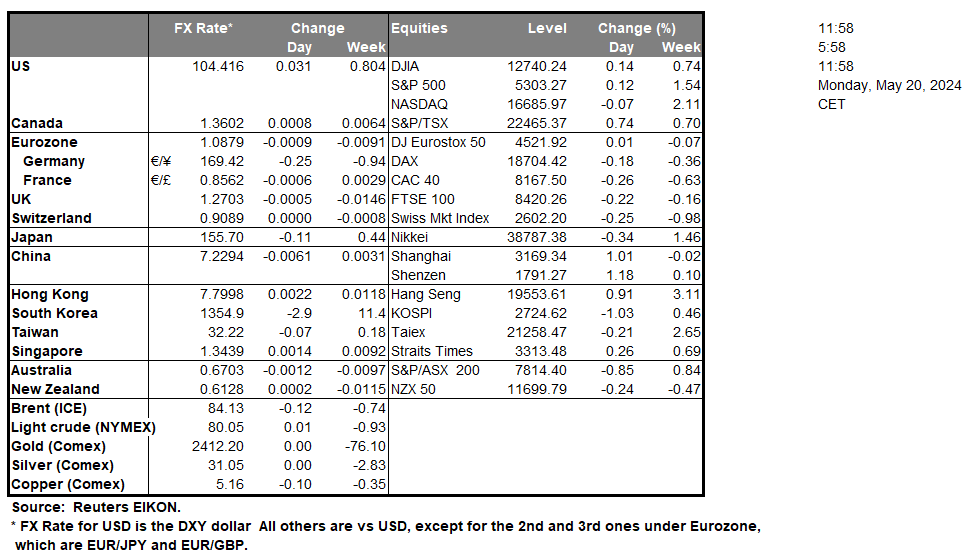

The USD remained relatively inactive maybe with some slight bearish tendencies against its counterparts on Friday, a development that allowed gold’s price to reach new record high levels. We have to note that today, headlines are focusing on the death of Iran’s President and Minister of Foreign Affairs in a helicopter crash on Sunday. Should there be suspicions of foul play we may see market worries for the outcome being enhanced, thus in such a scenario support may be provided to safe haven instruments such as gold, which implies that there seems to be room for the bulls to advance higher.

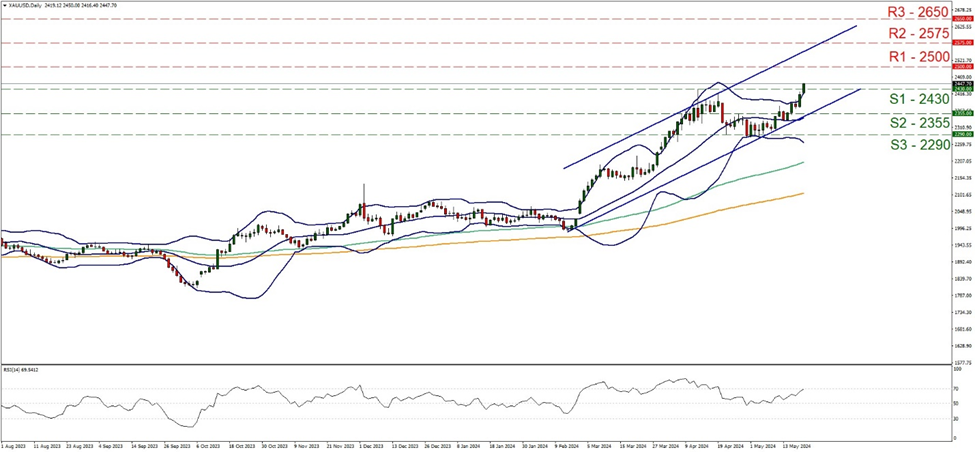

XAU/USD rose during today’s Asian session breaking the all-time high level of 2430 (S1) which served as a resistance line and now has been turned into a support level. We tend to maintain a bullish outlook for the precious metal’s price, given also that the RSI indicator is rising and nearing the reading of 70, implying a strong bullish sentiment of the market for gold. Yet on the other hand we note that Gold’s price action has broken the upper Bollinger band, which in turn may slow down the bulls or even cause the precious metal’s price to correct lower. Should the bulls maintain control over gold’s price, it will be in uncharted waters and we set as the next possible target for the bulls the 2500 (R1) resistance line. Should the bears take over the direction of gold’s price action, we may see the shiny metal’s price, breaking the 2430 (S1) support line and aiming, if not breaking the 2355 (S2) support level.

Aussie traders on the other hand are expected to keep a close eye on the release of RBA’s May meeting minutes. The document is expected to be scrutinised for any clues regarding the bank’s intentions and a possible hawkish tone could provide some support for the Aussie during tomorrow’s Asian session.

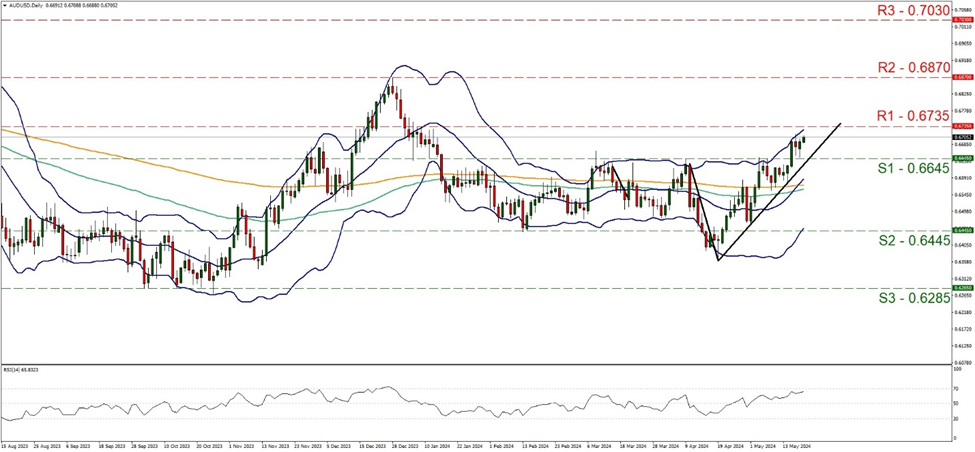

AUD/USD rose on Friday and during today’s Asian session and seems to be aiming for the 0.6735 (R1) resistance line. Based on the upward trendline that guides the pair since the 19 of April and the RSI indicator that remains close to the reading of 70, implying a bullish sentiment on behalf of market participants for the pair, we tend to maintain our bullish outlook for AUD/USD. Should the bulls maintain control over the pair we may see it breaking the 0.6735 (R1) resistance line and thus paving the way for the 0.6870 (R2) resistance base. Should the bears take over, we may see AUD/USD dropping, breaking the prementioned upward trendline in a first signal of an interruption of the upward movement, breaking the 0.6645 (S1) support line and start taking actively aim of the 0.6445 (S2) support hurdle.

その他の注目材料

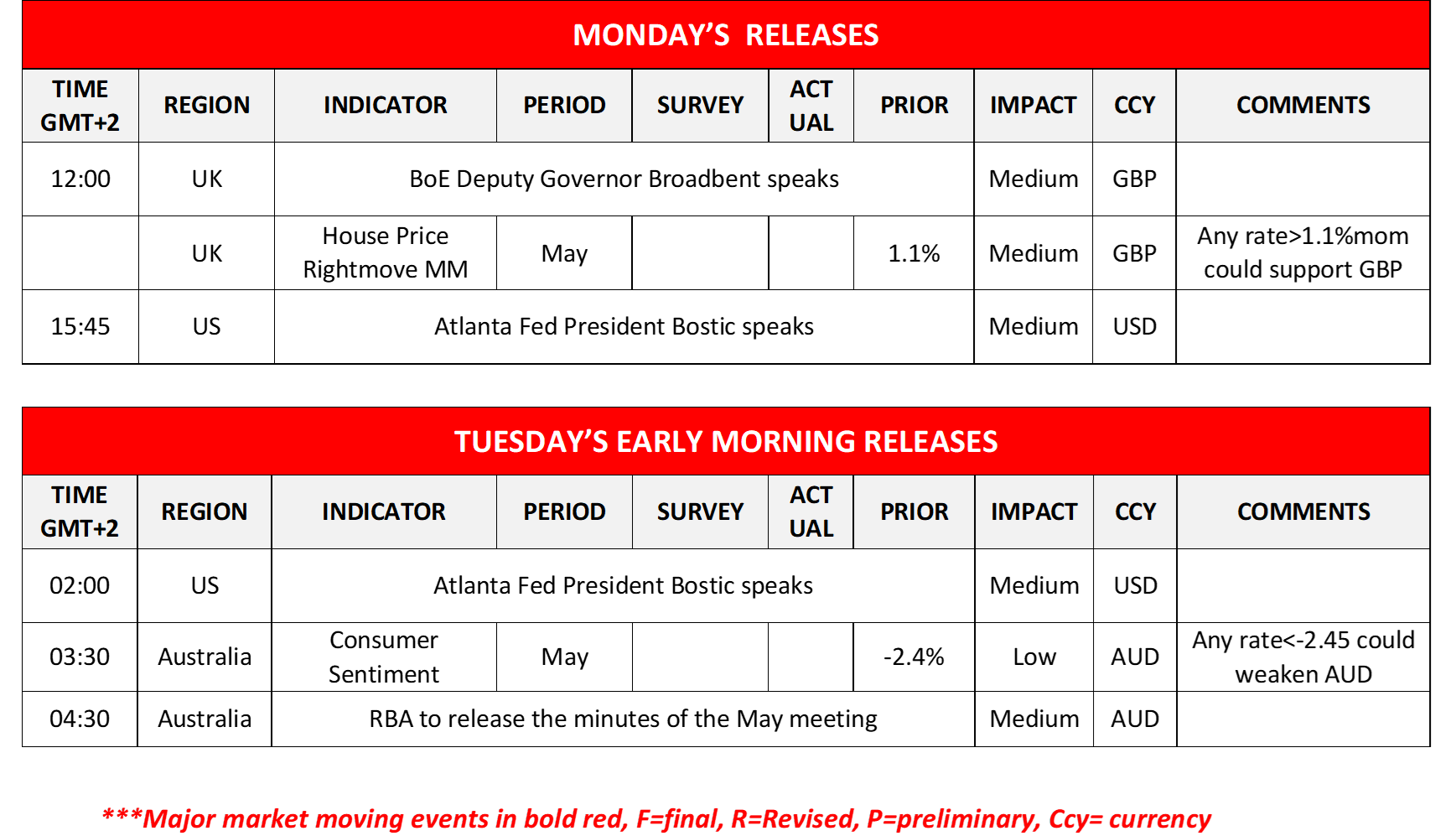

In a rather easy-going Monday we get UK’s Rightmove House prices for May, while on the monetary front, we note that BoE Deputy Governor Broadbent and Atlanta Fed President Bostic are scheduled to speak. During tomorrow’s Asian session, we get Australia’s consumer confidence for May.

今週の指数発表:

On Tuesday we highlight the release of Canada’s CPI rates for April. On Wednesday we get Japan’s machinery orders for March and we highlight from New Zealand RBNZ’s interest rate decision and UK’s CPI rates for April and later in the American session we note the release of the Fed’s last meeting minutes. On a busy Thursday, we note the release of the preliminary PMI figures for May of Australia, Japan, France, Germany, the Eurozone, the UK and the US and we also get the weekly US initial jobless claims figure and Eurozone’s preliminary consumer confidence for May, while from Turkey CBT is to release its interest rate decision. On Friday we get New Zealand’s trade data, Japan’s CPI rates, UK’s retail sales and the US Durable goods orders growth rates, all being for April, Canada’s retail sales for March, Germany’s detailed GDP rate for Q2 and the final US University of Michigan consumer sentiment for May.

XAU/USD Daily Chart

- Support: 2430 (S1), 2355 (S2), 2290 (S3)

- Resistance: 2500 (R1), 2575 (R2), 2650 (R3)

AUD/USD デイリーチャート

- Support: 0.6645 (S1), 0.6445 (S2), 0.6285 (S3)

- Resistance: 0.6735 (R1), 0.6870 (R2), 0.7030 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。