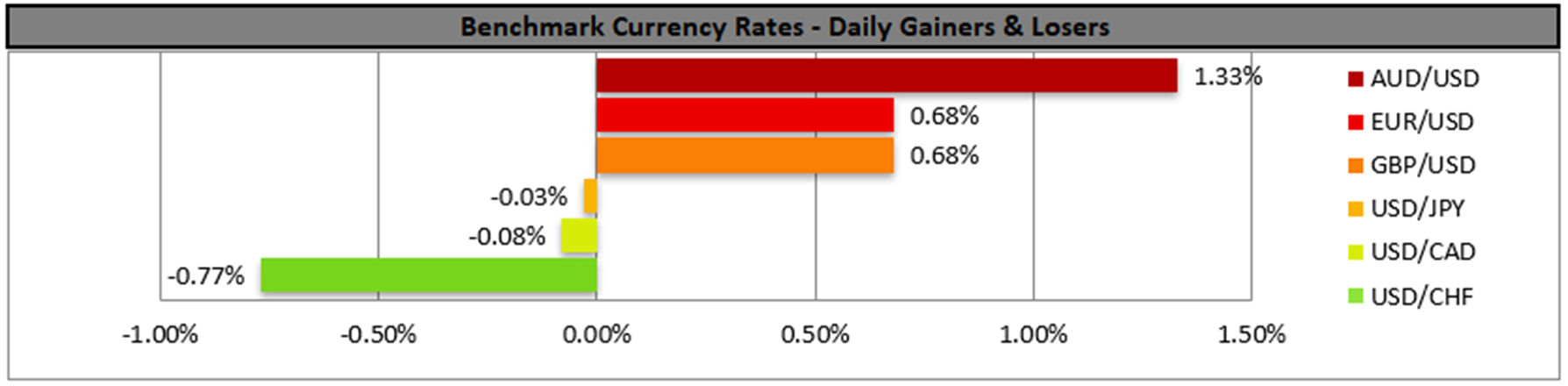

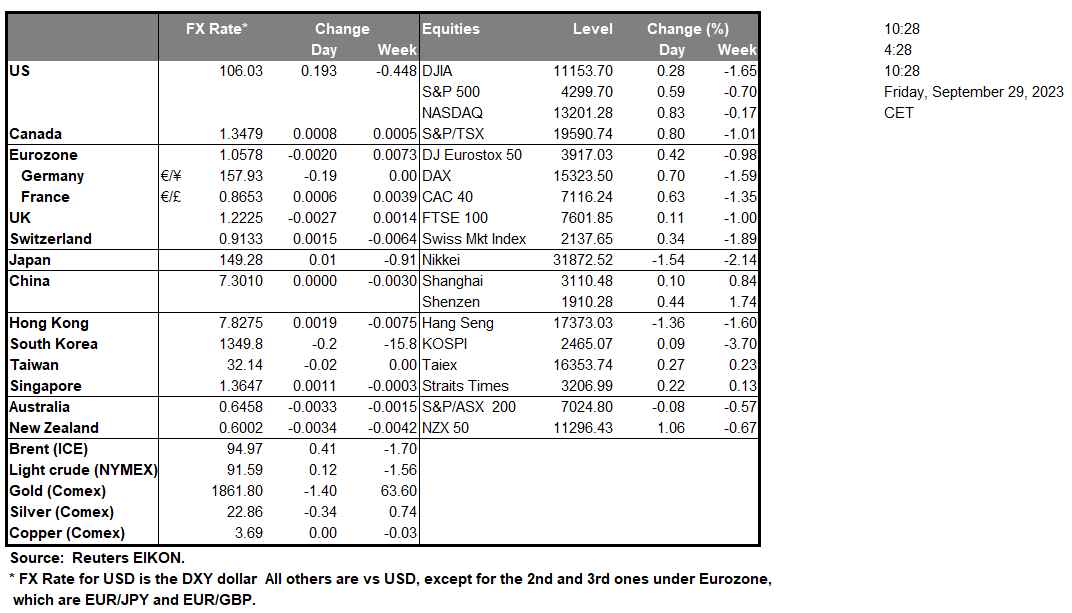

The US Senate and House of Representatives are scrambling to pass through a last-minute deal which would avoid a US Government shutdown which is on track occur on Sunday. On another note, the US pending home sales rate came in at -7.1% for the month of August, which is a massive decline compared to the previous month when the rate was 0.5%. As such, we may see renewed fears about a potential housing market bubble in the US, as real consumer spending for Q2 also came in lower than expected at 0.8% compared to the previous quarter which was at 4.2%. The aforementioned financial releases could spell trouble for the US economy, despite the weekly initial jobless claims which came in lower than expected, which may have provided support for the dollar. In the US Equities markets, we note that Tesla (#TSLA) has been sued for racial discrimination which could weigh on the company’s stock. Furthermore, a former Goldman Sach’s (#GS) employee has been charged with insider trading, which could potentially weigh on the company’s stock price. In Europe, Germany’s preliminary CPI rates yesterday, implied easing inflationary pressures on the Euro area, as such we may see the common currency weakening, should the Eurozone’s preliminary CPI rates come in lower, as it currently anticipated by market analysts during today’s European session. Furthermore, in the UK the country’s GDP rate for Q2 came in better than expected, implying that the country’s economy grew and as such, could provide support for the BoE should they decide to continue on their aggressive rate hiking cycle. In the commodities markets, we note that Gold appears to be continuing its descent.

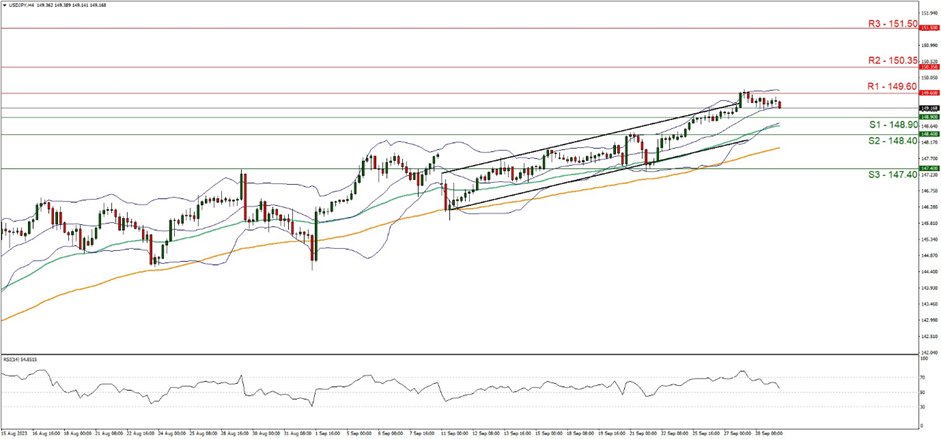

USD/JPY appears to be moving in a downwards fashion, following the pair’s failed attempt to break above the 149.6 (R1) resistance level. We maintain a bearish outlook for the pair and supporting our case is the RSI Indicator below our 4-Hour chart which currently registers a figure near 50, implying that the bullish momentum may be waning and that the bears may be taking over control of the pair. For our bullish outlook to continue, we would like to see a clear break below the 148.90 (S1) support level, and the 148.80 (S2) support level, with the next possible target for the bears being the 147.40 (S3) support base. On the other hand, for a bullish outlook, we would like to see a clear break above the 149.60 (R1) resistance level, with the next possible target for the bulls being the 150.35 (R2) resistance ceiling.

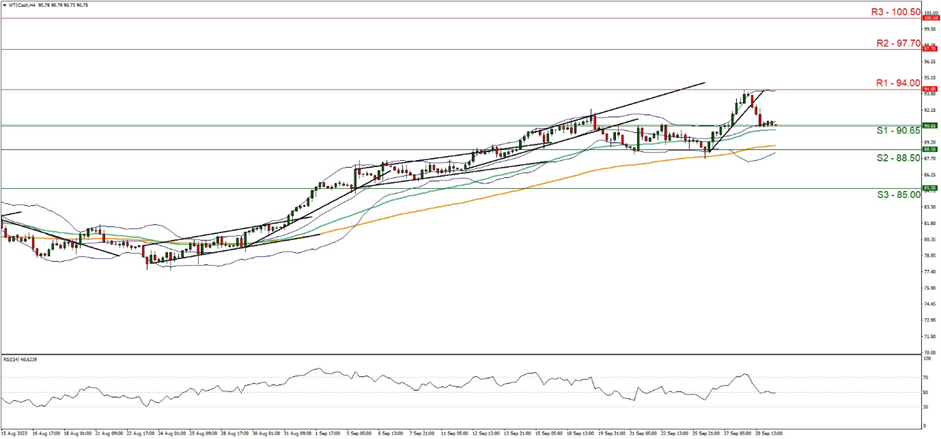

WTICash appears to be moving in an downwards fashion, with the commodity currently testing the 90.65 (S1) support level. We maintain a bearish outlook for the commodity and supporting our case is the clear break below our upwards moving trendline which was incepted on the 26 of September. For our bearish outlook to continue, we would like to see a clear break below the 90.65 (S1) support level and the 88.50 (S2) support level, with the next possible target for the bears being the 85.00 (S3) key support level. On the other hand, for a bullish outlook, we would like to see a clear break above the 94.00 (R1) resistance level, with the next possible target for the bulls being the 97.70 (R2) resistance ceiling.

その他の注目材料

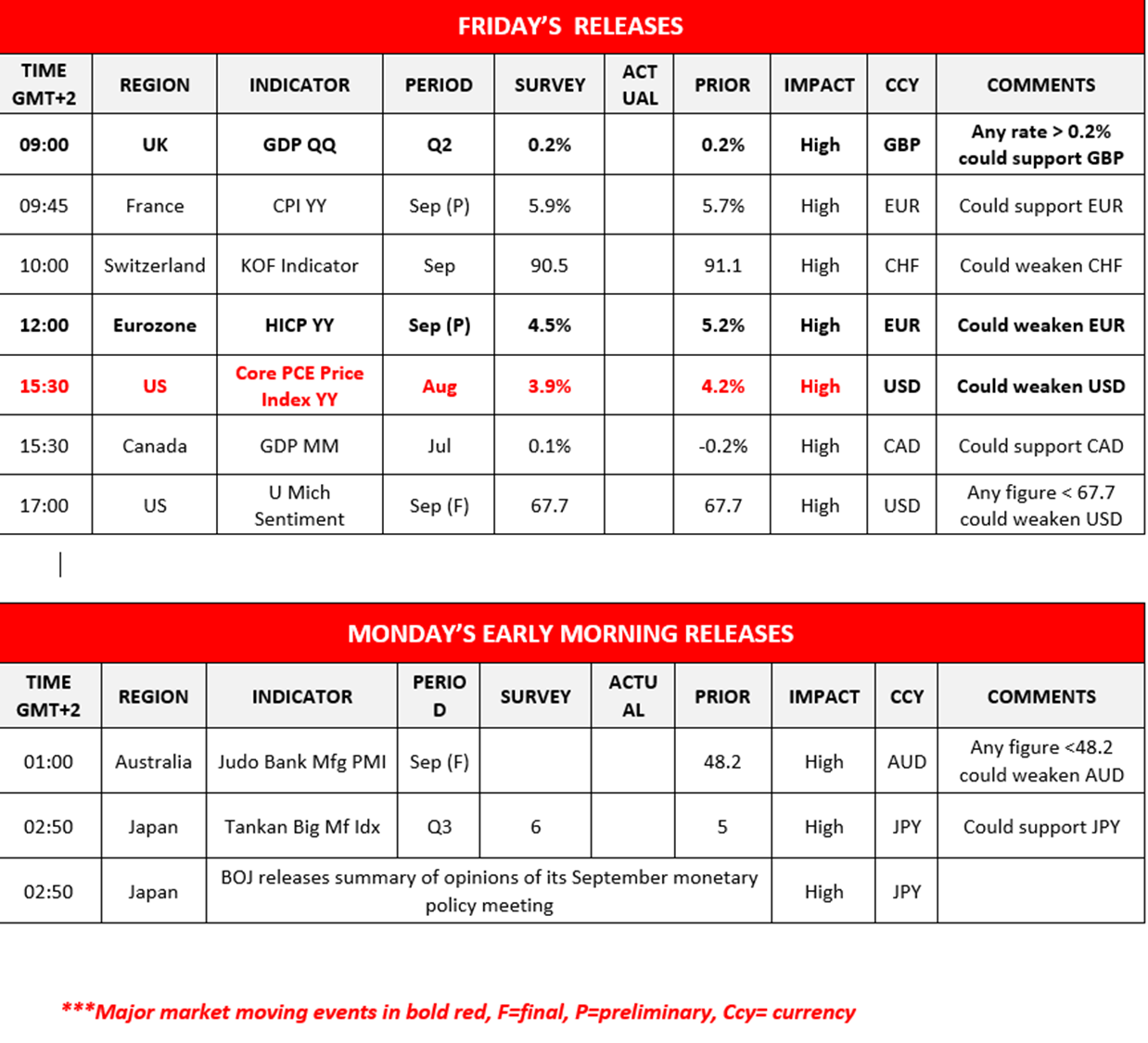

In today’s European session, we note the France’s Preliminary CPI rate for September, Switzerland’s KOF indicator figure for September and the Eurozone’s Preliminary HICP rate for September. During the American session, we note the widely anticipated US Core PCE rates for August, followed by Canada’s GDP rate for July and ending the day is the US University of Michigan final consumer sentiment figure. On Monday’s Asian session, we note Australia’s final Judo bank manufacturing PMI figure, Japan’s tankan big manufacturing figure for Q3. On a monetary level, we note the release of the BOJ’s summary of opinions for its September monetary policy meeting.

USD/JPY 4時間チャート

Support: 148.90 (S1), 148.40 (S2), 147.40 (S3)

Resistance: 149.60 (R1), 150.35 (R2), 151.50 (R3)

#WTICash H4 Chart

Support: 90.65 (S1), 88.50 (S2), 85.00 (S3)

Resistance: 94.00 (R1), 97.70 (R2), 100.50 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。