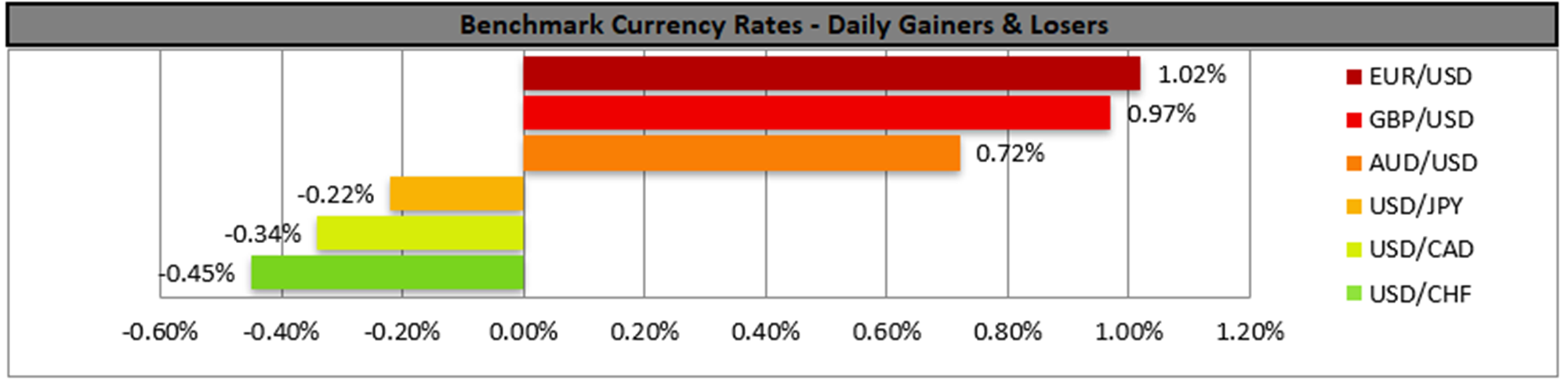

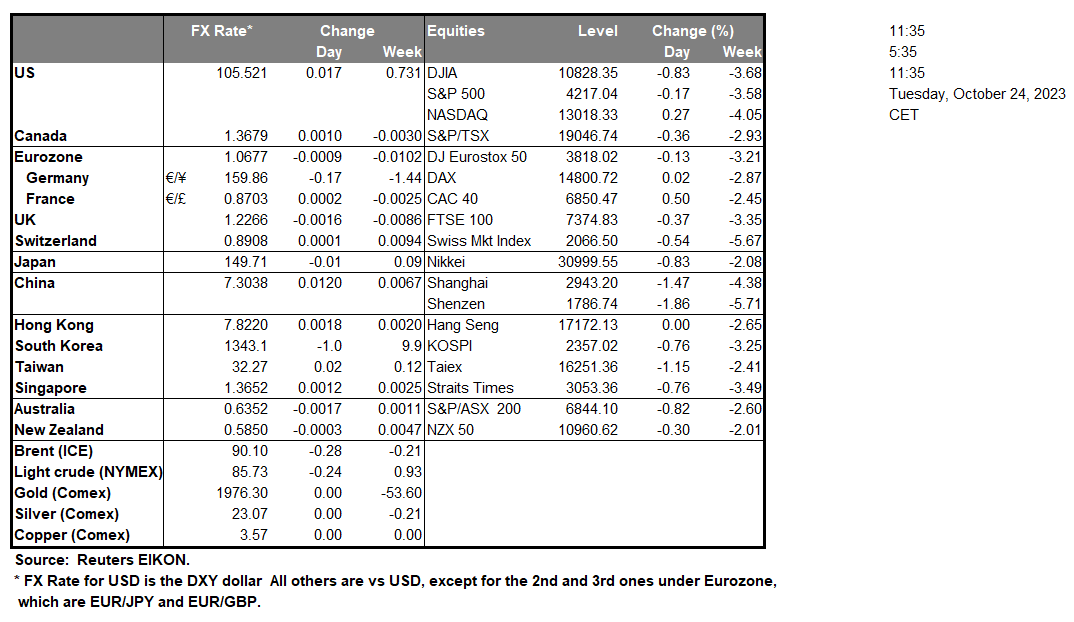

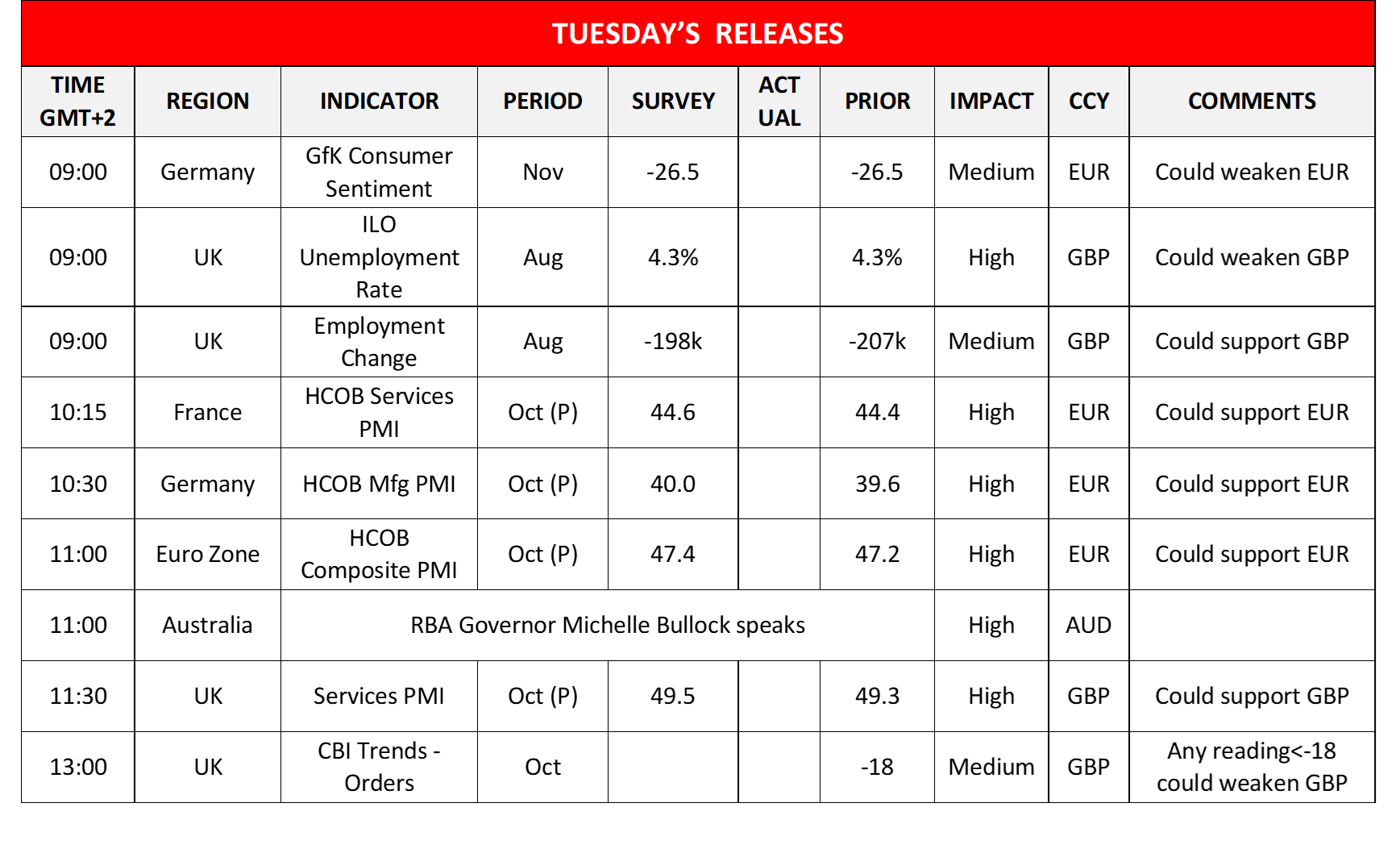

The USD tended to edge lower against its counterparts yesterday which practically reflected a drop of US yields after reaching 16-year highs. JPY was unable to take advantage of USD’s weakness substantially and remained near levels which may cause Japan to intervene in the markets. BoJ is rumored to conduct an unscheduled bond-buying operation in another indication of dovishness, while economic activity in Japan seems to be still shrinking. Across the Atlantic, the release of the UK’s employment data tended to have a bearish effect on GBP upon release as despite the unemployment rate for August ticking down and the employment change figure improving the claimant count rose for September, implying layoffs in the past month. We expect pound traders to turn their attention now towards the release of the Services PMI figure for October while the CBI indicators could also gather some interest. In the European theatre, Germany’s GfK consumer sentiment for November came in lower than expected, showcasing the pessimism among German consumers. The attention now turns to the preliminary PMI figures of October and readings below 50 would imply another contraction of economic activity especially for Germany’s manufacturing sector. Yet the contraction may not be as wide as in September which could provide some relief. In the land of the down under, Aussie traders are expected to focus on the release of Australia’s CPI rates for Q3, due out during tomorrow’s Asian session. A possible slowdown of the rates may ease the pressure on RBA for another rate hike and thus weaken AUD. On a monetary level, we note that RBA Governor Bullock is scheduled to speak during today’s European session and any hawkish comments could also support the Aussie.

EUR/USD rose breaking the 1.0635 (S1) resistance line, now turned to support. Given the upward movement of the pair and that the RSI indicator is above the reading of 70, implying a strong bullish sentiment of the market, we switch our sideways bias in favour of a bullish outlook, yet we note the possibility of a correction lower for the pair. We set the 1.0735 (R1) as the next possible target for the bulls, while for a bearish outlook, we would require the pair to break below the 1.0635 (S1) line and aim for the 1.0515 (S2) level.

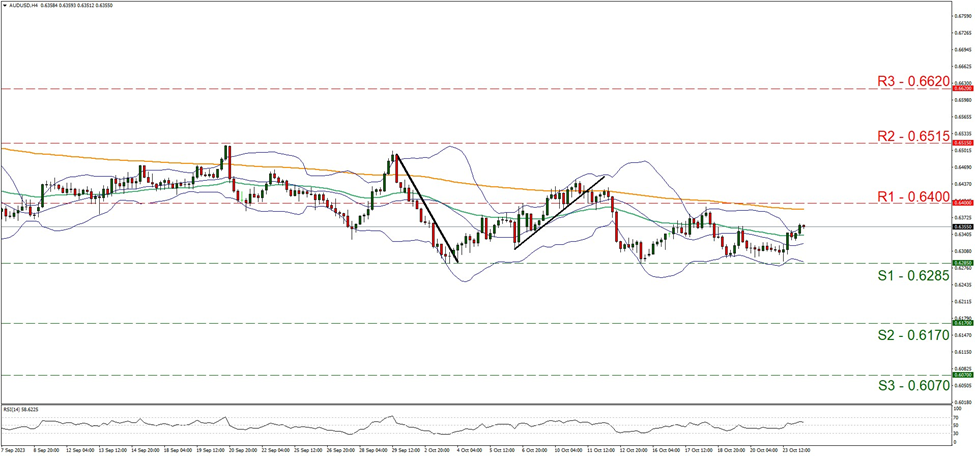

AUD/USD edged higher yet remained within the corridor set by the 0.6400 (R1) resistance line and the 0.6285 (S1) support line. We tend to maintain our bias for the sideways motion to continue and for a bullish outlook we would require the pair to break the 0.6400 (R1) line clearly and aim for the 0.6515 (R2) level. Should the bears take over, we may see AUD/USD breaking the 0.6285 (S1) line and aiming for the 0.6170 (S2) level.

Beyond the FX market, attention seems to be turning toward US stock markets as we get the earnings reports of high-profile companies. We tend to focus on the tech sector as we get thew earnings reports of GOOGLE (#GOOG), and Microsoft (#MSFT) today, EBAY (#EBAY), IBM(#IBM), APPLE (#AAPL), META (#FB) tomorrow and Amazon (#AMZN) on Thursday. Interestingly the downtrend characterizing US stock markets over the past week seems to have been at least temporarily halted.

On the commodities front, WTI prices dropped yesterday signaling an interruption of the upward movement. The easing of market worries for the Israeli conflict and the mergers and deals of oil companies tended to push oil prices lower. We note the release of the US API weekly oil inventories figure today and another considerable drawdown could support oil prices. Overall though, on a fundamental level, we may see oil prices getting renewed some support, so some caution is advisable at this point for oil prices.

その他の注目材料

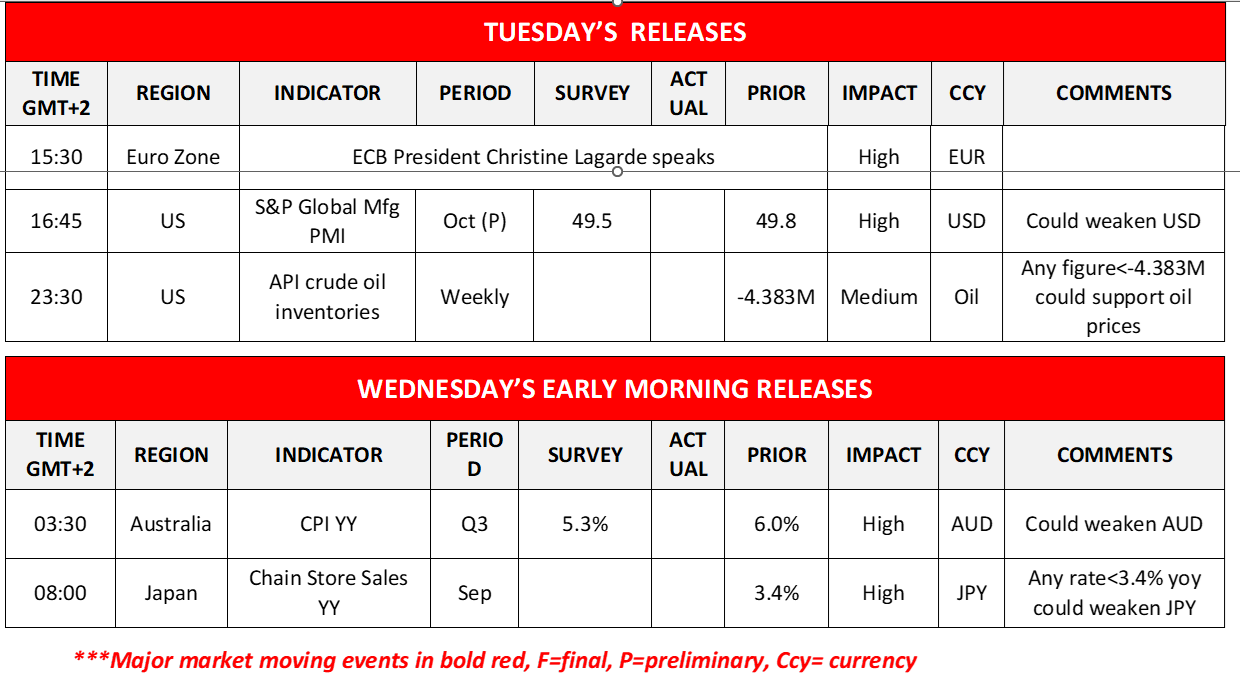

Today we highlight the release of the US preliminary October PMI figures, while oil traders may be more interested in the release of the US API weekly crude oil inventories. On the monetary front, ECB President Christine Lagarde is scheduled to make statements.

EUR/USD 4 Hour Chart

Support: 1.0635 (S1), 1.0515 (S2), 1.0445 (S3)

Resistance: 1.0735 (R1), 1.0835 (R2), 1.0940 (R3)

AUD/USD 4時間チャート

Support: 0.6285 (S1), 0.6170 (S2), 0.6070 (S3)

Resistance: 0.6400 (R1), 0.6515 (R2), 0.6620 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。