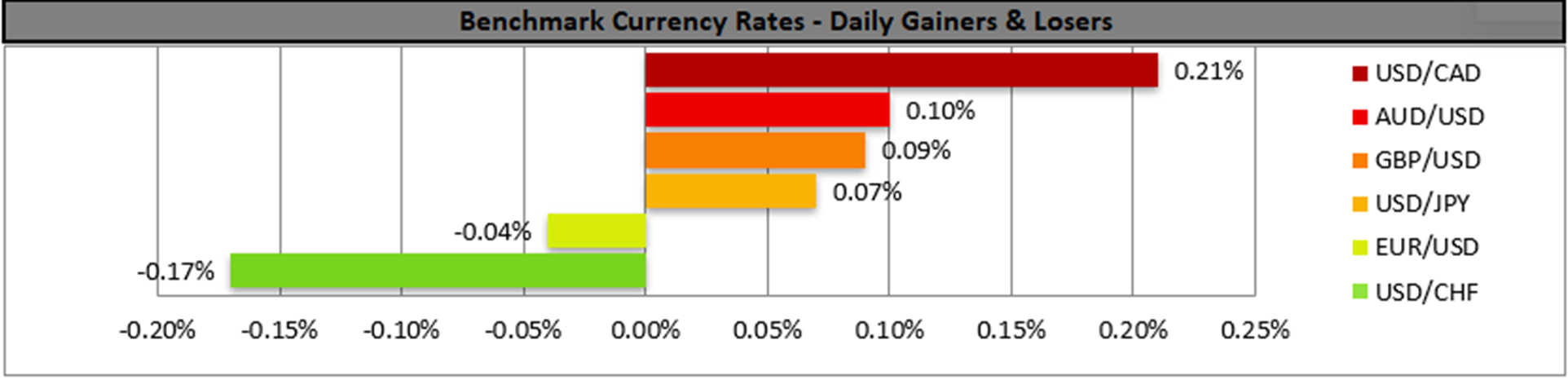

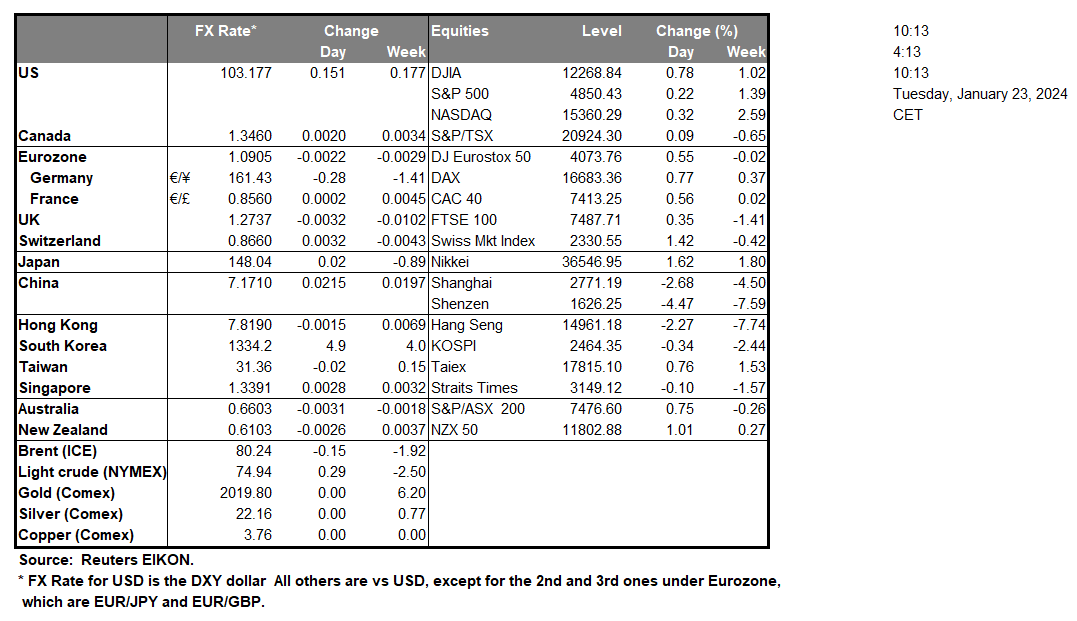

The BOJ during today’s Asian session, remained on hold as was widely expected. Moreover, in the bank’s accompanying , the BOJ said that it would “will continue with Quantitative and Qualitative Monetary Easing (QQE) with Yield Curve Control, aiming to achieve the price stability target, as long as it is necessary for maintaining that target in a stable manner”. Yet during the BOJ Press conference, Governor Ueda’s re-affirming that the BOJ will end its negative interest rate policy once 2% inflation is achieved, could support the JPY. According to Bloomberg, “Chinese authorities are considering a package of measures to stabilize the slumping stock market”, which could provide support for the CNY. Moreover, China’s continued attempts at protecting its economy, could boost its economy and increase economic stability. Thus, potentially also providing support for the AUD given their close economic ties.In the US stock market, Netflix (#NFLX) is due to release its earnings later on today. According to economists, the projected earnings per share is anticipated to come in at $2.21 per share, which would be lower than last quarter’s $3.73 EPS. Yet, the company’s revenue is anticipated to come in at 8.72B, which would be higher than last quarter’s revenue of 8.54B. As such, we may see a mixed reaction from market participants, as such attention may turn to the contents of the company’s earnings call. In the commodities markets, the heightened tensions in the Middle East could provide support for oil prices.

XAU/USD appears to be moving in a sideways fashion, with the commodity currently aiming for the 2035 (R1) resistance level. We maintain a sideways bias for the precious metal and supporting our case is the flattening of the 50 and 100 MA, in addition to the narrowing of the Bollinger bands, which may imply an indecisive market. Moreover, the RSI indicator below our chart currently registers a figure of 57, implying a neutral market sentiment. Yet, the upwards-moving trendline which was incepted on the 17 of January, which has yet to be broken, may imply a bullish trend. Nonetheless, for a sideways bias, we would like to see precious metal remain confined between the 2005 (S1) support line and the 2035 (R1) resistance level. For a bullish outlook, we would like to see a clear break above the 2035 (R1) resistance level, with the next possible target for the bulls being the 2064 (R2) resistance ceiling. Lastly, for a bearish outlook, we would like to see a break below the 2005 (S1) level, with the next possible target for the bears being the 1975 (S2) support base.

GBP/USD appears to be moving in a sideways fashion, having formed a sideways-moving channel since the 14 of December 2023. We maintain a sideways bias for the pair and supporting our case is the aforementioned sideways channel. Yet, the RSI indicator below our chart currently registers a figure of 60, implying some bullish tendencies. For our sideways bias to continue, we would like to see the pair remain confined between the 1.2610 (S1) support level and the 1.2760 (R1) resistance line. On the other hand, for a bullish outlook, we would like to see a clear break above the 1.2760 (R1) resistance line, with the next possible target for the bulls being the 1.2870 (R2) resistance ceiling. Lastly for a bearish outlook, we would like to see a clear break below the 1.2610 (S1) support level, with the next possible target for the bears being the 1.2440 (S2) support base.

その他の注目材料

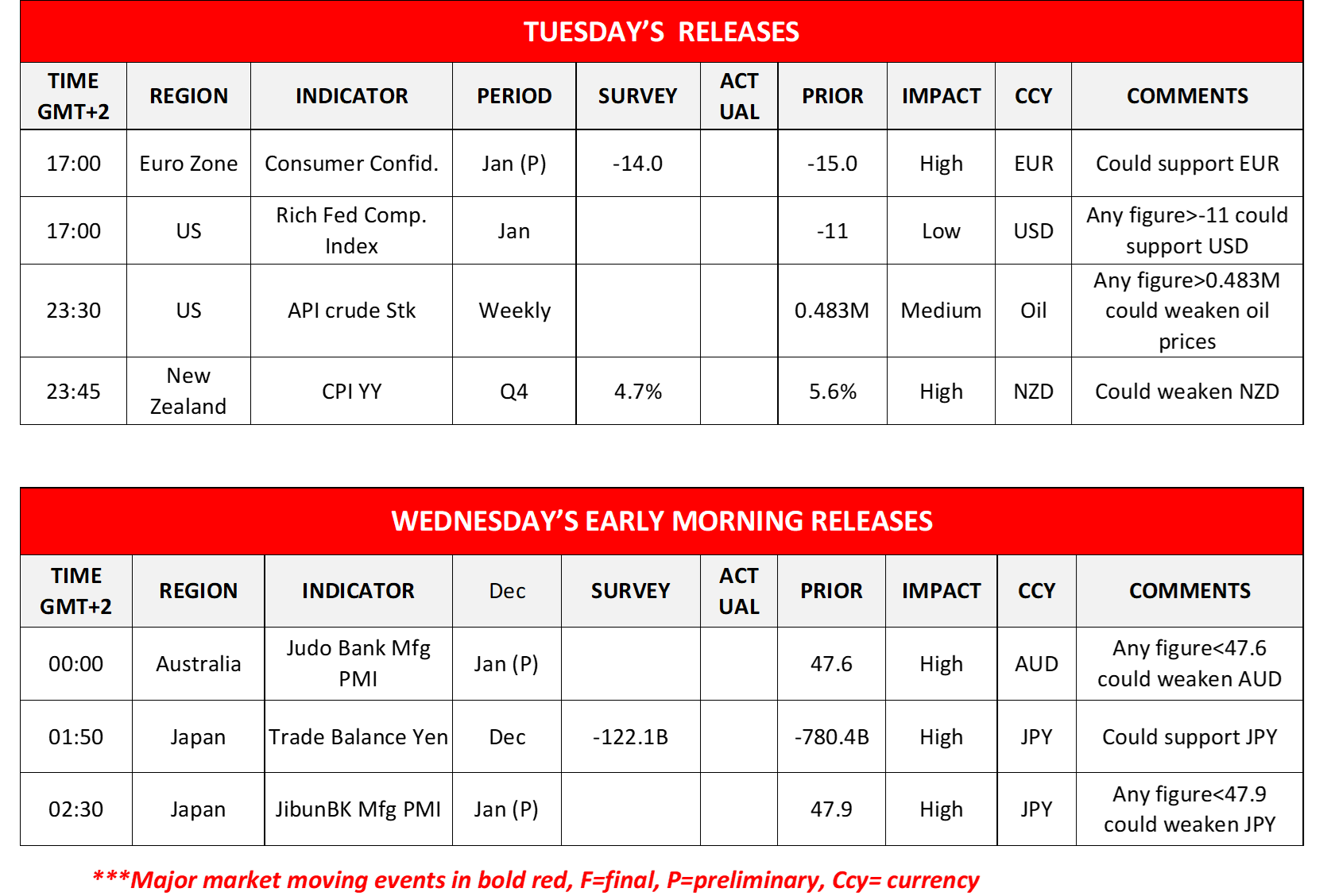

Today in the American session, we note the release of the Eurozone’s preliminary consumer confidence indicator and the US Richmond Fed Composite index both for January and later on oil traders may be more interested in the release of the US API weekly crude oil inventories figure, while Kiwi traders may keep an eye out for New Zealand’s Q4 CPI rates. During tomorrow’s Asian session, we note the release of Australia’s & Japan’s preliminary PMI figures for January and also Japan’s Trade data for December.

XAU/USD 4時間チャート

Support: 2005 (S1), 1975 (S2), 1945 (S3)

Resistance: 2035 (R1), 2064 (R2), 2088 (R3)

GBP/USD 4時間チャート

Support: 1.2610 (S1), 1.2440 (S2), 1.2270 (S3)

Resistance: 1.2760 (R1), 1.2870 (R2), 1.2990 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。