The RBA remained on hold at 4.35%, as was widely expected. The banks accompanying statement hinted that inflationary pressures in the Australian economy, continued to “moderate” and as such, may imply that the bank may have reached its terminal rate. As such, the statements made by the bank appear to be predominantly dovish, which appears to have weighed on the Aussie. Over in the commodities market, we note the comments made by the Saudi Energy Minister, who implied that the oil production cuts could potentially go beyond Q1, which could hinder the supply side of the market and as such could provide some support for oil prices. On a political level, we note the recent news reports, Russian President Vladimir Putin will be visiting Saudi Arabia and the UAE tomorrow, where he is expected to discuss oil markets issues. In the event that an agreement is reached for further production cuts, we may see oil gaining and vice versa. ECB board member Schnabel’s comments, earlier on today, may have implied that the bank may its terminal rate, as she stated that there was a “remarkable” fall in inflation. The board member’s comments, could in turn weigh on the EUR. In the US, the JOLTS Job Openings figures figure for October, is expected to be released and should the figure come in lower than expectations, we may see the dollar weakening. China’s Caixin Services PMI figure, came in better than expected during today’s Asian session, implying a slightly optimistic outlook for the Chinese economy, which could support the Aussie from a more macro-perspective.

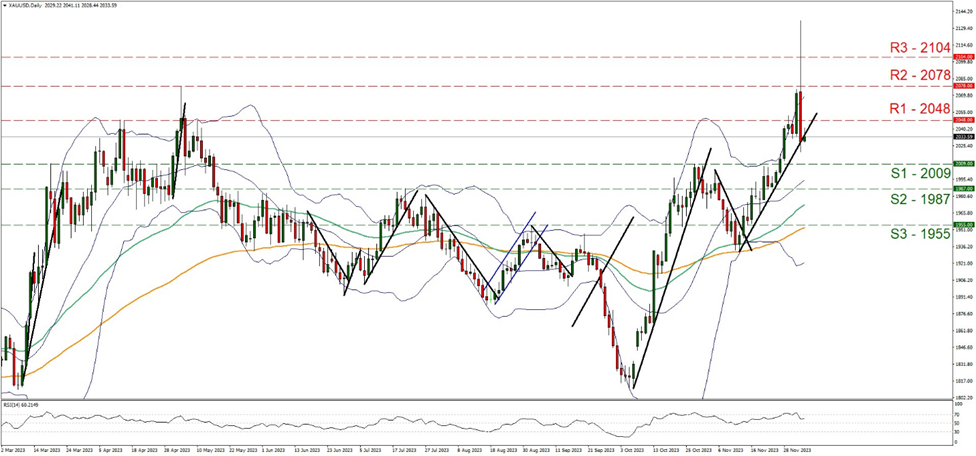

XAU/USD after reaching new all-time highs at 2136, it now appears to have corrected lower, with the precious metal having dropped below the support turned resistance level at 2048 (R1). We maintain, a bearish outlook for gold and supporting our case is the break below our upwards moving trendline which was incepted on the 13 of November. However, we also highlight that the RSI Indicator below our Daily chart currently registering a figure near 70, which implies a bullish market sentiment. Nevertheless, for our bearish outlook to continue we would require a clear break below the 2009 (S1) support level, with the next potential target for the bears being the 1987 (S2) support base. On the other hand, for a sideways bias we would like to see gold remaining confined between the 2009 (S1) support and the 2048 (R1) resistance levels respectively. Lasty for a bullish outlook, we would like to see a clear break above the 2048 (R1) resistance level, with the next possible target for the bulls being the 2078 (R2) resistance ceiling.

AUD/USD appears to be moving in a downwards fashion. We maintain a bearish outlook for the pair and supporting our case is the RSI indicator below our 4-Hour chart, which currently registers a figure near 30, implying a bearish market sentiment, in addition to the breaking below our upwards moving trendline, which was incepted on the 17 of November. For our bearish outlook to continue, we would like to see a break below the 0.6515 (S1) support level, with the next possible target for the bears being the 0.6400 (S2) support level. On the other hand, for a sideways bias, we would like to see the pair remaining confined between the 0.6515 (S1) support level and the 0.6620 (R1) resistance level. Lastly, for a bullish outlook, we would like to see a clear break above the 0.6620 (R1) resistance level, with the next possible target for the bulls being the 0.6725 (R2) resistance line.

その他の注目材料

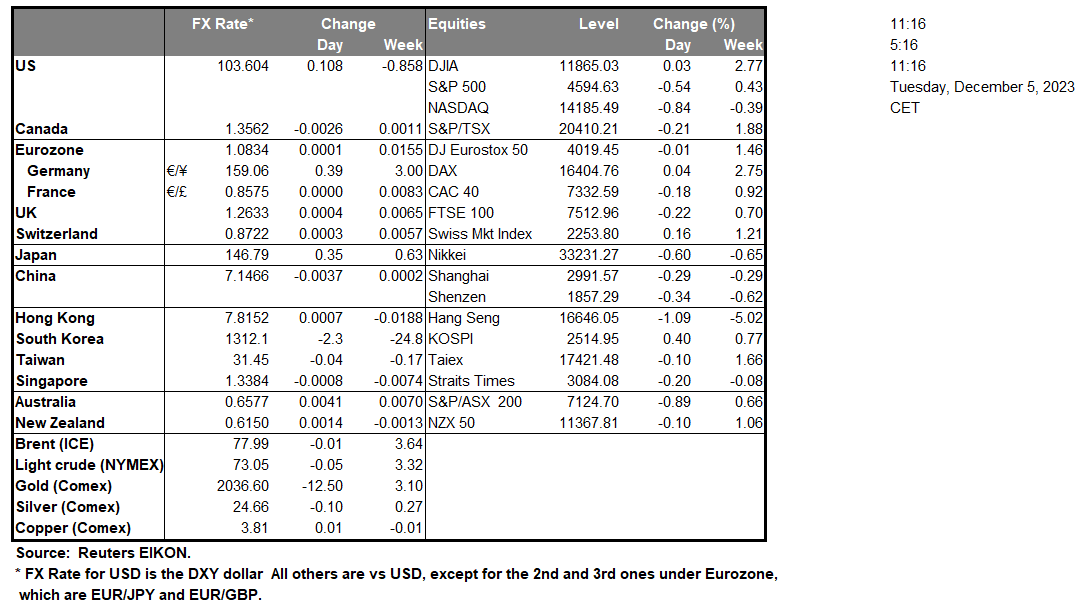

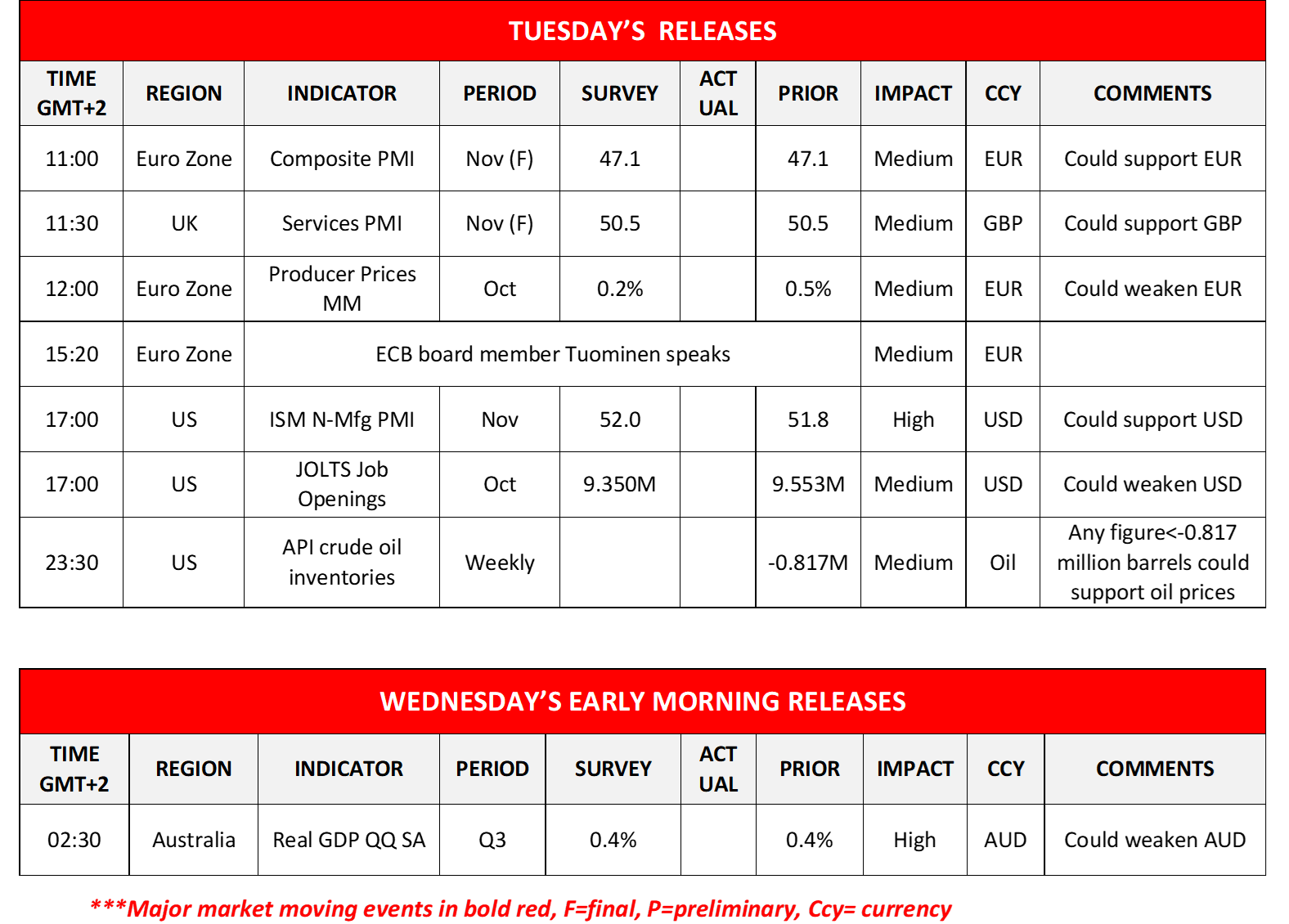

Today in the European session, we get the Eurozone’s final composite PMI and US final services figures for November and the Eurozone’s producer prices for October and on the monetary front ECB board member Tuominen speaks. In the American session, we get the US ISM non-manufacturing PMI for November, and the JOLTS job openings figure for October, while later on, oil traders may be more interested in the release of the weekly API crude oil inventories. During tomorrow’s Asian session, we get Australia’s GDP rate for Q3.

XAU/USD Daily Chart

Support: 2009 (S1), 1987 (S2), 1955 (S3)

Resistance: 2048 (R1), 2078 (R2), 2104 (R3)

AUD/USD 4時間チャート

Support: 0.6515 (S1), 0.6400 (S2), 0.6270 (S3)

Resistance: 0.6620 (R1), 0.6725 (R2), 0.6820 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。