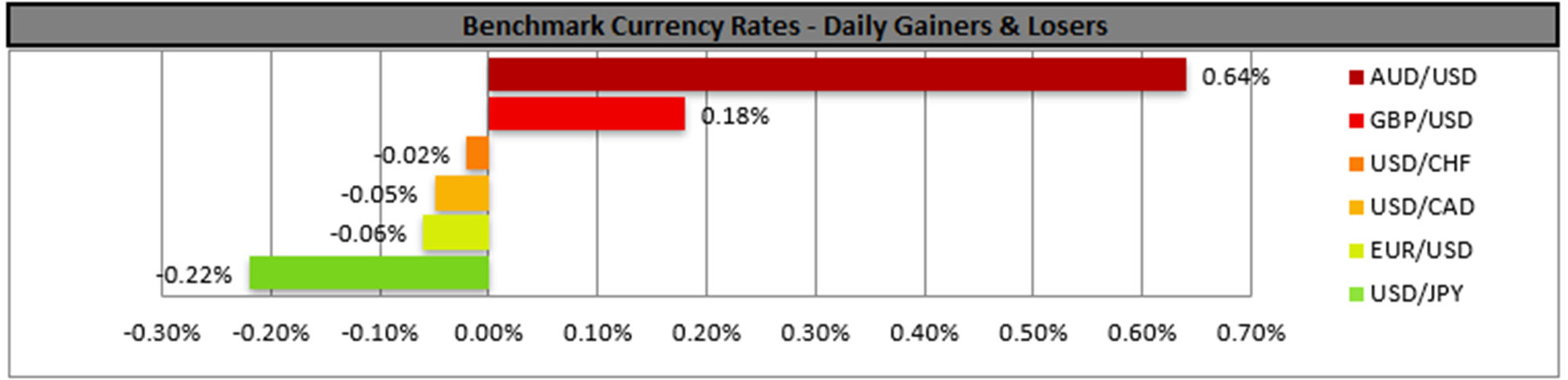

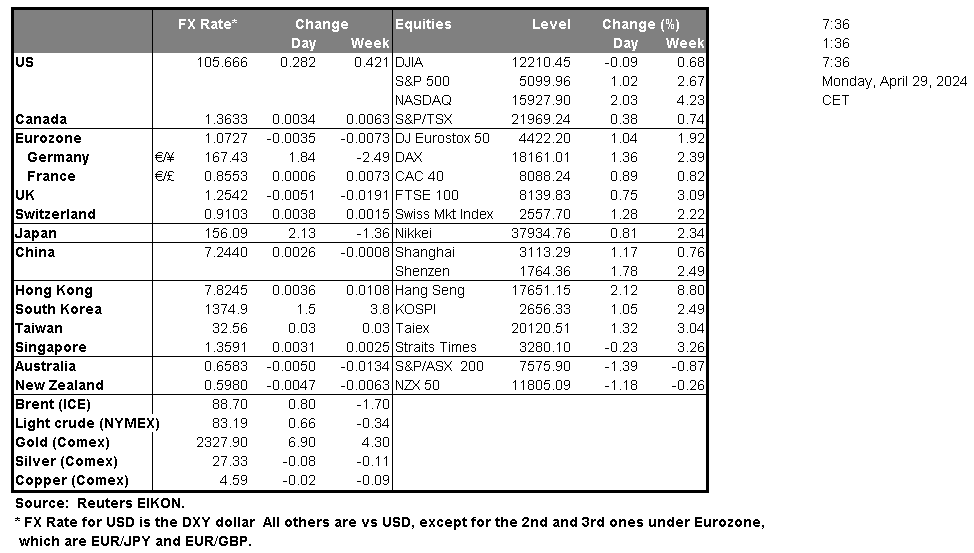

The USD gained against its counterparts on Friday as the PCE price index for March, both on a headline as well as on a core level, failed to slow down implying a persistence of inflationary pressures in the US economy. The release may add pressure on the Fed to maintain a more hawkish stance, while the market may start to reposition itself ahead of the Fed’s interest rate decision on Wednesday. Today during the Asian session, we noticed a strong buying of the JPY in a suspected market intervention by the Japanese Government. Despite some analysts mentioning the possibility that the effect may be magnified as Japan is closed today, for the Showa Day public holiday, we expect the effect may prove to be temporary given that the fundamentals underpinning JPY’s weakness, namely BoJ’s loose monetary policy is still there. Other than that, we note the European financial data due out during today’s Asian session while the market may focus on the Aussie during tomorrow’s Asian session.

その他の注目材料

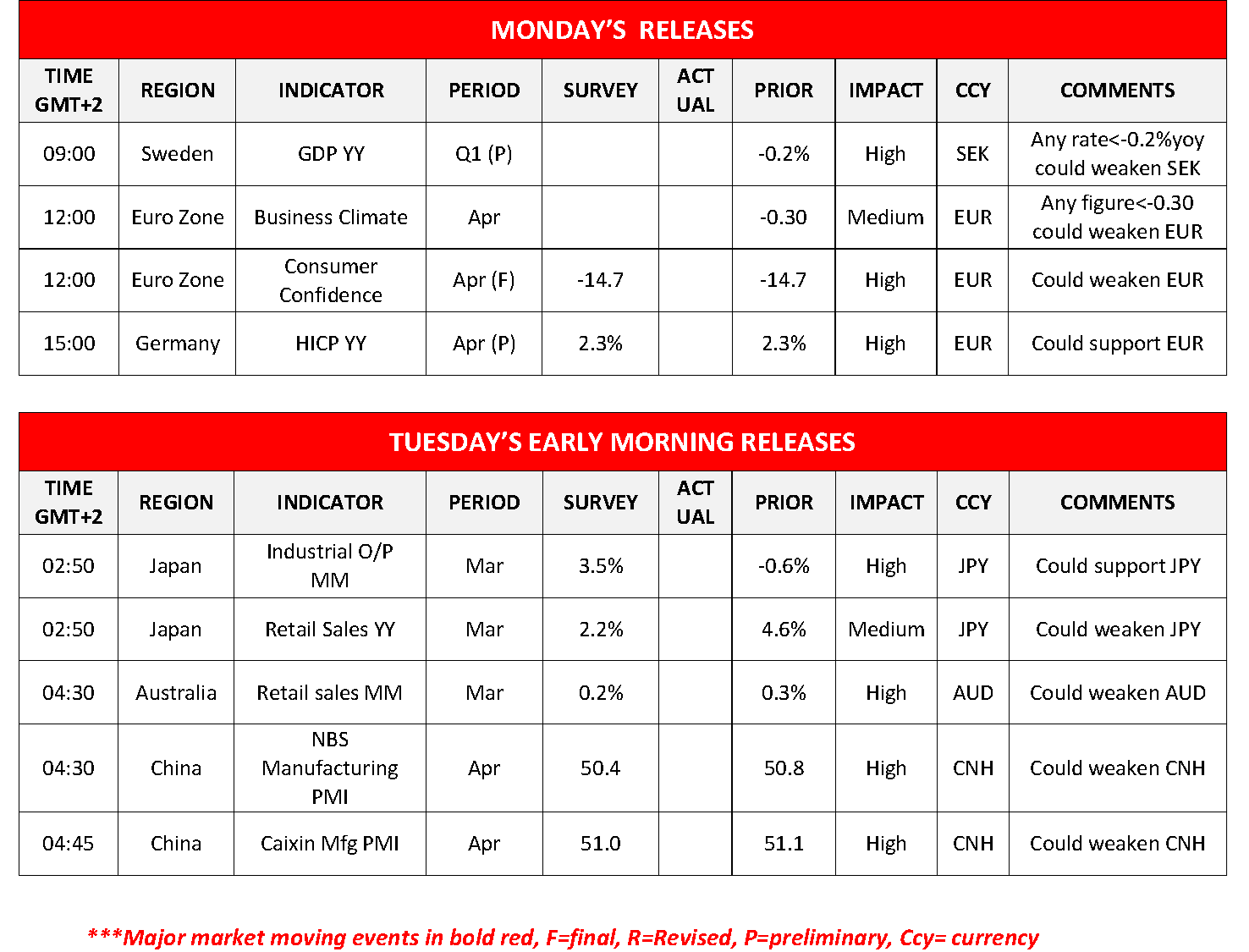

Today we get Sweden’s preliminary GDP rate for Q1, the Eurozone’s Business Climate for April we highlight the release of Germany’s preliminary HICP rate for the same month. During tomorrow’s Asian session, we get Japan’s preliminary industrial output and retail sales for March, Australia’s retail sales for the same month and China’s Caixin and NBS manufacturing PMI figures for April. A possible improvement of the Chinese manufacturing PMI figures could signal an improvement in the Chinese economic outlook and instigate an improvement of the market sentiment. In turn, we expect that a more risk-oriented approach by the market could provide some support for riskier assets such as commodity currencies and equities.

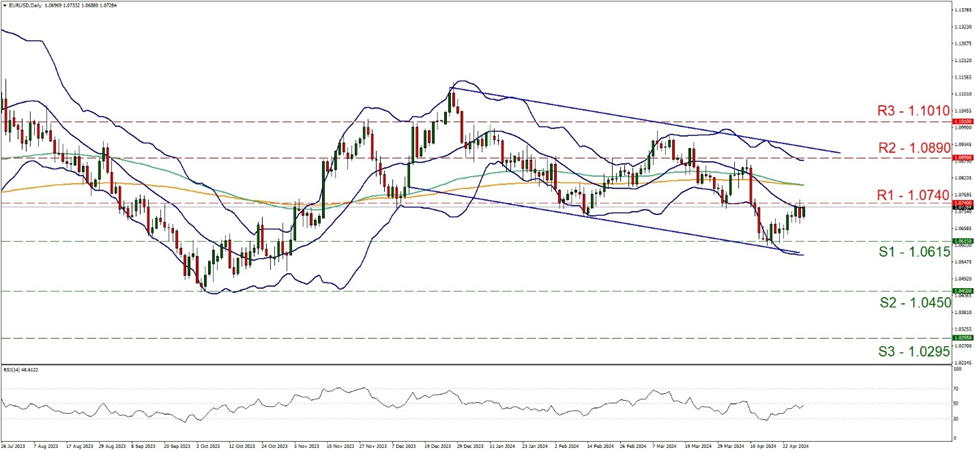

On a technical level, we note that EUR/USD edged lower on Friday as it hit a ceiling at the 1.0740 (R1) resistance line, yet the pair seems about to take another swing at it today. The RSI indicator has reached the reading of 50 and runs just below it, implying a rather indecisive market. We tend to maintain a bias for the sideways motion to continue yet we note also some bullish tendencies for the pair’s price action. Yet for a bullish outlook, we would require the pair to clearly break the 1.0740 (R1) resistance line and start aiming for the 1.0890 (R2) resistance level. Should the bears regain control over the pair, we may see EUR/USD dropping, breaking the 1.0615 (S1) support line and aiming for the 1.0450 (S2) support level.

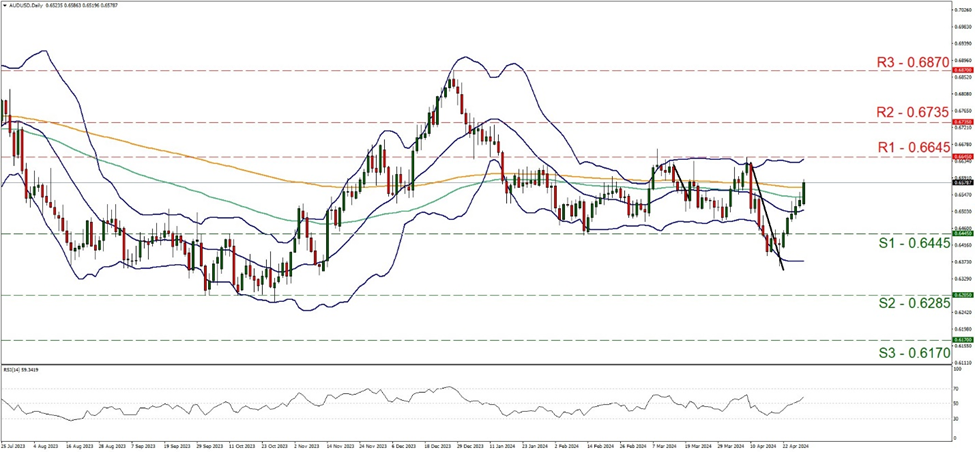

Across the world a totally different picture is presented by AUD/USD as the pair continued to advance higher on Friday and during today’s Asian session, aiming for the 0.6645 (R1) resistance line. We tend to maintain a bullish outlook for the pair given the continuous upward movement of the pair in the past week. Also, the RSI indicator has broken the reading of 50 and continues to rise, underscoring the build-up of a buying interest among market participants for the pair which in turn supports our bullish outlook. Should the bulls maintain control over the pair we may see AUD/USD breaking the 0.6645 (R1) resistance line and if the R1 is broken the door opens for the 0.6735 (R2) resistance hurdle. For a bearish outlook, we would require the pair to reverse direction, break the 0.6445 (S1) support line thus paving the way for the 0.6285 (S2) support level.

今週の指数発表

On Tuesday we get France’s preliminary GDP and HICP rates for Q1 and April respectively, Switzerland’s KOF indicator for April, the preliminary GDP rate for Q1 of the Czech Republic, Germany and the Eurozone as well as the preliminary HICP rate of the Eurozone for April and Canada’s GDP rate for February. On Wednesday we get New Zealand’s employment data for Q1 and from the US we note the release of the ISM manufacturing PMI figure for April. On Thursday we get Australia’s building approvals for March, UK’s Nationwide House Prices for April, Switzerland’s CPI rates for April, Canada’s trade data for March, and from the US the weekly initial jobless claims figure and March’s factory orders. On Friday we note the release of Turkey’s CPI rates for April, from the US the ISM non-manufacturing PMI figure for April and we highlight the release of the US employment report for April.

EUR/USD デイリーチャート

- Support: 1.0615 (S1), 1.0450 (S2), 1.0295 (S3)

- Resistance: 1.0740 (R1), 1.0890 (R2), 1.1010 (R3)

AUD/USD デイリーチャート

- Support: 0.6445 (S1), 0.6285 (S2), 0.6170 (S3)

- Resistance: 0.6645 (R1), 0.6735 (R2), 0.6870 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。