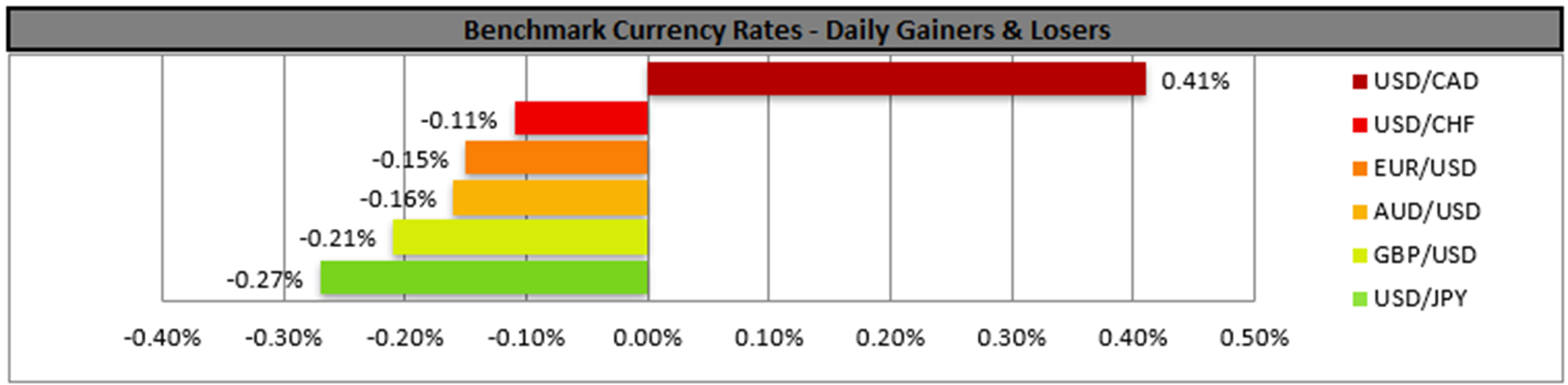

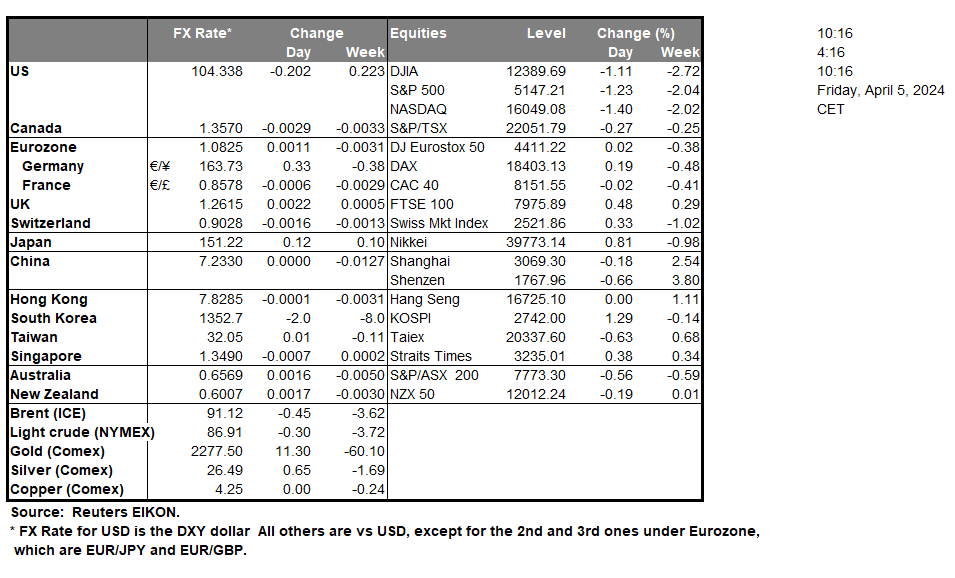

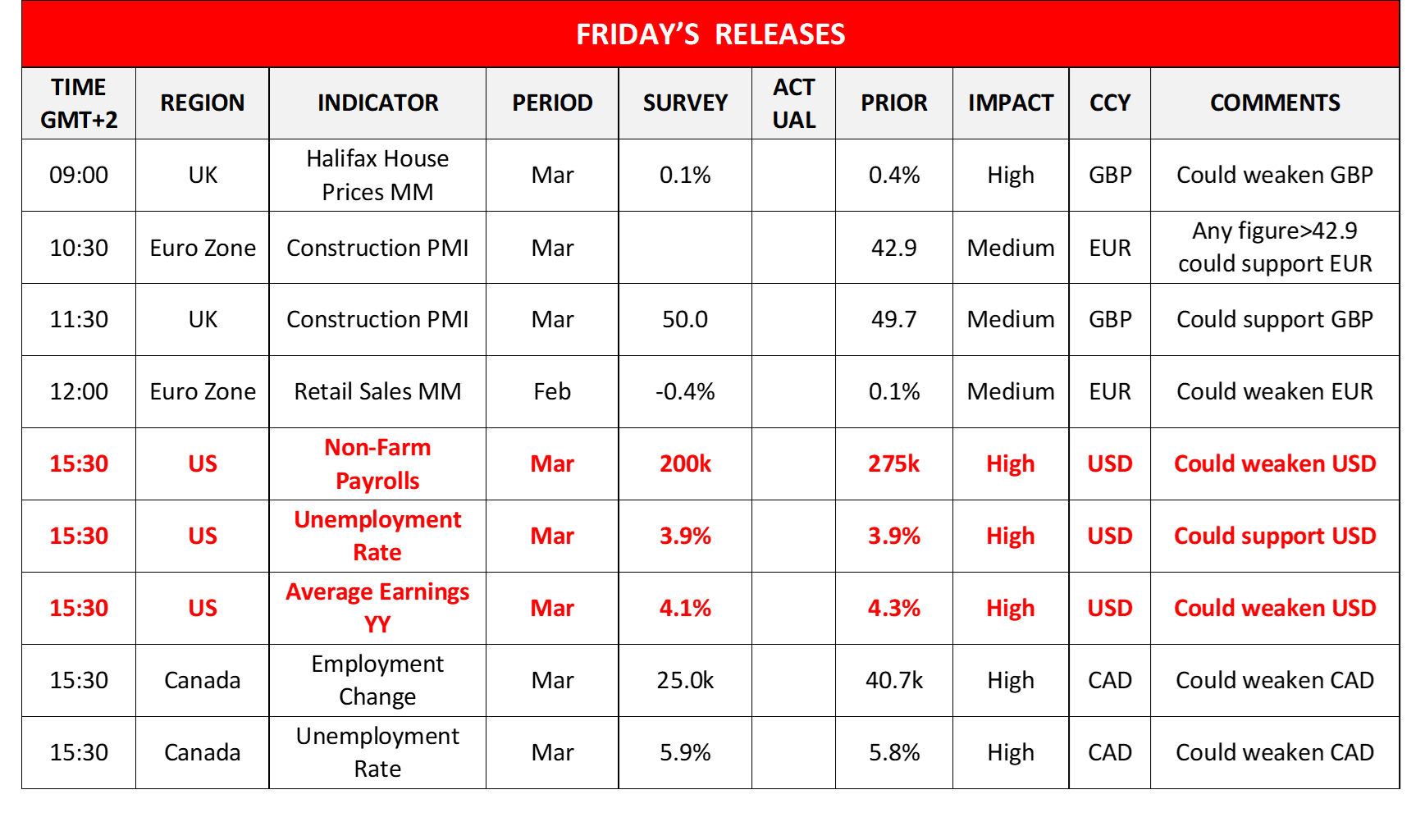

Today attention is expected to turn towards the release of the US employment report for March. The Non-Farm Payrolls figure is expected to drop to 200k, if compared to February’s 275k, the unemployment rate to remain unchanged at 3.9% and the average earnings growth rate to ease to 4.1%yoy. Should the actual rates and figures meet their respective forecasts we may see the USD slipping as the drop of the NFP figure may disappoint traders, yet the fact that the unemployment rate is to remain unchanged at 3.9%, low, implying a relative tightness of the US employment market, may soften the blow. Please note that the uncertainty for the actual rates and figures remains high, which may increase volatility at the time of the release. Also, the release is expected to have ripple effects beyond the USD, on US stock markets and gold and a possible easing of the US employment market’s tightness could support the gold and equities. The importance of the release is highlighted by the attention of the market to the Fed’s intentions about the timing and the extent of future rate cuts, given also the Fed’s dual mandate to keep inflation low and promote maximum employment. We do not expect the Fed’s stance to be materially altered as the data seem to remain in line with prior months and may allow the bank to maintain tight financial conditions in the US economy.

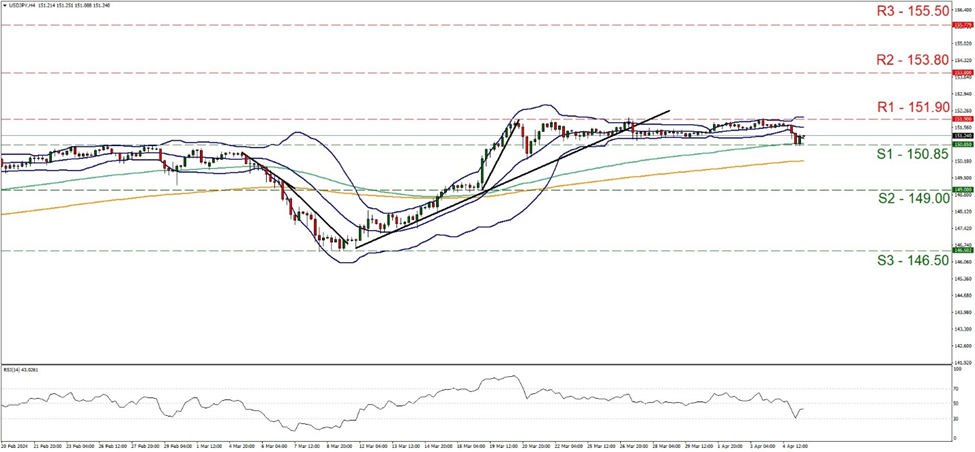

USD/JPY edged lower during today’s Asian session, yet bounced on the 150.85 (S1) support line. We tend to maintain our bias for the sideways motion of the pair to continue currently given the relative stability of the pair since the 21 of March, yet yesterday’s movement displayed the possibility of a change in direction. Should the bulls find a chance and take over once again, we may see USD/JPY breaking the 151.90 (R1) resistance line, which is a thirty year high with the next possible target for the bulls being set at the 153.80 (R2) resistance hurdle. Should the bears take over, we may see the pair breaking the 150.85 (S1) support line and taking aim of the 149.00 (S2) support base.

At the same time, we also get Canada’s employment data for the same month. The employment change figure is expected to drop to 20.0k and the unemployment rate to tick up to 5.9%. Should the actual rates and figures meet their respective forecasts, we may see the CAD losing some ground, as the release would imply further easing of the Canadian employment market and could shift BoC’s monetary policy stance towards a more dovish aspect.

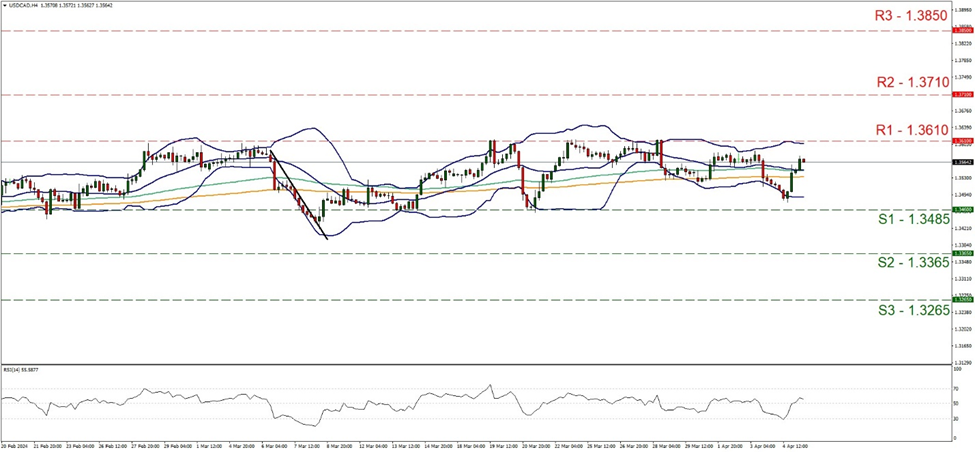

USD/CAD despite some weakening in yesterday’s European session, corrected higher later on and maintained its rangebound movement between the 1.3610 (R1) resistance line and the 1.3485 (S1) support line. We tend to maintain a bias for the sideways motion to be maintained given the pair’s movement since early February, yet also note that the simultaneous release of the US and Canadian employment data for March later today could prove to be a game changer for the pair. Should a selling interest be expressed by the market, we may see the pair breaking the 1.3485 (S1) support line and aim for the 1.3365 (S2) support level. Should the on the other hand, buyers take control over the pair’s direction, we may see USD/CAD breaking the 1.3610 (R1) resistance line and aiming for the 1.3710 (R2) resistance level.

その他の注目材料

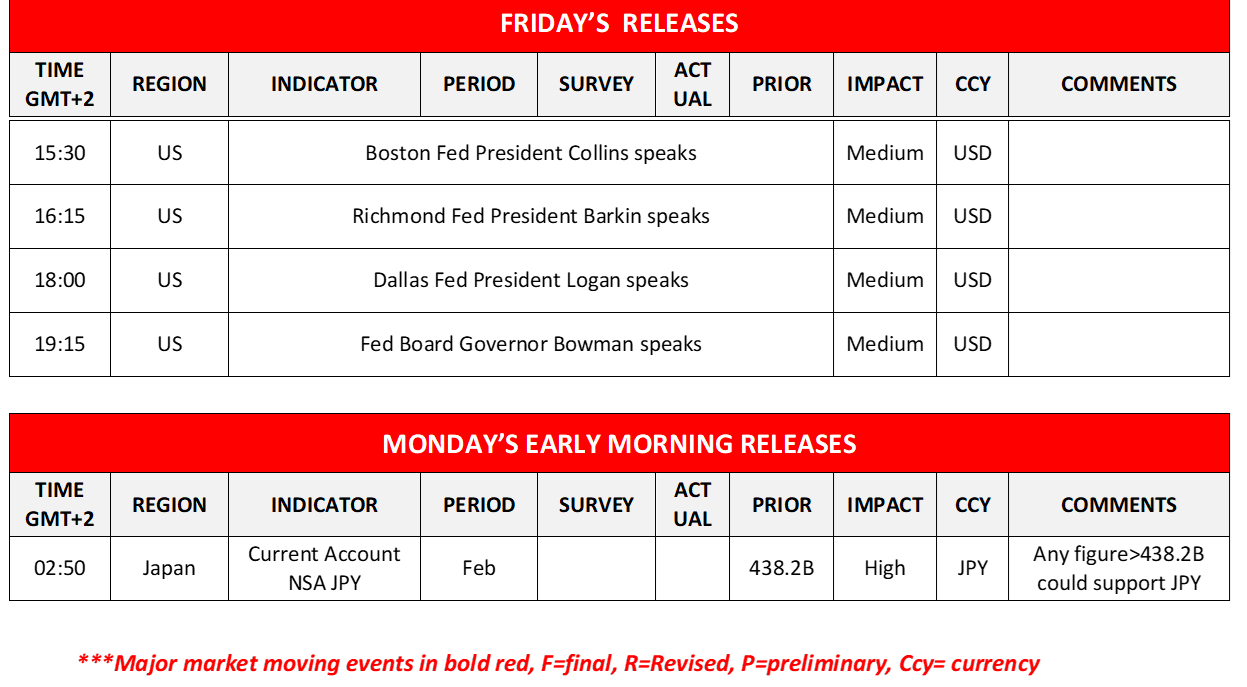

Today in the European session we note the release of UK’s Halifax House prices for March, UK’s and the Eurozone construction PMI figures for the same month and Eurozone’s retail sales for February. On the monetary front in the American session, we note that Boston Fed President Collins, Richmond Fed President Barkin, Dallas Fed President Logan and Fed Board Governor Bowman are scheduled to speak. In Monday’s Asian session, we get Japan’s current account balance for February.

USD/JPY 4時間チャート

Support: 150.85 (S1), 149.00 (S2), 146.50 (S3)

Resistance: 151.90 (R1), 153.80 (R2), 155.50 (R3)

USD/CAD 4時間チャート

Support: 1.3485 (S1), 1.3365 (S2), 1.3265 (S3)

Resistance: 1.3610 (R1), 1.3710 (R2), 1.3850 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。