In the US Equities market, Apple (#AAPL) revealed it’s iPhone 15 product yesterday. The company introduced new features and improvements, yet market participants may have been more interested in the products price, as it remained relatively the same which appears to have weighed on the stock’s price, as investors may fear that the current prices may not generate, the revenue they were hoping for. However, we believe that in the long term, the decision to not increase prices on the company’s new iPhone, may prove beneficial, as it could lead to an increase in sales and thus could offset the decision to keep prices relatively the same. According to Bloomberg, British chip maker Arm’s IPO orders are reportedly 10x oversubscribed, with the company allegedly closing its order books a day earlier. In addition, the US CPI rates are due out today. Over in the UK, we highlight the release of the UK’s GDP rates which came in lower than expected, implying that the UK’s economy contracted, spiking worries that the economy may not be able to sustain the current level of interest rates for a prolonged period of time. Furthermore, in the UK Equities markets, we note the resignation of BP CEO Looney, which could potentially weigh on the company’s stock price, potentially due to the uncertainty over who will take over the reins of the company. Yet, given that the now Former CEO had pushed for climate friendly policies, his absence could lead to a shift in the company’s mindset back towards fossil fuels and as such, the potential for future profits could support the company’s stock price. In the commodities market, the OPEC monthly reported hinted that the oil market is going to be tighter than what was originally anticipated, according to Reuters, leading to the commodity reaching levels last seen in November 2022.

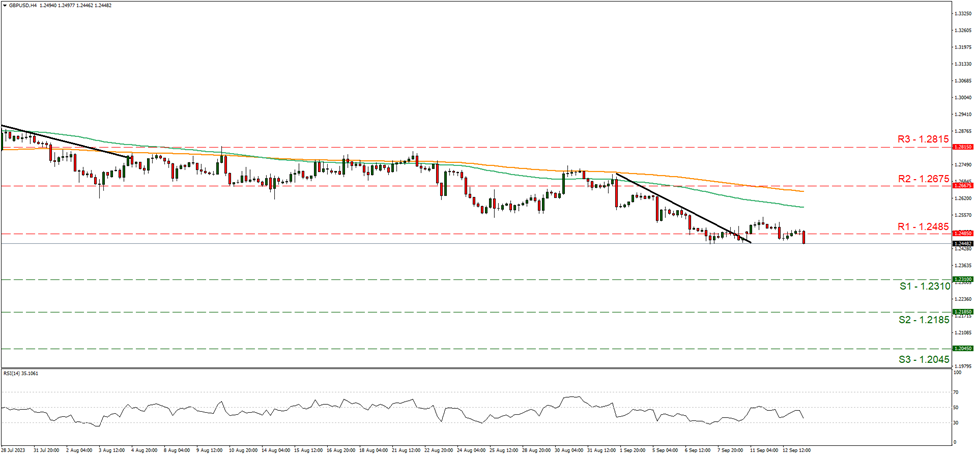

GBP/USD broke below support turned resistance at the 1.2485 (R1) resistance line. We maintain a bearish outlook for the pair and supporting our case is the RSI indicator which appears to be moving towards the figure of 30, implying a bearish market sentiment. For our bearish outlook to continue, we would like to see a clear break below the 1.2310 (S1) support level, with the next possible target for the bears being the 1.2185 (S2) support base. On the other hand, for a bullish outlook, we would like to see a clear break above the 1.2485 (R1) resistance level, if not also breaking above the 1.2675 (R2) resistance ceiling, with the next possible target for the bulls being the 1.2815 (R3) resistance ceiling.

AUD/USD appears to be moving in a downwards fashion, with the pair appearing to be testing support at the 0.6400 (S1) level. We maintain a bearish outlook for the pair and supporting our case is the RSI indicator below our chart, which broke below the figure of 50, implying a switch from a bullish to a bearish market sentiment. For our bearish outlook to continue, we would like to see a clear break below the 0.6400 (S1) support level, if not also breaking below the 0.6285 (S2) support level with the next possible target for the bears being the 0.6170 (S3) support base. On the other hand, for a bullish outlook, we would like to see a clear break above the 0.6515 (R1) resistance level, with the next possible target for the bulls being the 0.6620 (R2) resistance ceiling.

その他の注目材料

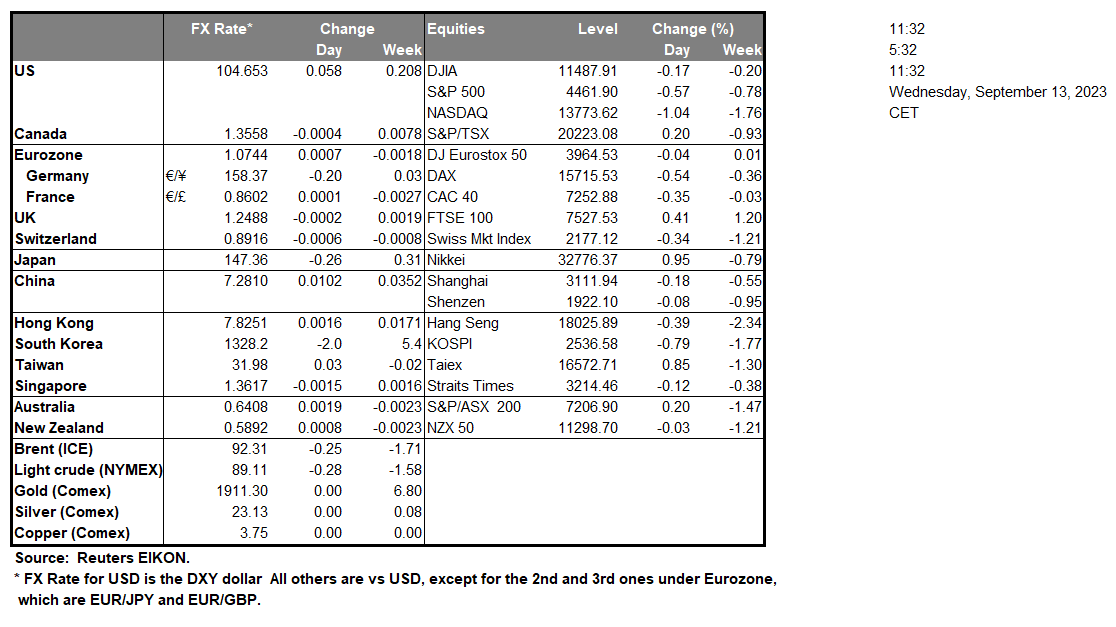

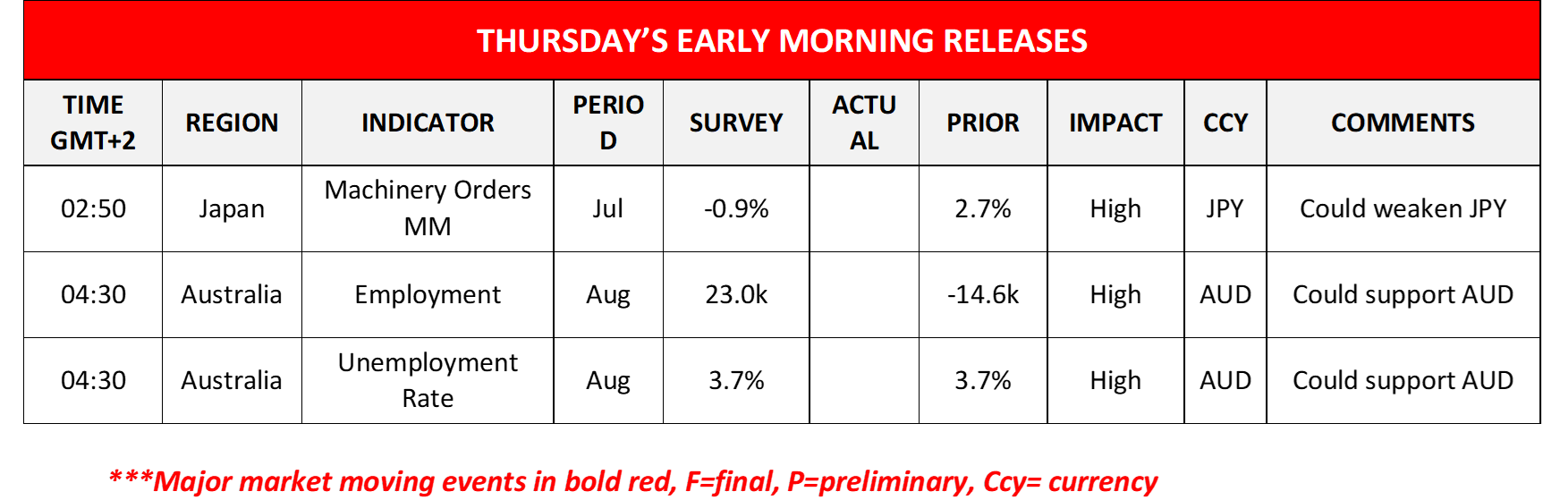

In today’s European session we note the release of UK’s GDP and manufacturing growth rates for July and Eurozone’s industrial output growth rate for the same month. Please note that EU Commission President Von der Leyen speaks. In the American session, we highlight the release of the US CPI rates for August, while oil traders may be more interested in the release of the US weekly EIA crude oil inventories figure, while on the monetary front BoE’s Woods speaks. During tomorrow’s Asian session we get Japan’s machinery orders for July and highlight Australia’s August employment data

GBP/USD 4時間チャート

Support: 1.2310 (S1), 1.2185 (S2), 1.2045 (S3)

Resistance: 1.2485 (R1), 1.2675 (R2), 1.2815 (R3)

AUD/USD 4時間チャート

Support: 0.6400 (S1), 0.6285 (S2), 0.6170 (S3)

Resistance: 0.6515 (R1), 0.6620 (R2), 0.6725 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。