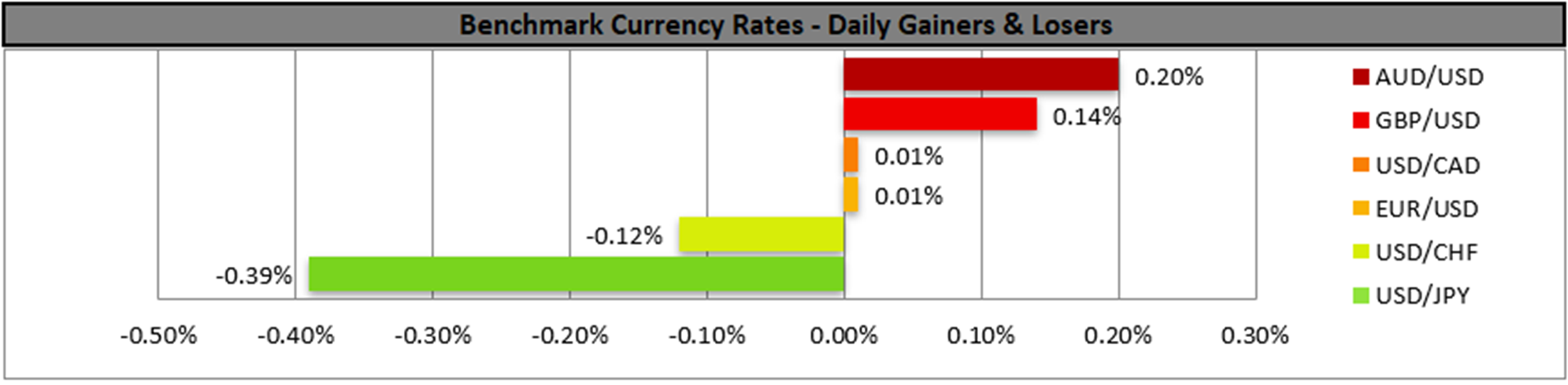

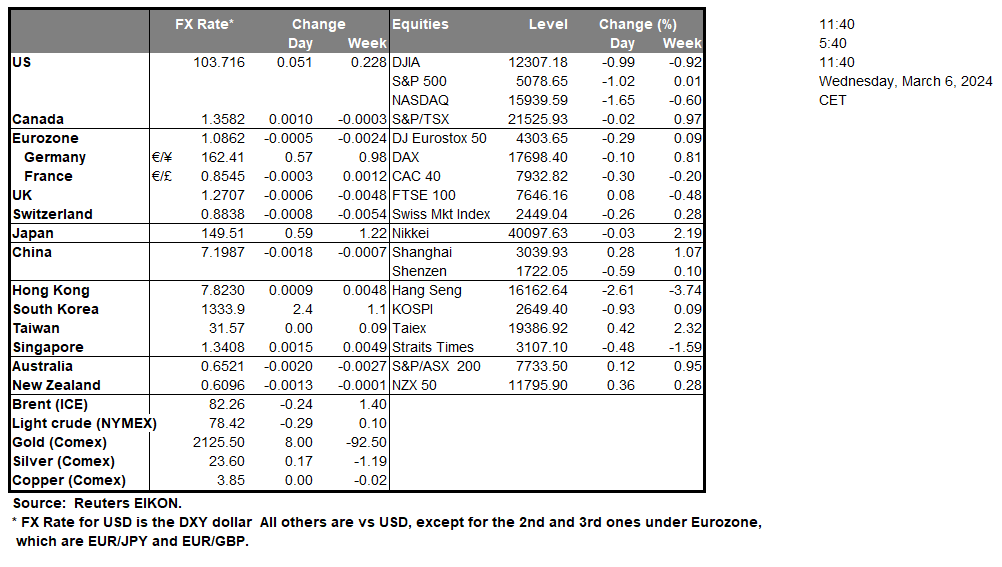

The USD edged lower yesterday against its counterparts, given also the easing of economic activity in the US non-manufacturing sector as implied by the relevant ISM PMI figure for February. Today USD traders are expected to keep a close eye on the release of the employment data, given also the release of the US employment report for February on Friday, and should they show a tightening of the US employment market we may see the USD getting some support. On the monetary front, we highlight the testimony of Fed Chairman Jerome Powell before the Senate. Should the Fed Chairman actually push against the market expectations for a possible rate cut in the bank’s June meeting we may see the USD gaining.

The testimony could have a wider effect like in US stock markets and gold’s price. On a technical level, we note that gold’s price continued its rally testing all-time high levels at the 2135 (R1) resistance line yesterday. Despite a relative hesitation on behalf of the bulls the bullish sentiment is still there as the RSI indicator is still at very high levels, hence we tend to maintain our bullish outlook for now. Yet we have to note that gold’s price may be at an over-bought level and the fact that it has breached the upper Bollinger band, may also be sending signals for a possible stabilisation or even a correction lower. Should the bulls maintain control over the precious metal’s price, we may see it breaking the 2135 (R1) resistance line and we set as the next possible target for gold bulls the 2180 (R2) resistance level. Should the bears take over, we may see gold’s price dropping and breaking the 2090 (S1) support line, a prerequisite for gold’s price start aiming the 2055 (S2) support level.

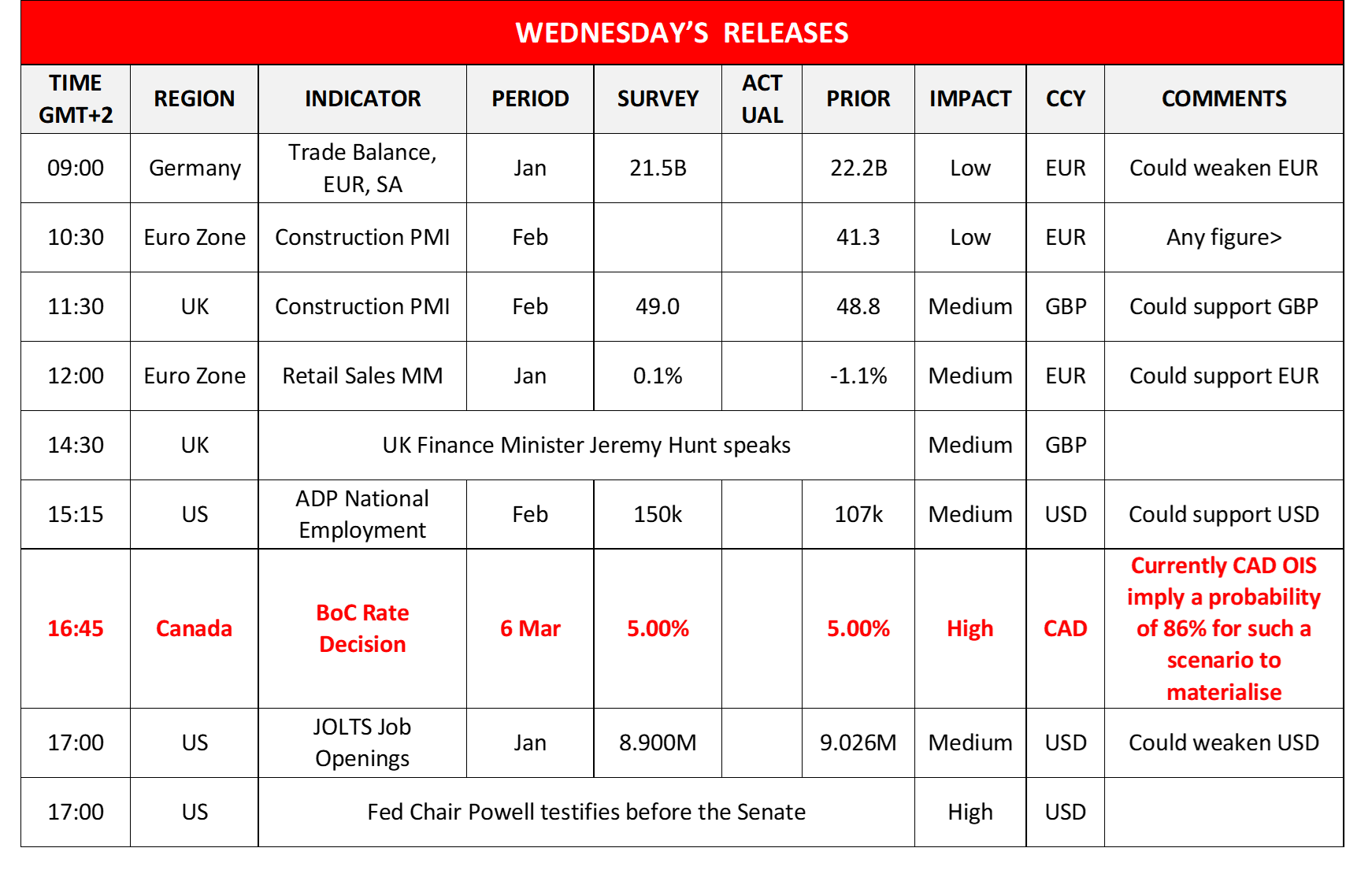

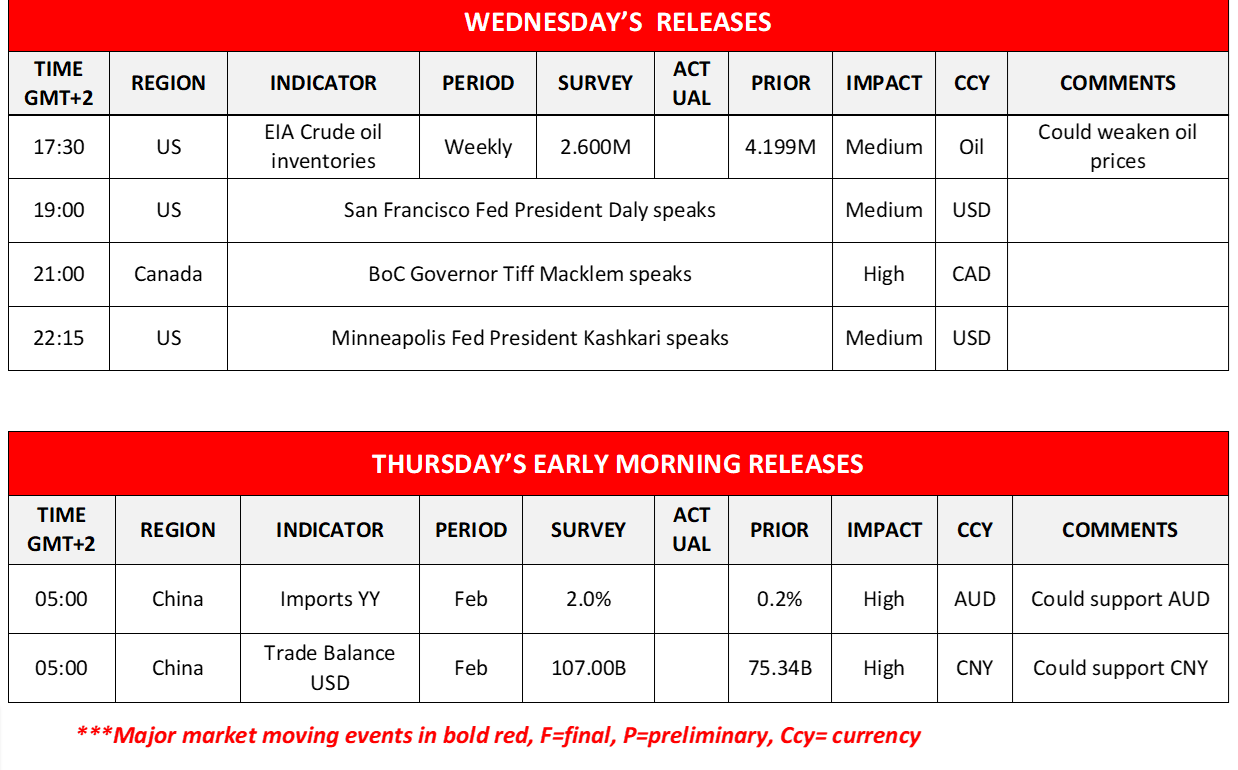

North of the US border we note the release of Bank of Canada’s interest rate decision. The bank is expected to keep rates unchanged at 5.00% and currently CAD OIS imply a probability of 98% for such a scenario to materialise. Should the bank remain on hold as expected, we may see the market turning its attention to the accompanying statement and BoC Governor Macklem’s press conference later in an effort to understand the bank’s intentions. For the time being, we note that the market seems to have priced in the bank delivering four rate cuts in total in 2024, starting from June and given that the CPI rate has slowed down and entered the bank’s targeted inflation range both on a core as well as on a headline level, we may see the bank easing on its hawkishness, which may weigh on the Loonie. Should the bank opt to keep its options open about the timing of any potential rate cut thus allowing for a more hawkish tone to be dominant supporting the CAD.

USD/CAD continued its sideways motion just below the 1.3610 (R1) resistance line yesterday. Thus, we tend to maintain our bias for the rangebound movement to be maintained, yet BoC’s interest rate decision and Fed Chairman Powell’s testimony may alter the pair’s direction. For a bearish outlook, we would require the pair to break the 1.3485 (S1) support line thus aiming for lower grounds. On the flip side should the bulls take over, we may see the pair breaking the 1.3610 (R1) resistance line and take aim for the 1.3710 (R2) resistance base.

その他の注目材料

Today in the European session, we note the release of Germany’s trade data for January, the Eurozone’s and the UK’s construction PMI figures for February and Eurozone’s retail sales for January and on a fiscal level, UK’s finance minister Jeremy Hunt is to deliver the annual budget in the House of Commons. In the American session, we note the release from the US of the ADP National employment figure for February and the JOLTS Job openings figure for January and the EIA weekly crude oil inventories figure. On the monetary front, we note that San Francisco Fed President Daly and Minneapolis Fed President Kashkari speak. During tomorrow’s Asian session, we note the release of China’s trade data for February.

XAU/USD 4時間チャート

Support: 2090 (S1), 2055 (S2), 1920 (S3)

Resistance: 2135 (R1), 2180 (R2), 2230 (R3)

USD/CAD 4時間チャート

Support: 1.3485 (S1), 1.3365 (S2), 1.3265 (S3)

Resistance: 1.3610 (R1), 1.3710 (R2), 1.3840 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。