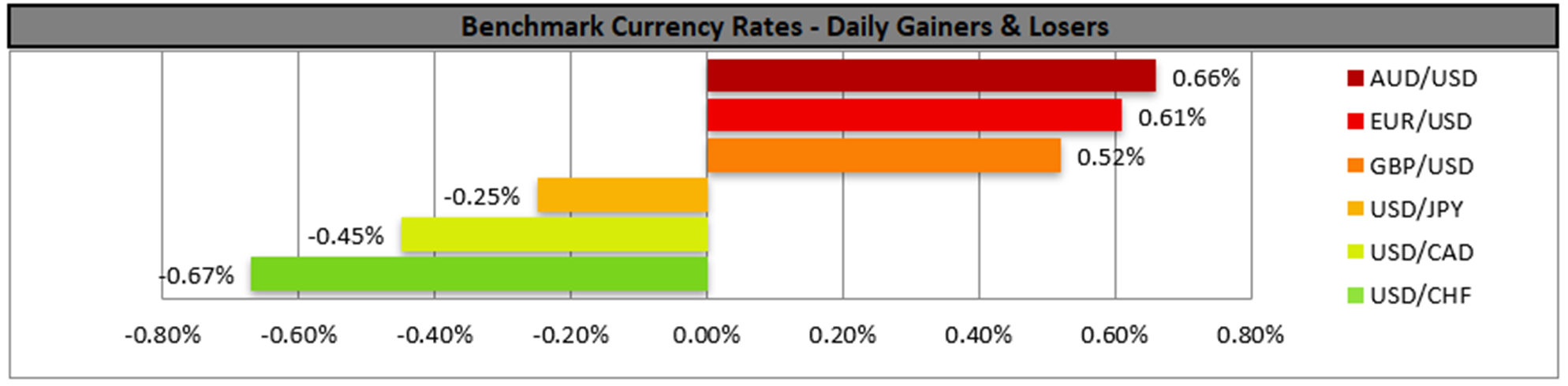

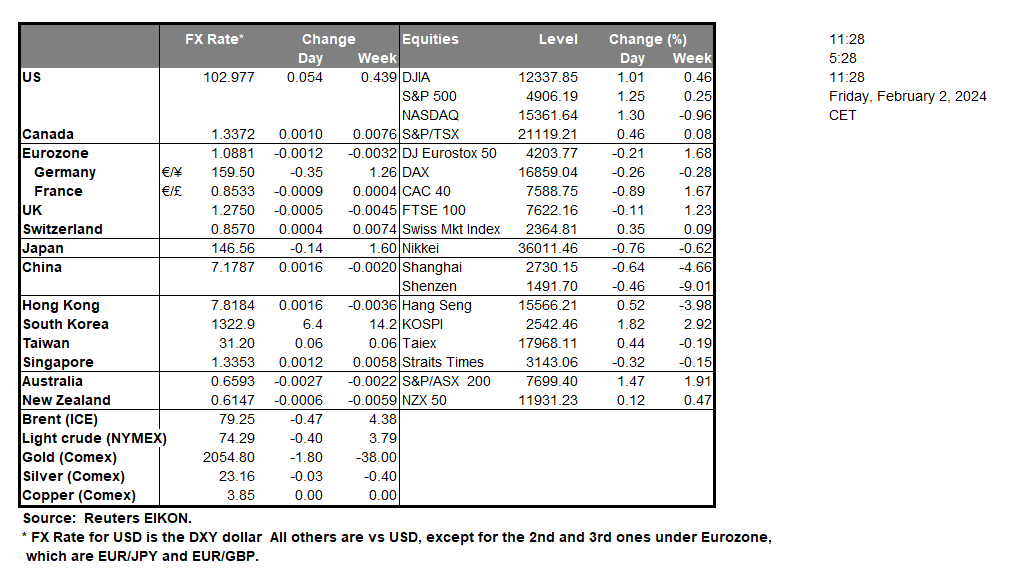

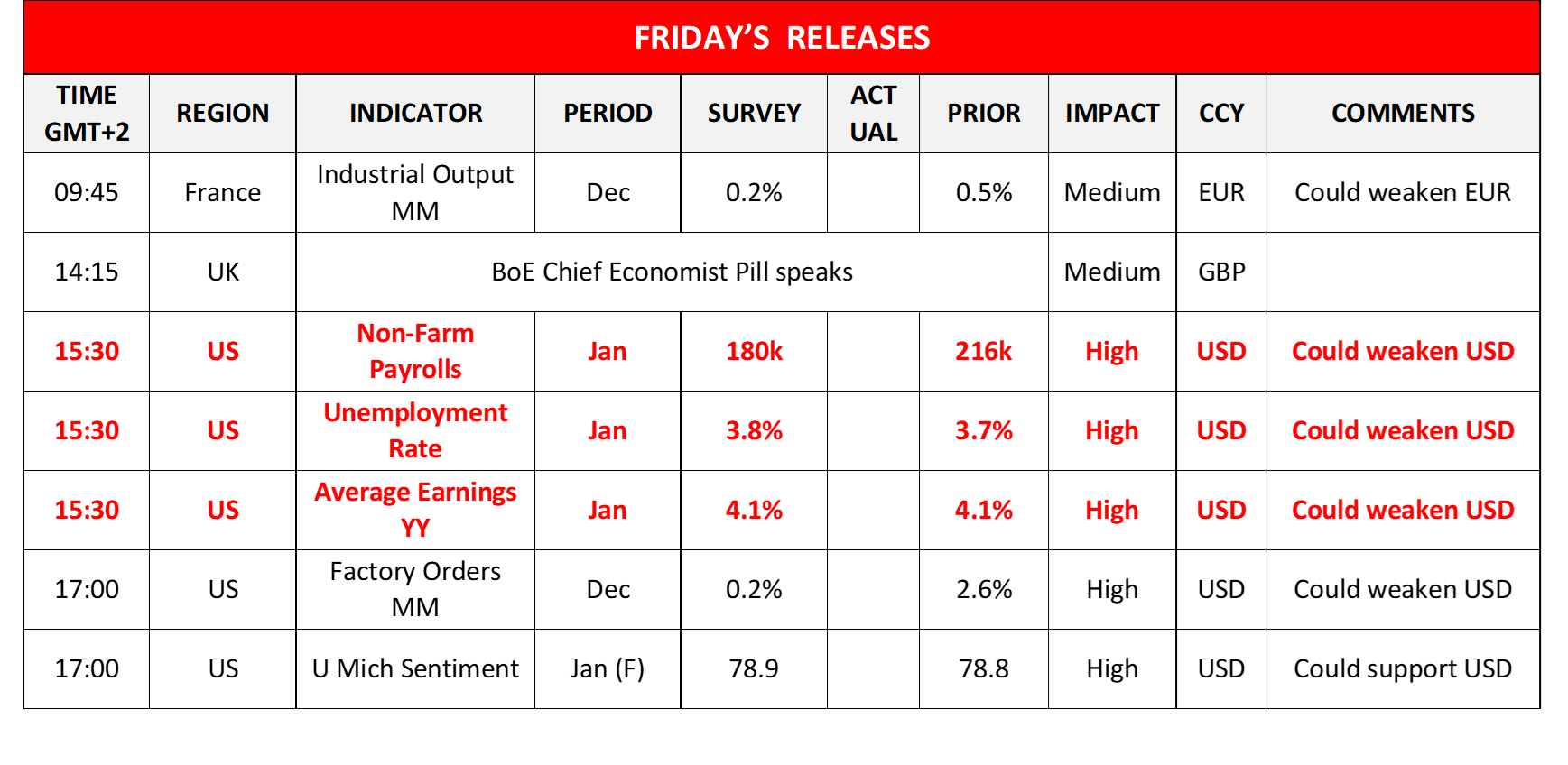

Volatility in the FX market picked up yesterday with the USD tumbling across the board, heading towards a weekly loss as the market eyes focus on the release of the US employment report for January, today in the American session. The non-farm payroll figure is expected to drop to 180k from December’s 216k, the unemployment rate to tick up to 3.8% and the average earnings growth rate to remain unchanged at 4.1% yoy if compared to December. Should the actual rates and figures meet their respective forecasts, we may see the USD weakening, as the rise of the unemployment rate and the drop of the Non-Farm Payroll figure point towards an easing of the US employment market’s tightening and thus disappoint USD traders. Such an easing may enhance the market’s expectations for the Fed to start aggressively cutting rates as early as May and even solidify market expectations for a total of six rate cuts in 2024. Overall, the release is expected to have a wider effect beyond major pairs in the FX market and US stockmarkets may get some support should the tightness of the US employment market ease, while a possible weakening of the USD could support gold’s price.

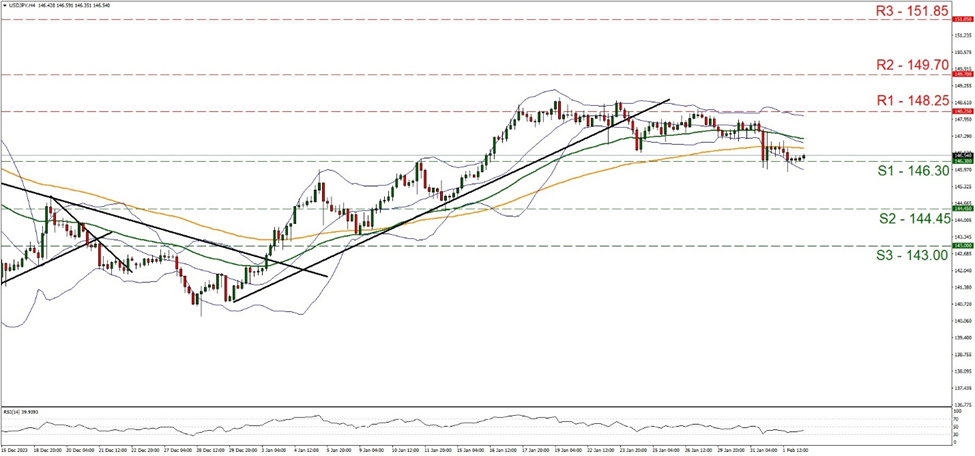

On a technical level, the USD edged lower against the JPY yesterday exercising additional pressure on the 146.30 (S1) support line. We tend to maintain our bias for the sideways motion to continue as the S1 held its ground. We also note that the RSI indicator is recovering from the depths of the reading 30, implying that the bearish sentiment in the market for the pair, tends to ease. Should the bears regain control over the pair, we may see the pair breaking the 146.30 (S1) support line and aim for the 144.45 (S2) support level. For a bullish outlook, we would require the pair to rise and break the upper boundary of its sideways motion, namely the 148.25 (R1) resistance line, thus opening the way for the 149.70 (R2) resistance level.

BoE remained on hold yesterday as expected and the bank in its seems prepared to keep a restrictive financial environment for a prolonged period to bring inflation down and the bank seems to be targeting inflation from the services sector. Also, it’s interesting how the power balance within the bank changes, strengthening the extremes, as we have a first vote in favor of a rate cut while in favor of a rate hike, the votes are now two. In his press conference, BoE Governor Bailey, highlighted that the bank is not at a point to discuss possible rate cuts yet, underscoring the Bank’s hawkish tone.

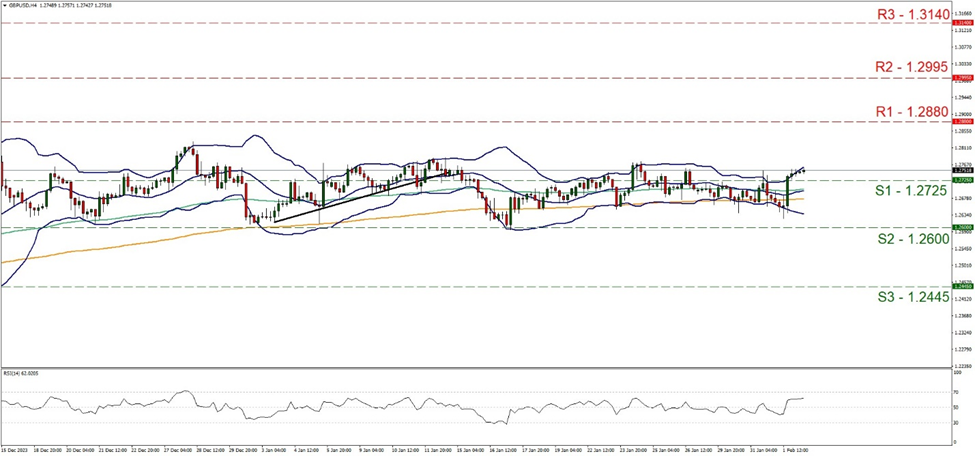

GBP/USD rose yesterday breaking the 1.2725 (S1) resistance line, now turned to support. We view cable’s rise more as a result of a USD weakening rather than a GBP strengthening. The bullish outlook seems to emerge yet we tend to maintain our doubts. Nevertheless, the RSI indicator was able to rise above the reading of 50 and stay there implying a build-up of a bullish sentiment, yet the indicator’s reading seems to have flattened out. Should a clearcut bullish movement be expressed by the market we may see USD/JPY aiming if not breaching the 1.2880 (R1) resistance line last tested on the 28 of July last year. On the other hand, should a selling interest be expressed by the market, we may see the pair breaking the 1.2725 (S1) support line and aim for the 1.2600 (S2) support base.

その他の注目材料

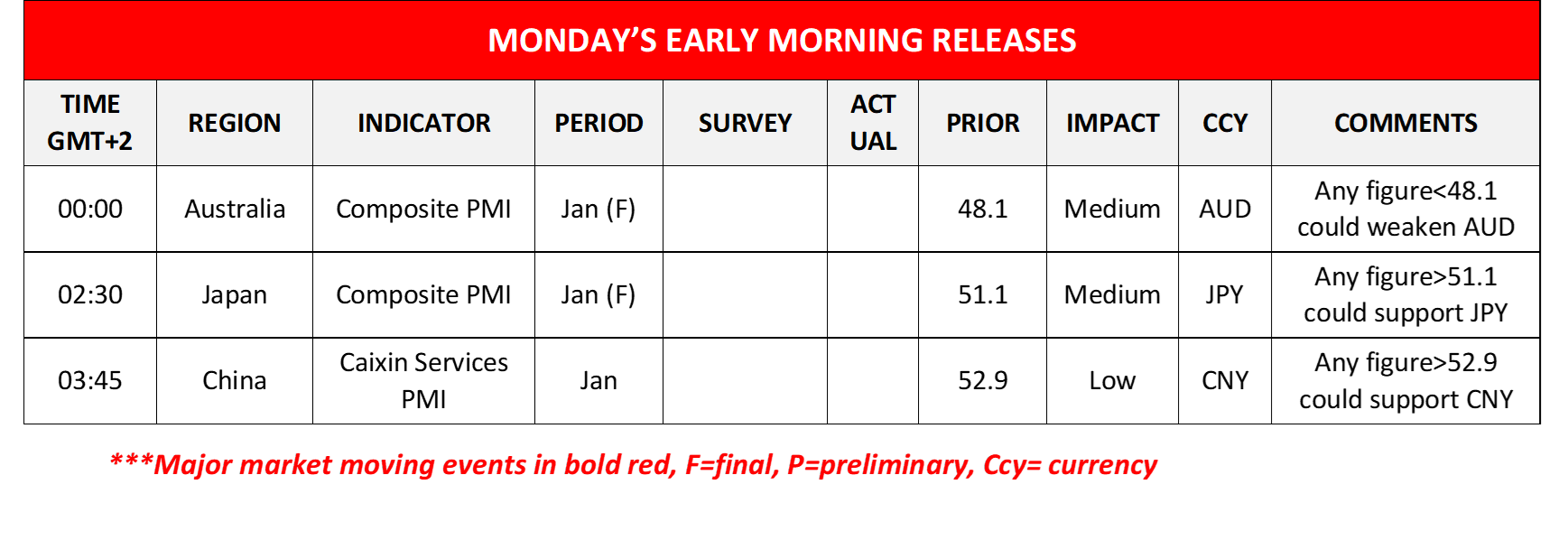

In today’s European session, we note the release of France’s industrial output for December, while on the monetary front, BoE’s chief economic Hugh Pill speaks. In the American session, besides the release of January’s US employment report, we also note the release from the US of the factory orders for December and the final University of Michigan consumer sentiment for January. During Monday’s Asian session, we note the release of Australia’s and Japan’s final composite and services PMI figures for January and China’s Caixin services PMI figure for the same month.

GBP/USD 4時間チャート

Support: 1.2725 (S1), 1.2600 (S2), 1.2445 (S3)

Resistance: 1.2880 (R1), 1.2995 (R2), 1.3140 (R3)

USD/JPY 4時間チャート

Support: 146.30 (S1), 144.45 (S2), 143.00 (S3)

Resistance: 148.25 (R1), 149.70 (R2), 151.85 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。