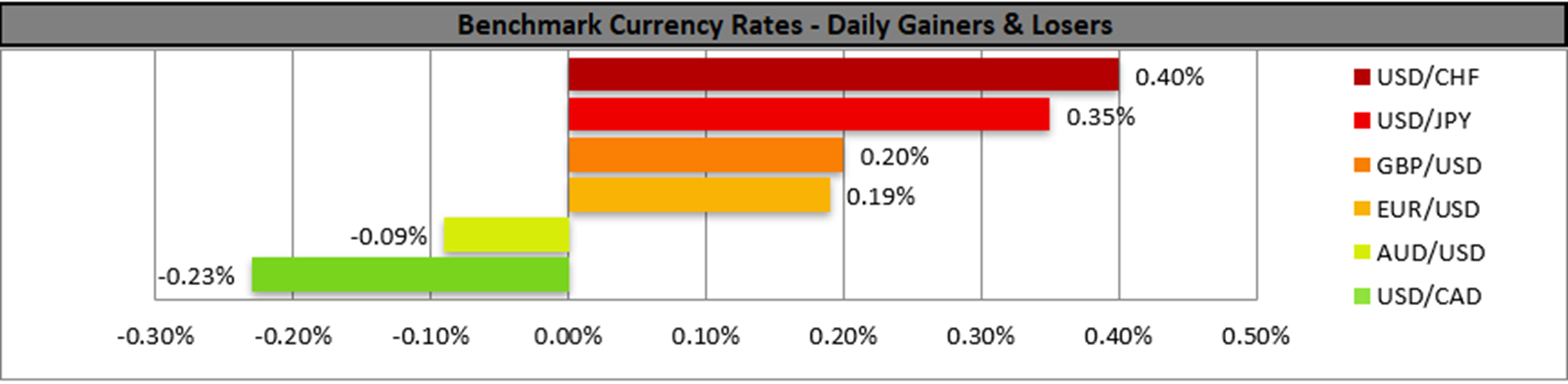

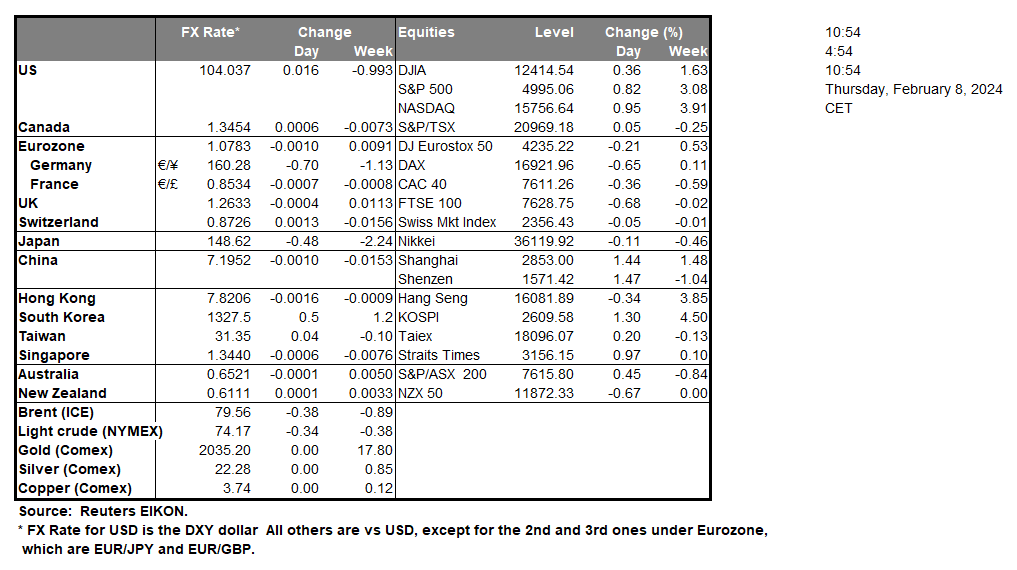

The US Atlanta Fed GDPNow preliminary rate for Q1, came in much lower than expected, during yesterday’s American trading session. The rate came in 3.4% versus the expected rate of 4.2%, highlighting some concerns about the US’s economic resiliency, which in turn may have weakened the greenback. Moreover, should further GDP releases for the US hint that the economy might be slowing down, it could further weigh on the dollar. Over in Asia, China’s PPI rate for January came in better than expected at -2.5% versus the expected rate of -2.6%. Yet, despite the better-than-expected PPI it is still in negative territory, implying deflation for Producer prices, for the past 16 months. Moreover, the CPI rate for January came in lower than expected at -0.8%, indicating deflationary pressures which in turn may imply weakening demand within the Chinese economy. The financial releases could prompt the Chinese Government to continue in its efforts to boost stimulus and restore confidence in the economy. In such a scenario, it could provide support for the CNY and the AUD, whereas should the situation continue to deteriorate it could weigh on the aforementioned currencies given their close economic ties. In the Equities markets, we note that Arm (#ARM) announced yesterday its earnings for the previous quarter. The British semiconductor company beat both revenue and earnings per share expectations by reporting a revenue of $824 million and $0.29 EPS. The better-than-expected earnings report could potentially provide support for the company’s stock price. Lastly, Disney (#DIS) announced that it would be investing $1.5bn in Epic Games.

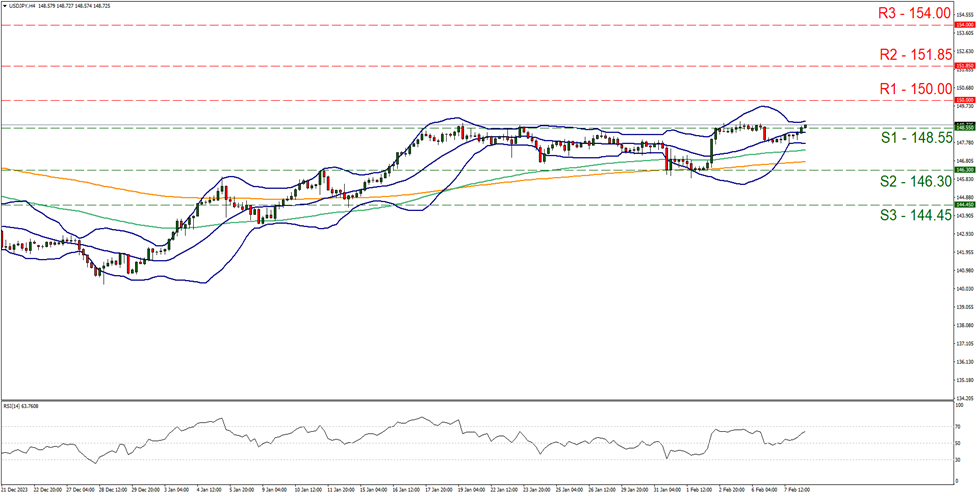

USD/JPY appears to be moving in an upwards fashion, with the pair having broken up the resistance turned support level at 148.55 (S1) . We maintain a bullish outlook for the pair and supporting our case is the RSI indicator below our chart, which currently registers a figure near 70, implying a bullish market sentiment. For our bullish outlook to continue, we would like to see a clear break above the 150.00 (R1) resistance level, with the next possible target for the bulls being the 151.85 (R2) resistance ceiling. On the other hand for a bearish outlook, we would like to see a clear break below the 148.55 (S1) support line, with the next possible target for the bears being the 146.30 (S2) support base. Lastly, for a sideways bias we would like to see the pair remain confined between the 148.55 (S1) support level and the 150.00 (R1) resistance line.

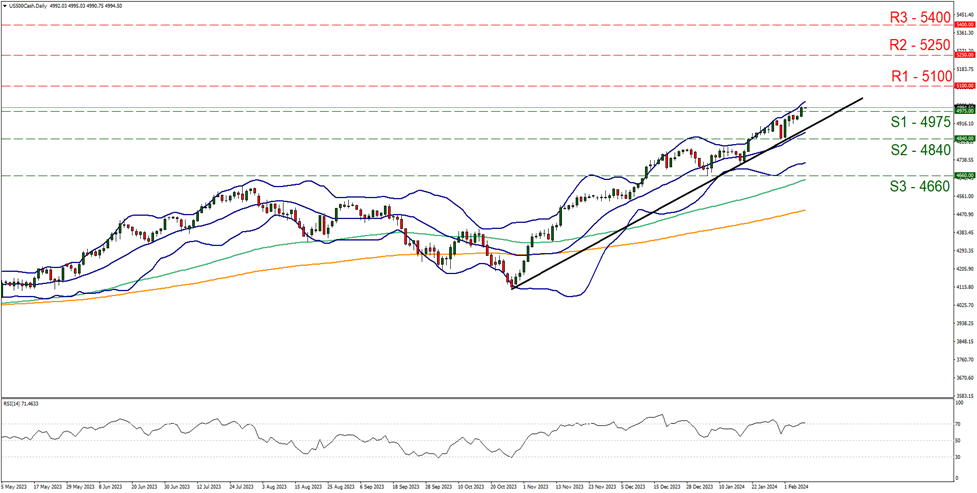

US500, appears to be moving in an upwards fashion. We maintain a bullish outlook for the index and supporting our case is having the upwards moving trendline that was incepted on the 10 of October 2023, in addition to the RSI indicator below our chart which currently registers a figure near 70, implying bullish market tendencies. For our bullish outlook to continue, we would like to see a clear break above the 5100 (R1) resistance level, with the next possible target for the bulls being the 5250 (R2) resistance line. On the other hand, for a bearish outlook, we would like to see a clear break below the 4975 (S1) support level if not also the 4840 (S2) support base, with the next possible target for the bears being the 4660 (S3) support base. Lastly, for a sideways bias we would like to see the index remain confined between the 4975 (S1) support level and the 5100 (R1) resistance line.

その他の注目材料

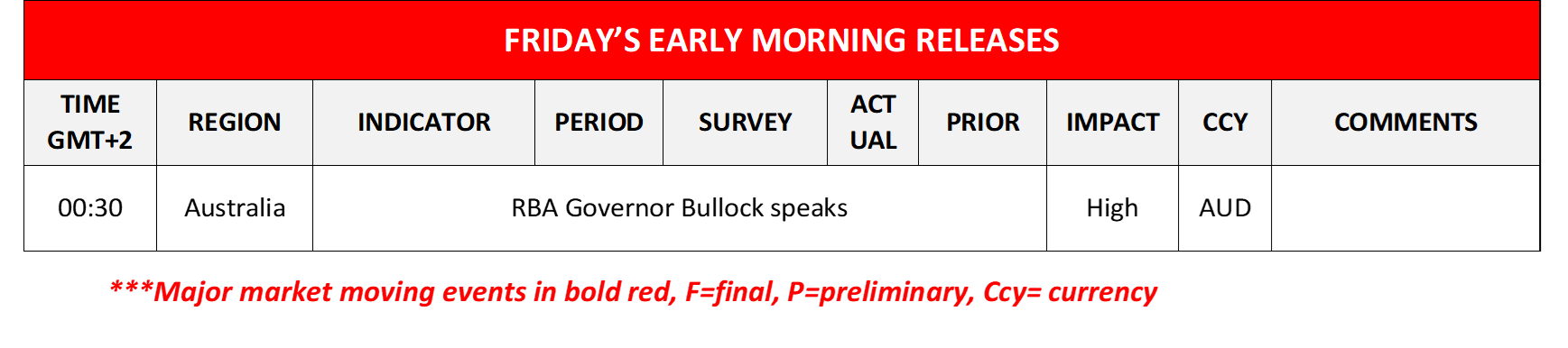

We note in today’s American session, we note the release from the Czech Republic, CNB’s interest rate decision and the US weekly initial jobless claims figure. On the monetary front please note that ECB’s governing council member Wunsch, Richmond Fed President Barkin, BoE MPC member Dhingra, ECB Board Member Elderson, BoE MPC member Mann, ECB Board Member Lane and Richmond Fed President Barkin are scheduled to speak. During tomorrow’s Asian session, we note that RBA Governor Bullock is scheduled to speak before Australian lawmakers.

USD/JPY 4時間チャート

Support: 148.55 (S1), 146.30 (S2), 144.45 (S3)

Resistance: 150.00 (R1), 151.85 (R2), 154.00 (R3)

US500 Daily Chart

Support: 4975 (S1), 4840 (S2), 4660 (S3)

Resistance: 5100 (R1), 5250 (R2), 5400 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。