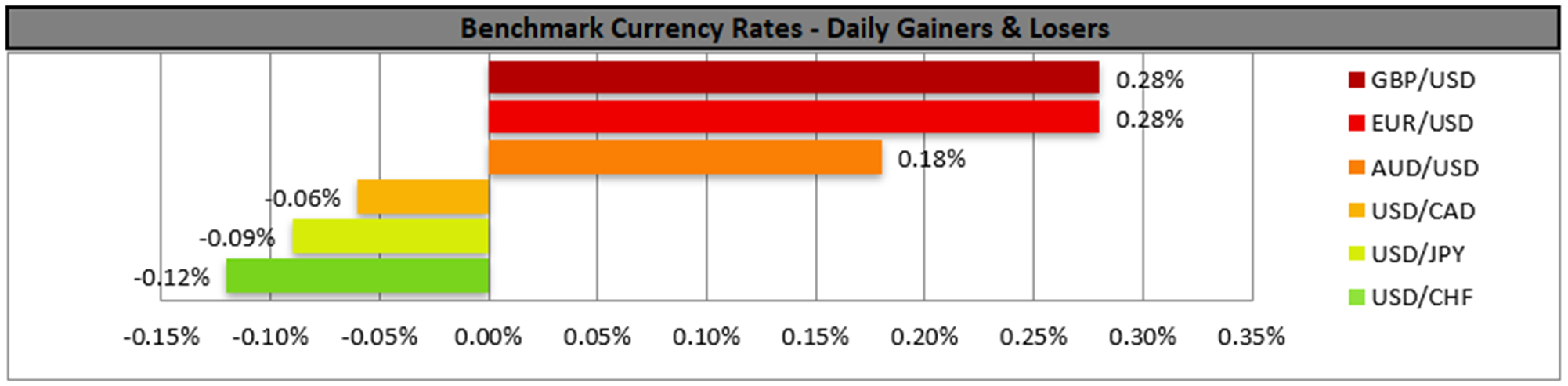

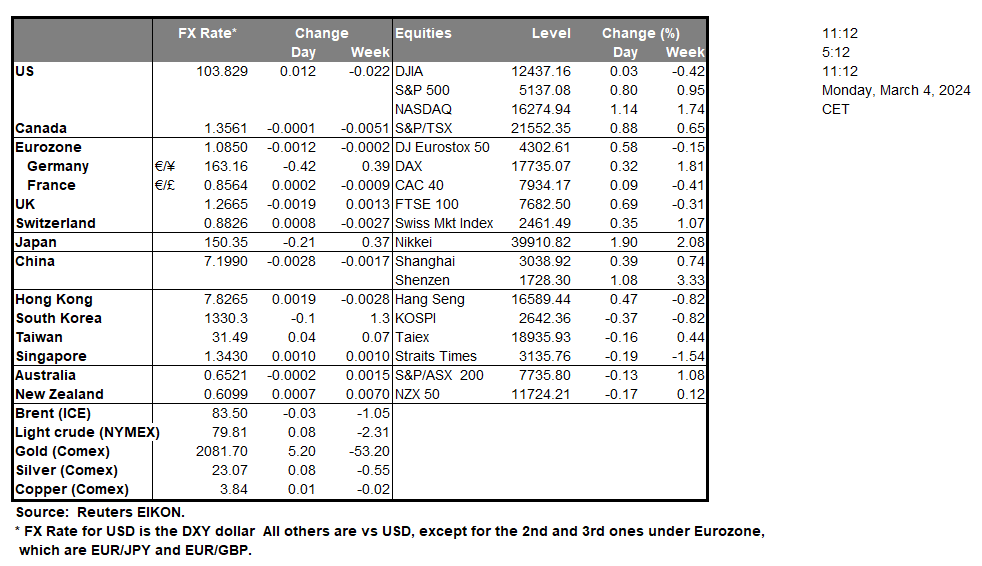

The USD edged lower against its counterparts on Friday as the drop of the US ISM manufacturing PMI figure for February and the final UoM consumer sentiment for the same month came in lower than expected, thus weighing on the greenback. At the same time, market expectations for a possible rate cut by the Fed seem to have intensified also weighing on the greenback, yet we tend to see the market’s expectations as a bit overdrawn to the dovish side for the time being. The weakening of the USD seems to have allowed gold’s price to rally, yet note that the rise of gold’s price seems to be asymmetrical to the weakening of the USD, while analysts tend to note a possible short covering of the market, which may have pushed gold’s price higher.

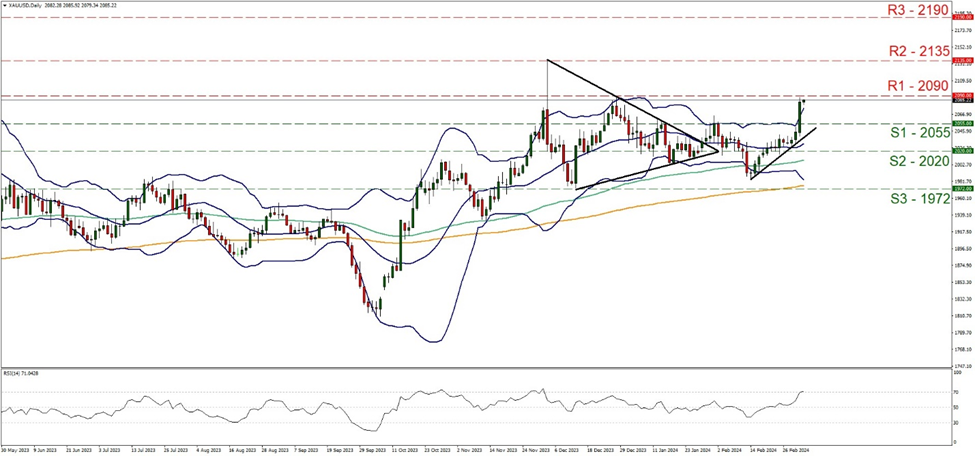

On a technical level, we note that gold’s price broke the 2055 (S1) resistance line, now turned to support and continued higher aiming for the 2090 (R1) resistance level. We tend to maintain our bullish outlook for now given also that the RSI indicator has reached and surpassed the reading of 70, which implies a strong bullish sentiment for the precious metal’s price yet at the same time also implies that gold may have reached overbought levels and may be ripe for a correction lower. Similar signals stem from the fact that gold’s price action has breached the upper Bollinger band, so a correction lower should not be taken by surprise gold traders. Should the bull’s maintain control over the precious metal’s price we may see it surpassing the 2090 (R1) threshold and take aim of gold’s all-time high at 2135 (R2) resistance hurdle. On the flip side for a bearish outlook, we would require gold’s price to drop break the 2055 (S1) support line clearly and take aim of the 2020 (S2) support barrier.

その他の注目材料

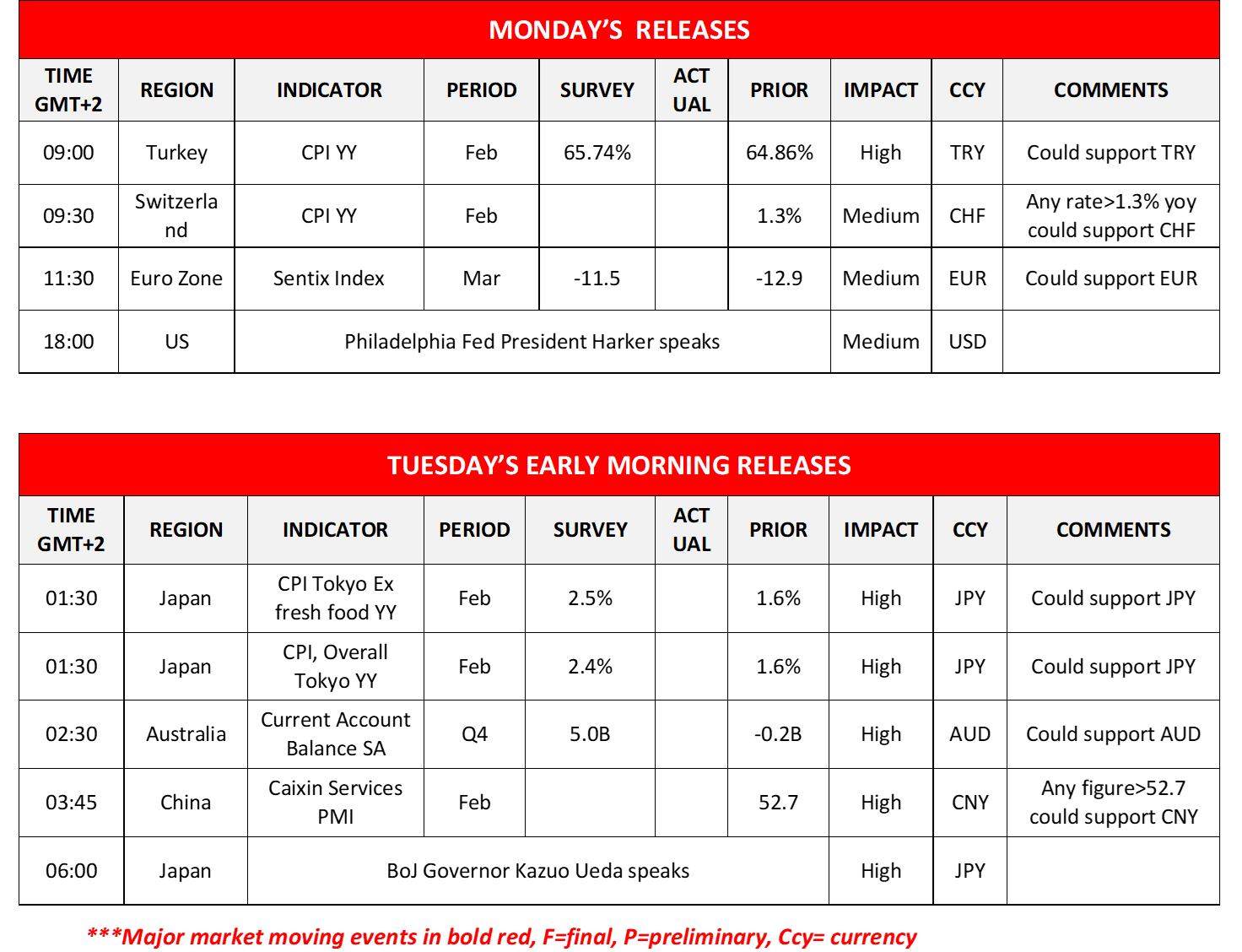

We note in today’s European Session the release of Turkey’s and Switzerland’s CPI rates for February as well as Eurozone’s Sentix index for March and on the monetary front in the American session Philadelphia Fed President Harker speaks. During tomorrow’s Asian session, we note from Japan the release of Tokyo’s CPI rates for February, Australia’s current account balance for Q4, and China’s Caixin services PMI figure for February, while we also highlight BoJ Governor Kazuo Ueda’s planned speech.

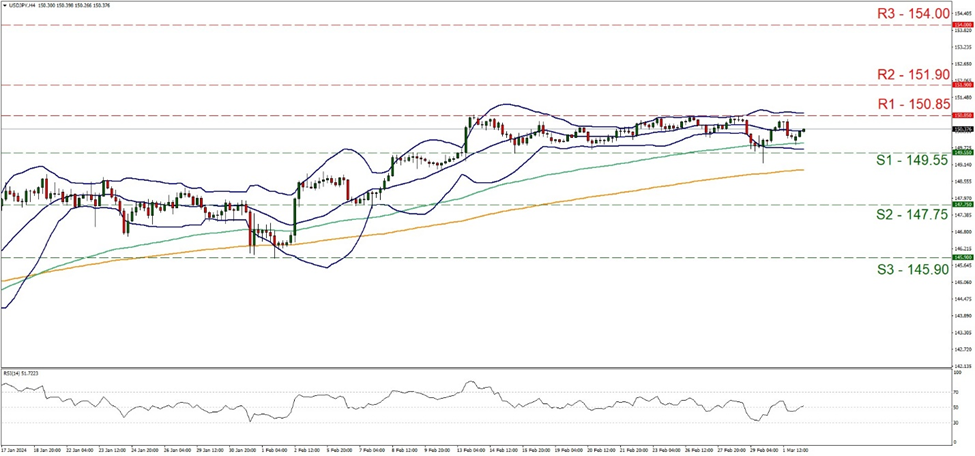

USD/JPY maintained its sideways motion between the 150.85 (R1) resistance line and the 149.55 (S1) support level. We tend to maintain our bias for the sideways motion to continue and also note that the RSI indicator reached the reading of 50, implying a rather indecisive market. Should buyers take over the reins of the pair’s direction, we may see the pair breaking the 150.85 (R1) resistance line and aim for the 151.90 (R2) resistance level. On the flip side should a selling interest be expressed by the market we may see the pair breaking the 149.55 (S1) support line and aim for the 147.75 (S2) support base.

今週の指数発表:

On Tuesday we get the US Factory orders rate for January and the US ISM-Non manufacturing PMI figure for February. On Wednesday, we note Australia’s GDP rate for Q4 and we highlight from Canada BoC’s interest rate decision. On Thursday we make a start with China’s trade balance figure for February, Germany’s industrial orders rate for January, the UK’s Halifax house prices rate for February, the US weekly initial jobless claims figure and Canada’s trade balance figure for January, while on the monetary front, we get from the Eurozone, ECB’s interest rate decision. On a busy Friday we begin with Japan’s current account balance for January, Germany’s industrial output rate and Sweden’s GDP rate both for the month of January, followed by the Eurozone’s final GDP rate for Q4 of 2023 and the highlight of the week which is the US Employment data for February and ending off the week is Canada’s employment data also for February.

XAU/USD Daily Chart

Support: 2055 (S1), 2020 (S2), 1972 (S3)

Resistance: 2090 (R1), 2135 (R2), 2190 (R3)

USD/JPY 4時間チャート

Support: 149.55 (S1), 147.75 (S2), 145.90 (S3)

Resistance: 150.85 (R1), 151.90 (R2), 154.00 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。