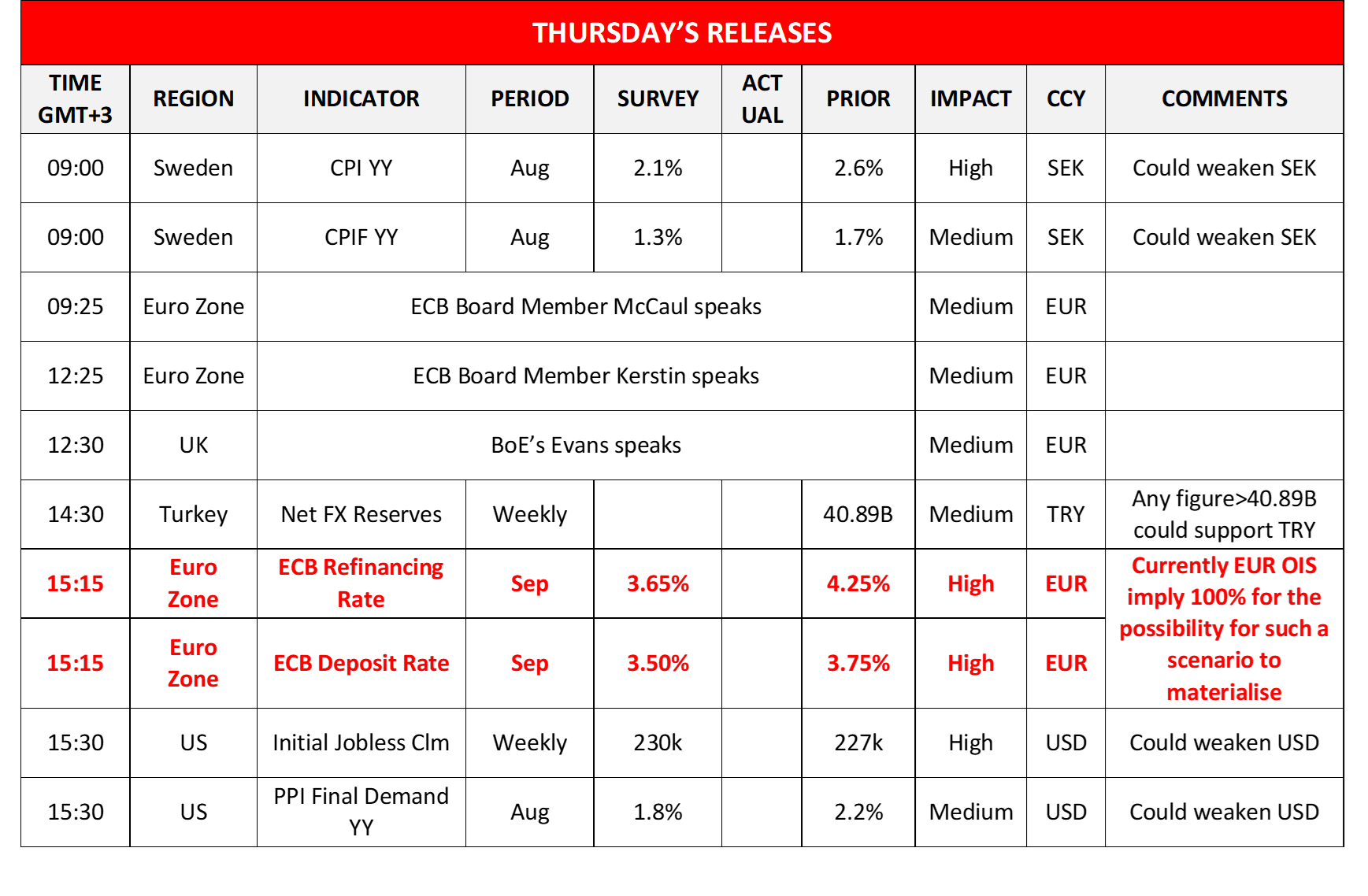

Today in the European session, we get Sweden’s August CPI rates and Turkey’s weekly net FX reserves figure, while ECB’s McCaul, Kerstin and BoE’s Evans speak. During the American session, we get from the US, the weekly initial jobless claims and we highlight the release of the US PPI rates for August as well as Canada’s Building Permits for July, while on the monetary front, besides ECB’s interest rate decision and ECB President Lagarde’s press conference, we note that ECB Bank Supervisor Buch is speaking. During tomorrow’s Asian session, we get New Zealand’s manufacturing PMI figure for August.

EUR/USD デイリーチャート

- Support: 1.1010 (S1), 1.0890 (S2), 1.0780 (S3)

- Resistance: 1.1140 (R1), 1.1275 (R2), 1.1385 (R3)

USD/JPY Daily Chart

- Support: 140.30 (S1), 137.25 (S2), 133.00 (S3)

- Resistance: 143.40 (R1), 146.00 (R2), 149.40 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。