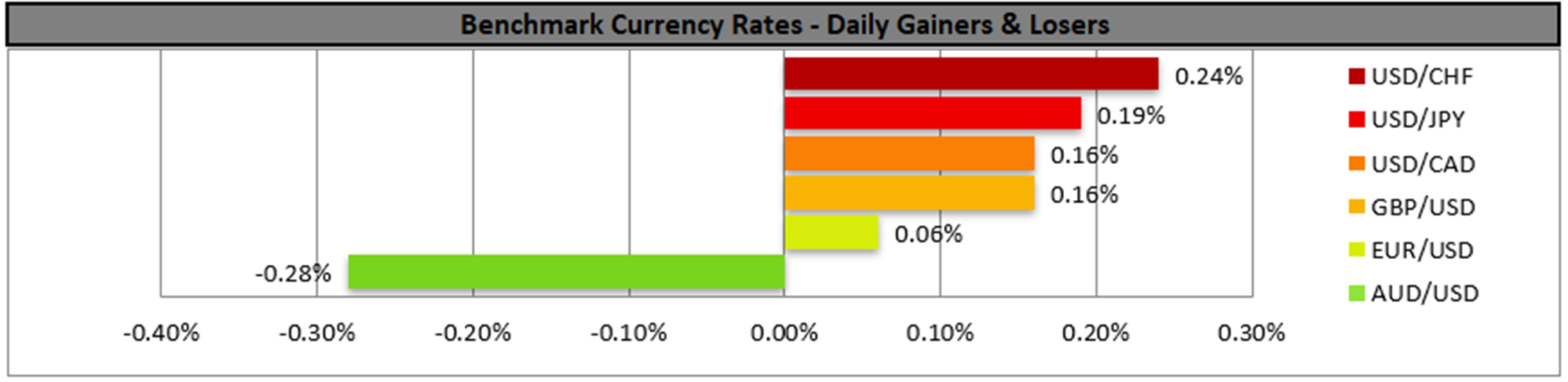

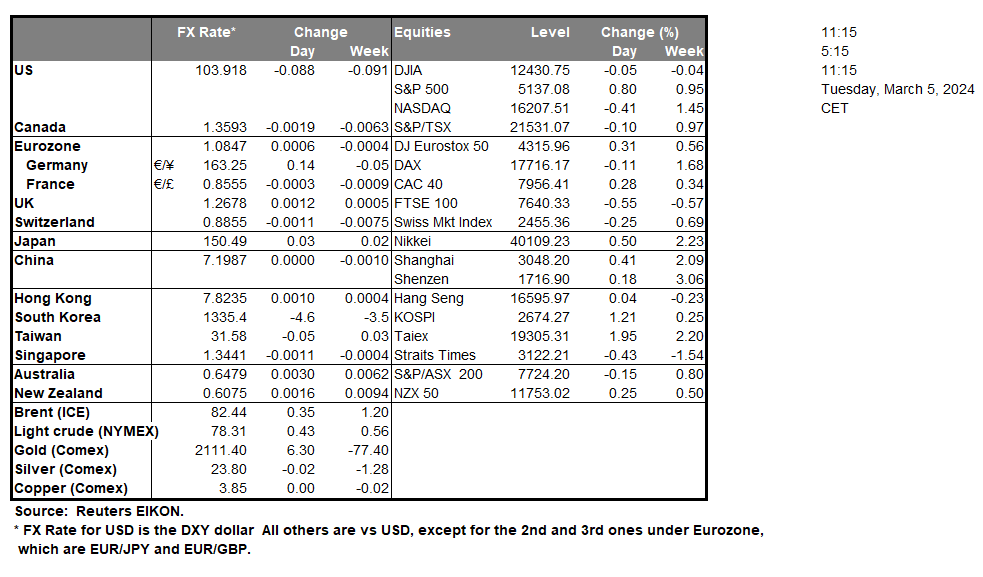

The USD seems to have stabilised somewhat against its counterparts, while the market prepares for Fed Chairman Powell’s testimony before the US Senate tomorrow and the release of the US employment data for February on Friday. On a fundamental level, we note that November’s US Presidential election is expected to gain traction as today we have a Super Tuesday in the primaries and President Biden is to deliver his State of the Union speech at the end of the week. Today market attention is expected to be on the release of the ISM non-manufacturing PMI figure for February given also the wide contraction of economic activity noted for the manufacturing sector for the same month. At the same time USD’s inactivity enabled gold’s price to jump even higher yesterday and is now aiming for record-high levels. On the flip side, US stock market bulls took a step back as the week began yesterday. Should market sentiment deteriorate we may see US equities markets retreating somewhat.

Back in the FX market we note that the Aussie weakened against the USD despite the current account balance turning positive and coming in higher than expected for Q4. We expect Aussie traders tomorrow during the Asian session, to turn their attention towards the release of Australia’s GDP rate for Q4 and a possible slowing down could weaken the Australian Dollar, as it could highlight also the results of a tight monetary policy by the RBA. Overall though we also note the market sentiment as determining factor behind AUD’s direction and a possible deterioration could weigh on the Aussie as it is considered a riskier asset.

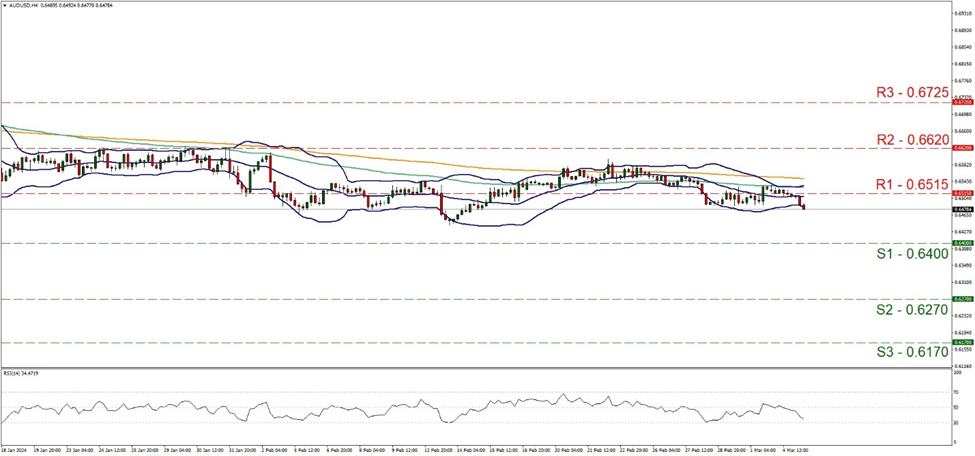

On a technical level AUD/USD dropped yesterday breaking the 0.6515 (R1) support line, now turned to resistance. Despite AUD/USD’s price action revolving around the 0.6515 (R1) axis over the past month, we note increasing bearish signals for the pair. It’s characteristic that the RSI indicator dropped aiming, yet not reaching, the reading of 30. For a clearcut bearish outlook though we would require the pair to reach if not breach the 0.6400 (S2) support level, a scenario that would pave the way for the 0.6270 (S2) support barrier. Should the bulls take over, we may see the pair breaking the 0.6515 (R1) resistance line and aim if not breach the 0.6620 (R2) resistance hurdle.

JPY on the other hand continued to wobble, being in a make-or-break position against the USD. The wide acceleration of Tokyo’s CPI rates tends to send a message about a persistence of inflationary pressures in the Japanese economy concurring with market expectations for a possible rate hike in BoJ’s April meeting. It should be noted that BoJ Governor Ueda avoided to make any comments about the outlook of monetary policy yet a wait and see position by the bank seems to counter the market’s optimism.

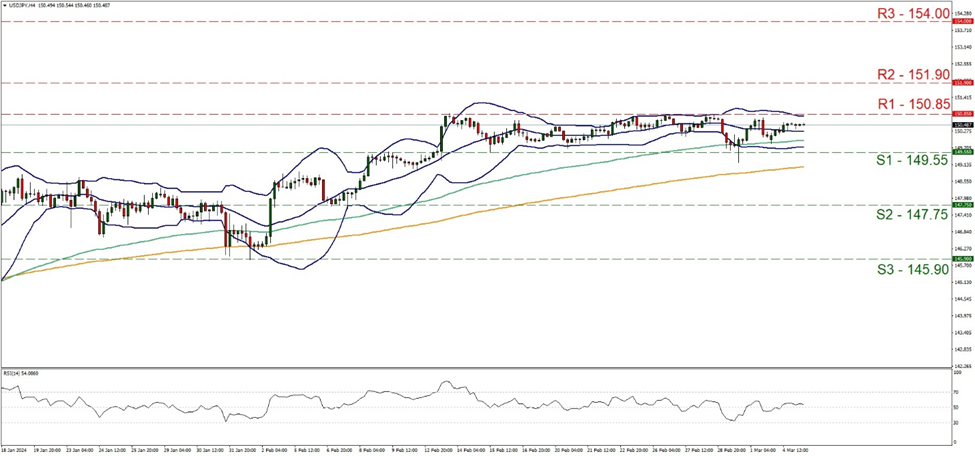

USD/JPY maintained its sideways motion between the 150.85 (R1) resistance line and the 149.55 (S1) support level. We tend to maintain our bias for the sideways motion to continue and also note that the RSI indicator continued being near the reading of 50, implying a rather indecisive market. Should buyers take over the reins of the pair’s direction, we may see the pair breaking the 150.85 (R1) resistance line and aim for the 151.90 (R2) resistance level. On the flip side should a selling interest be expressed by the market we may see the pair breaking the 149.55 (S1) support line and aim for the 147.75 (S2) support base.

その他の注目材料

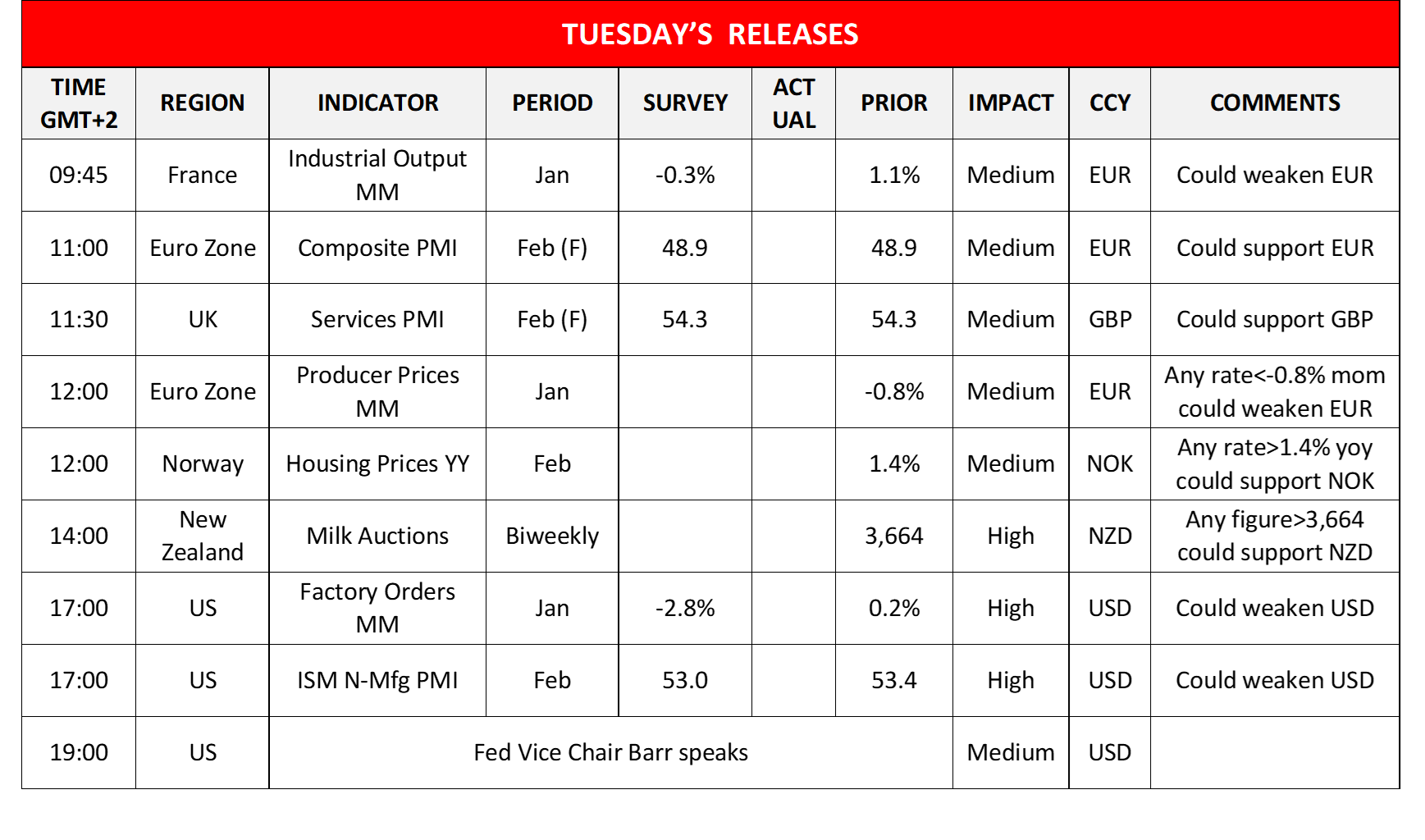

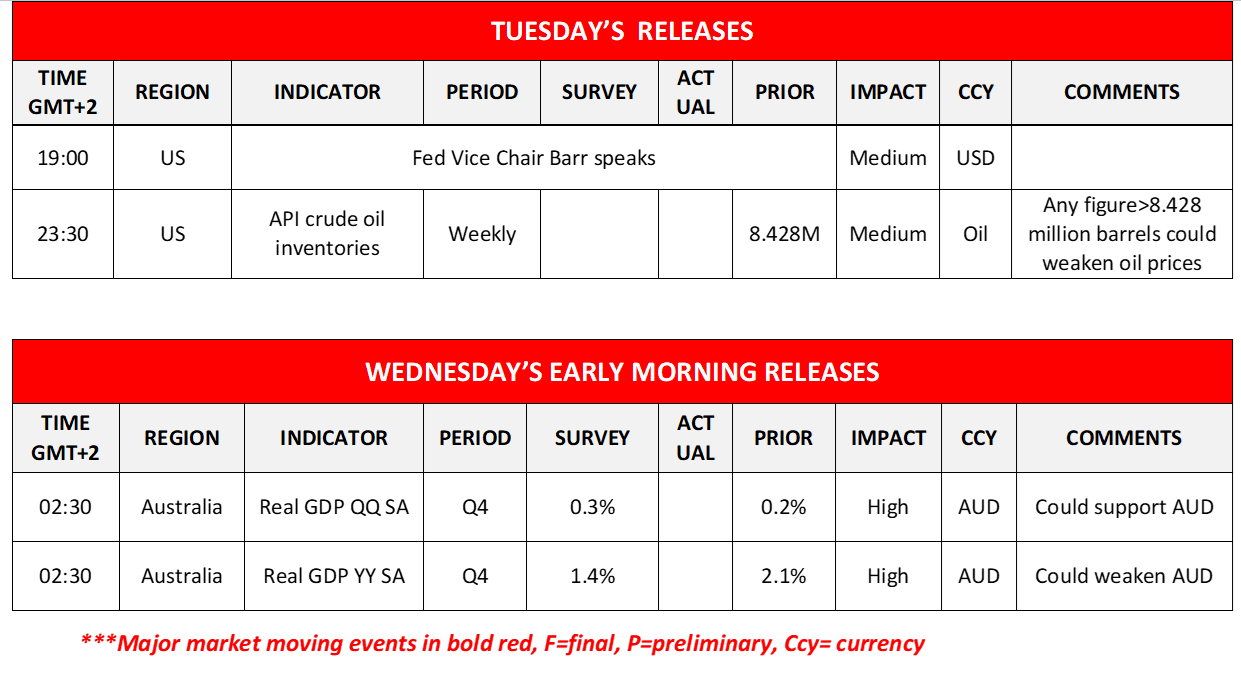

Today in the European session, we note the release of France’s industrial output for January, Eurozone’s and the UK’s final services and composite PMI figures for February, Norway’s Housing Prices for February and New Zealand’s Milk Auctions. In the American session, we get from the US the factory orders for January and later on the API weekly crude oil inventories figure. On the monetary front, we note that Fed Vice Chair Barr is scheduled to speak.

USD/JPY 4時間チャート

Support: 149.55 (S1), 147.75 (S2), 145.90 (S3)

Resistance: 150.85 (R1), 151.90 (R2), 154.00 (R3)

AUD/USD 4時間チャート

Support: 0.6400 (S1), 0.6270 (S2), 0.6170 (S3)

Resistance: 0.6515 (R1), 0.6620 (R2), 0.6725 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。