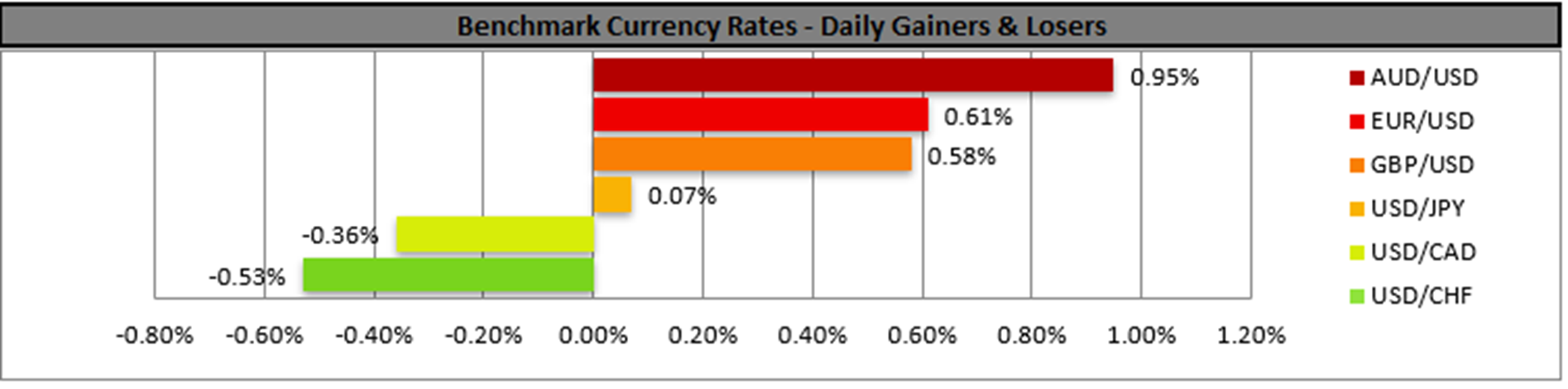

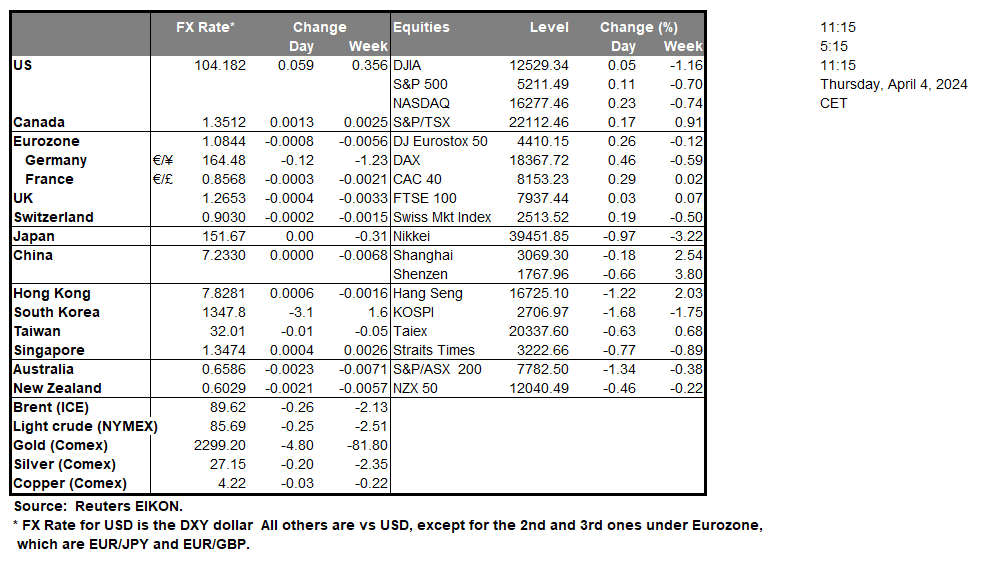

The US ADP Non-Farm Employment figure for March vastly exceeded market expectations by coming in at 184k versus the expected figure of 148k. The better-than-expected employment figure appears to have temporarily supported the greenback. Yet the ISM Non-Manufacturing PMI figure for March which was released later on seems to have predominantly impacted the dollars direction during yesterday’s trading session. The PMI figure came in lower than expected implying that the US non-manufacturing industry may be struggling and thus could cast some doubt over the narrative that the US economy remains resilient, thus weighing on the greenback. On a monetary level, Fed Chair Powell’s comments yesterday could be perceived as dovish, with him having stated that “The recent data do not, however, materially change the overall picture…….and inflation moving down toward 2 percent on a sometimes-bumpy path”. The comments imply that the Fed may proceed with easing monetary policy, in line with market expectations of 3 rate cuts this year, thus potentially weighing on the greenback. In the commodities market, a meeting between top OPEC+ Ministers kept oil supply policy unchanged. The unchanged oil supply policy could provide some support to oil prices should the group’s members conform with the voluntary oil production cuts set in place.

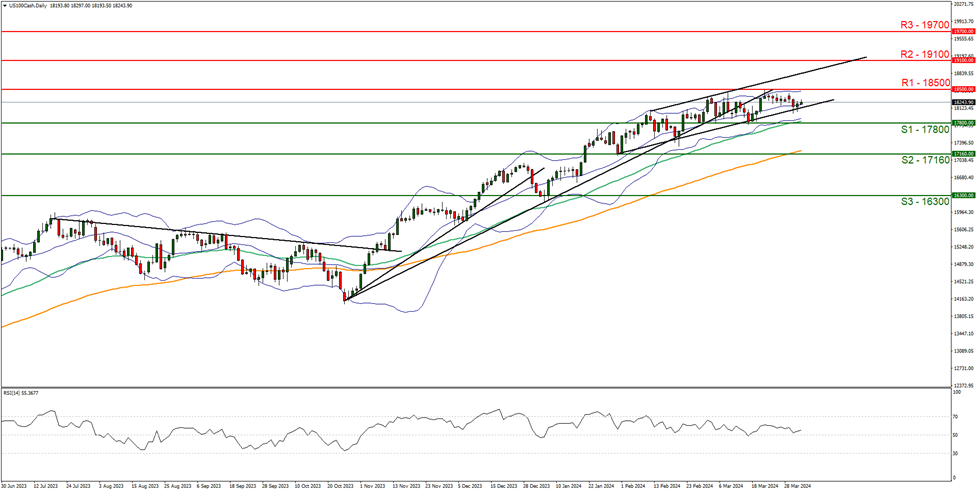

US100Cash appears to be moving in an upwards fashion, after failing to break below our upwards-moving channel. We tend to maintain a bullish outlook for the index and supporting our case is the aforementioned upwards moving channel. Yet, we note our concerns regarding the narrowing of the Bollinger bands which imply low market volatility, in addition to the RSI indicator below our chart currently registering a figure of 50, implying a neutral market sentiment. Nonetheless, for our bullish outlook to continue we would require a clear break above the 18500 (R1) resistance level, with the next possible target for the bulls being the 19100 (R2) resistance line, in addition to the upwards moving channel remaining intact. On the other hand, for a sideways bias to occur we would require the index to remain confined between the 17800 (S1) support level and the 18500 (R1) resistance line. Lastly, for a bearish outlook, we would require a clear break below the 17800 (S1) support level, with the next possible target for the bears being the 17160 (S2) support line.

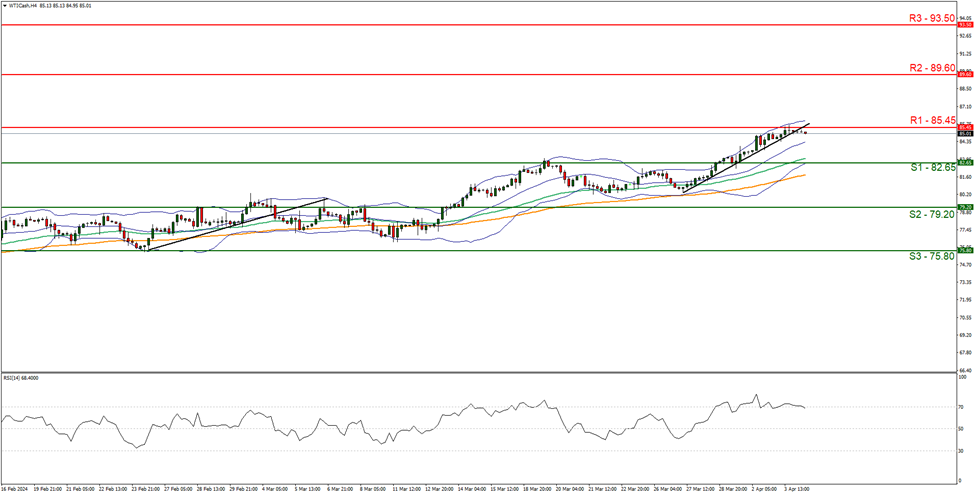

WTICash appears to be moving in an upwards fashion, despite breaking below our upwards moving trendline. We maintain a bullish outlook for the commodity and supporting our case is the RSI Indicator below our chart which currently registers a figure near 70, implying a strong bullish market sentiment. For our bullish outlook to continue, we would require a clear break above 85.45 (R1) resistance level, with the next possible target for the bulls being the 89.60 (R2) resistance line. On the other hand, for a sideways bias we would require the commodity’s price to remain confined between the 82.65 (S1) support line and the 85.45 (R1) resistance level. Lastly, for a bearish outlook we would require a clear break below the 82.65 (S1) support level, with the next possible target for the bears being the 79.20 (S2) support line.

その他の注目材料

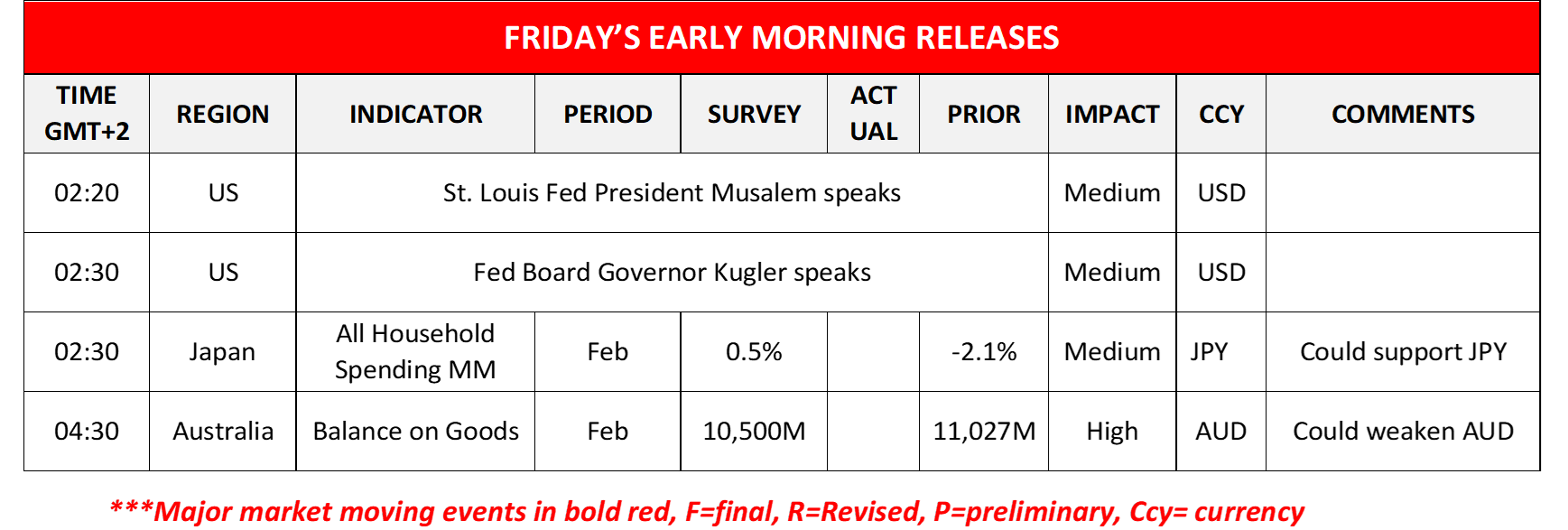

Today in the European session, we note the release of Switzerland’s CPI rates for March, Eurozone’s and the UK’s final composite and services PMI figures for March. In the American session, we note the release of the US weekly initial jobless claims figure and Canada’s trade data for February. On the monetary front, we note that Philadelphia Fed President Harker, Richmond Fed President Barkin, Chicago Fed President Goolsbee, Minneapolis Fed President Kashkari and Cleveland Fed President Mester are scheduled to speak. During tomorrow’s Asian session, we get Japan’s all-household spending growth rate for February and Australia’s trade balance for the same month. As for speakers we note that St. Louis Fed President Musalem and Fed Board Governor Kugler are scheduled to make statements.

US100Cash Daily Chart

Support: 17800 (S1), 17160 (S2), 16300 (S3)

Resistance: 18500 (R1), 19100 (R2), 19700 (R3)

WTICash 4時間チャート

Support: 82.65 (S1), 79.20 (S2), 75.80 (S3)

Resistance: 85.40 (R1), 89.60 (R2), 93.50 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。