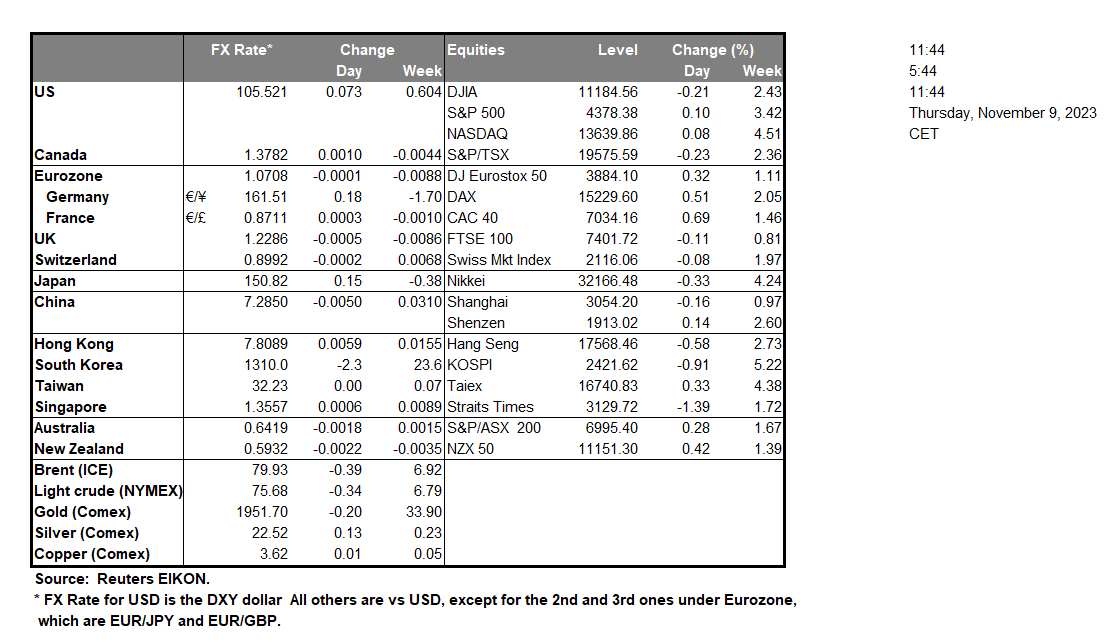

Fed Chair Powell during his speech yesterday, did not comment on the outlook for monetary policy in his remarks according to Bloomberg. However, Fed Chair Powell implied that forecasters should think outside traditional economic models. As a result, market participants may be interested in his speech later on today, which may shed some light on his previous comments. The BoC minutes stated that the “lack of downward momentum in underlying inflation was a source of considerable concern”, implying that the bank is concerned about persistent inflationary pressures. As such, we may see the bank adopt a slightly hawkish tone in the future. In Europe, ECB Vice President De Guindos stated that “we are not there yet” when referring to reducing interest rates. Yet he also expressed his concern about the Eurozone’s growth outlook, as the “leading indicators point to the growth outlook being somewhat more negative than we previously projected”, which may weigh on the EUR. Over in Asia, China’s economy slips back into deflation levels, following their CPI rates coming in lower than expected. Sparking concern about China’s economic resilience. In Japan, BoJ Governor Ueda in his remarks earlier today, implied that the bank may abandon its ultra-loose monetary policy, sooner than what may have been previously expected.

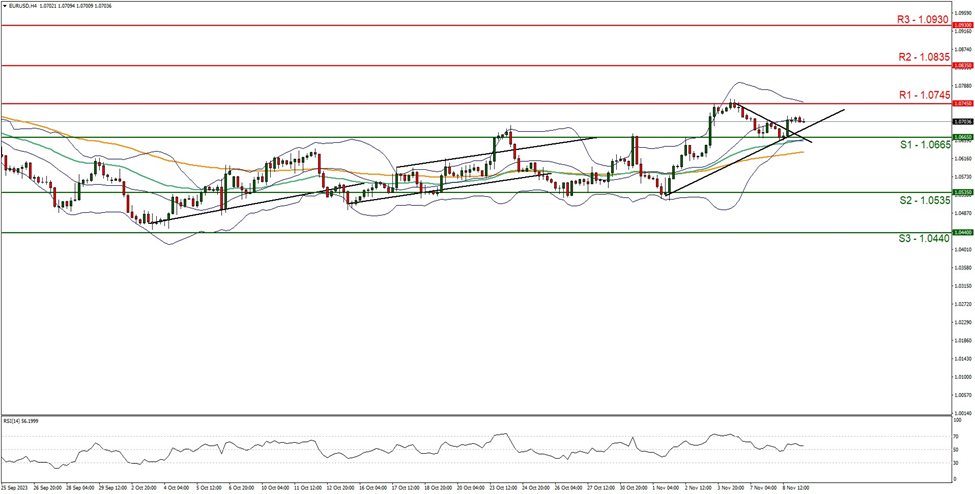

On a technical level, the EUR gained slightly against the dollar during yesterday’s trading session, having broken above our downwards-moving trendline which was incepted on the 6 of November. Despite the formation of a new upwards-moving trendline incepted on the 1 of November, we maintain a neutral outlook for the pair, and supporting our case is the RSI indicator below our 4-hour chart, which is currently fluctuating around the figure of 50, implying a neutral market sentiment. In addition, the narrowing of the Bollinger bands with the upper and lower bounds coinciding with the R1 and S1 levels, appear to further support our theory of a neutral market sentiment. As such for our neutral outlook to continue we would like to see the pair remaining between the 1.0665 (S1) support and the 1.0745 (R1) resistance levels. On the other hand, for a bearish outlook, we would like to see a clear break below the 1.0665 (S1) support level, with the next potential target for the bears being the 1.0535 (S2) support base. Lastly, for a bullish outlook, we would like to see a clear break above the 1.0745 (R1) resistance ceiling, with the next possible target for the bulls being the 1.0835 (R2) resistance ceiling.

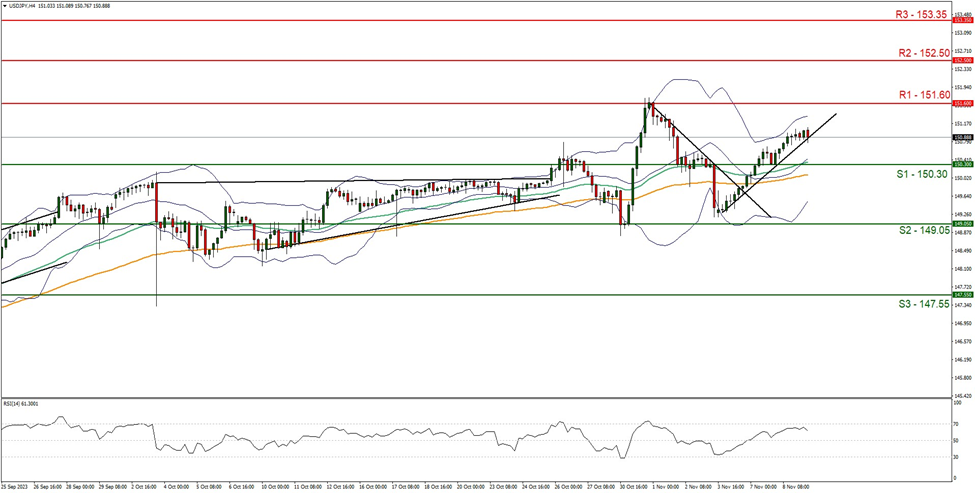

USD/JPY appears to be moving in an upward fashion and supporting our case is the upwards-moving trendline which was incepted on the 3rd of November, in addition to the RSI indicator currently reading a figure near 70, implying a bullish market sentiment. For our bullish outlook to continue, we would like to see a break above the 151.60 (R1) resistance level, with the next possible target for the bulls being the 152.50 (R2) resistance ceiling. For a bearish outlook, we would like to see a break below our upward-moving trendline, in addition to a clear break below the 150.30 (S1) support level, with the next possible target for the bears being the 149.05 (S2) support base. Lastly, for a sideways bias, we would like to see the pair remaining confined between the 150.30 (S1) support and the 151.60 (R1) resistance levels.

その他の注目材料

In an easy going Thursday, we note the release of the US weekly initial jobless claims figure and near the beginning of the Asian session, we note the release of New Zealand’s manufacturing PMI figure. On the monetary front, we note that ECB Chief Economist Lane, BoE’s chief Economist Pill, BoJ Governor Kazuo Ueda, Atlanta Fed President Bostic, Richmond Fed President Barkin, St. Louis Fed President O’Neil Paese, BoC Senior Deputy Governor Rogers, ECB President Christine Lagarde are scheduled to speak and RBA releases statement on monetary policy in tomorrow’s Asian session.

#EUR/USD 4 Hour Chart

Support: 1.0665 (S1), 1.0535 (S2), 1.0440 (S3)

Resistance: 1.0745 (R1), 1.0835 (R2), 1.0930 (R3)

#USD/JPY 4 Hour Chart

Support: 150.30 (S1), 149.05 (S2), 147.55 (S3)

Resistance: 151.60 (R1), 152.50 (R2), 153.35 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。