US stock markets continued their upwards rally for a third week in a row, as expectations of the Fed having reached its terminal rate, appear to be dominating the market sentiment at this point in time. In this report, we aim to present the recent earnings release results of Nvidia and discuss the potential strikes by Deutsche Bank Employees, discuss the developments in the case of Rio Tinto versus the SEC and conclude with a technical analysis of Nvidia.

Nvidia beats earnings expectations, yet some serious questions arise

Nvidia, (#NVDA), the technology giant, infamous for its graphics card, amongst gamers around the globe, posted its earnings yesterday evening after the markets had closed. Nvidia reported its revenue coming in at $18.12B and its Earnings per share coming in at $4.02, with the company’s third-quarter revenue having increased by 34% compared to the previous quarter and 206% for the same period last year. The company’s CEO Huang, stated during Nvidia’s earnings call that the strong growth, reflects the broad industry platform transition from general-purpose to accelerate computing and generative AI large language model startups. However, despite the better-than-expected earnings result, the market reaction seems to remain relatively muted following the earnings release, which may be attributed to growing concerns about a reduction in demand from its sales in China. That represents roughly 20%-25% of Data center revenue, over the past few years. In particular, CFO Kress stated that “The export controls will have a negative effect on our China business, and we do not have good visibility into the magnitude of that impact even over the long term”. The concerns about the company’s sales projections in China, appear to have countered the better-than-expected earnings release and as such could weigh on the company’s stock price. On the other hand, should the better-than-expected readings in conjunction with the broad use of NVIDIA’s GPU in the AI sector excite traders we may see a positive effect on its share price.

Deutsche Bank wage negotiations continue

According to the FT, Deutsche Bank is preparing to enter negotiations with Germany’s second-largest union, for wage negotiations following a growing call for better pay by the bank’s workers. The article states that official hourly rates at DB Direkt, a wholly owned subsidiary that operates Deutsche Bank call centers, start at €12.05, which is only five cents more than what is required by law. Should the bank fail to present a serious proposal, it may lead to extended walkouts by employees which could in turn over the long run weigh on the company’s profitability. In the event that no pay deal is reached between the union and the banking behemoth, we may see an adverse effect on the bank’s stock price, as the walkouts could disrupt day-to-day operations given also the company’s restructuring efforts. In conclusion, despite the possibility of extended walkouts by bank workers the matter may not escalate and as such it may not have an effect on the bank’s stock price. On the other hand, should we see a prolonged period of walkouts, it could negatively impact the bank’s stock price over the long run.

Rio Tinto settles SEC case

According to various media outlets, Rio Tinto (#RIO) has settled with the SEC and will be paying $28 million in order to settle the Commission’s probe into its Mozambique coal deal. The settlement will bring an end to a six-year investigation by the SEC, into allegations that the company inflated the value of Mozambique coal assets in 2011. However, the company will pay the penalty without admitting or denying the charges that were brought against it. In conclusion, given that the company’s revenue in June 2023 was roughly $13.33B, we do not anticipate the fine to have any material impact on the company’s revenues and as such, may not impact their stock price.

テクニカル分析

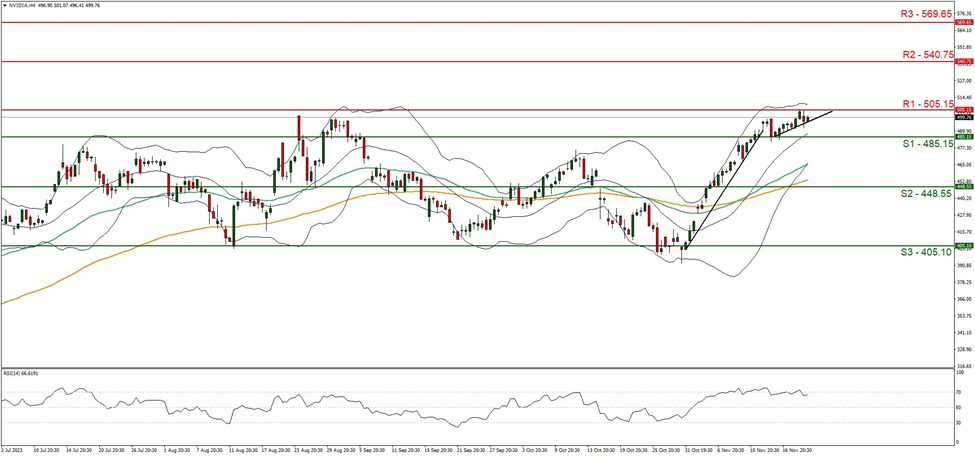

NVIDIA H4 Chart

Support: 485.15 (S1), 448.55 (S2), 405.10 (S3)

Resistance: 505.15 (R1), 540.75 (R2), 569.65 (R3)

Nvidia appears to be moving in an upward fashion, having formed an upwards moving trendline on the 15 of November. We maintain a bullish outlook for the company’s stock price and supporting our case is the RSI indicator below our 4-Hour chart which currently registers a figure near 70, implying a bullish market sentiment. For our bullish outlook to continue, we would like to see a break above the 505.15 (R1) resistance level with the next possible target for the bulls being the 540.75 (R2) resistance level. On the other hand, for a bearish outlook, we would like to see a break below the 485.15 (S1) support level, with the next possible target for the bears being the 448.55 (S2) support base. Lastly, despite S1 and R1 being relatively close to one another, we may see the stock moving in a sideways fashion, should it remain confined in the narrow path set by the aforementioned S1 and R1 levels.

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。