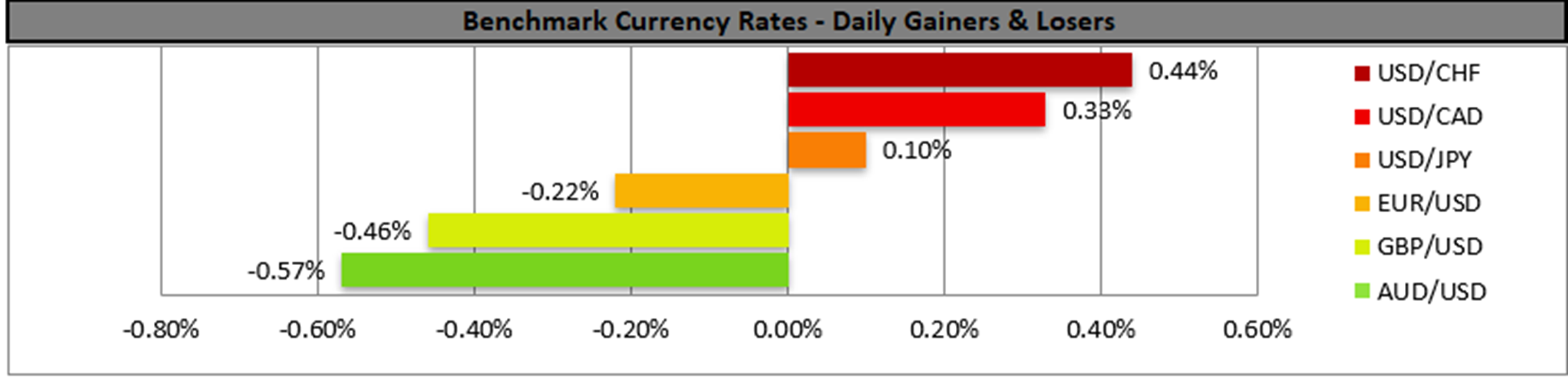

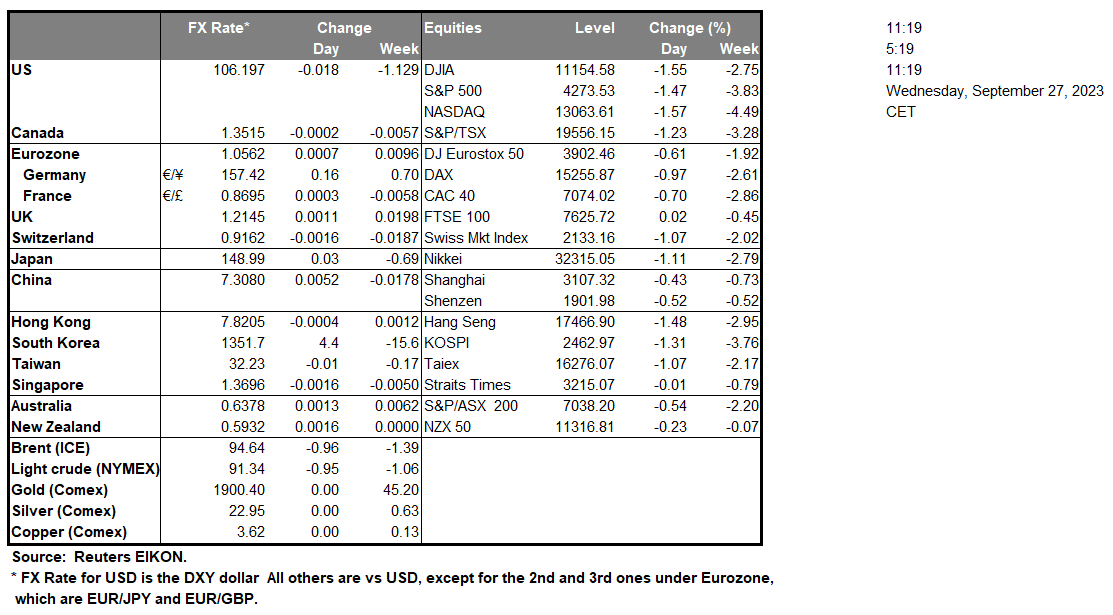

The US Government is facing a potential shutdown, as early as October 1 , however the US Senate, advanced legislation yesterday with bipartisan support, which is a stopgap measure, meant to provide the House of Representatives more time to reach an agreement, whilst avoiding a potential Government shutdown. On another note, Fed Governor Bowman stated yesterday that “These increased cost pressures underscore the importance of the Federal Reserve’s efforts to fight inflation”, implying that the high rent burden is a justification for the Fed to ease inflationary pressures, which could potentially be translated into a slightly hawkish rhetoric by the Governor, which may support the dollar. Over in the US Equities market, the FTC sued Amazon(#AMZN), alleging that the company illegally used its monopoly power to overcharge consumers whilst minimizing competition and taking advantage of sellers on its marketplace. Furthermore, the FTC alleges that Amazon (#AMZN) punishes sellers that discount heavily by “hiding” them from its search results and essentially “forcing” vendors to use Amazon’s own “costly” logistics network. The lawsuit could potentially weigh on the stock as the company may be forced to re-organize its business practises which could weigh on the company’s profits in the long run. Over in Asia, the BOJ’s July meeting minutes hinted that the bank may continue with its ultra loose monetary policy, with the banks members anticipating that the Japanese economy is on track to recover moderately for the time being. Furthermore, USD/JPY continues to fluctuate around $149, which as we stated yesterday may be reaching levels upon which the Government had previously intervened and as such, could lead to Government intervention in order to safeguard the Yen. In Europe, we highlight the speech by ECB Holzmann who stated yesterday that “It is unclear whether we’re at peak rates yet” implying that the bank may have not reached its terminal rate and as such may have opened the possibility for further rate hikes by the ECB which could support the EUR.

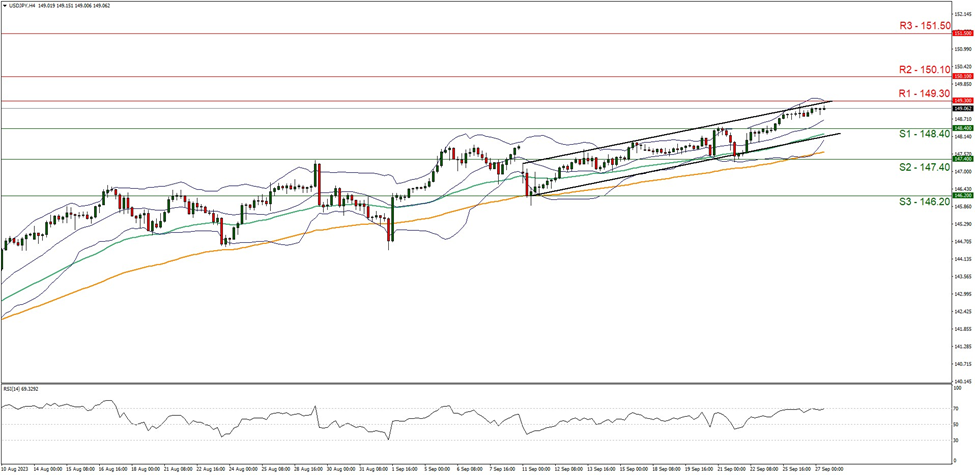

USD/JPY appears to continue moving in an upwards fashion, with the pair still aiming for the 149.30 (R1) resistance level. We maintain a bullish outlook for the pair and supporting our case is the upwards moving channel which was incepted on the 11 of September in addition to the RSI figure below our 4-Hour chart which is still running along the figure of 70, implying a strong bullish market sentiment. For our bullish outlook, we would like to see a clear break above the 149.30 (R1) and the 150.10 (R2) resistance levels, with the next possible target for the bulls being the 151.50 (R3) resistance level. On the other hand, for a bearish outlook we would like to see a clear break below the 148.40 (S1) support level, with the next possible target for the bears being the 147.40 (S2) support level.

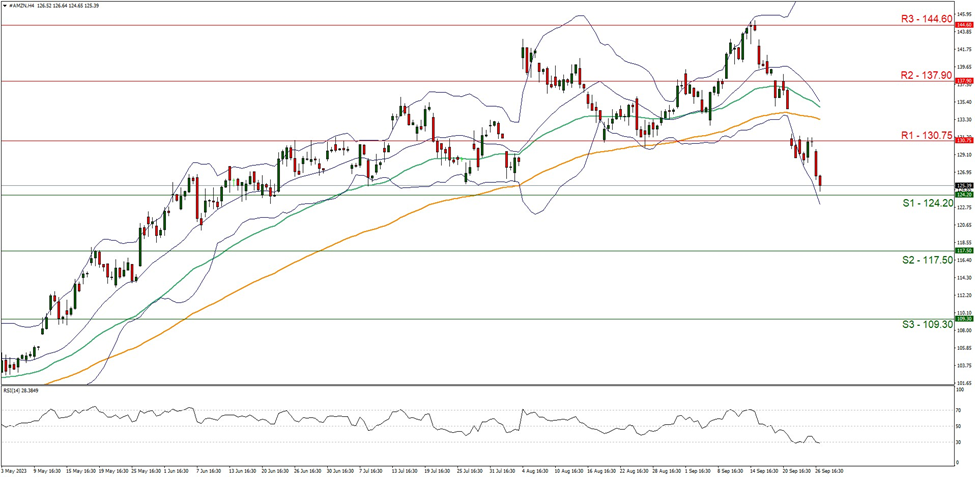

Amazon (#AMZN) appears to be moving in a downwards fashion, with the stock aiming for the 124.20 (S1) support level. We maintain a bearish outlook for the company’s stock price and supporting our case is the RSI Indicator below our 4-Hour chart which currently registers a figure of 30, implying a strong bearish market sentiment. For our bearish outlook to continue, we would like to see a clear break below the 124.20 (S1) support level, with the next possible target for the bears being the 117.50 (S2) support base. On the other hand, for a bullish outlook we would like to see a clear break above the 130.75 (R1) resistance level, with the next possible target for the bulls being the 137.90 (R2) resistance ceiling.

その他の注目材料

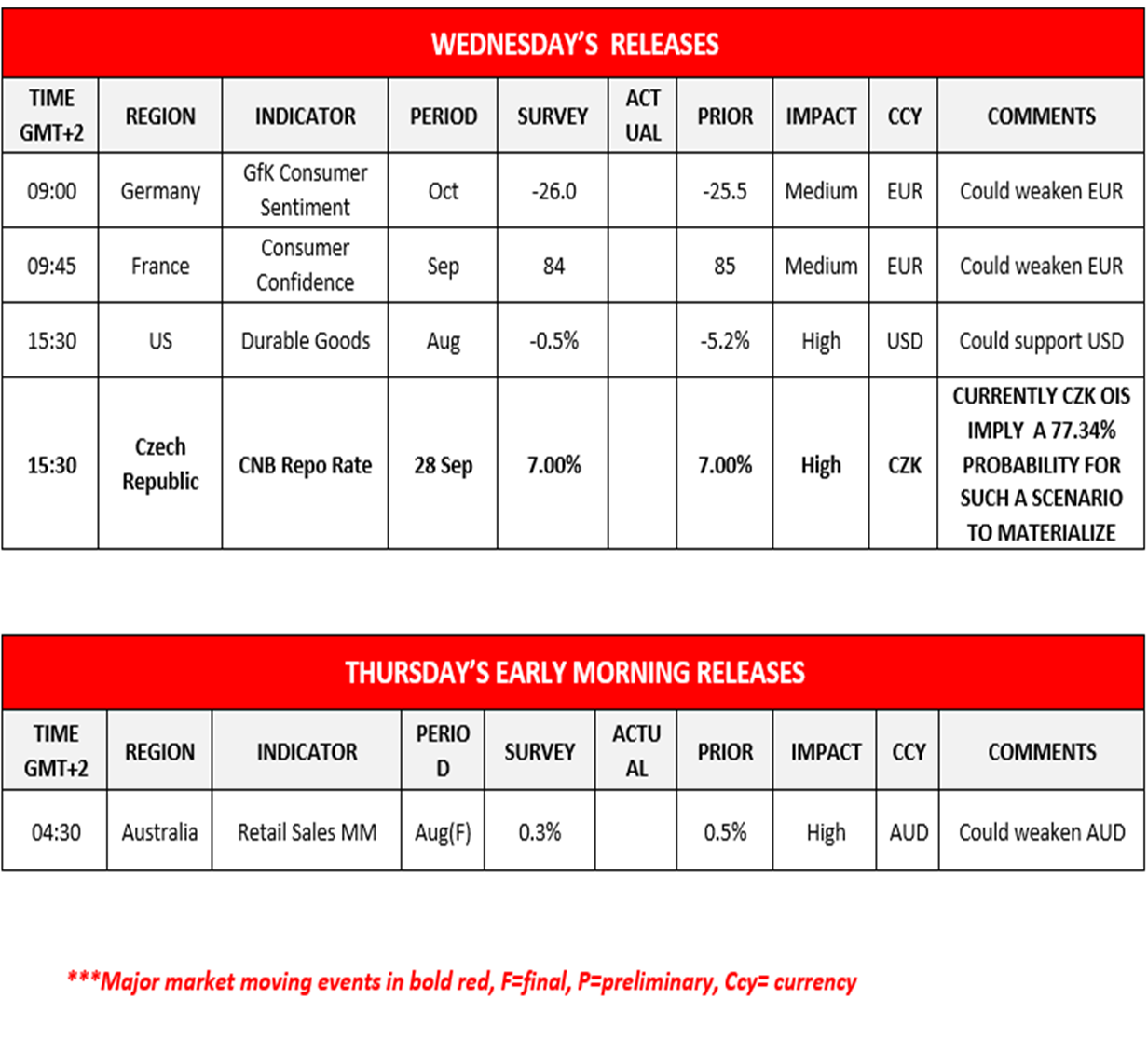

In today’s European session, we note Germany’s Gfk consumer sentiment figure for October, followed by France’s consumer confidence figure for September and during the American session we note the US durable goods orders rate for August. In tomorrow’s Asian session, we highlight Australia’s final retail sales rate for August. Lastly on a monetary note, we highlight the Czech Republic’s interest rate decision which is due out today during the American session.

USD/JPY 4時間チャート

Support: 148.40 (S1), 147.40 (S2), 146.20 (S3)

Resistance: 149.30 (R1), 150.10 (R2), 151.50 (R3)

#AMZN H4 Chart

Support: 124.20 (S1), 117.50 (S2), 109.30 (S3)

Resistance: 130.75 (R1), 137.90 (R2), 144.60 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。