According to Reuters, BOJ Governor Ueda stated earlier today, that the bank will examine whether or not it will maintain its various monetary easing measures, including negative interest rates, when sustained achievement of its inflation target comes into sight. The comments made by the Governor, could potentially provide support for the JPY as the ending of the bank’s negative interest rate policy appears to be in sight.

利 UK’s Core Retail sales rate for January which were released earlier on today, came in better than expected at 0.7% , which was much higher when compared to the expected rate of -1.6%. The better-than-expected rate, may imply that consumer spending in the UK may be more resilient than expected, and as such could lead to persistent inflationary pressures in the future, should the current rate be maintained. Therefore, the financial release could amplify the BoE’s hawkish rhetoric of maintaining interest rates at their current levels, which in turn could support the pound.

In the US Equities markets, we note the exclusive report by Bloomberg, that Apple (#AAPL) is set to introduce its AI software which is meant to rival that of Microsoft’s. The announcement could potentially provide support for Apple’s (#AAPL) stock price. Atlanta Fed President Bostic during his speech yesterday, implied that the bank may need more data to be convinced that the economy is on a path that could allow interest rate cuts.

The comments made by Fed Bostic, could be perceived as hawkish in nature, which could potentially be providing support for the greenback, as the hawkish rhetoric of maintaining interest rates higher for longer, appears to be maintained by Fed officials.

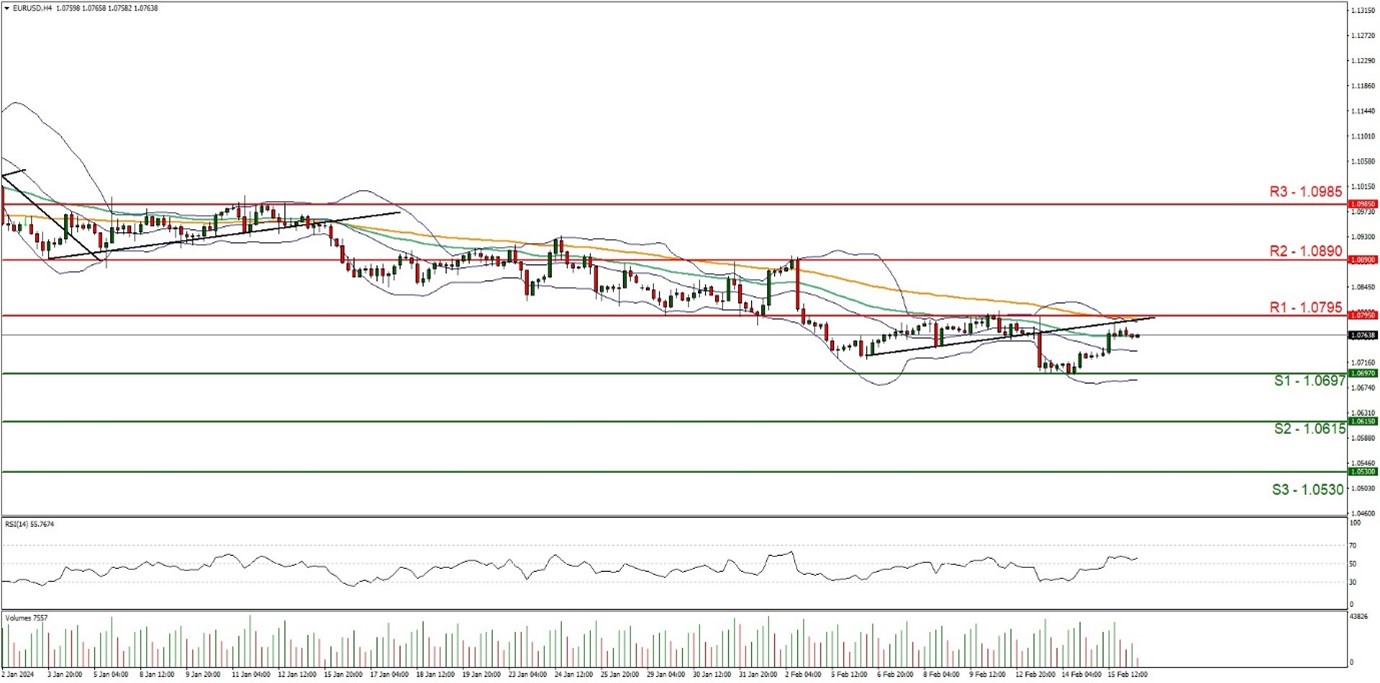

EUR/USD appears to be moving in a sideways fashion. We maintain a neutral outlook for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment, in addition to the narrowing of the Bollinger bands implying low market volatility. For our sideways motion to be maintained, we would like to see the pair remain confined between the 1.0697 (S1) support level and the 1.0795 (R1) resistance line. On the other hand, for a bearish outlook, we would like to see a clear break below the 1.0697 (S1) support level, with the next possible target for the bears being the 1.0615 (S2) support base. Lastly, for a bullish outlook, we would like to see a clear break above the 1.0795 (R1) resistance line, with the next possible target for the bulls being the 1.0890 (R2) resistance barrier.

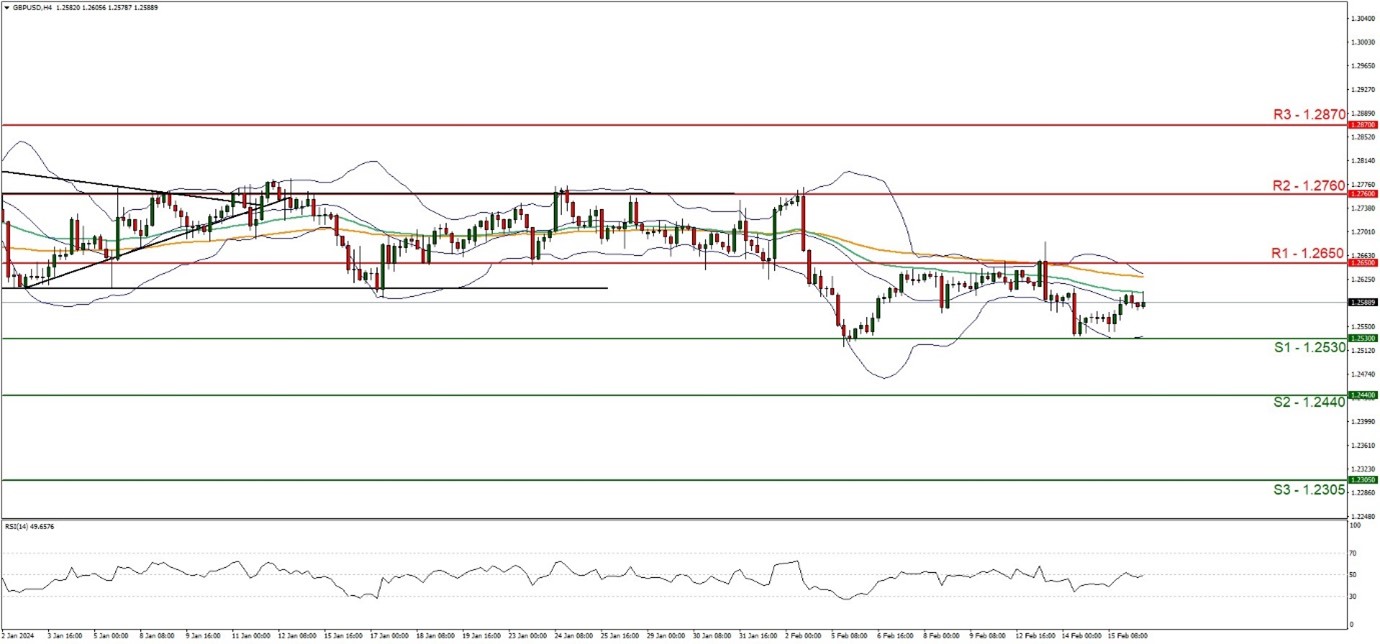

GBP/USD appears to be moving in a sideways fashion. We maintain a neutral outlook for the pair and supporting our case is the RSI indicator below our chart which currently registers a figure near 50, implying a neutral market sentiment. For our sideways bias to be maintained, we would like to see the pair remain confined between the 1.2530 (S1) support level and the 1.2650 (R1) resistance line. On the other hand, for a bearish outlook we would like to see a clear break below the 1.2530 (S1) support level, with the next possible target for the bears being the 1.2440 (S2) support base. Lastly, for a bullish outlook, we would like to see a clear break above the 1.2650 (R1) resistance line with the next possible target for the bulls being the 1.2760 (R2) resistance level.

その他の注目材料

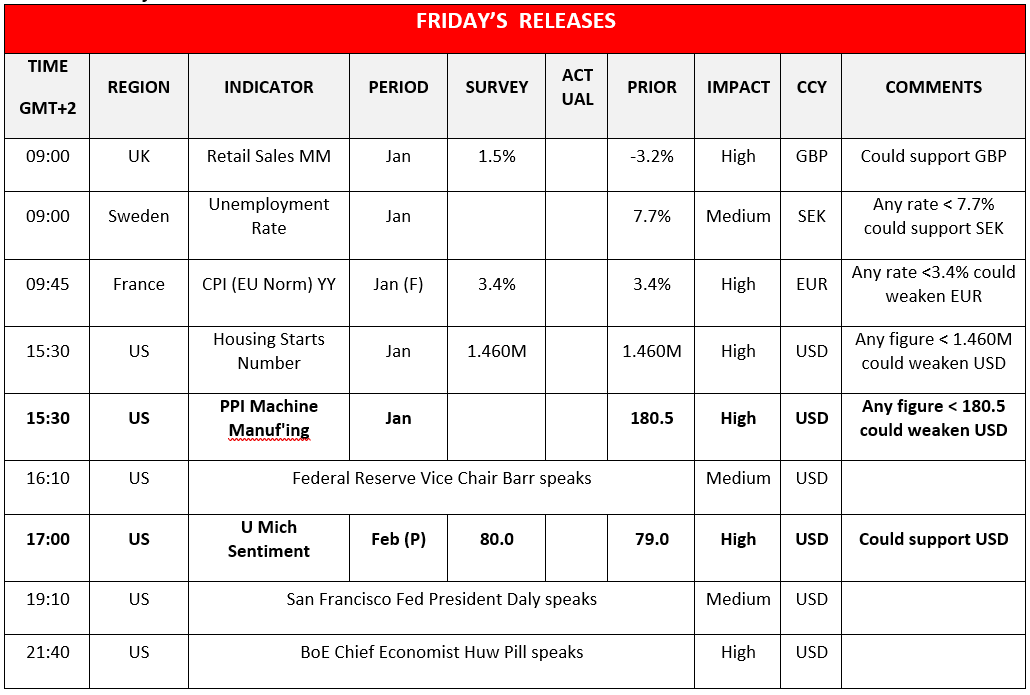

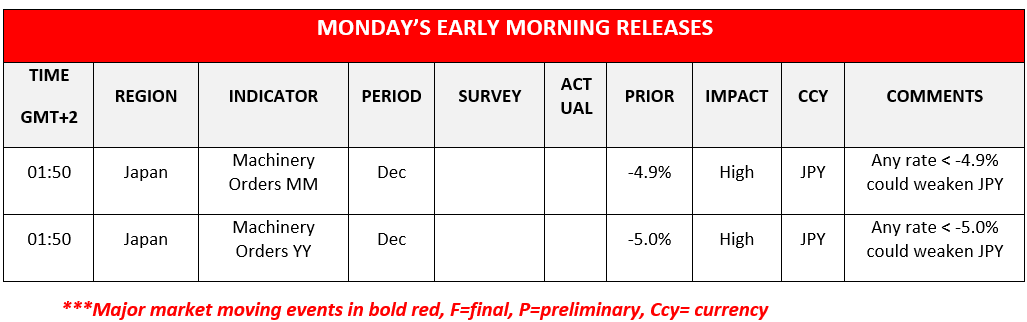

We note in today’s American session the release of the US housing starts figure and PPI Machine manufacturing figure both for the month of January, followed by the US Preliminary University of Michigan consumer sentiment for February. In Monday’s Asian session, we note Japan’s Machinery orders rates for the month of December. On a monetary level, we highlight the speeches by Fed Vice Chair Barr, San Francisco Fed President Daly and BoE Chief economist Pill which are all set to take place during today’s American session.

EUR/USD 4時間チャート

- Support: 1.0697 (S1), 1.0615 (S2), 1.0530 (S3)

- Resistance: 1.0795 (R1), 1.0890 (R2), 1.0985 (R3)

GBP/USD 4時間チャート

- Support: 1.2530 (S1), 1.2440 (S2), 1.2305 (S3)

- Resistance: 1.2650 (R1), 1.2760 (R2), 1.2870 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。