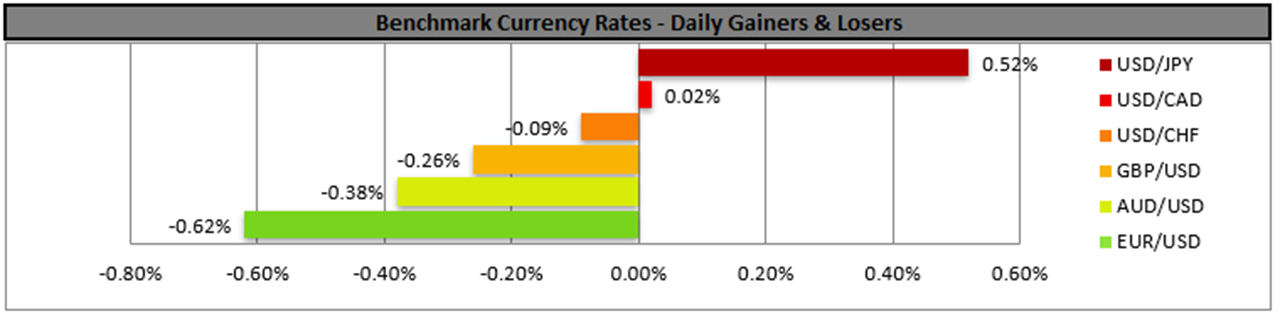

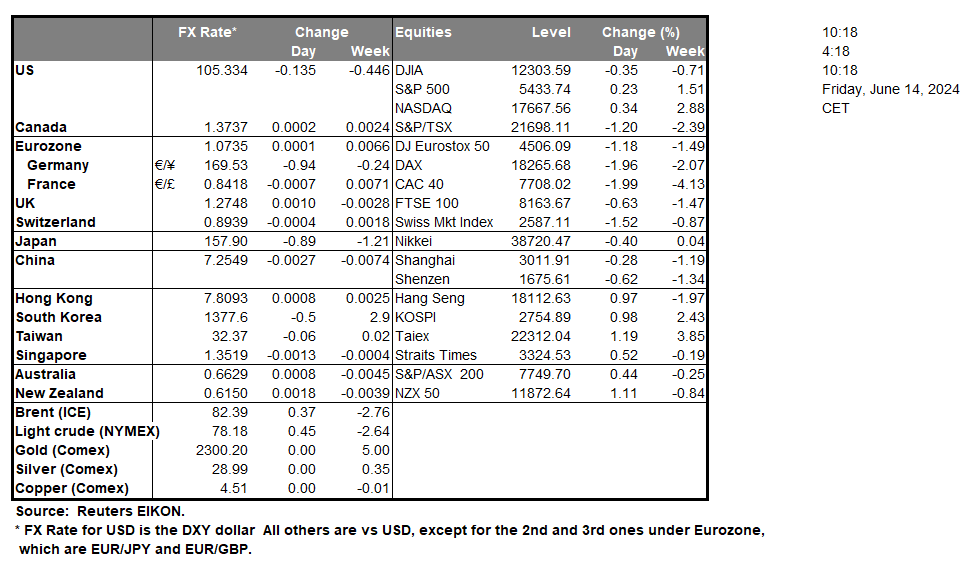

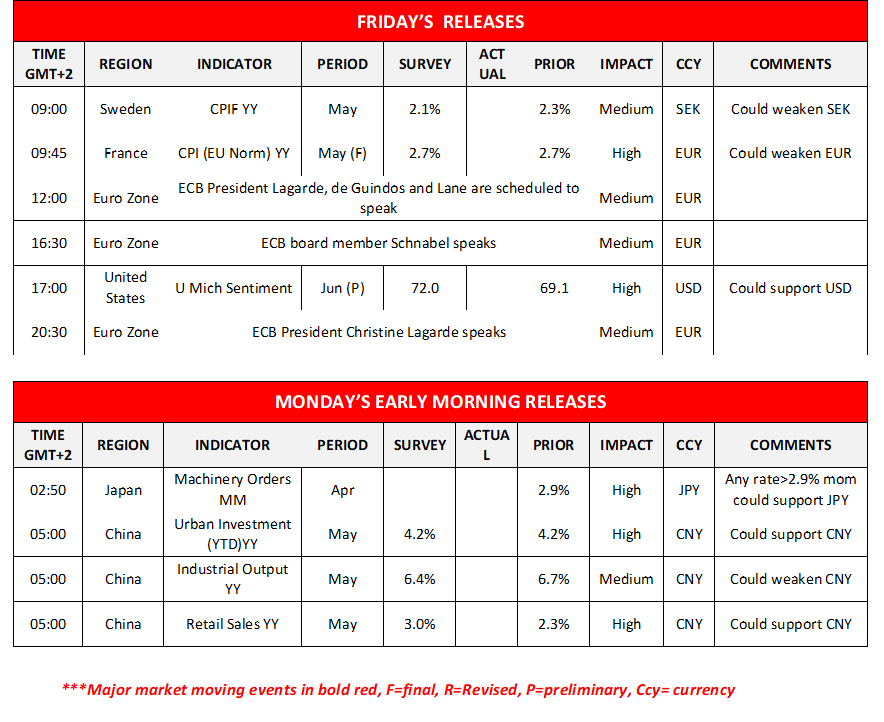

The USD edged higher against its counterparts yesterday in a move that allowed to recover the losses of Thursday. Yet we have to note that the PPI rates highlighted an easing of inflationary pressures on a producer’s level for the past month. The release may enhance the market’s expectations for the Fed to start cutting rates in September. For today we note the release of the preliminary University of Michigan consumer sentiment and a possible rise of the indicator’s reading could provide some support for the USD as it would imply more optimism among US consumers.

In the land of the rising sun, BoJ has remained on hold in its , as was widely expected. Overall, the forward guidance remained relatively unchanged. The bank also seems to intend to continue to buy government bonds at the current pace and may start reducing bond purchases in the coming one-two years. Overall, maintaining the current pace of bond buying seems to be getting a slight dovish tone across as it would keep the liquidity of the Japanese economy at high levels through an expansionary QQE policy. Understandably, JPY weakened across the board, yet at this point we would like to express our worries for a possible market intervention by the Japanese government and BoJ given that the JPY is nearing an over thirty-year low level. Please we had a market intervention to JPY’s rescue under similar at the end of April.

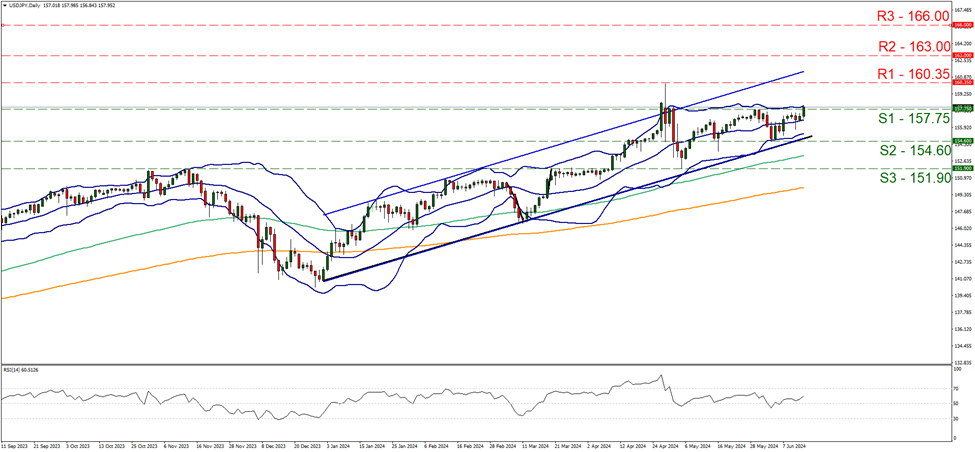

USD/JPY rose during today’s Asian session and finally broke the 157.75 (S1) resistance line now turned to support. The pair’s movement tends to highlight it’s bullish tendencies on a technical level, given also that the 20, 100 and the 200 moving averages are all pointing upwards, while at the same time the RSI indicator is rising, aiming for he reading of 70. Hence we switch our bias for a sideways motion of the pair, in favour of a bullish outlook. Should the bulls actually maintain control we may see the pair aiming if not reaching the 160.35 (R1) resistance line. Yet the rise of the pair seems to be timid and should the sideways motion continue we may see the pair’s price action dropping below yet remaining close to the S1. For a bearish outlook we would require the pair to break the S1, yet continue lower and also break the 154.60 (S2) support level, with the ultimate barrier for the bears being the 154.60 (S3) support level.

During Monday’s Asian session, we also note the release of China’s industrial output, urban investment and retail sales growth rates, all being for May. Forecasts are for the industrial output rate to slow down and the urban investment rate to remain unchanged, signaling problems in the recovery of the Chinese economy. Some comfort could be provided by a possible acceleration of the retail sales growth rate which would imply a robust demand side at which the Chinese economy could rely on. Should the forecasts be realised we may see the cautiousness of the market intensifying.

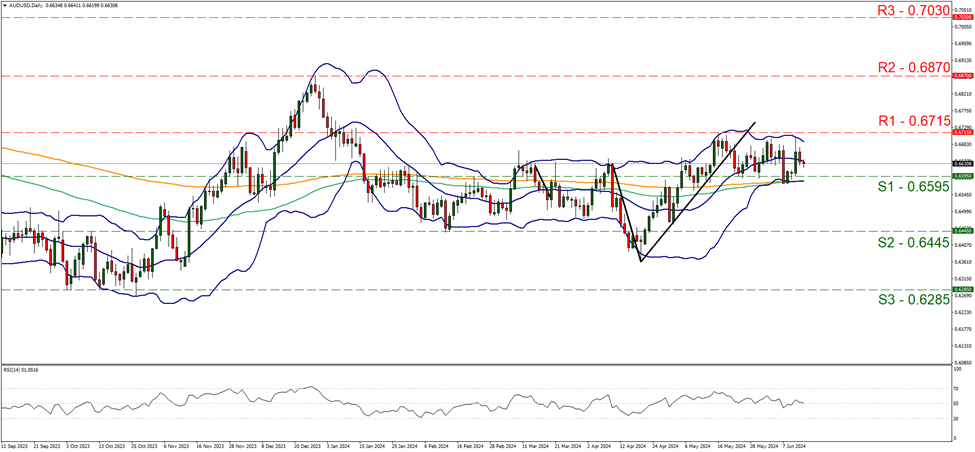

AUD/USD edged lower yesterday’s and during today’s Asian session, yet remained well within the boundaries set by the 0.6715 (R1) resistance line and the 0.6595 (S1) support level. We tend to maintain a bias for the sideways motion to continue, given also that the RSI indicator remains near the reading of 50 implying a relative indecisiveness on behalf of market participants. Should a full bearish outlook be expressed we may see the pair breaking the 0.6595 (S1) support line and aim for the 0.6445 (S2) support level. For a bullish outlook, we would require the pair to rise, break the 0.6715 (R1) resistance line and pave the way for the 0.6870 (R2) resistance base.

その他の注目材料

Today we note the release of Sweden’s inflation metrics for May as well as France’s final HICP rate for the same month. On the monetary front, we note that ECB President Lagarde and a number of ECB policymakers are scheduled to speak. During tomorrow’s Asian session, we note the release of Japan’s April Machinery orders.

USD/JPY Daily Chart

- Support: 157.75 (S1), 154.60 (S2), 151.90 (S3)

- Resistance: 160.35 (R1), 163.00 (R2), 166.00 (R3)

AUD/USD デイリーチャート

- Support: 0.6595 (S1), 0.6445 (S2), 0.6285 (S3)

- Resistance: 0.6715 (R1), 0.6870 (R2), 0.7030 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。