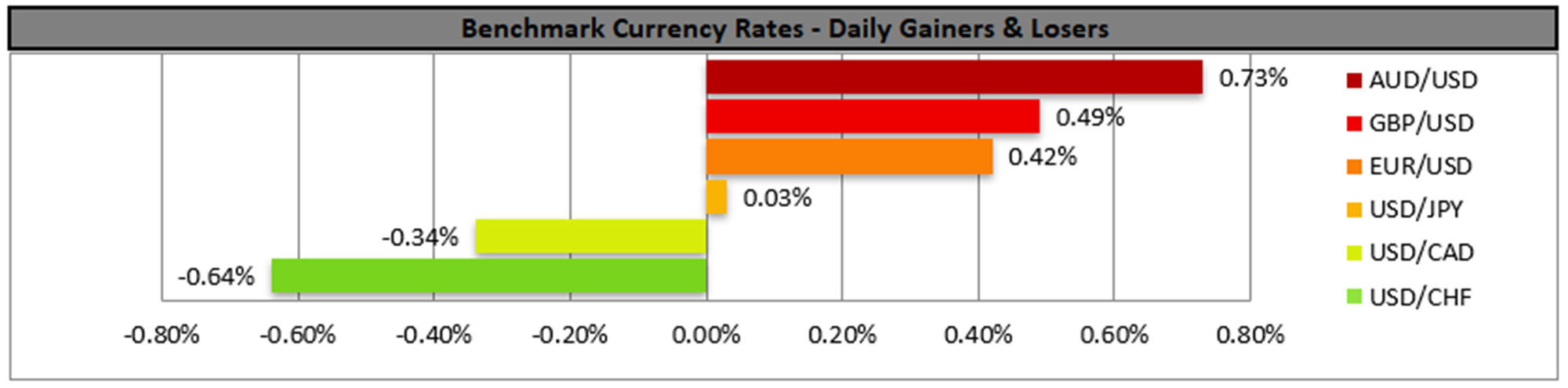

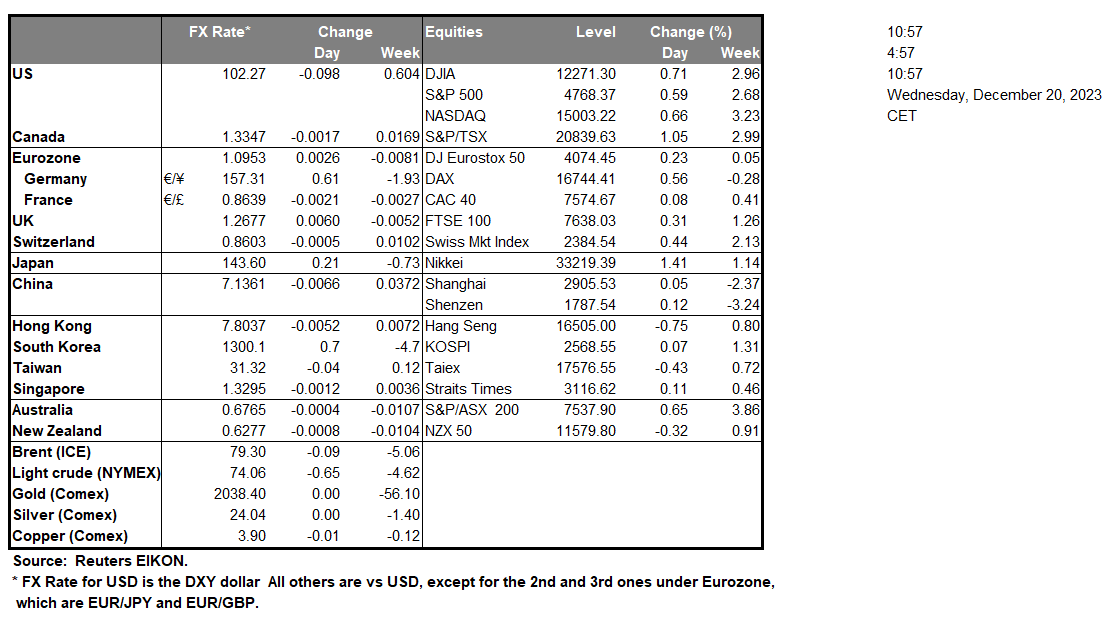

The USD edged lower yesterday against its counterparts, despite the mixed data provided by November’s construction data as the number of housing starts unexpectedly rose, yet the number of building permits dropped beyond market expectations. Overall the dovish pivot of the Fed last week, continues to weigh on the USD on a monetary level, yet Chicago Fed President Goolsbee yesterday, as well as other Fed policymakers in previous days tended to warn the market not to get ahead of itself. It should be noted that the market currently expects the Fed to cut rates six times in 2024, while the latest dot-plot only three. Should more Fed policymakers be stressing the possibility of higher rates for longer we may see the USD gaining some ground. Today we expect the US consumer confidence for December to come under the microscope of traders to gauge the sentiment on the demand side of the US economy and should the reading come in better than expected we may see the USD gaining some ground, as it would imply some optimism on behalf of the average US consumer.

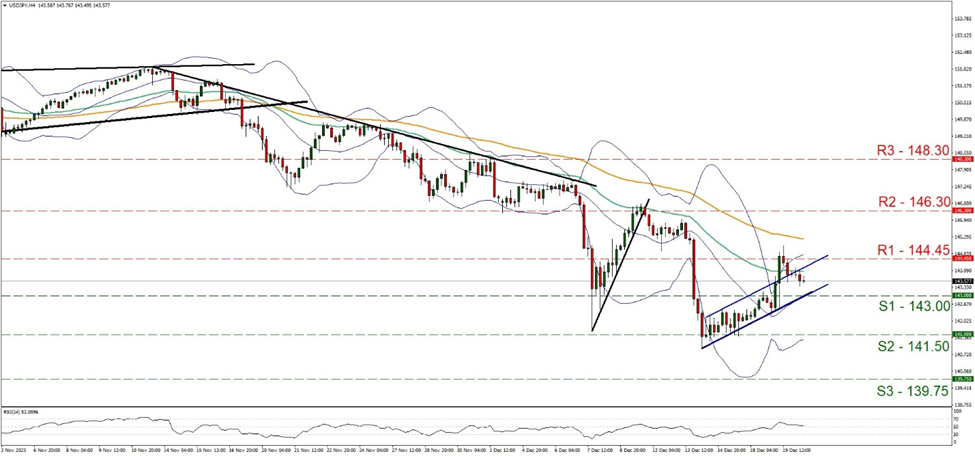

On a technical level the USD strengthened against the JPY yesterday and USD/JPY seems to have hit a ceiling on the 144.45 (R1) resistance line yesterday and retreated lower. We expect some stabilisation for the pair for the time being given that the RSI indicator remains near the reading of 50, implying a rather indecisive market. On the other hand, the upward trendline supporting the pair, seems to remain intact. Should the buyers regain control over USD/JPY’s direction, we may see it breaking the 144.45 (R1) resistance line clearly and aiming for the 146.30 (R2) resistance nest. Should the bears take over, we may see the pair breaking the prementioned upward trendline signalling an interruption of the upward movement, breach the 143.00 (S1) support line and aim for the 141.50 (S2) support level.

Across the Atlantic, the pound tumbled just before the European session began today, as November’s headline and core CPI rates came in lower than expected. The slowdown of the CPI rates may allow the Bank of England to proceed more decisively with rate cuts in the coming year as the tightening of the bank’s monetary policy seems to have eased inflationary pressures considerably. It should be also noted that the market currently expects the bank to proceed with six rate cuts in total in the coming year and after the release the market’s expectations for such a scenario to materialize seem to intensify. Overall we tend to expect the release to continue to weigh on the pound at a monetary policy level.

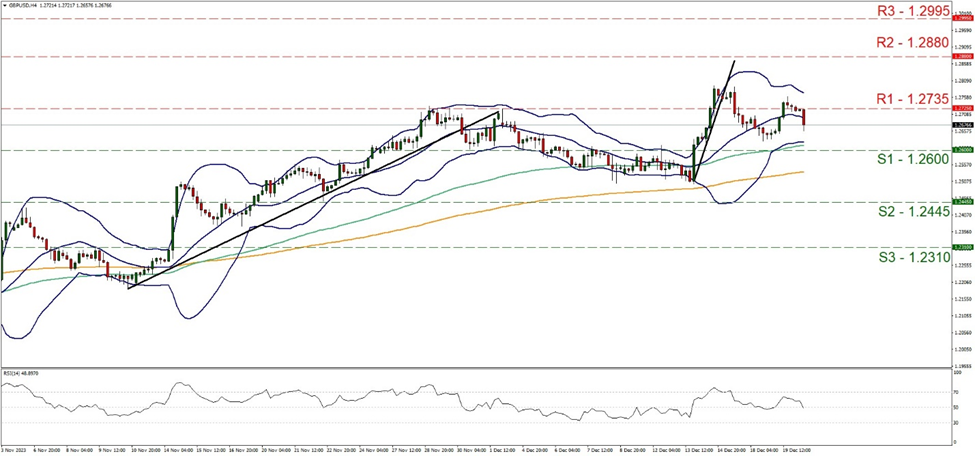

GBP/USD edged lower as the European session today was about to start, after failing to clearly break the 1.2735 (R1) resistance line. There seem to be some bearish tendencies as the RSI indicator dropped to the reading of 50 decisively and there seems to be some room until the lower Bollinger band, which may allow for the bears to play. Yet for a bearish outlook we would require the pair to clearly break the 1.2600 (S1) support line and aim for the 1.2445 (S2) support level. On the flip side, should the bulls manage to take control over the pair’s direction, we may see GBP/USD reversing direction breaching the 1.2735 (R1) resistance line and aim for the 1.2880 (R2) resistance barrier.

その他の注目材料

Today in the European session, we note the release of Germany’s GfK consumer sentiment for January. In the American session, we note the release of Eurozone’s preliminary consumer confidence for December, the US consumer confidence for the same month, and the US existing home sales for November. Oil traders on the other hand may be more interested in the release of the weekly EIA crude oil inventories figure while on the monetary front, we note that ECB’s chief economist Lane is scheduled to speak and BoC is to release the December meeting deliberations.

USD/JPY 4時間チャート

Support: 143.00 (S1), 141.50 (S2), 139.75 (S3)

Resistance: 144.45 (R1), 146.30 (R2), 148.30 (R3)

GBP/USD H4 Chart

Support: 1.2600 (S1), 1.2445 (S2), 1.2310 (S3)

Resistance: 1.2735 (R1), 1.2880 (R2), 1.2995 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。