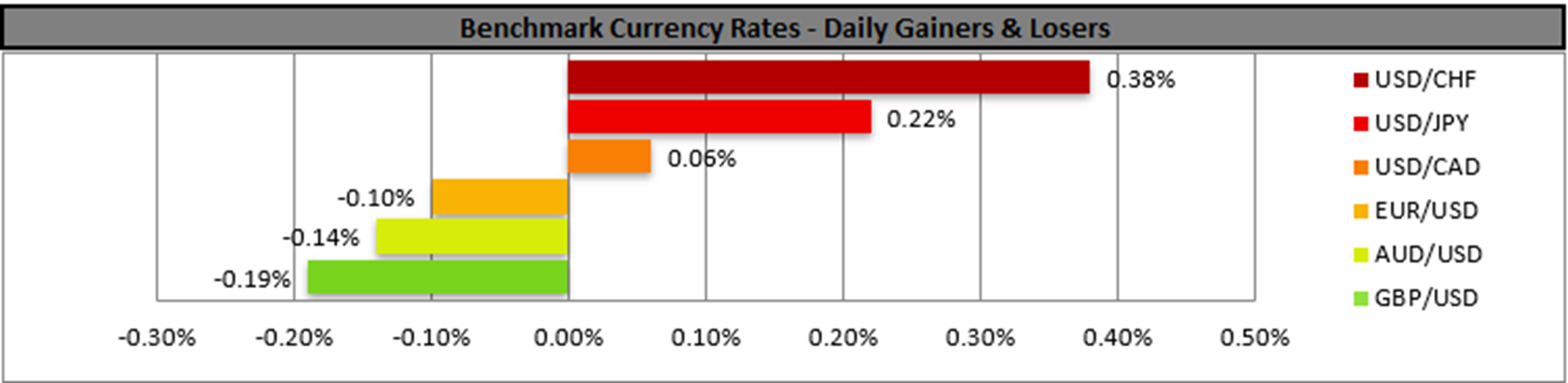

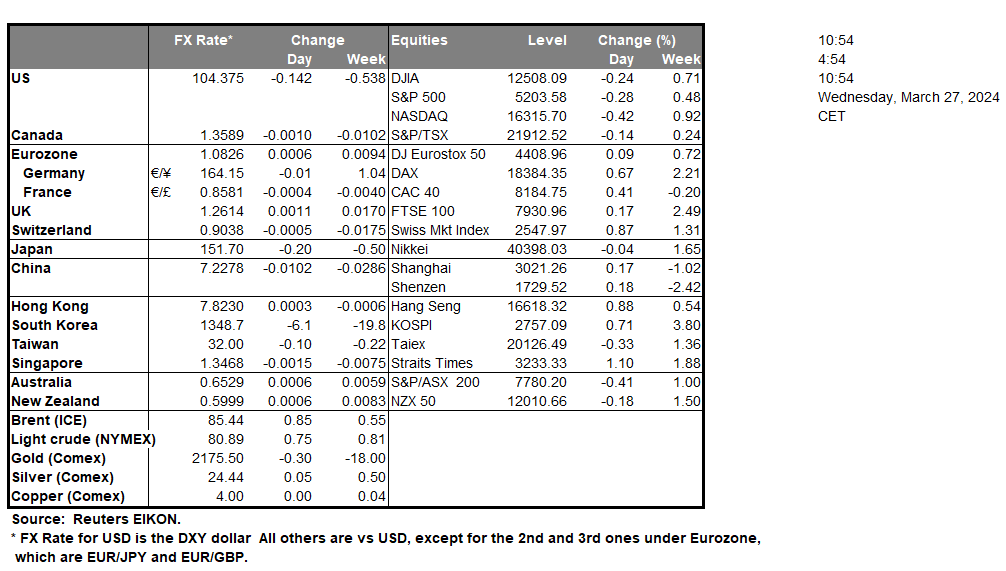

As headlines for the Baltimore Key Bridge disaster continue to reel in, we note that in the FX market, the USD was able to make some modest gains yesterday and during today’s Asian session, against its counterparts. We also note that the wider-than-expected acceleration of the US durable goods orders growth rate for February which was released yesterday, also provided tailwinds for the greenback. The release tended to imply a greater degree of confidence on behalf of US businesses to actually invest in the US economy. On the other hand, the drop in the consumer confidence indicator for March seems to imply less optimism among US consumers, which may weigh on the growth of retail sales in the coming months. Overall, we highlight as the next big test for the USD the release of the Core PCE Price index for February on Good Friday, yet until then we expect fundamentals to lead the greenback.

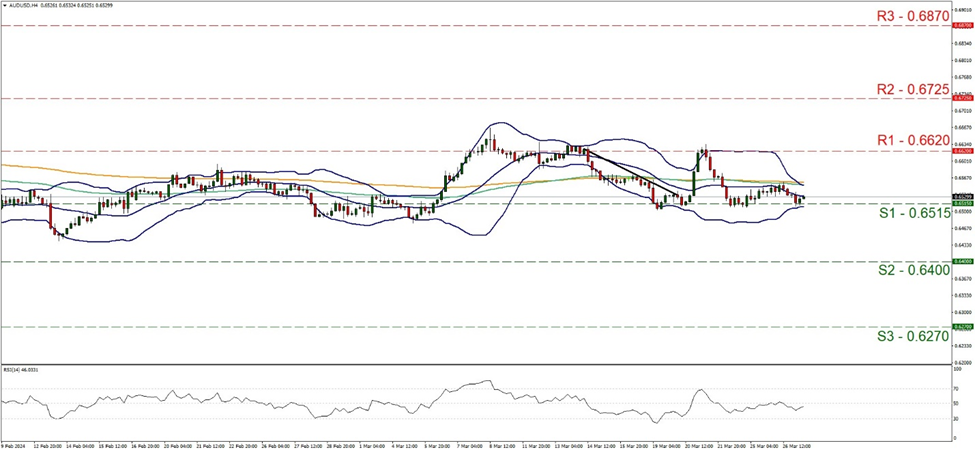

On a technical level, the USD strengthened against the AUD, causing the AUD/USD to drop yet the pair bounced on the 0.6515 (S1) support line. Given that the pair respected the lower boundary of its current sideways motion, and currently the RSI indicator remains below but near the reading of 50, implying a weakening bearish sentiment we tend to maintain a bias for the sideways motion to continue for the time being. For a bearish outlook, we would require the pair the break the 0.6515 (S1) support line, taking aim of the 0.6400 (S2) support level. Should the bulls take over, we may see AUD/USD rising and breaking the 0.6620 (R1) resistance line, thus paving the way for the 0.6725 (R2) resistance level.

We also note the weakening of the JPY which characteristically has approached a historic 34-year low against the USD. The weakening of JPY prompted Japan’s Finance Minister Suzuki to warn the markets that Japanese authorities would take “decisive steps”. It should be noted that the Japanese government used the same wording before a market intervention in the past hence speculation of a possible imminent operation by the Japanese government to save the Yen is on the rise. On the flip side BoJ board member Tamura highlighted the need for a steady yet slow monetary policy normalization while BoJ Governor Ueda was reported stating that BoJ must continue to support the Japanese economy with easy policy. The comments of the two BoJ policymakers were a painful reminder that the bank may proceed with a rather slow normalization of the monetary policy and in turn may weigh on JPY. We also highlight the release of BoJ’s summary of opinions for its March meeting and should we see that BoJ policymakers intend to proceed with a slow pace toward the normalization of the bank’s monetary policy we may see JPY weakening.

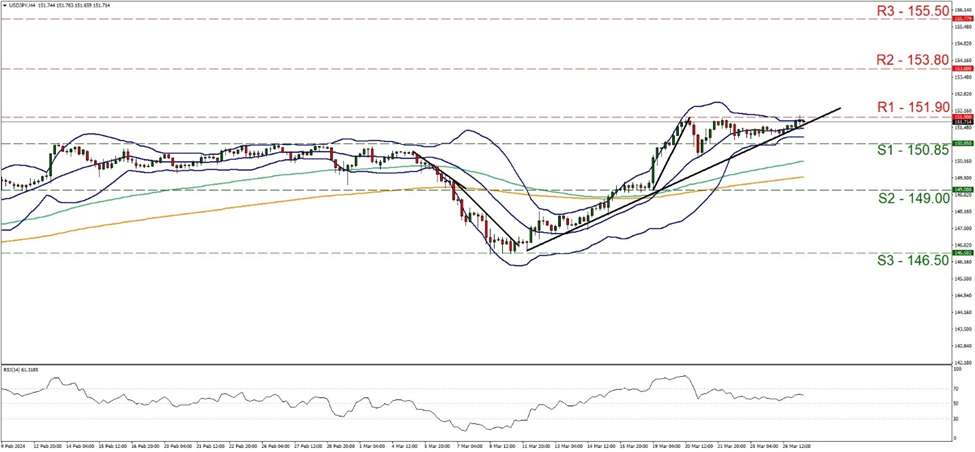

USD/JPY was flirting with the 151.90 (R1) resistance line, yet the level held its ground. On the one hand, the upward trendline tends support the notion of a bullish outlook, on the other hand, the 151.90 (R1) resistance line remains strong and may prevent the pair from rising to new 34-year record-high levels. The RSI indicator remains above the reading of 50, implying a residue of a bullish sentiment among market participants. Should the bulls be able to regain control over the pair we expect the pair to break the 151.90 (R1) resistance line with the next possible target for the bulls being set at the 153.80 (R2) resistance levels. On the other hand, should the bears take over the reins of the pair’s direction, we expect the pair to break initially the prementioned upward trendline in a first signal that the upward movement has been interrupted and continue lower to break also the 150.85 (S1) support base and take aim of the 149.00 (S2) support level.

その他の注目材料

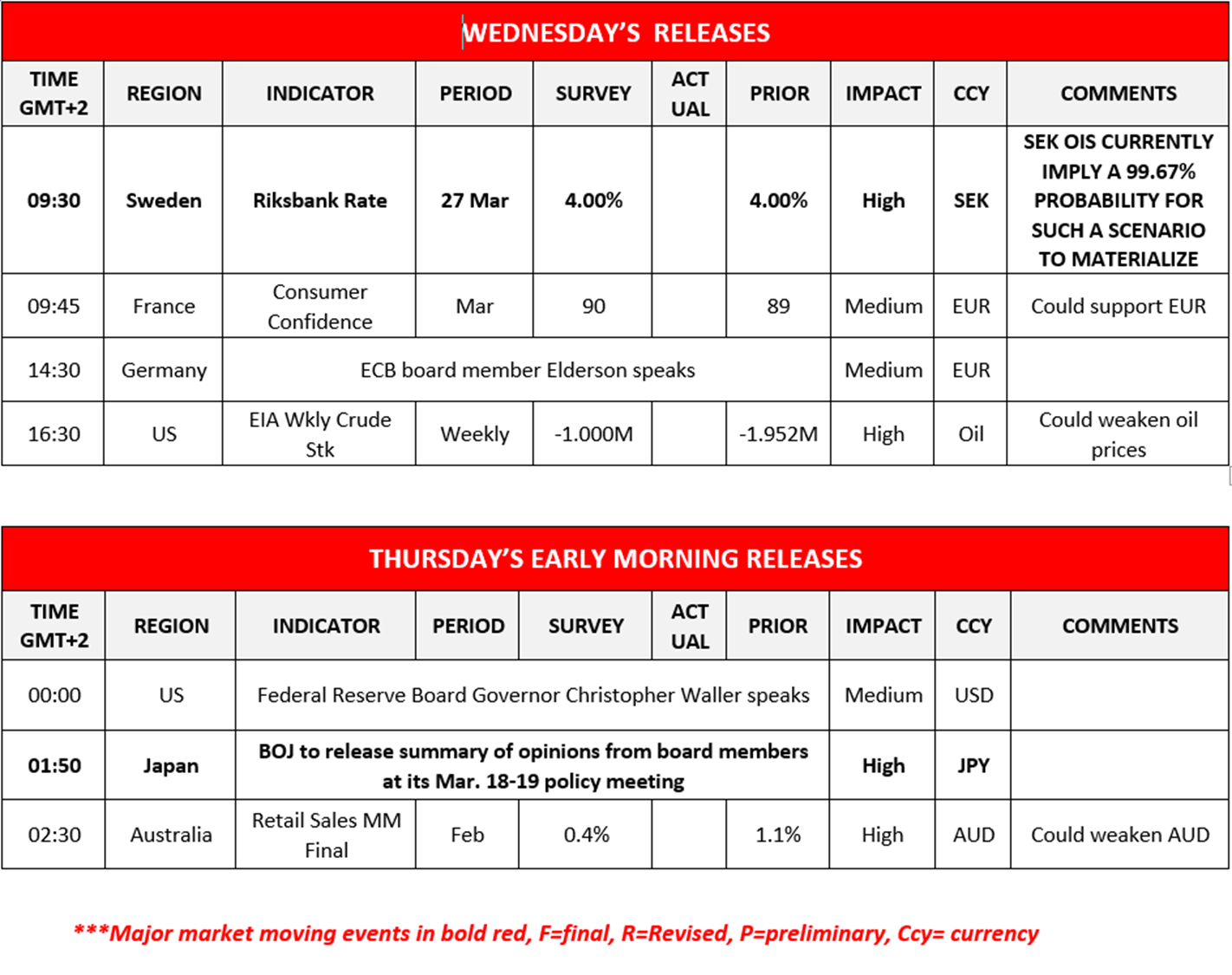

Today we get the US weekly EIA crude oil inventories figure. In tomorrow’s Asian session, we get Australia’s retail sales rate for February. Also, we note Riksbank’s interest rate decision, followed by the speech by ECB Elderson.

USD/JPY 4時間チャート

Support: 150.85 (S1), 149.00 (S2), 146.50 (S3)

Resistance: 151.90 (R1), 153.80 (R2), 155.50 (R3)

AUD/USD 4時間チャート

Support: 0.6515 (S1), 0.6400 (S2), 0.6270 (S3)

Resistance: 0.6620 (R1), 0.6725 (R2), 0.6870 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。