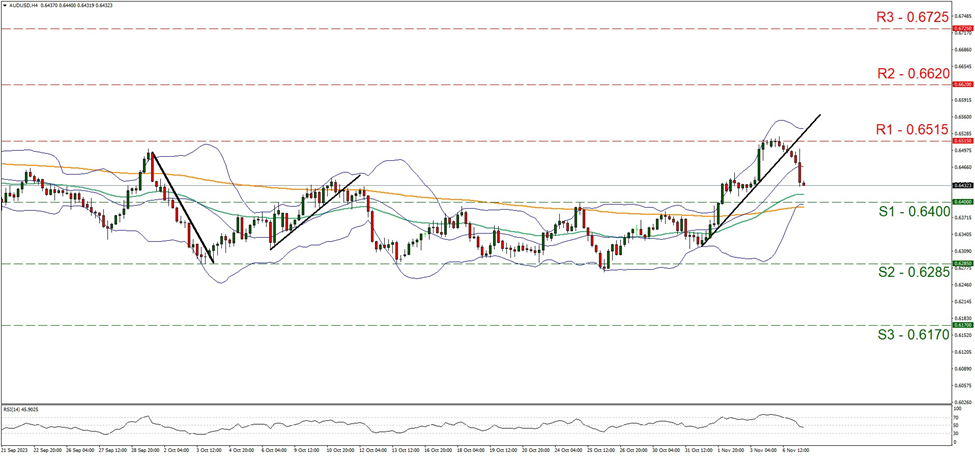

AUD retreated against the USD as RBA in its interest rate decision decided to hike rates by 25 basis points yet in Governor Bullock’s statement refrained from committing to further rate hikes. The Governor in her statement recognised that inflation is still too high and that it remains persistent, possibly with a slower easing than initially expected, yet also stated that the bank practically remains data dependent, thus weakening AUD. We tend to view the bank’s stance as weighing on the Aussie on a monetary level. It should be noted that AUD/USD’s drop may have also been assisted by the strengthening of the USD yesterday.

AUD/USD dropped yesterday after hitting a ceiling at the 0.6515 (R1) level. Given that the price action broke the upward trendline guiding it, we switch our bullish outlook in favour of a sideways-motion bias for the time being. Recent expectations around RBA Hikes have done little to shift momentum. Should the bulls take over, we may see the pair breaking the 0.6515 (R1) resistance line and aim for the 0.6620 (R2) resistance nest. Should the bears be in charge, we may see the index breaking the 0.6400 (S1) support line and aim for the 0.6285 (S2) support level.

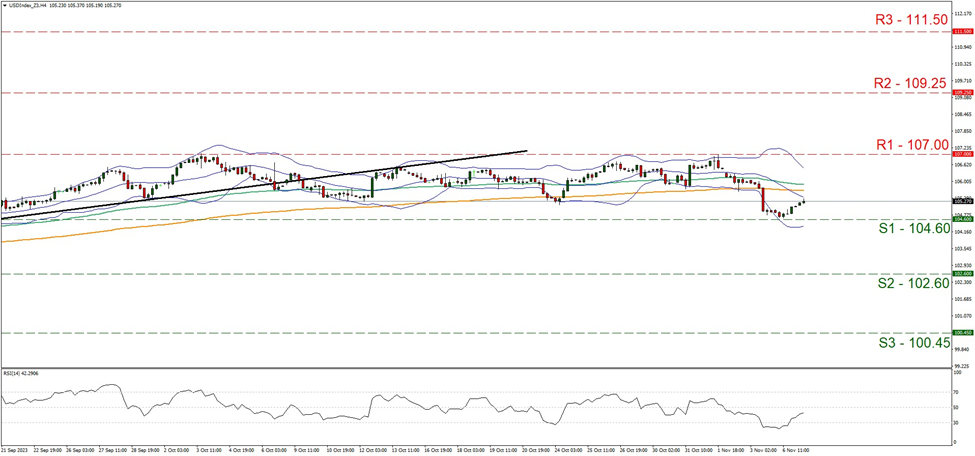

The USD index bounced on the 104.60 (S1) support line yesterday. Given also that the RSI indicator has risen above the reading of 30, implying an easing of the bearish sentiment, we tend to maintain our bias for a sideways motion of the USD for the time being, especially as broader policy expectations such as recent RBA Hikes have influenced global FX sentiment. Should the bulls be in charge, we may see the index breaking the 107.00 (R1) resistance line in search of higher grounds, while for a bearish outlook we would require the index to break below the 104.60 (S1) support line.

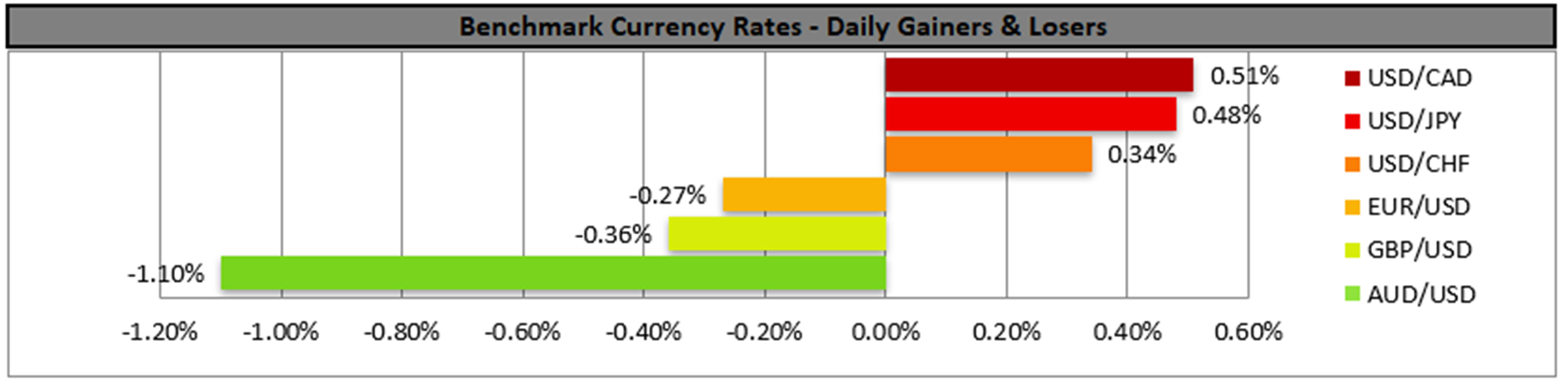

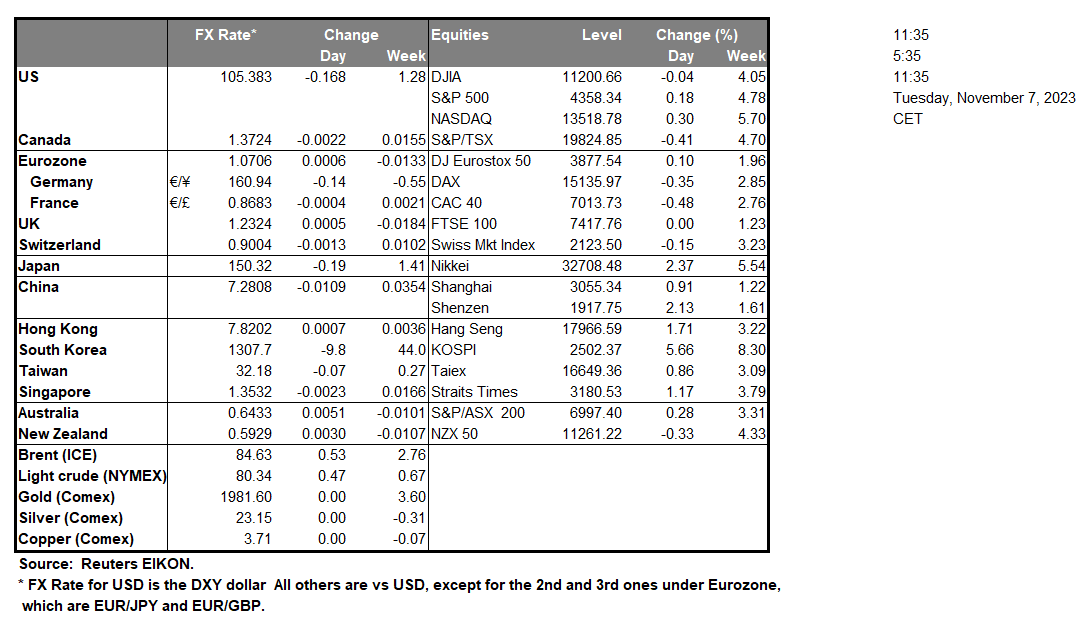

The Loonie continued to weaken against the USD yesterday, with the drop in oil prices possibly weighing on the CAD as well. Today we expect CAD traders to keep a close eye on the release of Canada’s trade data for September. Should the trade surplus widen, we may see the CAD gaining some ground, while on the monetary front, CAD traders are expected to focus also on BoC Deputy Governor Kozicki’s speech, especially as global policy comparisons such as recent RBA Hikes remain in focus. On a more fundamental level, an improved market sentiment could support the CAD. US stock markets tended to show little volatility as the week began yesterday, sending some mixed signals to the markets.

Overall, equities bulls took a break after Friday’s wide jump and we still consider that an improvement of the market sentiment may provide some support for equities as they are considered riskier assets on a fundamental level, especially as global policy shifts such as recent RBA Hikes continue to influence broader risk appetite. The earnings season is still on and today we note the release of the reports of #EBAY, #GPRO, Kodak and Uber.

Gold’s price edged lower yesterday possibly as the slight strengthening of the USD tended to weigh on the precious metal’s price. The negative correlation of the USD to gold seems to have been interrupted or eased in the past few days. US yields seem to have edged up a bit yesterday which may have weighed on Gold’s price, while on a deeper fundamental level, we note that the precious metal may be experiencing safe haven outflows as market worries may have eased about the Israeli conflict. On the commodities front, WTI’s price edged lower yesterday despite Russia and Saudi Arabia announcing that they will maintain the voluntary production cuts in place. On the other hand, China’s trade data for October were not encouraging for the demand side of the commodity, while also the easing of market worries for the Israeli conflict may also weigh on oil prices. Today oil traders may also be interested in the release of the US weekly API crude oil inventories figure for a view on the US oil market, especially as global policy comparisons such as recent RBA Hikes continue to shape broader market sentiment, with traders evaluating whether RBA Hikes could influence risk appetite and how expectations around further RBA Hikes may interact with commodity-linked currencies.

その他の注目材料

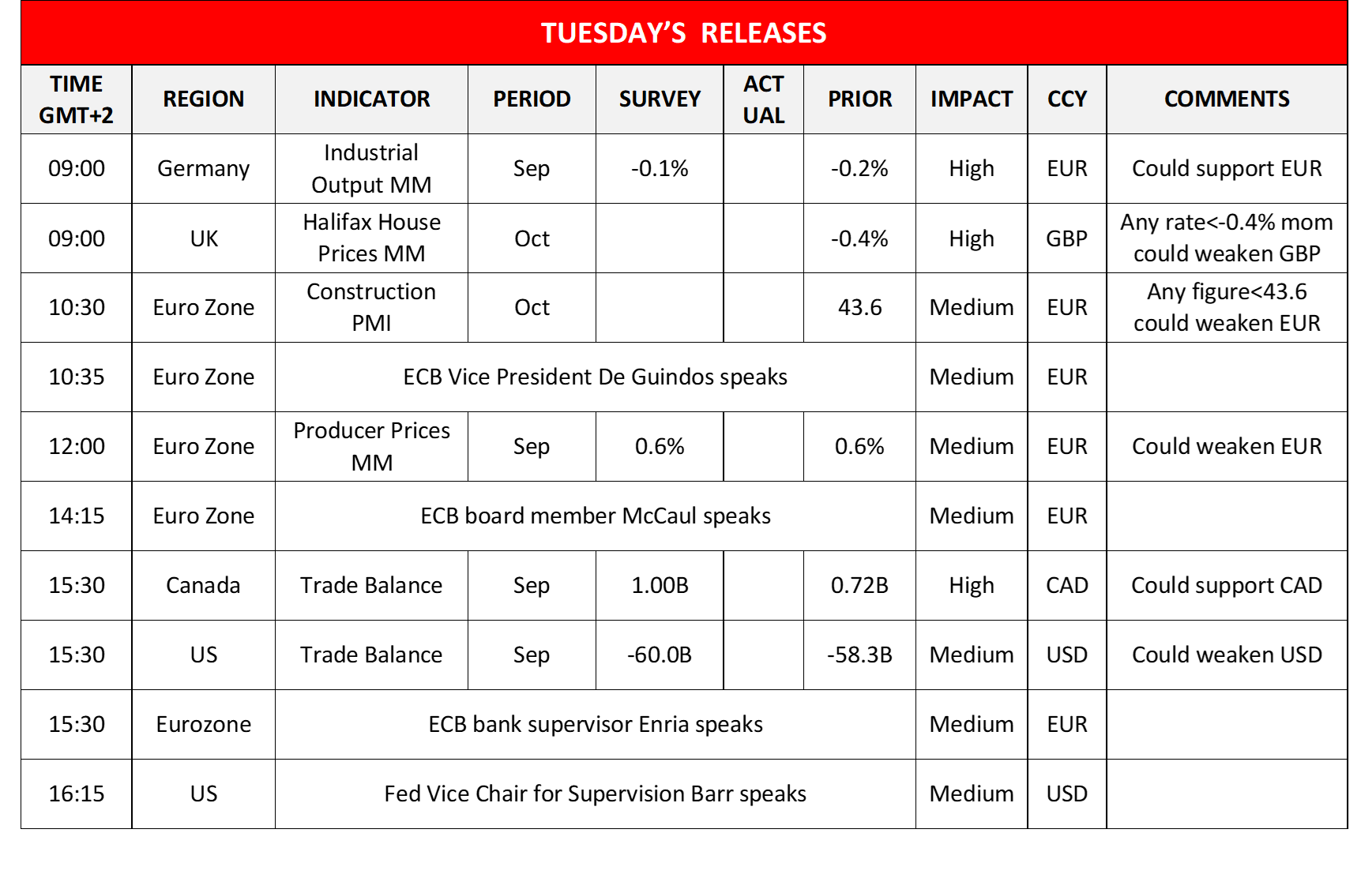

Today we get Germany’s industrial output for September, Eurozone’s construction PMI figure for October, Eurozone’s PPI rate for September and in the American session the US and Canada’s trade data for September.

USD Index 4 Hour Chart

Support: 107.00 (S1), 109.25 (S2), 111.50 (S3)

Resistance: 104.60 (R1), 102.60 (R2), 100.45 (R3)

AUD/USD 4時間チャート

Support: 0.6400 (S1), 0.6285 (S2), 0.6170 (S3)

Resistance: 0.6515 (R1), 0.6620 (R2), 0.6725 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。