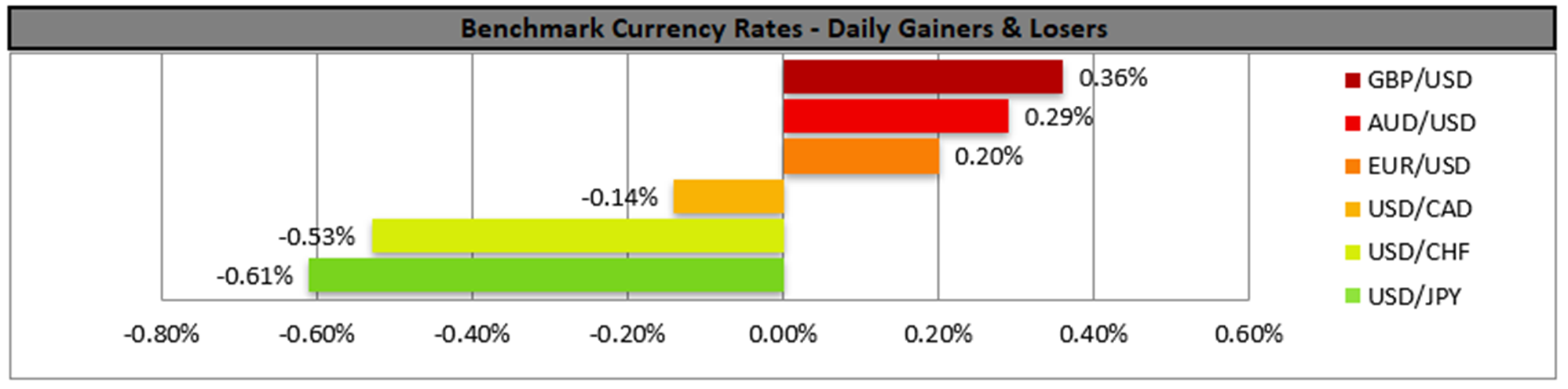

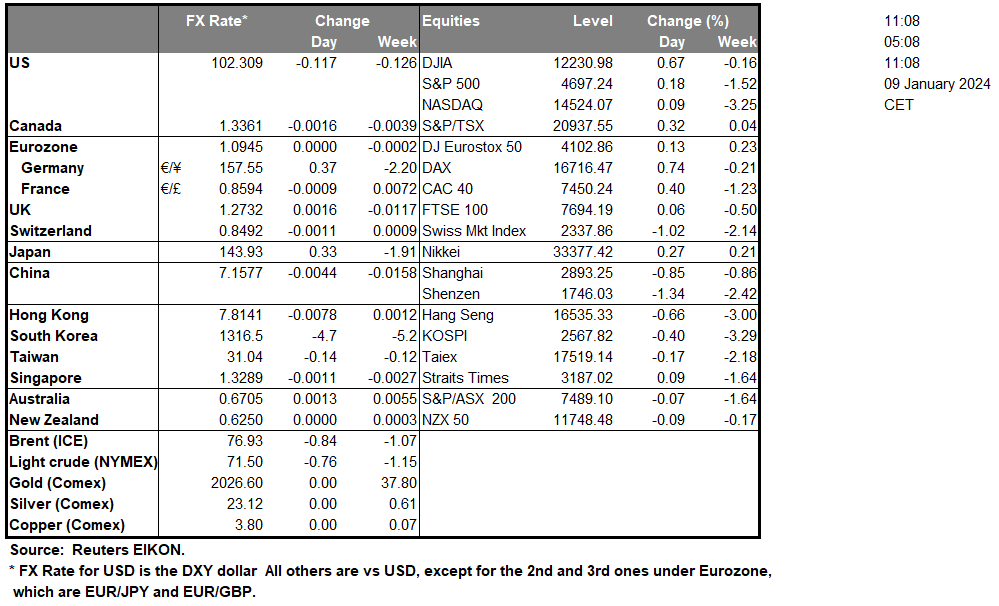

USD edged lower yesterday against its counterparts despite Fed officials more or less maintaining a relatively hawkish stance. It was characteristic that Fed Board Governor Bowman stated that hikes are more likely over, yet the Fed is not ready to cut rates yet and on a similar tone Atlanta Fed President Bostic stated that bias remains towards keeping a tight monetary policy, thus implying that the bank may keep rates higher for longer. The statements contradicted the market’s expectations for aggressive rate cutting in the current year starting on March and delivering in total six rate cuts. Yet it’s characteristic how the market does not seem to alter its expectations despite warnings to the contrary stemming from the Fed. Given the lack of high-impact releases stemming from the US today, we expect fundamentals to lead the way.

On the flip side US stock markets uniformly jumped higher as the week began based on an improved market sentiment and we view this as another sign of how the market does not take into account statements of Fed officials. We have to note the kick-off of the earnings season on Friday with big banks such as JP Morgan (#JPM), Bank of America (#BAC), Wells Fargo (#WFC) and Citigroup (#C) making their releases. We highlight how the Alaska Airlines accident has affected the Boeing’s share price at yesterday’s opening. The quality issues of Boeing airplanes were highlighted as the company had to ground over 170 airplanes for inspection. It should be noted that it’s not the first time the company had to ground airplanes due to software or hardware issues and the confidence of investors to the company has been shaken once again. Yesterday Boeing’s share price was at a freefall, losing over 8% within the trading day and despite there being some stabilisation at a level a bit lower than $229, a bearish predisposition may still be present in the market.

その他の注目材料

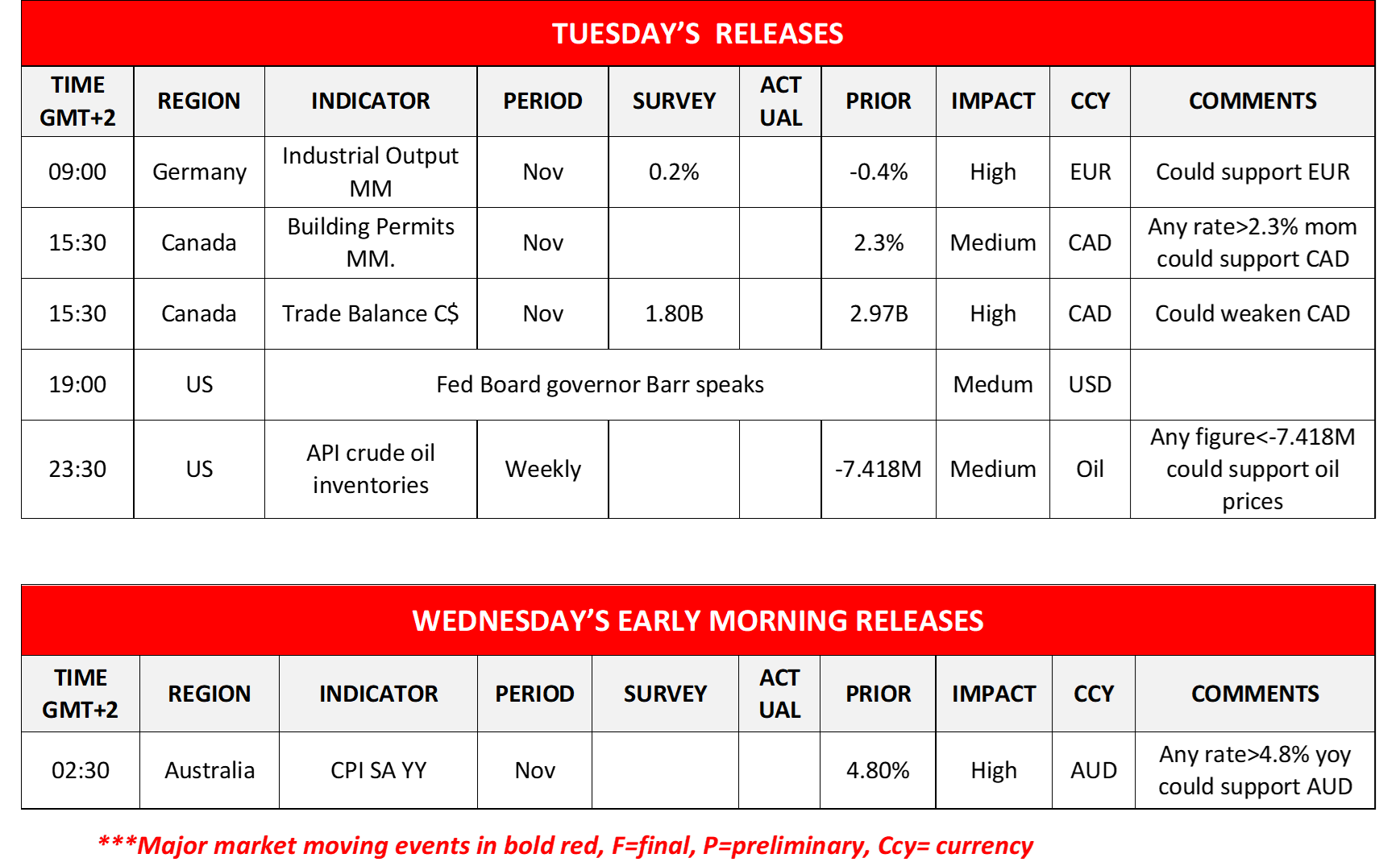

Today in the European session, we note the release of Germany’s industrial output for November. In the American session, we get Canada’s November building permits and trade data while oil traders may be more interested in the release of the US API weekly crude oil inventories figure. On the monetary front please note that Fed Board Governor Barr is scheduled to speak. During tomorrow’s Asian session, we get from Australia, November’s CPI rates.

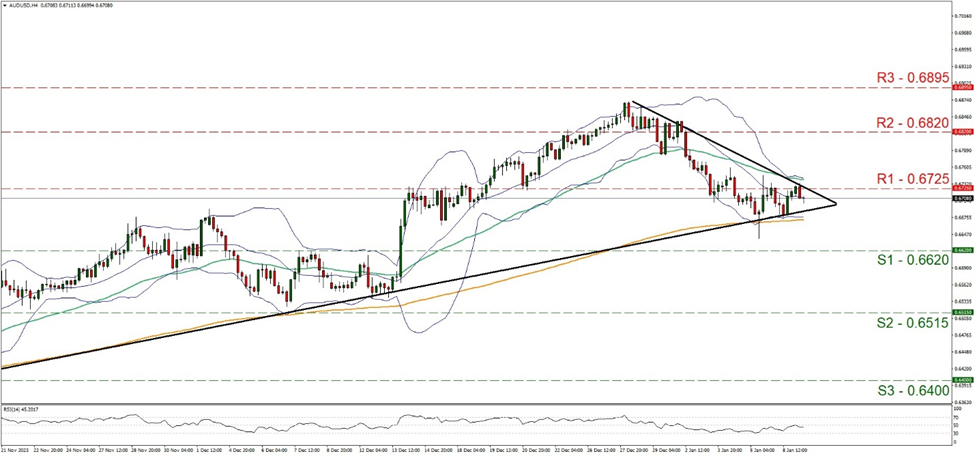

AUD/USD despite repeatedly testing the 0.6725 (R1) resistance line, proved unable to clearly break it. For the time being, we tend to maintain our bias for a sideways motion, yet note the symmetrical triangle that’s being formed and may allow the pair to break out. The RSI indicator tends to remain just below but close to the reading of 50 implying a rather indecisive market that may allow the sideways motion to continue. Should the pair find extensive buying orders along its path we may see AUD/USD breaking the 0.6725 (R1) resistance line and aiming for the 0.6820 (R2) resistance level. Should the selling interest be extended, we may see the pair breaking the 0.6620 (S1) support line and aiming for the 0.6515 (S2) support base.

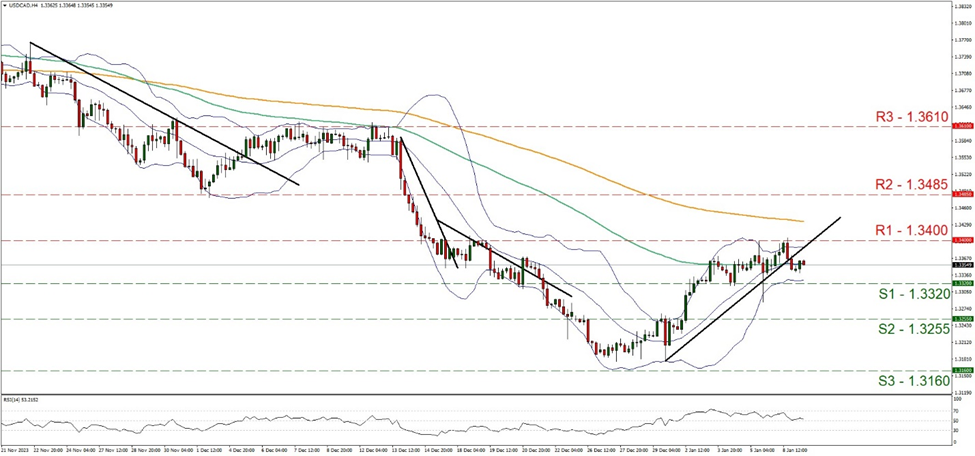

USD/CAD on the other hand tested unsuccessfully the 1.3400 (R1) resistance line and corrected lower. It should be noted that the price action in its downward correction broke the upward trendline guiding it since the 29 of December and hence we switch our bullish outlook in favor of a sideways motion bias initially. Furthermore, we note that the RSI indicator continues to run along the reading of 50, implying a rather indecisive market. Should the bulls lead the way for USD/CAD we may see the pair breaking the 1.3400 (R1) resistance line and aiming for the 1.3485 (R2) resistance hurdle. Should the bears take over the reins regarding the pair’s direction, we may see USD/CAD breaking the 1.3320 (S1) support line and aiming for the 1.3255 (S2) support barrier.

USD/CAD 4時間チャート

Support: 1.3320 (S1), 1.3255 (S2), 1.3160 (S3)

Resistance: 1.3400 (R1), 1.3485 (R2), 1.3610 (R3)

AUD/USD 4時間チャート

Support: 0.6620 (S1), 0.6515 (S2), 0.6400 (S3)

Resistance: 0.6725 (R1), 0.6820 (R2), 0.6895 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。