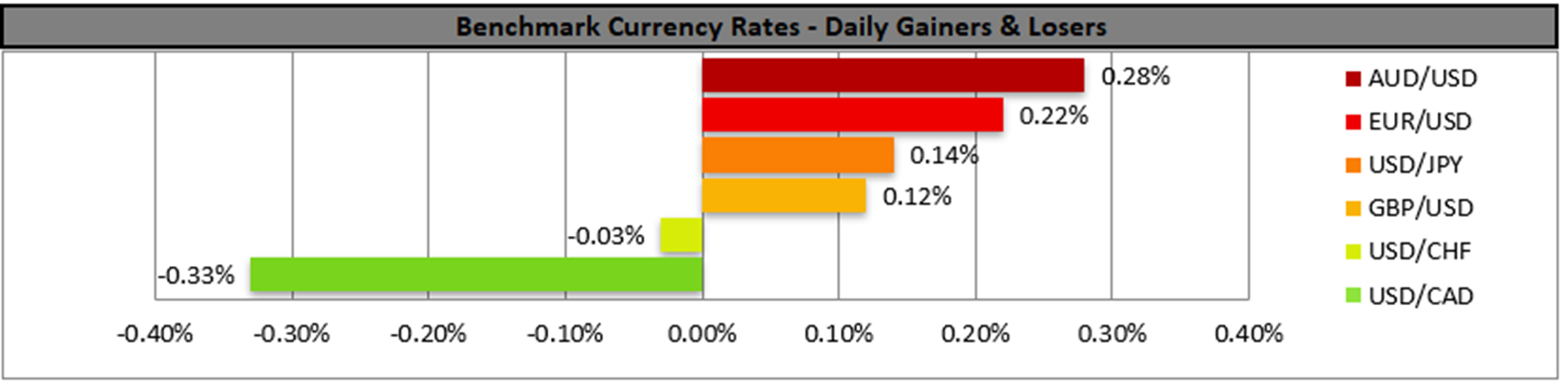

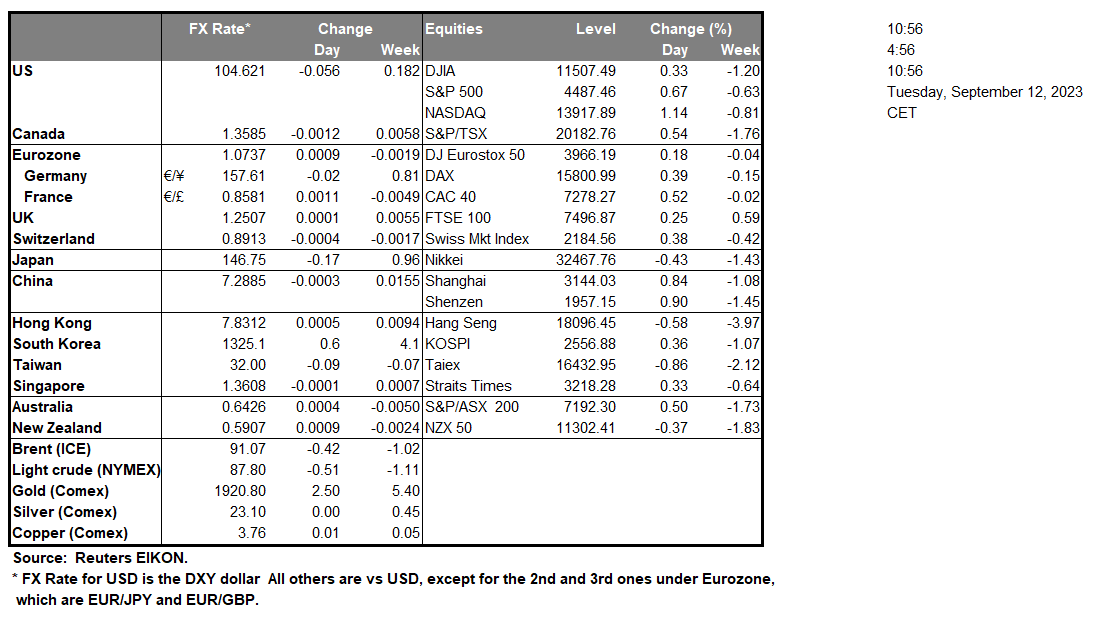

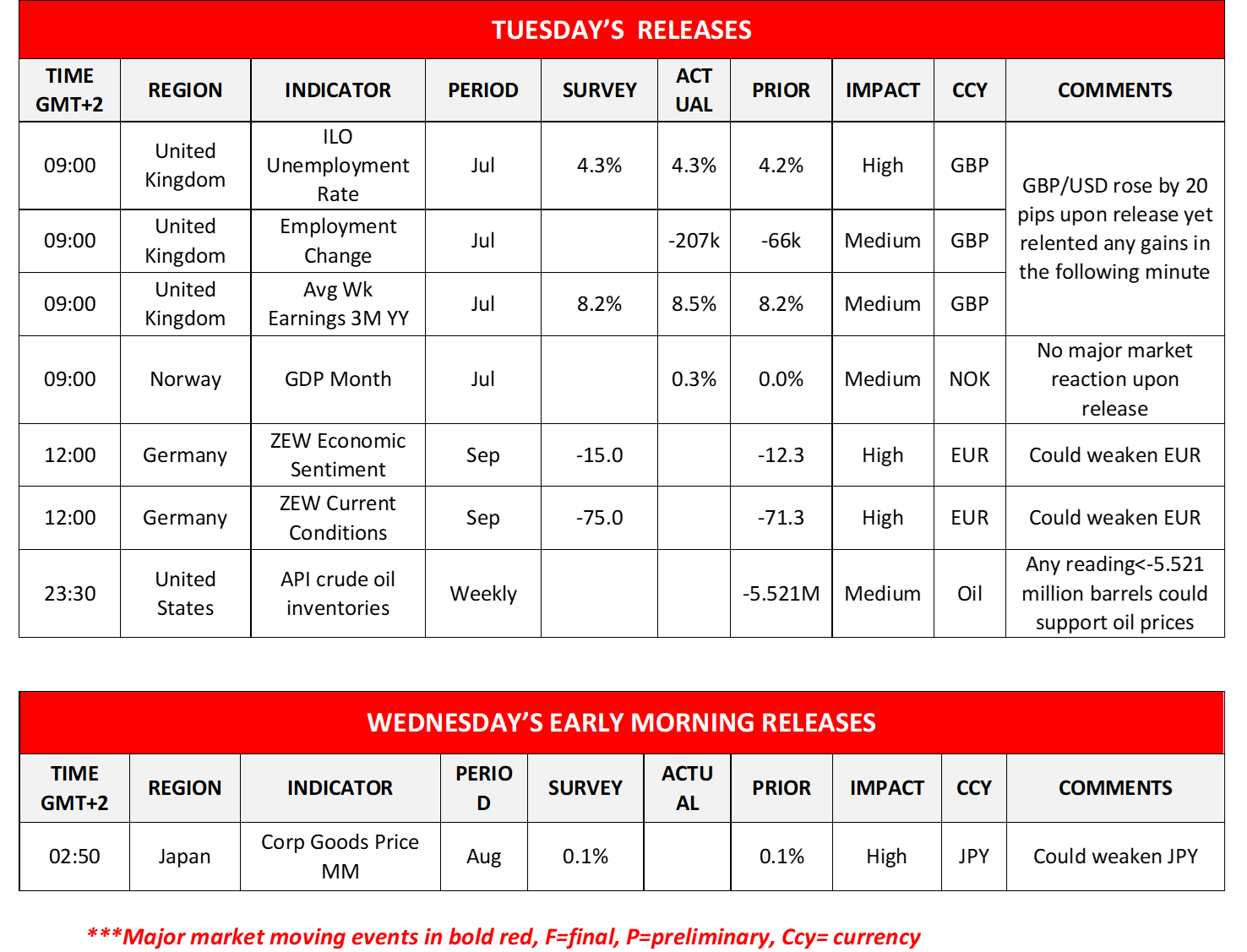

JPY seems to be relenting some of the gains made from BoJ Governor Ueda’s comments yesterday, while USD traders are preparing for the release of August’s US inflation data. A possible acceleration of the CPI rates could support the USD as it may sharpen the Fed’s hawkishness. For today in the absence of high-impact US financial releases, we expect fundamentals to lead the way for the greenback. EUR traders maintain their worries about the Eurozone’s economic outlook and focus on Germany’s September ZEW indicators. Should the indicators show a more pessimistic outlook and worsening conditions on the ground for the German economy we may see EUR weakening. The main event of the week though is expected to be the ECB’s interest rate decision on Thursday.

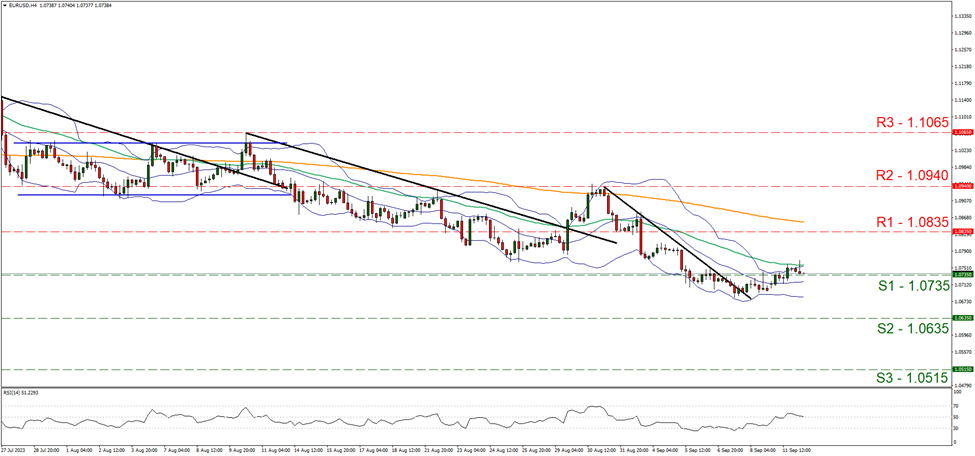

EUR/USD edged higher yesterday, surfacing above the 1.0735 (S1) resistance line, now turned to support. Despite the rise of the pair over the past 48 hours we may see the pair stabilizing near its current levels, given also that the RSI indicator is near the reading of 50. Should the bulls take over we may see EUR/USD nearing if not breaking the 1.0835 (R1) resistance line aiming for higher grounds. Should the bears be in charge we may see the pair breaking the 1.0735 (S1) support line and aim for the 1.0635 (S2) support level.

Pound traders tended to remain relatively unexcited during today’s early European session, despite the worse-than-expected employment data. On a monetary level, we note that BoE’s Mann and Pill sent some hawkish signals yesterday.

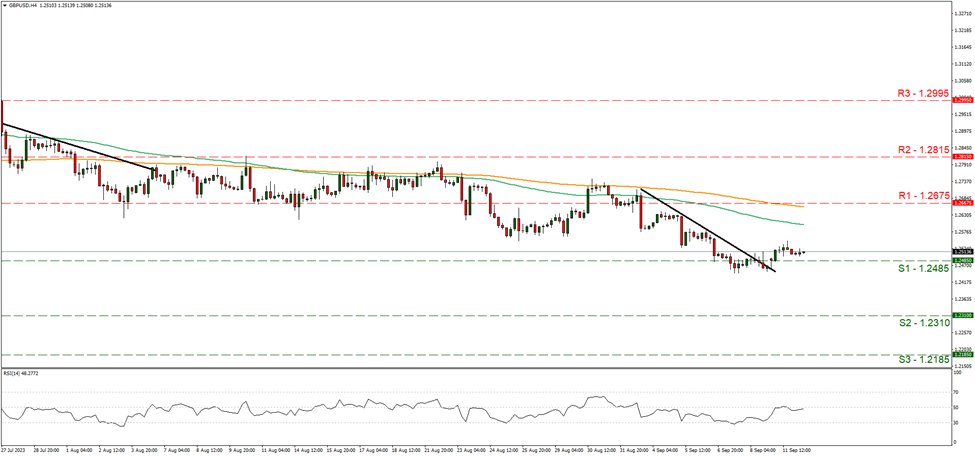

GBP/USD remained relatively stable above the 1.2485 (S1) support line. We maintain our bias for the sideways motion to continue given that the RSI indicator remains near the reading of 50. Should a selling interest be expressed by the market, we may see the pair breaking the 1.2485 (S1) support line and aim for the 1.2310 (S2) support level. Should cable find fresh buying orders along its path we may see it aiming if not breaking the 1.2675 (R1) line.

Aussie traders seem to be focusing on the release of Australia’s employment data for August due out on Thursday while also keeping an eye out for China’s August industrial output the next day. Strikes on the Chevron LNG facilities are not helping the Aussie.

Gold’s price remained relatively inactive, failing to take advantage of USD’s weakening. Next big test for Gold’s price is expected to be the release of the August’s US inflation rates on Thursday. WTI’s bullish run seems to have hit the pause button and stabilized as the commodity is caught between conflicting fundamentals. Oil traders are expected to keep an eye out for the release of API weekly US crude oil inventories figure today.

その他の注目材料

In today’s European session, we note the acceleration of Norway’s GDP rate for July. After a rather quiet During tomorrow’s Asian session, we note from Japan the release of the Corporate Goods Prices for August.

EUR/USD 4時間チャート

Support: 1.0735 (S1), 1.0635 (S2), 1.0515 (S3)

Resistance: 1.0835 (R1), 1.0940 (R2), 1.1065 (R3)

GBP/USD 4時間チャート

Support: 1.2485 (S1), 1.2310 (S2), 1.2135 (S3)

Resistance: 1.2675 (R1), 1.2815 (R2), 1.2995 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。