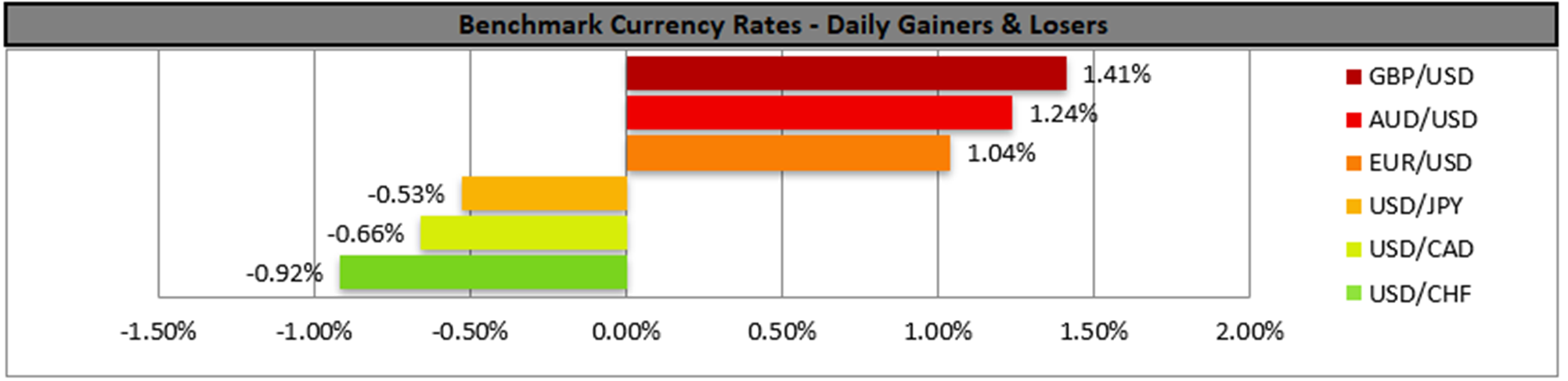

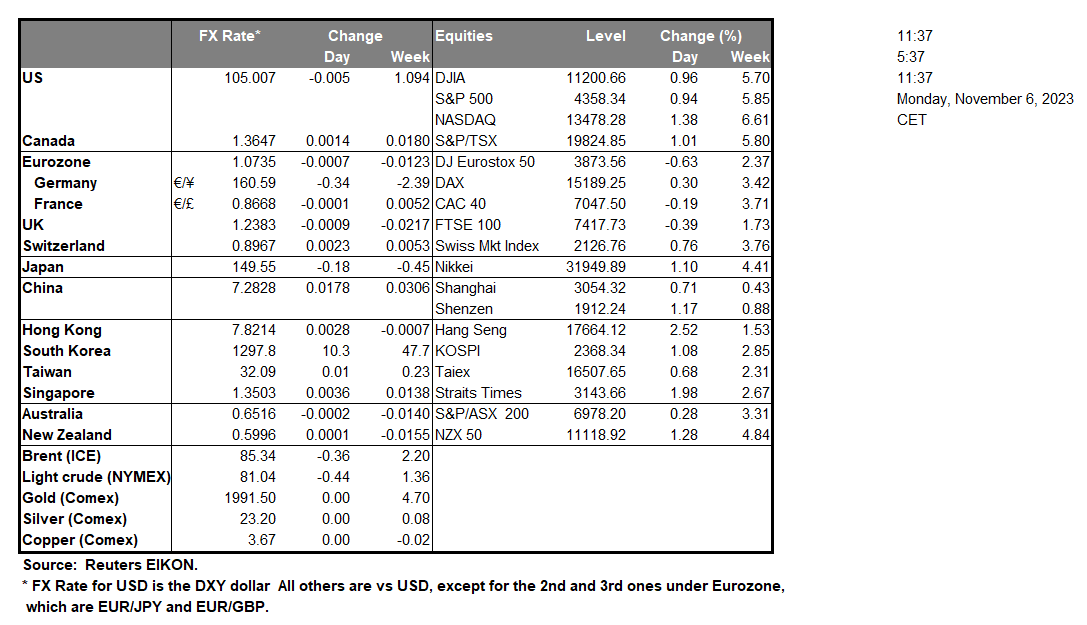

The USD weakened across the board on Friday as October’s US employment report showed some cracks in the US employment market’s tightness. The US economy added 150,000 jobs in October, shy of the estimated 180,000, the unemployment rate ticked up to 3.9% from 3.8%, and wage growth slowed. At the same time, the release provided some support for US stock markets as the market expectations that the Fed will not proceed with more RBA rate hikes seemed to solidify.

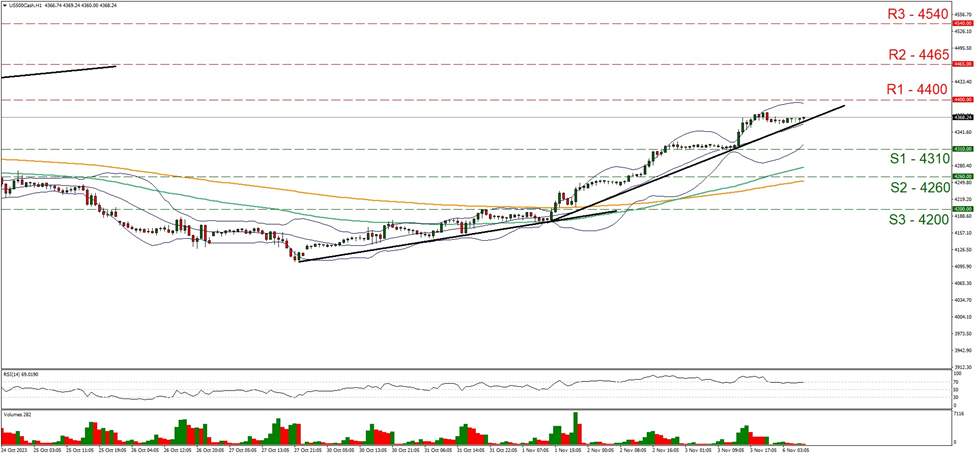

US 500 rose, placing some distance between the price action and the 4310 (S1) support line in Friday’s American session, then stabilised somewhat. We tend to maintain a bullish outlook given the upward trendline guiding the index and the RSI indicator which remains near the reading of 70 in our 1-hour chart, implying a bullish sentiment of the market for the index. Yet the RSI indicator may also imply that the index is at overbought levels and a correction lower is possible. On the other hand, the price action has some room until the upper Bollinger band, which could allow the bulls to play around some more. Recent global risk flows influenced partly by RBA developments may also play a secondary role. Should the bulls actually maintain control over the index, we may see it breaking the 4400 (R1) resistance line and aim for the 4465 (R2) level. Should the bears take over, we expect the index’s price action to initially break the prementioned upward trendline, in a first sign that the upward motion has been interrupted, and reach if not breach the 4310 (S1) support line in search of lower grounds.

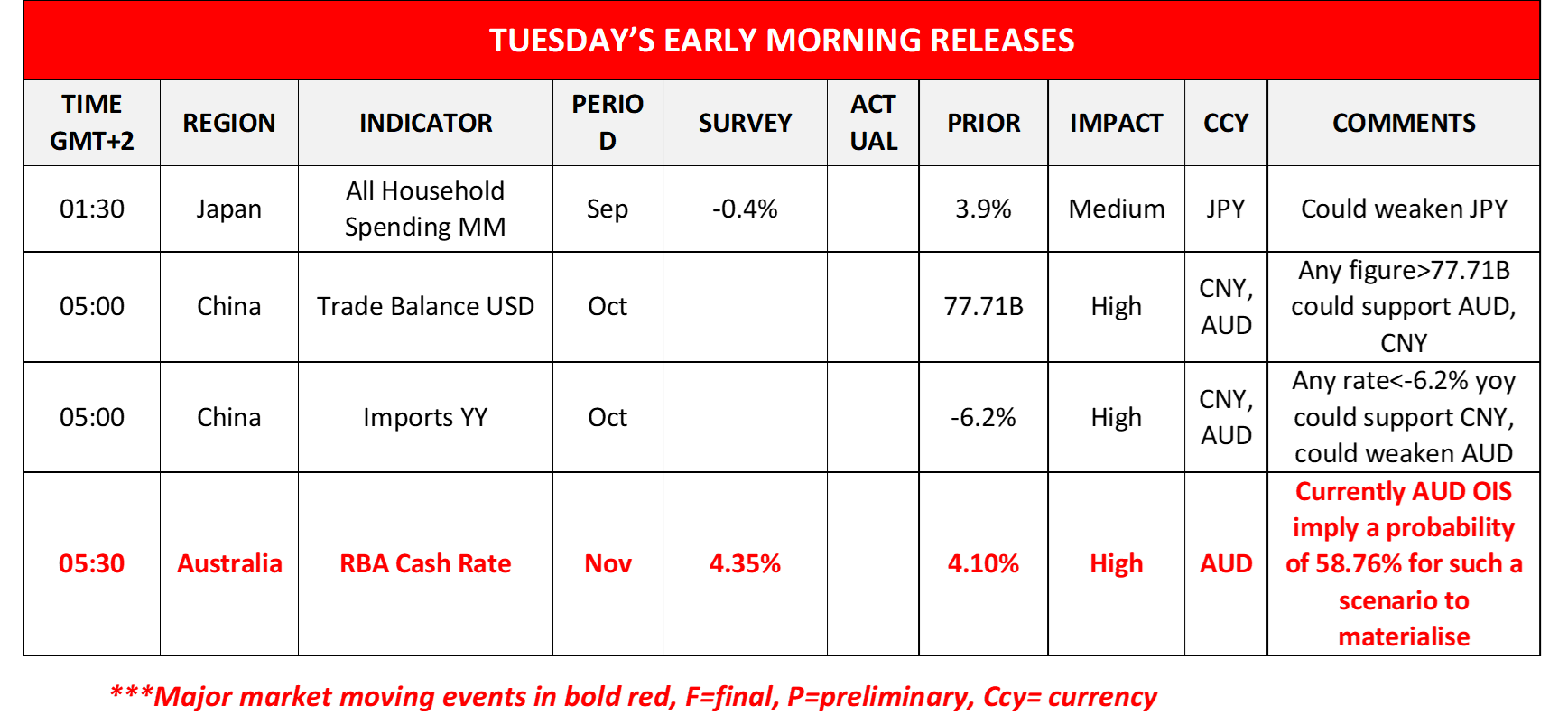

Across the world during tomorrow’s Asian session, we note the release of RBA’s interest rate decision. The bank is expected to RBA to hike rates by 25 basis points, yet currently, AUD OIS imply a probability of only 58.76% for such a scenario to materialise. Should the bank hike rates as expected we may see AUD getting some support, yet much of the market’s reaction may depend on the tone of Governor Bullock’s accompanying statement. Should the bank maintain a hawkish tone we may see the support for AUD growing while if a cautious tone prevails, we may see the RBA rate hike turning into a dovish hike and the Aussie may weaken.

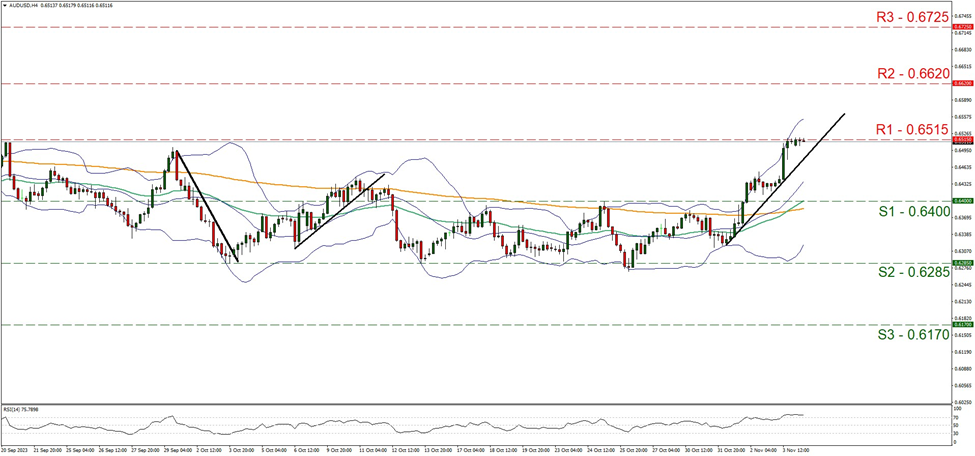

AUD/USD rose on Friday and is currently testing the 0.6515 (R1) resistance line. Given the upward trendline guiding the pair and the RSI indicator which remains above the reading of 70, implying a bullish sentiment of the market for the pair, we maintain a bullish outlook for AUD/USD. Recent expectations surrounding RBA policy may also be providing additional support. Should the buying interest be maintained, we may see the pair breaking the 0.6515 (R1) line and aim for the 0.6620 (R2) level. Should sellers say enough is enough and take over, we may see the pair dropping, breaking the prementioned upward trendline in a signal that the upward movement has been interrupted, and aim to break the 0.6400 (S1) support line.

その他の注目材料

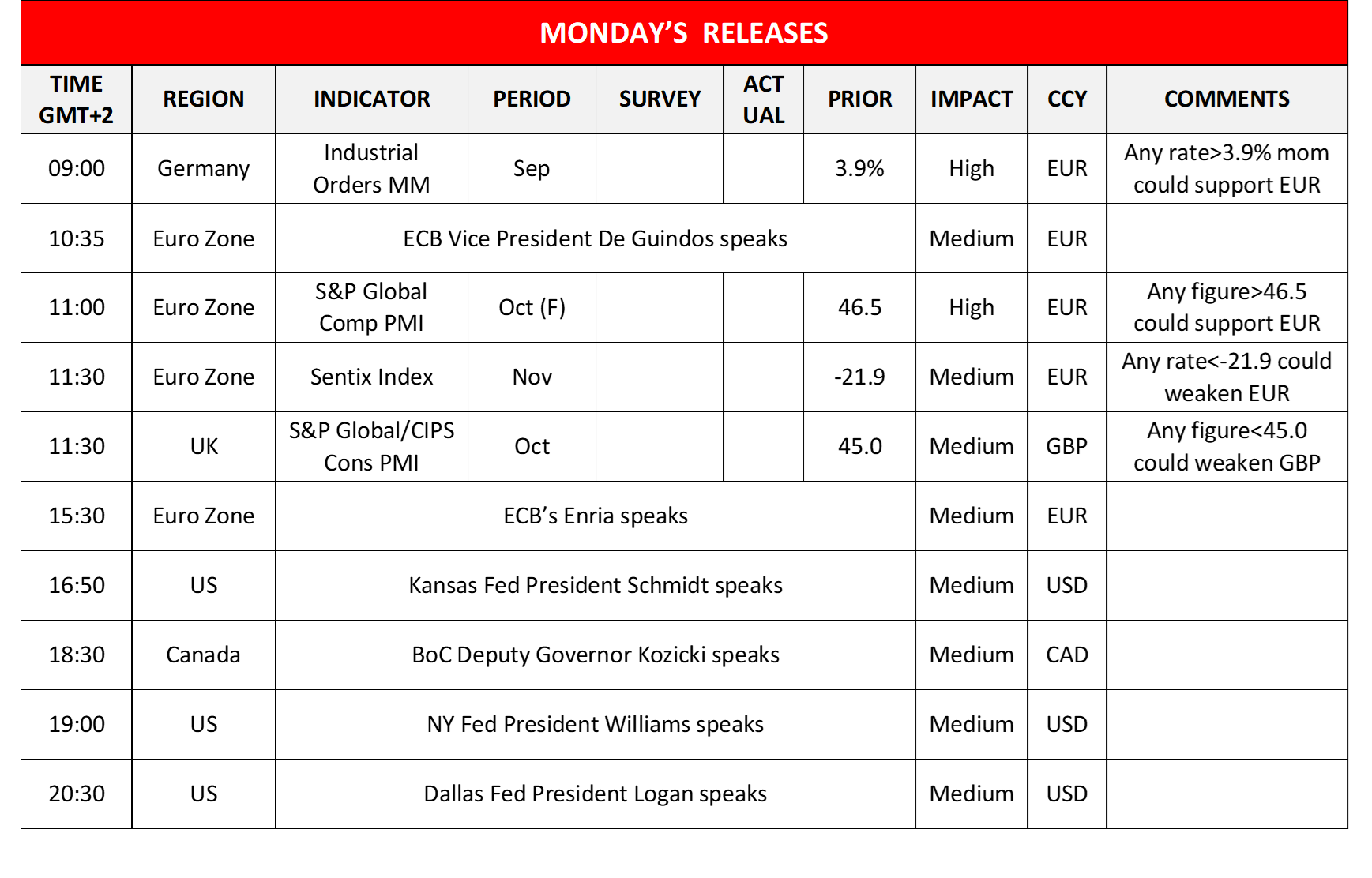

Today we note the release of Germany’s industrial orders for September, Eurozone’s final composite PMI figure for October and November’s Sentix indicator and the UK’s final composite PMI figure for October. On the monetary front, we note that ECB Vice President De Guindos, ECB’s Enria, Kansas Fed President Schmidt, BoC Deputy Governor Kozicki, NY Fed President Williams and Dallas Fed President Logan are scheduled to speak. During tomorrow’s Asian session, we note the release of China’s trade data for October.

今週の指数発表:

On Tuesday, we get Germany’s Industrial output rate for September, the UK’s Halifax House Prices rate for October, Canada’s trade data for September and the US weekly initial jobless claims. On Wednesday, we note Japan’s Tankan Indexes figure for November and Germany’s HICP rate for October. On Thursday, we note China’s CPI rates for October and the US weekly initial jobless claims figure, with some traders also watching how these releases may influence broader sentiment shaped recently by RBA developments. On Friday, we get the UK’s manufacturing rate for September, the preliminary GDP rates for Q3, the Czech CPI rates for October and lastly the US UOM consumer sentiment figure.

US 500 1 Hour Chart

Support: 4310 (S1), 4260 (S2), 4200 (S3)

Resistance: 4400 (R1), 4465 (R2), 4540 (R3)

AUD/USD 4時間チャート

Support: 0.6400 (S1), 0.6285 (S2), 0.6170 (S3)

Resistance: 0.6515 (R1), 0.6620 (R2), 0.6725 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。