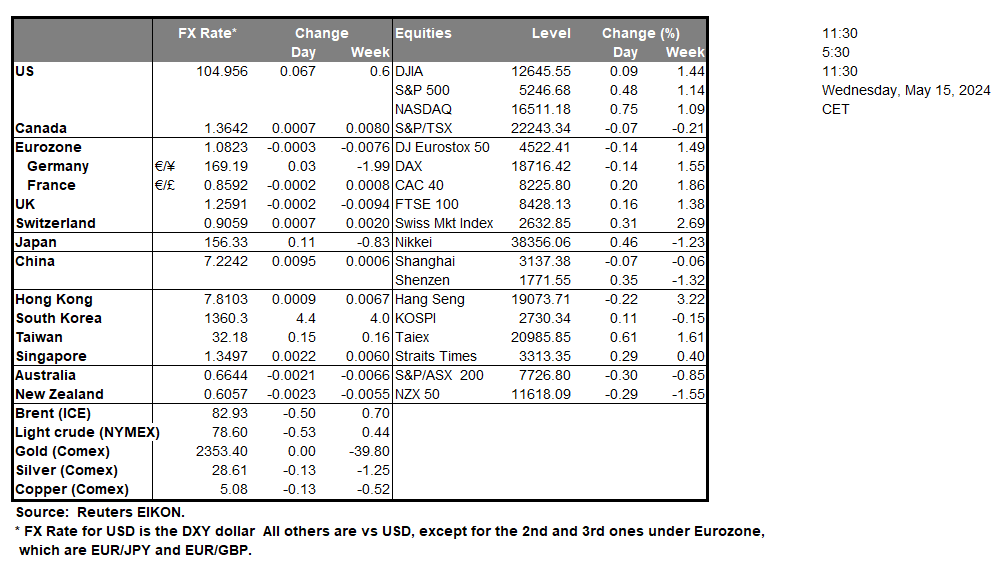

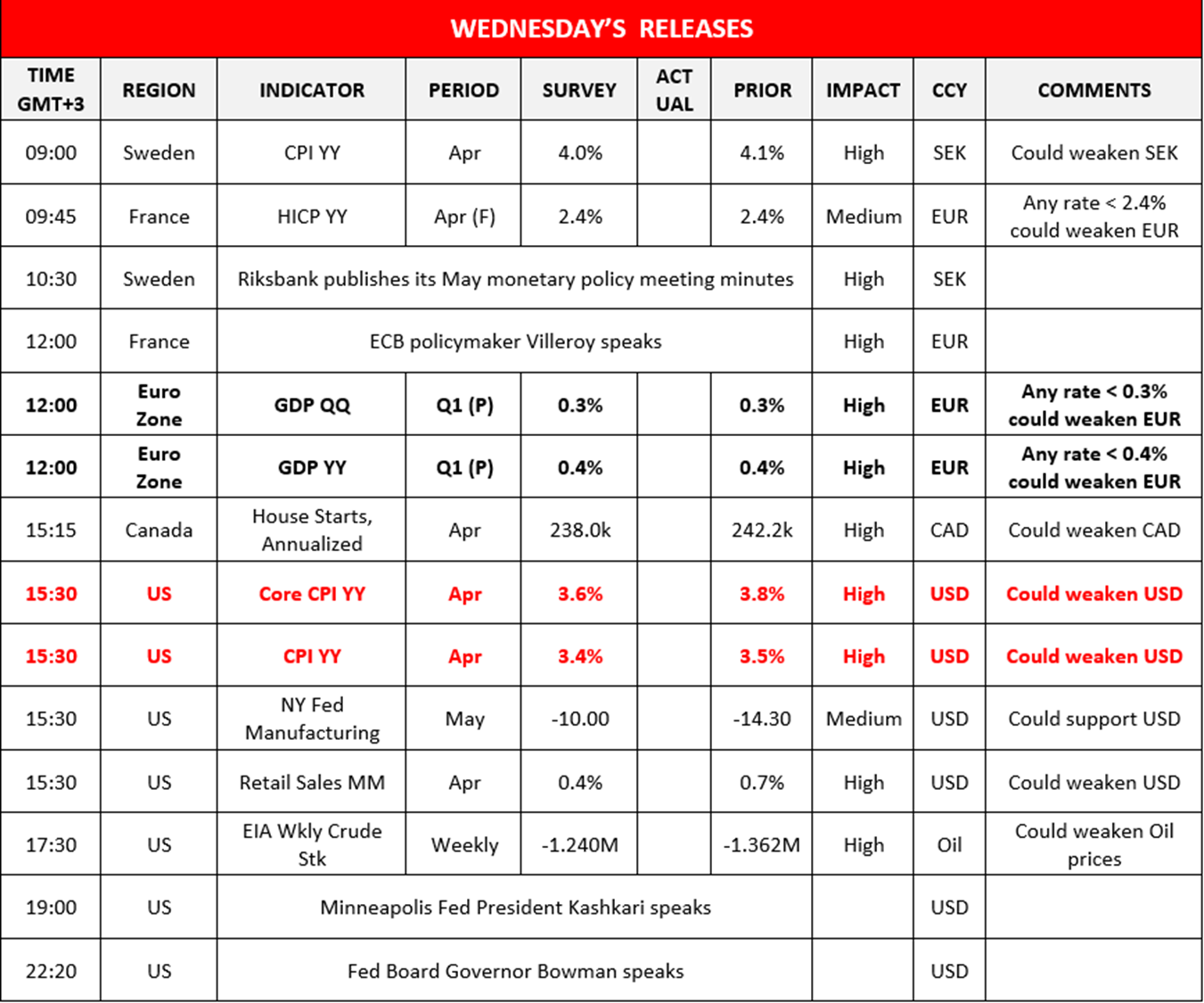

The US CPI rates for April are set to be released in today’s American session. At this point in time, the expectations are for the Core CPI rate on a year-on-year level to decelerate to 3.6% from 3.8%. Furthermore, the headline CPI rate is also expected to decelerate on a year-on-year level to 3.4% from 3.5%. Thus, should the US CPI rates imply easing inflationary pressures, it could increase pressure on Fed policymakers to reduce the tight financial conditions surrounding the US economy. Whereas, should they come in higher than expected and hence imply persistent or even an acceleration of inflationary pressures, we may see the opposite occurring.The US Government unveiled new tariffs against China yesterday. In particular, the US Government quadrupled EV duties to over 100%, which could support US-based EV manufacturers such as Tesla (#TSLA). The EU’s second revision of the bloc’s GDP rates for Q1 are set to be released in today’s European session. Currently economists are anticipating the GDP rate to accelerate to 0.4% from 0.1% on a year-on-year level, and to 0.3% from -0.1% on a quarter-on-quarter basis. Therefore, should the GDP rates come in as expected or higher, it could be inferred that the Eurozone’s economy is growing, which in turn could provide support for the common currency. On the flip side, a deviation to the downside for the readings could weigh on the EUR.

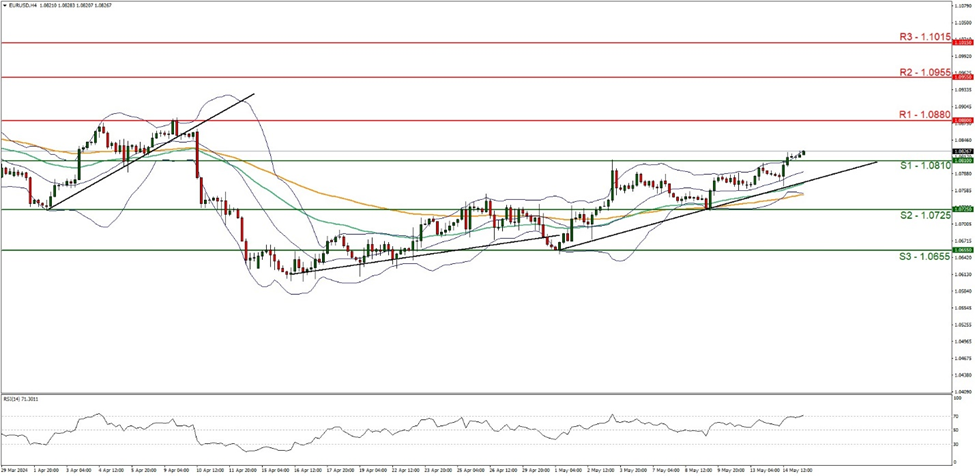

EUR/USD appears to be moving in an upwards fashion. We maintain a bullish outlook for the pair and supporting our case is the upwards moving trendline which was incepted on the 1 of May, in addition to the RSI Indicator below our chart which currently registers a figure near 70, implying a strong bullish market sentiment. For our bullish outlook to continue, we would require a break above the 1.0880 (R1) resistance line with the next possible target for the bulls being the 1.0955 (R2) resistance line. On the flip side, for a bearish outlook we would require a clear break below the 1.0810 (S1) support level, with the next possible target for the bears being the 1.0725 (S2) support line. Lastly, for a sideways bias we would require the pair to remain confined between the 1.0810 (S1) support level and the 1.0880 (R1) resistance line.

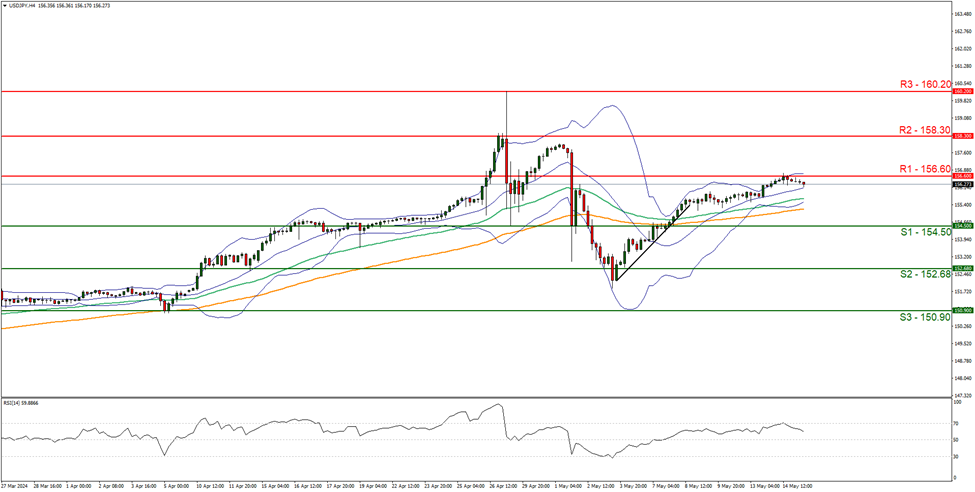

USD/JPY appears to be moving in an upwards fashion. We maintain a bullish outlook for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure near 60, implying some bullish market tendencies. However, we would also like to note that the RSI figure below our chart decreased from the figure of 70 to our current figure near 60, which could also imply that the bullish momentum may be waning. For our bullish outlook to continue, we would require a clear break above the 156.60 (R1) resistance line, with the next possible target for the bulls being the 158.30 (R2) resistance level. On the flip side for a sideways bias, we would require the pair to remain confined within the 154.50 (S1) support level and the 156.60 (R1) resistance line. Lastly, for a bearish outlook we would require a break below the 154.50 (S1) support level with the next possible target for the bears being the 152.80 (S2) support line.

その他の注目材料

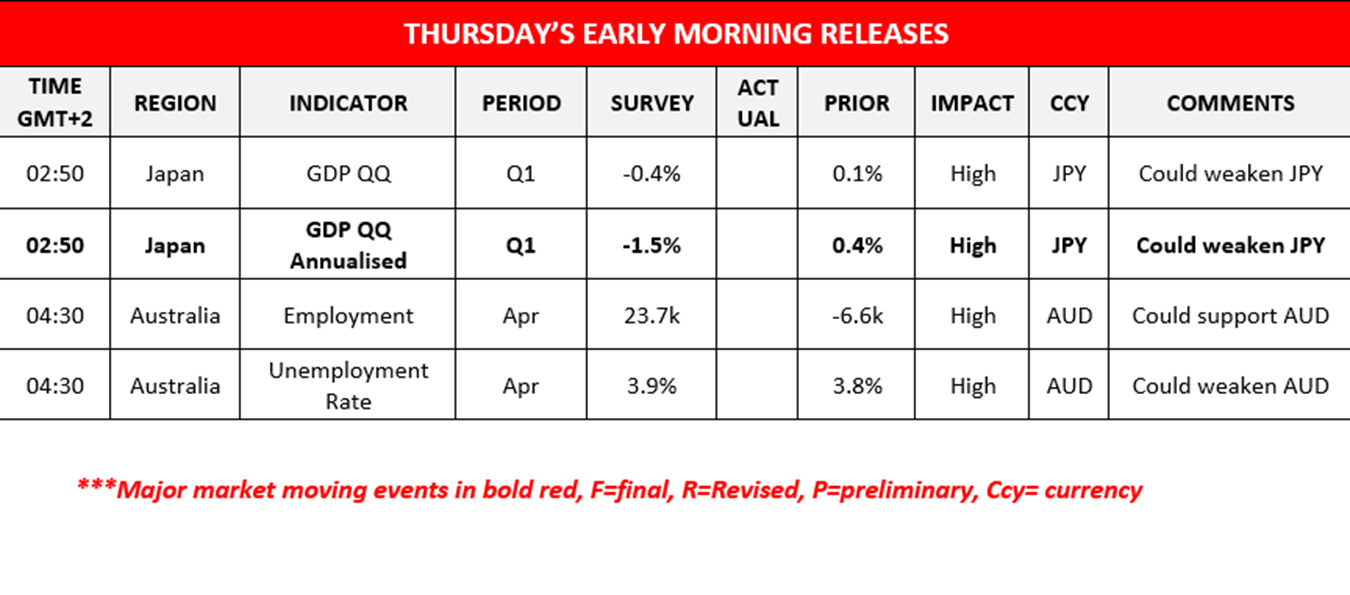

In today’s European session we get Sweden’s CPI rate and France’s Final HICP rate both for the month of April, followed by the Eurozone’s preliminary GDP rates for Q1. During the American session we get Canada’s Housing starts figure for April, the US CPI rates for April which are set to be the highlight of the day, followed by the NY Fed Manufacturing figure for May, the US Retail sales rate for April and the weekly US EIA crude oil inventories figure. In tomorrow’s Asian session, we get Japan’s GDP rates for Q1 and Australia’s employment data for April. On the monetary front, we note the release of the Riksbank’s May monetary policy meeting minutes, followed by the speech by ECB policymaker Villeroy and during the American session, the speeches by Minneapolis Fed President Kashkari and Fed board Governor Bowman.

EUR/USD 4時間チャート

Support: 1.0810 (S1), 1.0725 (S2), 1.0655 (S3)

Resistance: 1.0880 (R1), 1.0955 (R2), 1.1015 (R3)

USD/JPY 4時間チャート

Support: 154.50 (S1), 152.80 (S2), 150.90 (S3)

Resistance: 156.60 (R1), 158.30 (R2), 160.20 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。