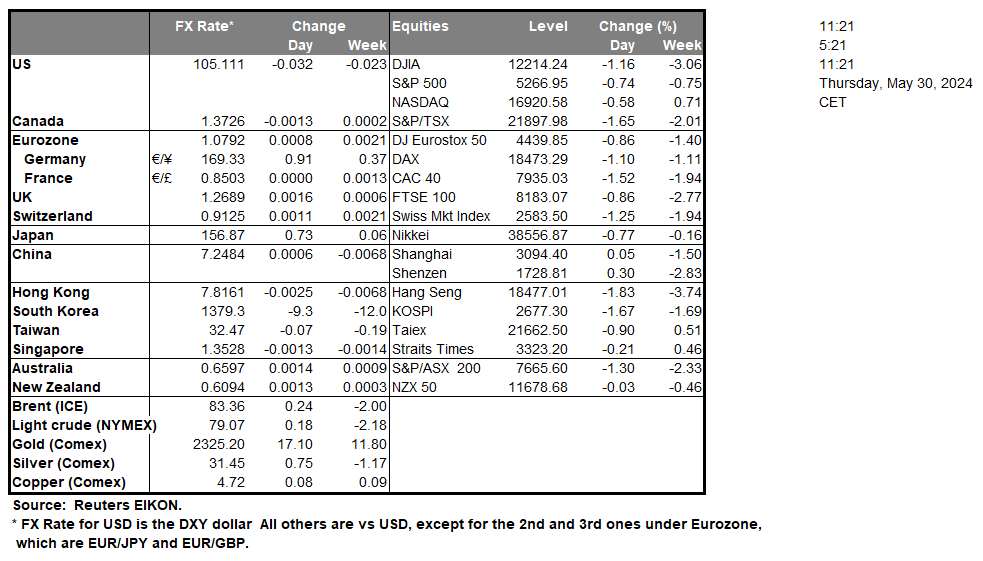

Germany’s Preliminary HICP rates for May which were released yesterday, showcased persistent inflationary pressures. In particular, Germany’s Preliminary HICP rate for May on a year-on-year basis came in higher than expected at 2.8% versus the expected rate of 2.7%, thus implying an acceleration in inflationary pressures in one of Europe’s largest economies. The higher-than-expected rate may prove a thorn in the market participants’ ambitions for a June rate cut by the bank, as it may increase pressure on the ECB to maintain interest rates higher for longer. However, there was a silver lining and that was the preliminary HICP rate for May on a month-on-month basis which came in lower than expected at 0.1% versus the expected rate of 0.2%, which implies a slight easing of inflationary pressures, at least on a mom level. Over in America, the US’s 2nd revision for its GDP rate for the first quarter of 2024 is set to be released during today’s American session. Currently, market expectations are for the revised GDP rate to come in at 1.3% versus the first preliminary rate estimate of 1.6%. Such a scenario could imply that the economic situation in the US may be worse than initially anticipated and as such could weigh on the greenback. Over in Asia, China’s NBS Manufacturing PMI figure for May is set to be released in tomorrow’s Asian session. The NBS Manufacturing PMI figure is considered to be one of the gauges in regards to the resilience of the Chinese manufacturing sector. Furthermore, an uptick in Chinese manufacturing activity, may also imply an increase in demand for raw materials from Australia and thus could support the Aussie as well as the CNY.

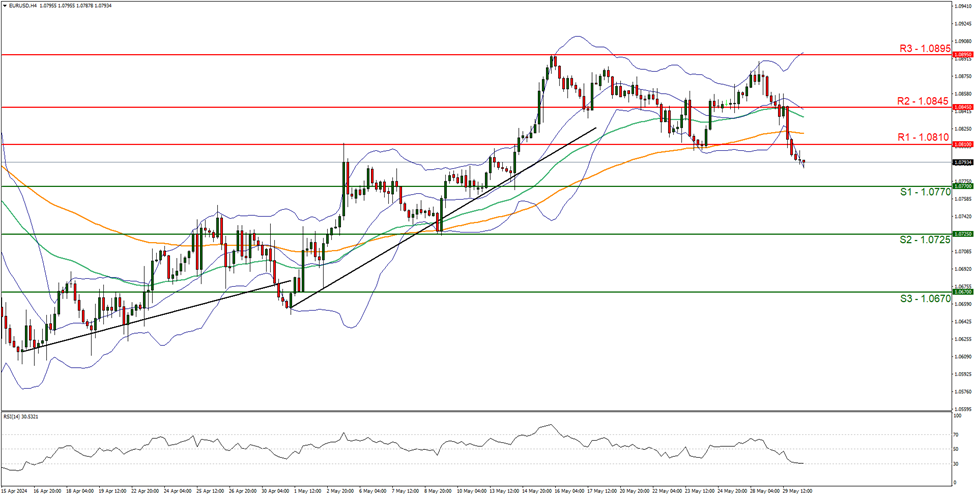

On a technical level EUR/USD appears to be moving in a downwards fashion. We switch our sideways bias in favour of a bearish outlook for the pair, and supporting our case is the breaking below our support turned to resistance line at the 1.0810 (R1) level. Moreover, the RSI indicator below our chart currently registers a figure near 30, implying a bearish market sentiment. For our bearish outlook to continue, we would like to see a break below the 1.0770 (S1) support level, with the next possible target for the bears being the 1.0725 (S2) support line. On the flip side for a bullish outlook, we would require a clear break above the 1.0810 (R1) resistance line with the next possible target for the bulls being the 1.0845 (R2) resistance level. Lastly, for a sideways bias we would like to see the pair remain confined between the 1.0770 (S1) support level and the 1.0810 (R1) resistance line.

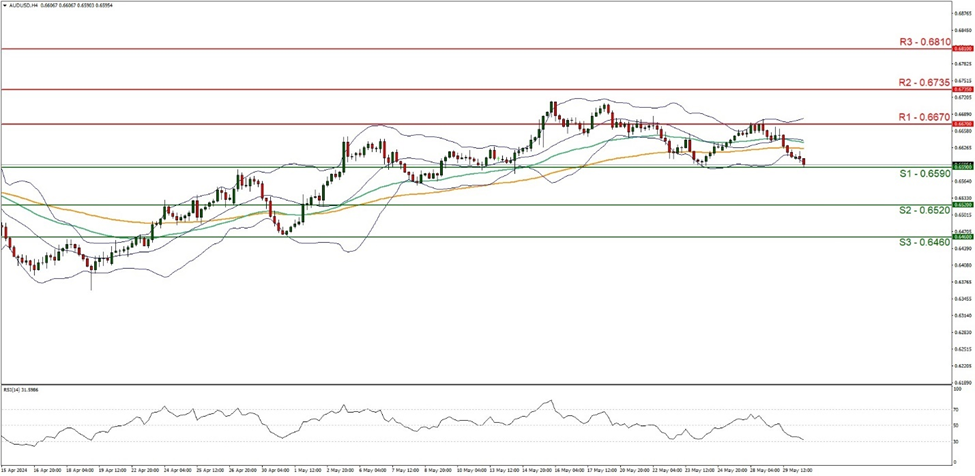

AUD/USD appears to be moving in a sideways fashion. We maintain a sideways bias for the pair and supporting our case is the flattening out of the 50MA and 100MA lines in addition to the narrowing of the Bollinger bands, which all imply low market volatility. However, the RSI indicator below our chart which currently registers a figure of 30, implying some bearish tendencies. For our sideways bias to continue we would require the pair to remain confined between the 0.6590 (S1) support level and the 0.6670 (R1) resistance line. On the flip side, for a bearish outlook, we would require a clear break below the 0.6590 (S1) support level, with the next possible target for the bears being the 0.6520 (S2) support line. Lastly for a bullish outlook we would require a clear break above the 0.6670 (R1) resistance line, with the next possible target for the bulls being the 0.6735 (R2) resistance level.

その他の注目材料

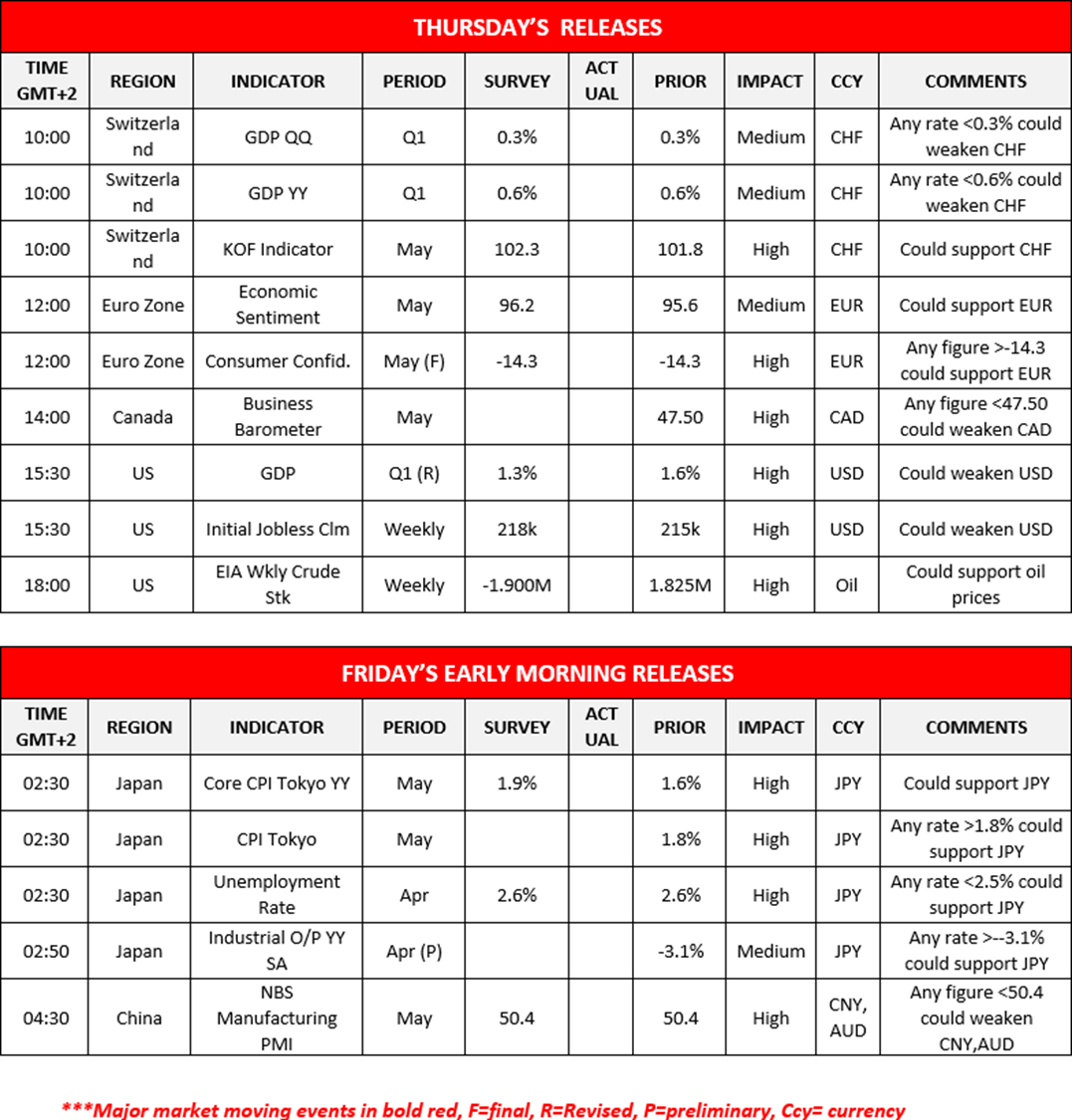

Today we note the release of Switzerland’s GDP rates for Q1 and KOF indicator figure for May, followed by the Eurozone’s Economic sentiment and final consumer confidence figures both for May and Canada’s business barometer figure for May. During the American session, we note the 2 revision of the US’s GDP rate for Q1, weekly initial jobless claims figure and the US weekly crude oil inventories figure. In tomorrow’s busy Asian session, we note Japan’s Tokyo CPI rates for May, Japan’s unemployment rate for April, preliminary Industrial output rate for April and China’s NBS Manufacturing PMI figure for May

EUR/USD 4時間チャート

- Support: 1.0770 (S1), 1.0725 (S2), 1.0670 (S3)

- Resistance: 1.0810 (R1), 1.0845 (R2), 1.0895 (R3)

AUD/USD 4時間チャート

- Support: 0.6590 (S1), 0.6520 (S2), 0.6445 (S3)

- Resistance: 0.6670 (R1), 0.6735 (R2), 0.6810 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。