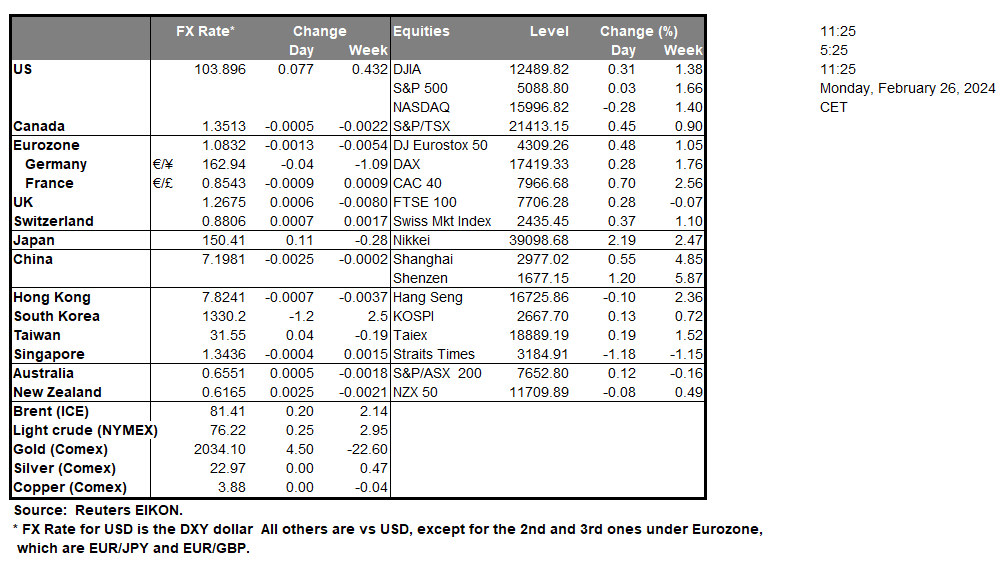

Japan’s CPI rate for January is due to be released in tomorrow’s Asian session. Should the rate come in as expected at 1.8%, implying easing inflationary pressures it could weigh on the JPY and vice versa. Yemen’s Houthi Rebels attempted to strike a US Naval Vessel, which could keep tensions in the Red Sea elevated and as such could provide some support to oil prices. According to Reuters, GoldmanSachs (#GS) has signed a private credit Asia-Pacific partnership with Mubadala, which is reportedly worth at around $1bln and as such could provide support for GoldmanSach’s stock price.

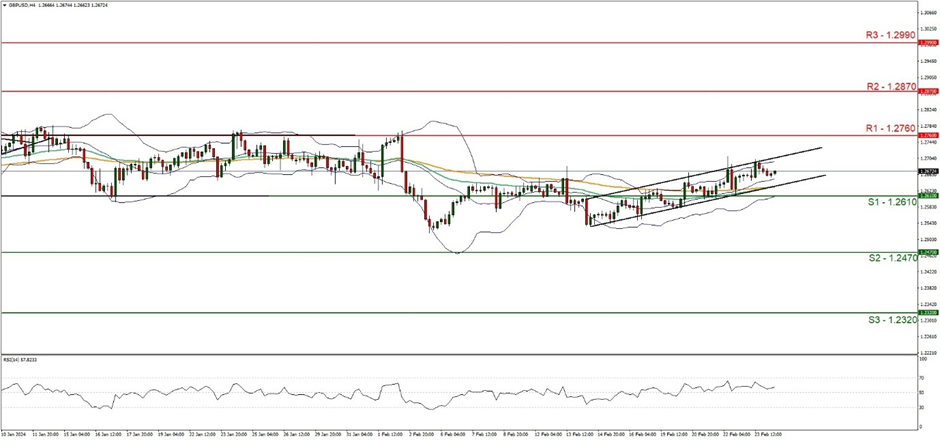

GBP/USD appears to be moving in an upwards fashion. We maintain a bullish outlook for the pair and supporting our case is the upwards moving channel which was incepted on the 14 of February. For our bullish outlook to continue, we would like to see the continuation of our upwards-moving channel, in addition to a clear break above the 1.2760 (R1) resistance level, with the next possible target for the bulls being the 1.2870 (R2) resistance line. However, the RSI indicator below our chart currently registers a figure near 50, implying a neutral market sentiment, and as such for a sideways bias we would like to see the pair remain confined between the 1.2610 (S1) support level and the 1.2760 (R1) resistance line. Lastly, for a bearish outlook we would like to see a clear break below the 1.2610 (S1) support level, with the next possible target for the bears being the 1.2470 (S2) support line.

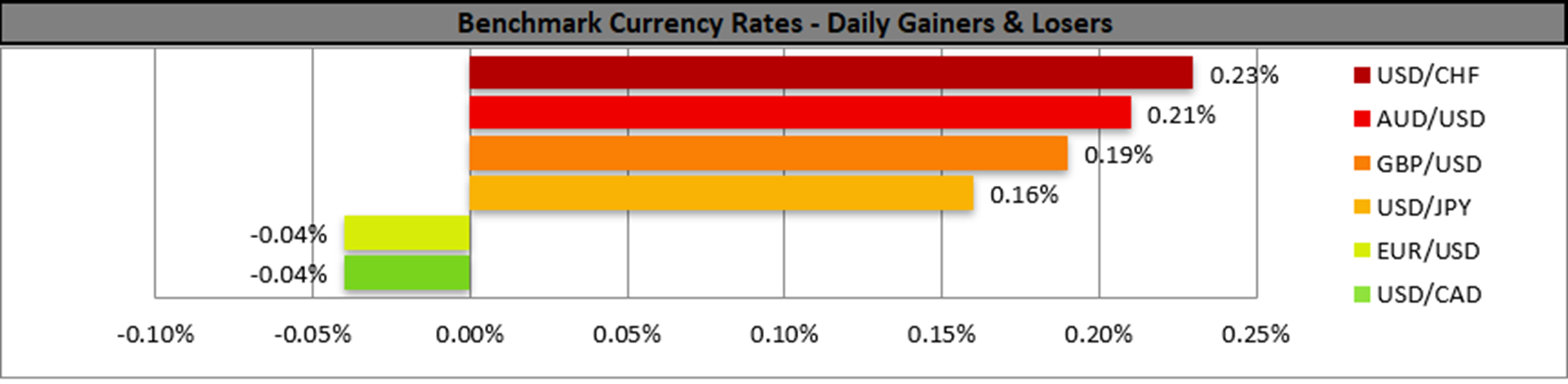

EUR/USD appears to be moving in a sideways fashion. We maintain a sideways bias for the pair and supporting our case is the breaking below of our upwards moving trendline which was incepted on the 14 of February, in addition to the narrowing of the Bollinger bands which imply low market volatility. Yet our RSI indicator below our chart currently registers a figure near 60, implying some bullish market tendencies. Nonetheless, for our neutral outlook to continue, we would like to see the pair remain confined between the 1.0795 (S1) support level and the 1.0890 (R1) resistance line. On the other hand, for a bullish outlook we would like to see a clear break above the 1.0890 (R1) resistance line with the next possible target for the bulls being the 1.0985 (R2) resistance level. Lastly, for a bearish outlook, we would like to see a clear break below the 1.0795 (S1) support level, with the next possible target for the bears being the 1.0697(S2) support line.

その他の注目材料

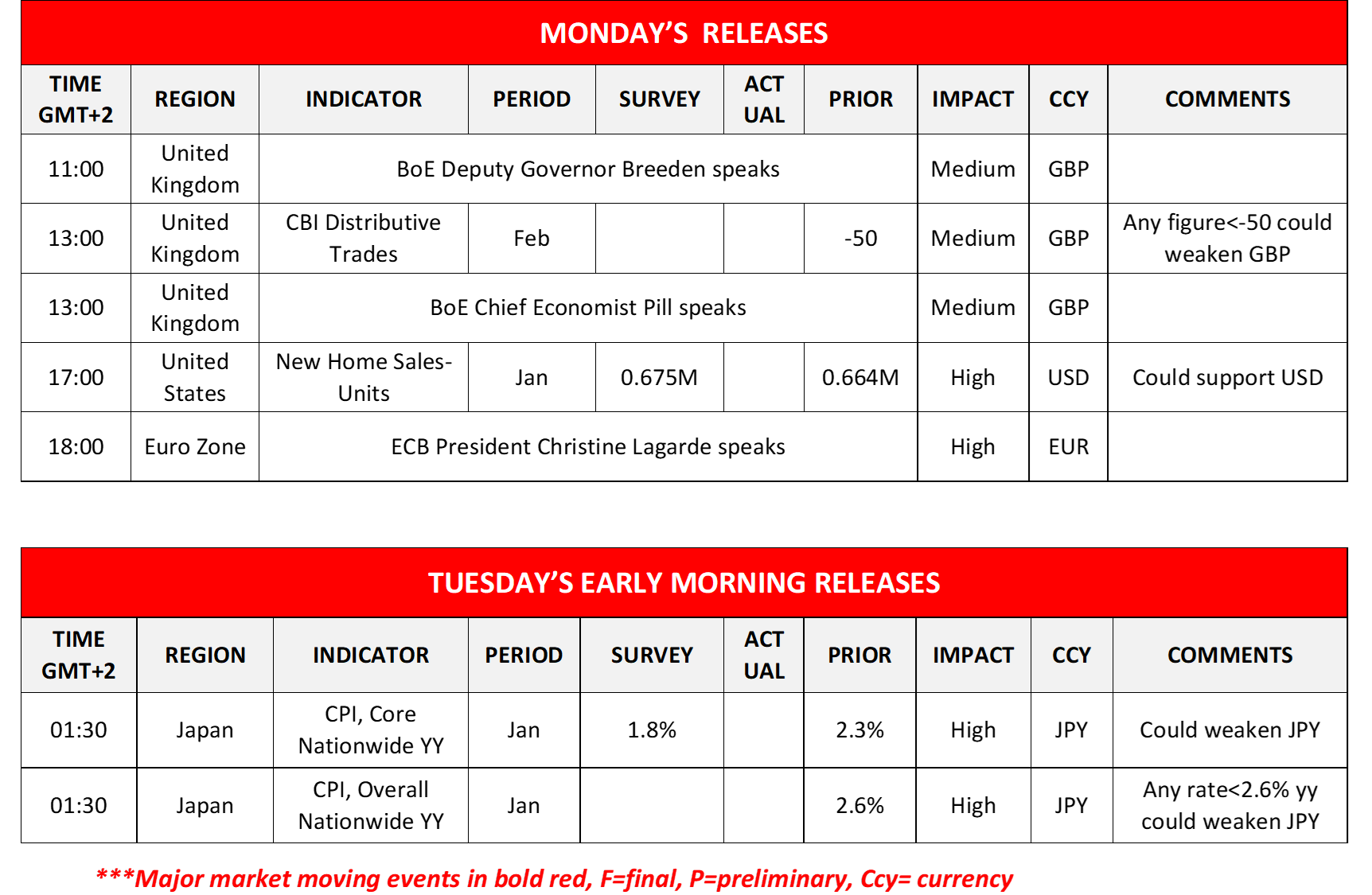

We note in today’s European Session the release of UK’s CBI distributive trades for February and in the American session the US New Home Sales figure for January. On a monetary level, we note the speeches of BoE’s Deputy Governor Breeden and chief economist Hugh Pill and later on ECB President Christine Lagarde. During tomorrow’s Asian session, we get Japan’s CPI rates for January.

今週の指数発表:

On Tuesday we note the release of Germany’s consumer confidence for March and the US durable goods. On Wednesday, we get from New Zealand RBNZ’s interest rate decision, Australia’s CPI rates for January, Eurozone’s economic sentiment for February and we highlight the release of the revised US GDP rate for Q4. In a packed Thursday, we get Japan’s preliminary industrial output for January, Australia’s CAPEX rate for Q4, and retail sales for January, Turkey’s, Sweden’s, France’s and Switzerland’s GDP rates for Q4, while we also note France’s and Germany’s preliminary HICP rates for February, Switzerland’s KOF indicator for February, Canada’s business barometer for the same month and from the US the consumption rate and Core Price index both being for January. Finally, on Friday, we note the release of China’s manufacturing PMI figures for February, the Czech Republic’s final GDP rates for Q4, Eurozone’s preliminary HICP rates, Canada’s S&P manufacturing PMI figure, the US ISM Manufacturing PMI figure and the US final University of Michigan consumer sentiment, all being for February.

GBP/USD 4時間チャート

Support: 1.2610 (S1), 1.2470 (S2), 1.2320 (S3)

Resistance: 1.2760 (R1), 1.2870 (R2), 1.2990 (R3)

EUR/USD 4時間チャート

Support: 1.0795 (S1), 1.0697 (S2), 1.0615 (S3)

Resistance: 1.0890 (R1), 1.0985 (R2), 1.1065 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。