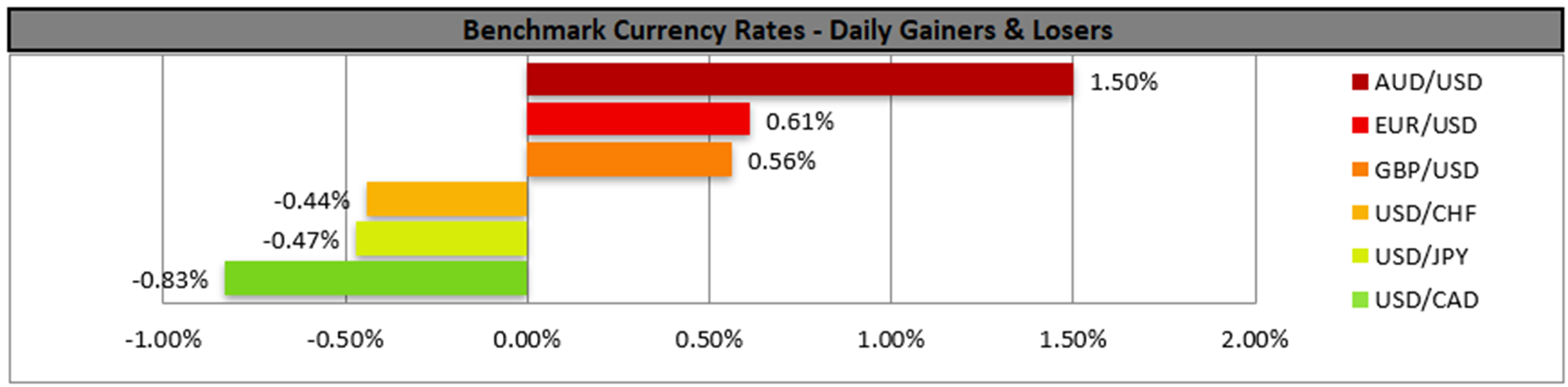

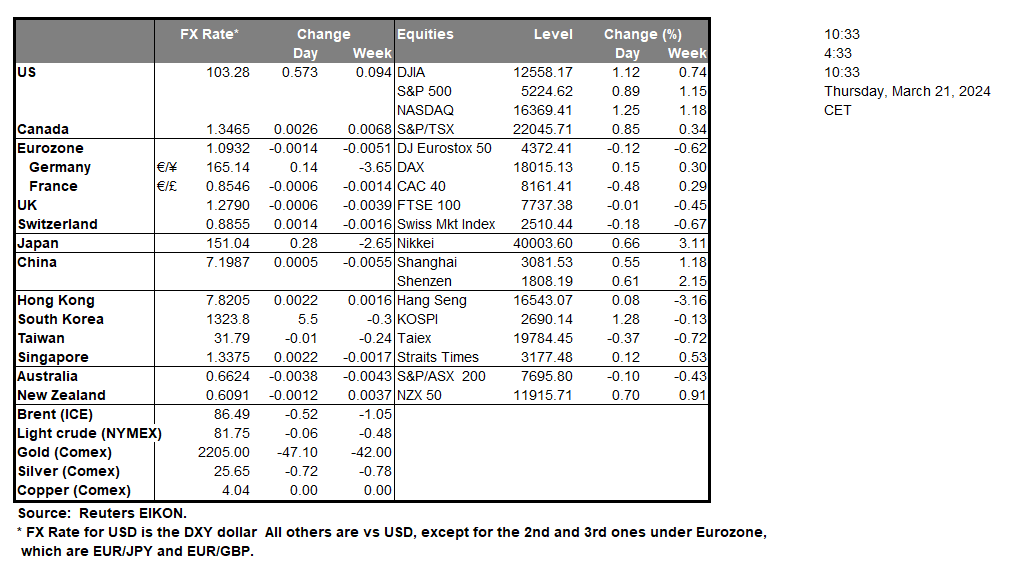

The USD weakened across the board yesterday, following the Fed’s interest rate decision. The bank as was widely expected remained on hold and seemed to verify that rate cuts are coming. Yet in its accompanying statement, the bank also mentioned that “The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent” showcasing some hesitancy on cutting rates. Furthermore, the new dot plot verified the market’s current expectations for a total of three rate cuts in the year which also tended to weigh on the USD. It should be noted that the interest rate decision improved the market sentiment, thus supporting US stock markets, while the weakening of the USD allowed for gold’s price to rise.

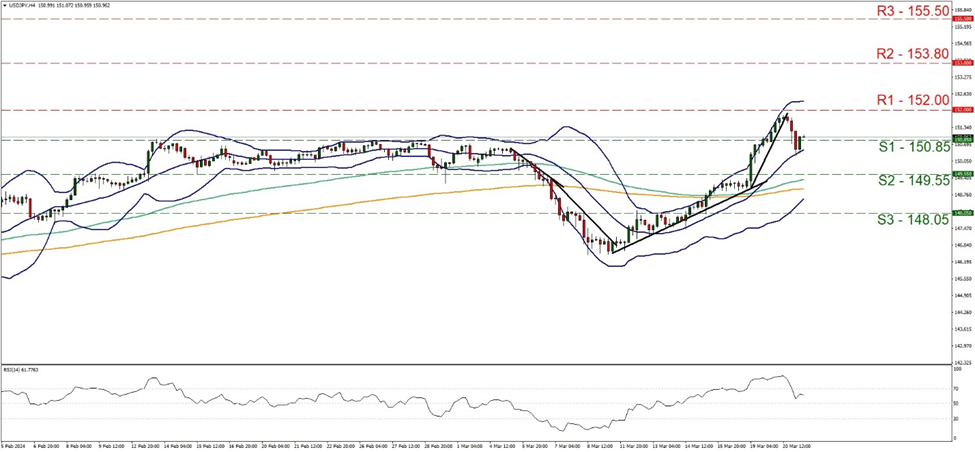

On a technical level, we note that USD/JPY dropped initially below the 150.85 (S1) support line, as a result of USD’s weakening, yet in today’s late Asian session, was able to surface above it once again. For the time being, we switch our bullish outlook in favour of a sideways motion bias, as the upward motion has been interrupted. Yet we see the bullish potentials of the pair given its recovery and the fact that the RSI indicator at the lowest of the pair in the past 24 hours was not able to penetrate below the reading of 50. Should the bulls take over we may see the pair breaking the 30-year high of 152.00 (R1) resistance line, with the next target for the bulls being set at the 153.80 (R2) level. Should the bears be in charge of the pair’s direction we may see USD/JPY breaking the 150.85 (S1) line clearly and taking aim at the 149.55 (S2) support base.

Across the Atlantic, BoE is set to release its own interest rate decision later today. The bank is widely expected to remain on hold, keeping rates at 5.25% and currently, GBP OIS imply a probability of 95.74% for such a scenario to materialise. Hence, we turn our attention to the release of the accompanying statement. On the one hand, the beyond-market-expectations easing of inflationary pressures in the UK economy for February could allow for the bank to relax its hawkish tone in which case we may see the pound slipping against its counterparts. Yet we have to note that the CPI rates are still higher than the bank’s 2% target and the bank may opt to keep its hawkishness in place not risking any easing of its vigilance against inflationary pressures in the UK economy, which could support the sterling.

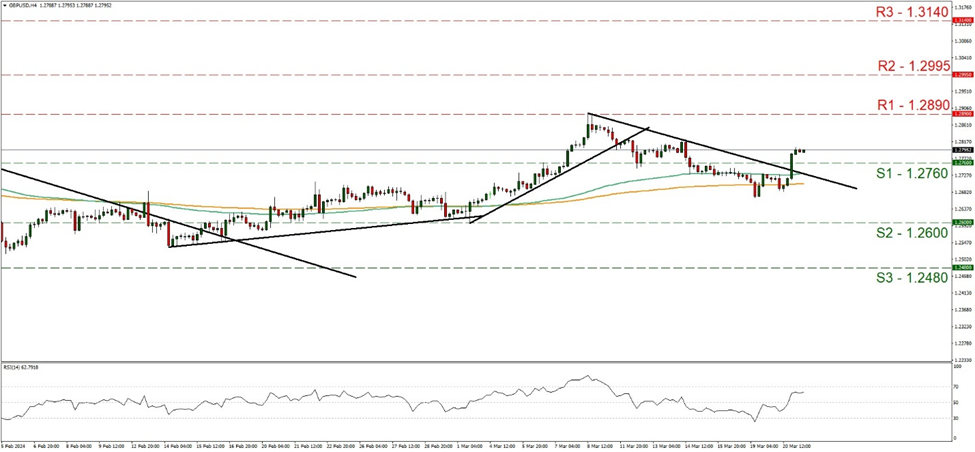

Cable jumped on the release of the Fed’s interest rate decision, breaking the 1.2760 (S1) resistance line, now turned to support. We note that the pair’s jump broke the downward trendline guiding the pair, thus we switch our bearish outlook initially in favour of a sideways bias. Yet we have to note that GBP/USD’s direction, may be directly related to the release of BoE’s interest rate decision. Should a selling interest be expressed by the market, we may see cable breaking the 1.2760 (S1) support line and aiming if not breaching the 1.2600 (S2) support base. Should buyers be in charge of the pair’s direction we may see the pair breaking the 1.2890 (R1) resistance line thus paving the way for the 1.2995 (R2) resistance hurdle.

その他の注目材料

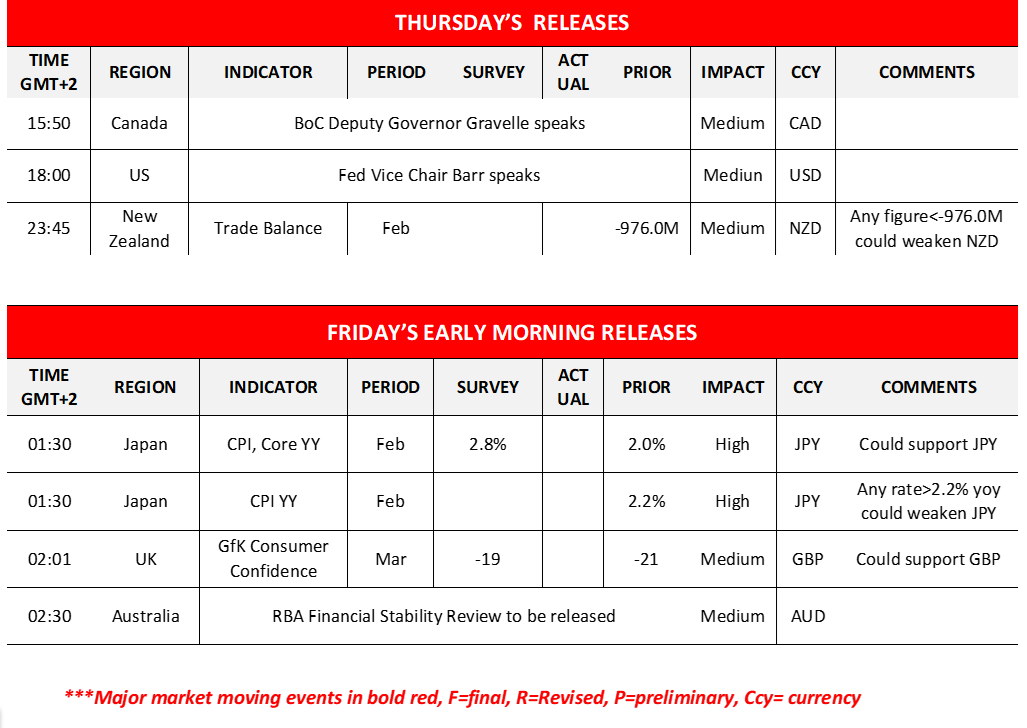

Today we note the release of the preliminary PMI figures of France, Germany, the Eurozone as a whole, the UK and the US for March. From the US we also note the release of the weekly initial jobless claims and March’s Philly Fed Business index, while from New Zealand we get the trade data for February. On the monetary front, we note the release of SNB’s, Norgesbank’s and CBT’s interest rate decisions, while ECB Board Member Buch, BoC Deputy Governor Gravelle and Fed Vice Chair Barr are scheduled to speak. During tomorrow’s Asian session, we note the release of Japan’s CPI rates for February and the UK’s GfK consumer confidence for March, while RBA’s Financial Stability Review is to be released.

USD/JPY 4時間チャート

Support: 150.85 (S1), 149.55 (S2), 148.05 (S3)

Resistance: 152.00 (R1), 153.80 (R2), 155.50 (R3)

GBP/USD 4時間チャート

Support: 1.2760 (S1), 1.2600 (S2), 1.2480 (S3)

Resistance: 1.2890 (R1), 1.2995 (R2), 1.3140 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。