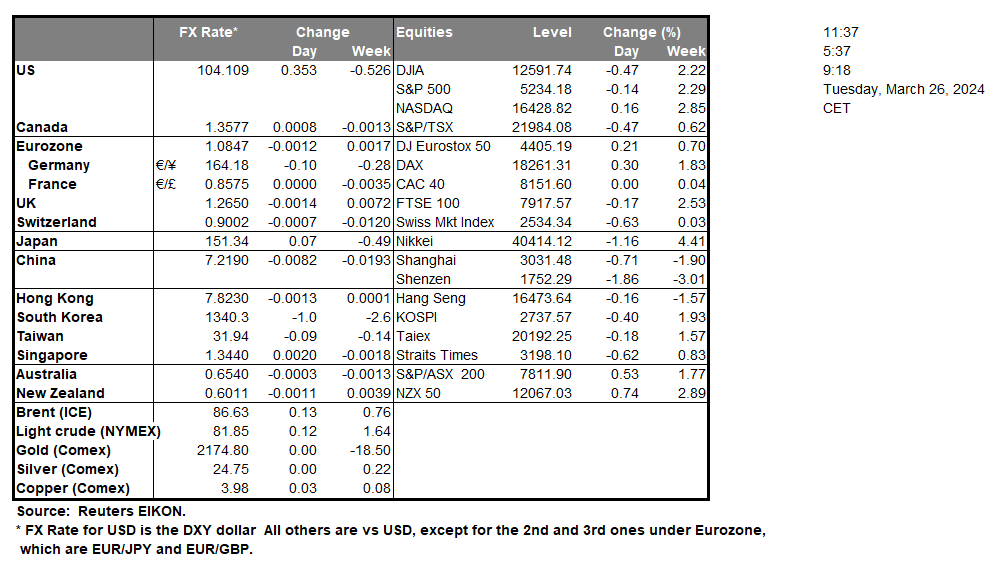

In the US, Fed Governor Cook stated yesterday that the “risks to achieving our inflation and employment goals are moving better into balance”. Furthermore, Fed Governor Cook also stated the risks of easing monetary policy too soon, which could lead to more restrictive monetary policy in the future. Yet also mentioned the risks of easing monetary policy too late. Overall, it appears that the comments made by Fed Governor Cook that the data for inflation stemming from housing-services, appears to be implying that inflation from that sector may continue to fall, could be perceived as dovish in nature. The same narrative appears to have been re-iterated by Chicago Fed President Goolsbee who raised his concerns about housing inflation, yet implied that the Fed is “getting back to target” when referring to inflation. On the other hand, Atlanta Fed President Bostic appears to have re-iterated his expectations for one interest-rate cut this year, which could be perceived as hawkish and may mitigate the overall dovish sentiment that appears to have emerged from Fed Governor Cook and Chicago Fed President Goolsbee. In the US Equities Market Boeing’s (#BA) CEO has stepped down according to Reuters. The announcement comes as Boeing is under immense scrutiny following the company’s safety crisis which had begun in January after a panel blew off a 737 MAX plane during an Alaska Airlines flight. Over, in the UK, BoE Mann stated that her rates view was “finely” balanced before the march vote.”

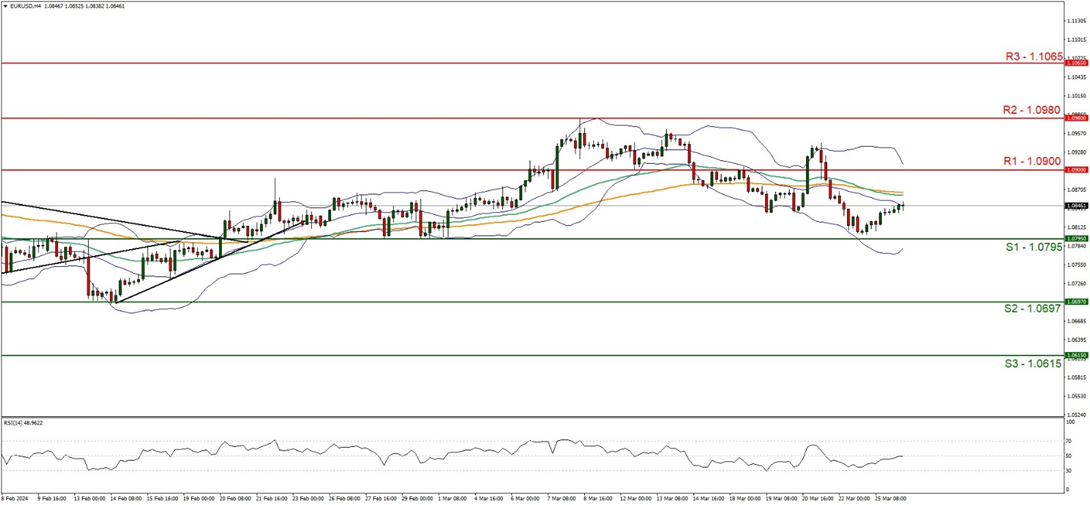

On a technical level, EUR/USD appears to be moving in a relatively sideways bias. We maintain a neutral outlook for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment. For our sideways bias to continue, we would like to see the pair remain confined between the 1.0795 (S1) support level and the 1.0900 (R1) resistance line. On the other hand, for a bearish outlook, we would like to see a clear break below the 1.0795 (S1) support level with the next possible target for the bears being the 1.0697 (S2) support base. Lastly, for a bullish outlook, we would like to see a clear break above the 1.0900 (R1) resistance line with the next possible target for the bulls being the 1.0980 (R2).

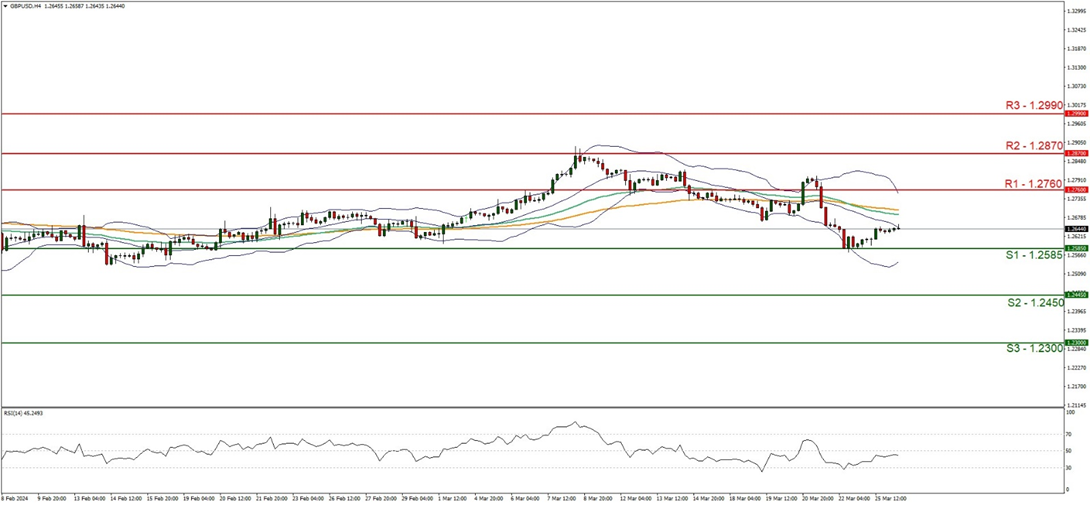

GBP/USD appears to be moving in a relatively sideways motion, with the pair having bounced off the 1.2585 (S1) support level. We maintain a neutral outlook for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment. Yet we would like to note that the Bollinger bands appear to be tilted to the downside, implying bearish market tendencies.For our sideways bias to continue, we would like to see the pair remain confined between the 1.2585 (S1) support level and the 1.2760 (R1) resistance line. On the other hand, for a bearish outlook, we would like to see a clear break below the 1.2585 (S1) support level, with the next possible target for the bears being the 1.2450 (S2) support base. Lastly, for a bullish outlook, we would like to see a clear break above the 1.2760 (R1) resistance line, with the next possible target for the bulls being the 1.2870 (R2) resistance level.

その他の注目材料

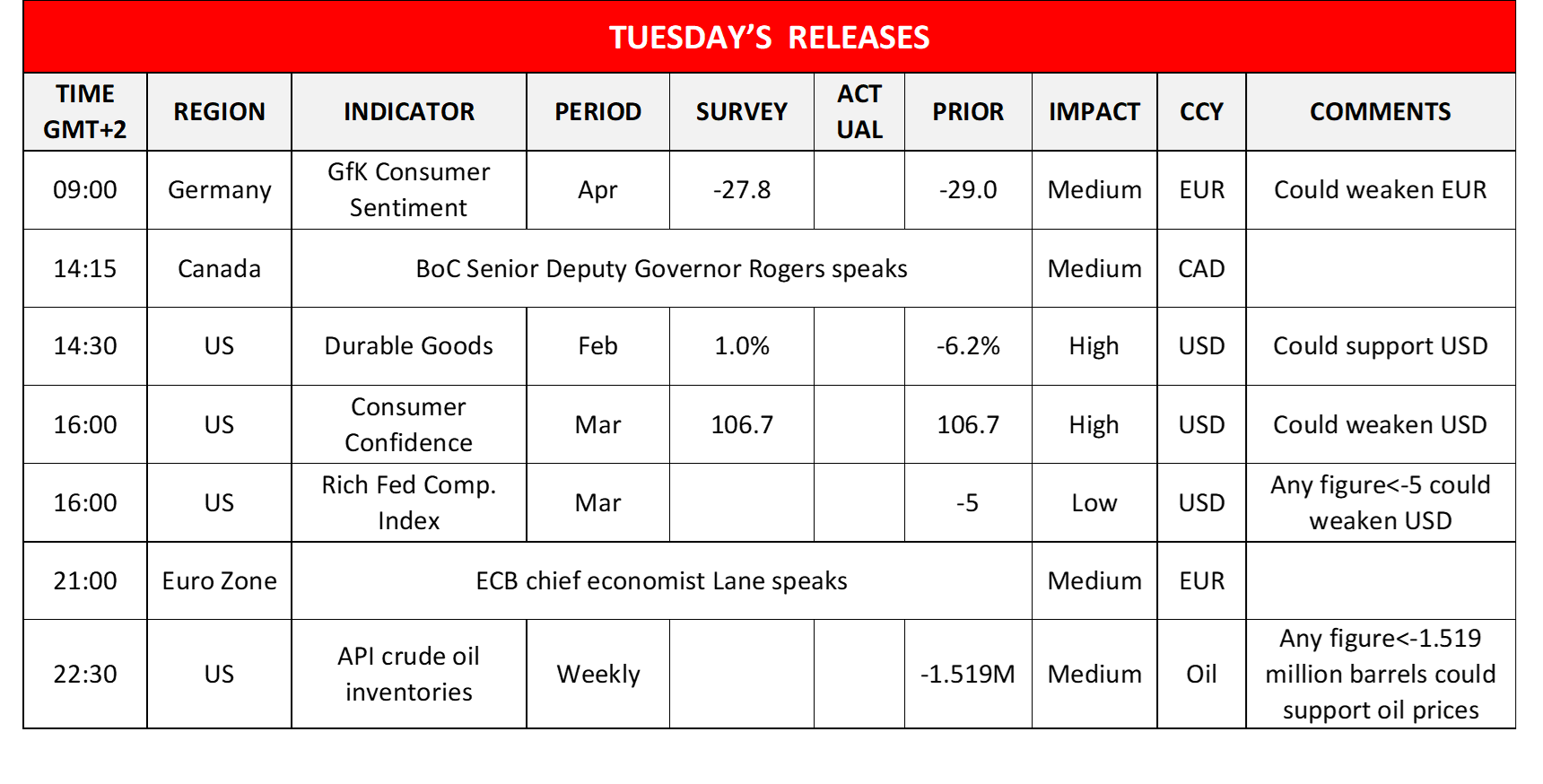

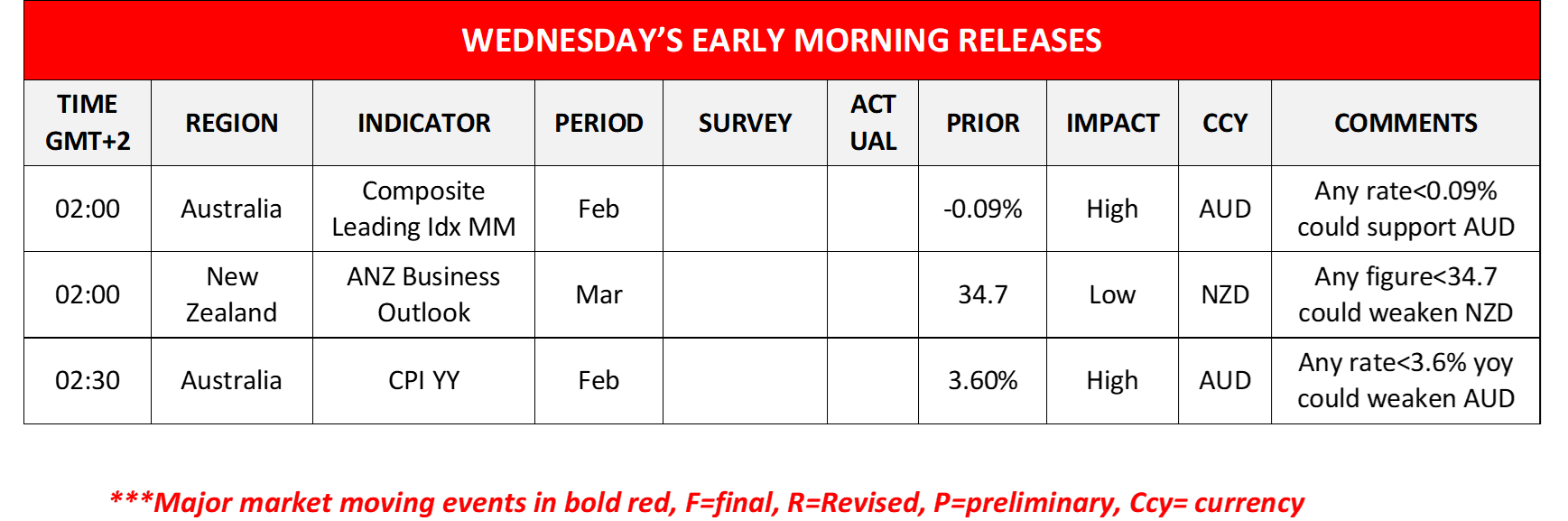

Today in the European session we note the release of Germany’s GfK consumer sentiment for April. In the American session, we get from the US the durable goods orders for February, the consumer confidence for March and the Richmond Fed Composite Index for the same month, while oil trades may be more interested in the release of the API weekly crude oil inventories figure. On the monetary front, we note that BoC Senior Deputy Governor Rogers and ECB Chief Economist Lane are scheduled to speak. During tomorrow’s Asian session, we get Australia’s Composite Leading Index for February and New Zealand’s ANZ Business outlook for March, while we highlight the release of Australia’s CPI rates for February.

EUR/USD 4時間チャート

Support: 1.0795 (S1), 1.0697 (S2), 1.0615 (S3)

Resistance: 1.0900 (R1), 1.0980 (R2), 1.1065 (R3)

GBP/USD 4時間チャート

Support: 1.2585 (S1), 1.2450 (S2), 1.2300 (S3)

Resistance: 1.2760 (R1), 1.2870 (R2), 1.2990 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。