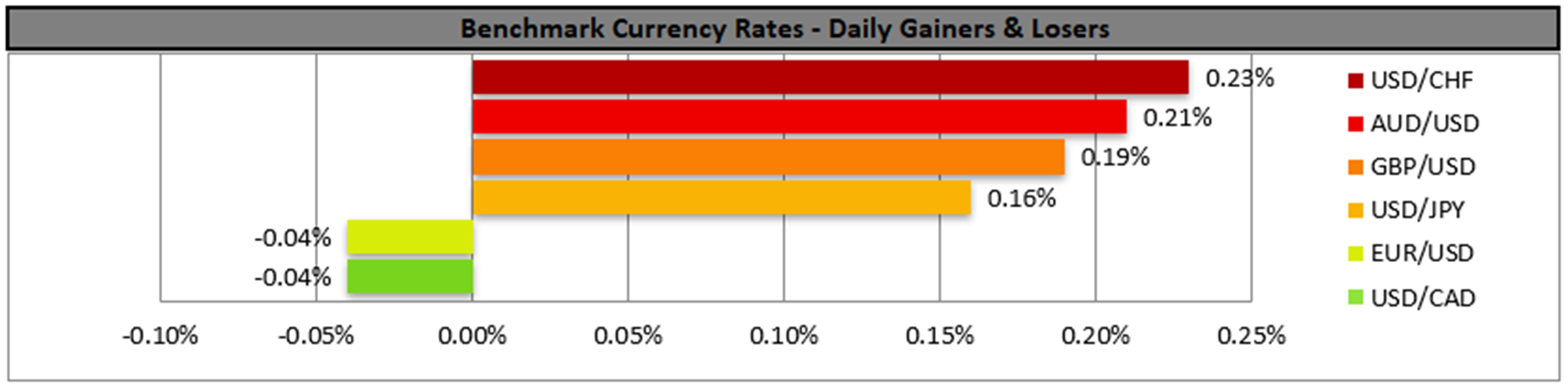

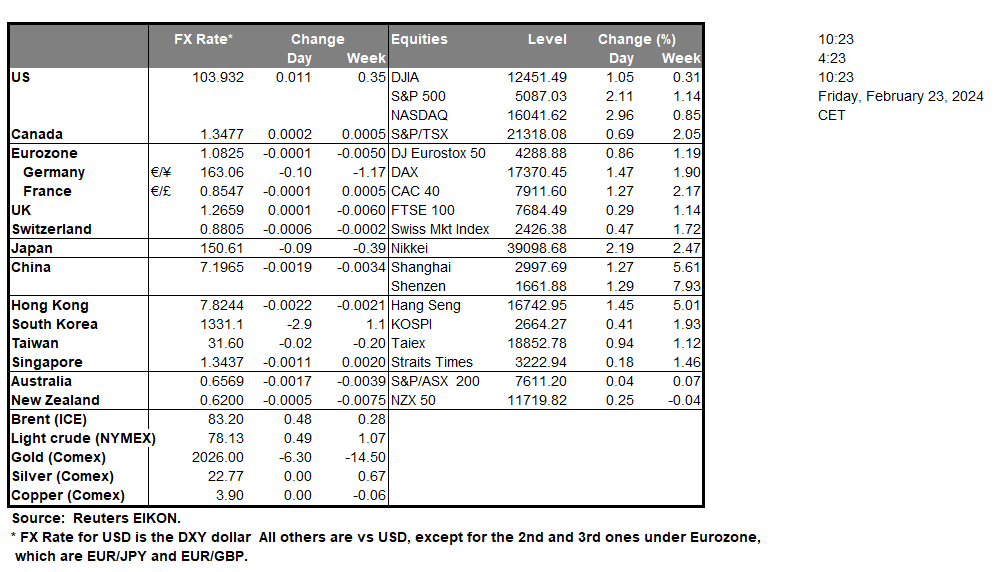

The USD managed to stabilize somewhat yesterday against its counterparts, yet the bearish sentiment does not seem to have left the market quite yet for the greenback. On the other hand, US stock markets rallied yesterday with all three main stock market indexes, namely the Dow Jones, Nasdaq and S&P 500, uniformly rising and reaching new record high levels. The rally was at least partially underpinned by NVIDIA’s meteoric rise yesterday after the better-than-expected readings in its Q4 earnings report. The company’s share price soared by 16% adding reportedly further capitalization of $277 billion. Should the positive market sentiment be maintained we may see US stock markets being supported.

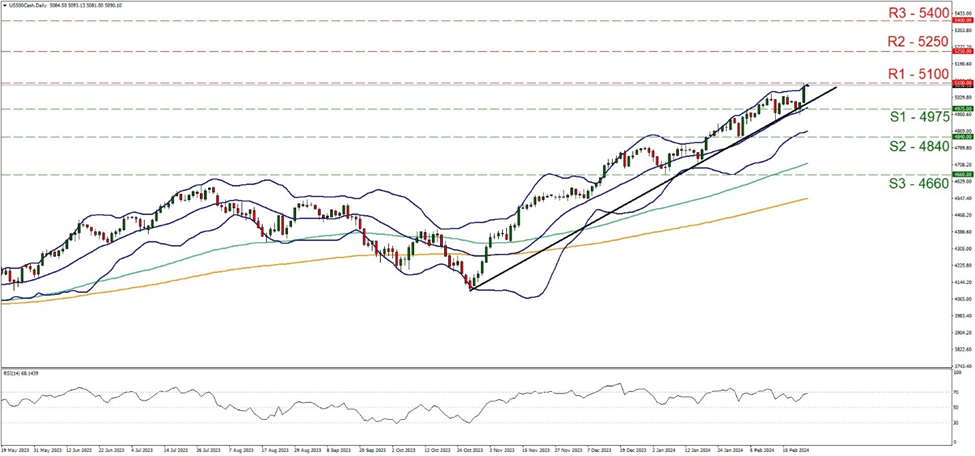

On a technical level, S&P 500 rallied yesterday nearing the 5100 (R1) resistance line. We tend to maintain a bullish outlook for the index given the upward trendline guiding the index since the 27 of October. Furthermore, we note that the RSI indicator is nearing the reading of 70 implying the existence of a bullish sentiment in the market for the index, while the 20 moving average, the 100 moving average and the 200 moving average are pointing upwards also supporting the notion of a bullish market. On the other hand, we must note that the price action has hit the upper boundary of the Bollinger bands which may slow down the bulls’ ascent. Should the buying interest be maintained we may see the index breaking the 5100 (R1) resistance line with the next possible target for the bulls being set at the 5250 (R2) level. Should the bears take over, we may see the index breaking the prementioned upward trendline in a first signal that the upward motion has been interrupted, breaking the 4975 (S1) line and aiming for the 4840 (S2) support base.

Across the Atlantic, common currency traders got some mixed signals from yesterday’s preliminary PMI release for February, as on the one hand, economic activity in Germany’s manufacturing sector, which is considered a powerhouse for the Eurozone, contracted more than expected, intensifying market worries for a recession in the trading bloc. Yet on the other hand, across sectors and on a Eurozone level, the composite PMI figure tended to show a narrower contraction which may imply that member states may have been able to compensate for Germany’s shortcomings.

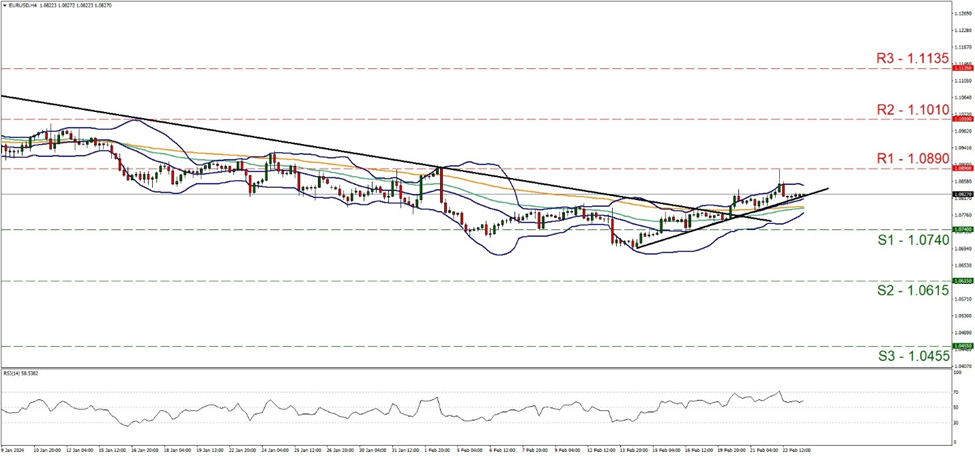

EUR/USD hit a ceiling at the 1.0890 (R1) resistance line and corrected lower. The upward trendline was tested but has not been broken yet. The pair seems to be in a make-or-break situation and for a continuance of the bullish outlook we would require a higher peak than the last, thus the pair has to break the 1.0890 (R1) line and aim for the 1.1010 (R2) level. For our bullish outlook to change we would require the pair to break the prementioned upward trendline and there are some signs of stabilization, yet should the bears take over, we may see EUR/USD also breaking the 1.0740 (S1) support line and aim for the 1.0615 (S2) barrier.

Also, we note the slight weakening of the JPY for the eighth week in a row, which brings the Japanese currency near record weak levels against the already weak USD, yet weakness can be witnessed against the pound and the EUR. The continuance of BoJ’s ultra-loose monetary policy has forced traders to chase better yields all over the world, causing an outflow for JPY. The market seems unconvinced that the situation will dramatically change soon, despite rate hikes being priced in by the market as early as April. On the other hand, inflation is falling and tends to make BoJ’s narrative less credible.

その他の注目材料

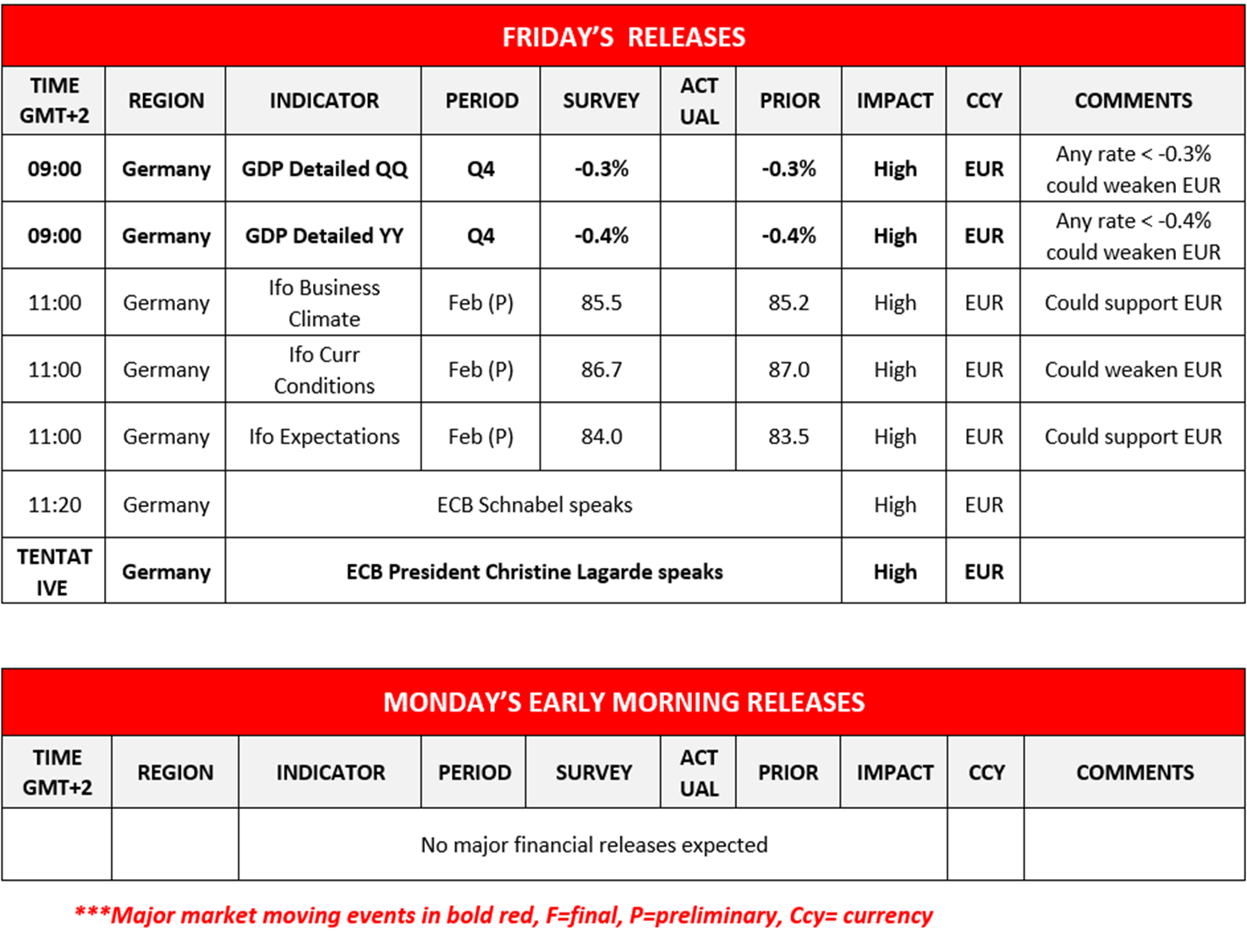

We note in today’s European session, Germany’s GDP rates for Q4, followed by Germany’s preliminary Ifo business climate, Ifo current conditions and Ifo expectations figures all for the month of February. In tomorrow’s Asian session, we note no major financial releases are expected. On a monetary level, we note the speeches of ECB Schnabel and ECB President Lagarde.

US 500 Cash Daily Chart

Support: 4975 (S1), 4840 (S2), 4660 (S3)

Resistance: 5100 (R1), 5250 (R2), 5400 (R3)

EUR/USD 4時間チャート

Support: 1.0740 (S1), 1.0615 (S2), 1.0435 (S3)

Resistance: 1.0890 (R1), 1.1010 (R2), 1.1135 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。