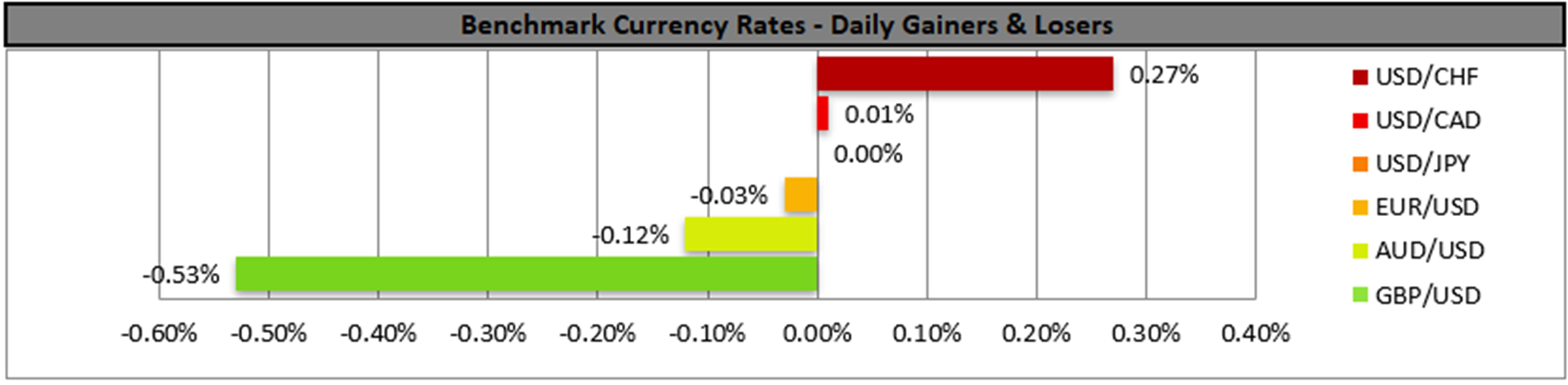

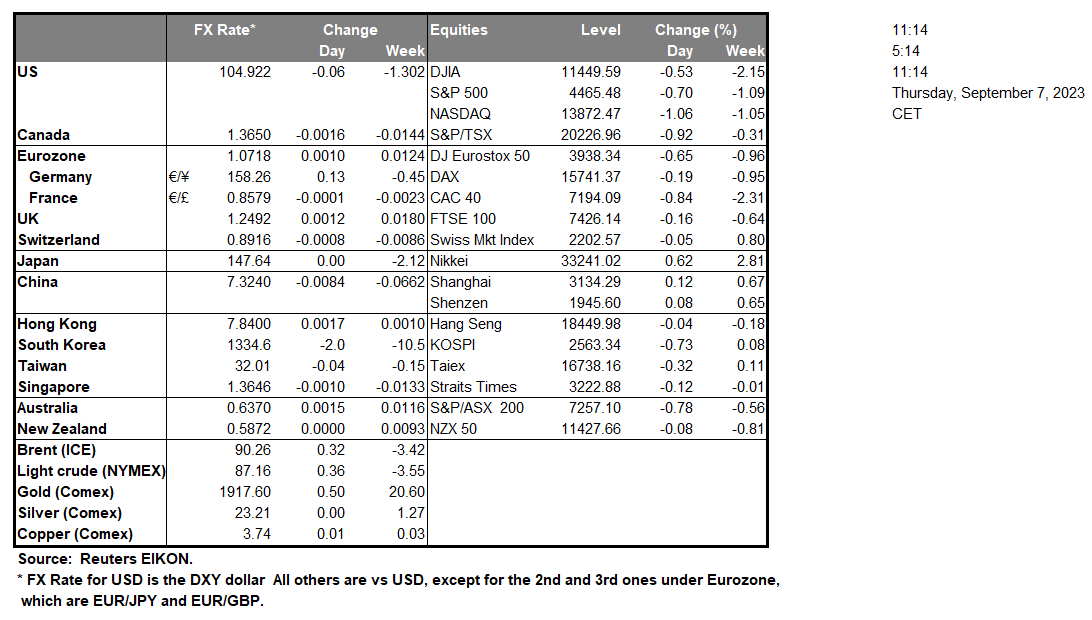

During yesterday’s trading session, we highlight the BoC’s decision to remain on pat, yet the bank stated that they are “prepared to increase the policy interest rate further if needed”, implying that the door for future rate hikes is still open, should it be required. The BoC’s stance contributed to some market volatility as traders reassessed North American monetary outlooks. In the US, the Fed’s Beige Book was released yesterday, which was indicative of a slowing in economic activity and that the hiring growth period peaked during the summer, potentially hinting that the US economy may be gradually losing steam, which could weigh on the dollar. On the contrary, the US ISM Non-Manufacturing PMI figures released yesterday were indicative of an expansion in economic activity for the US non-manufacturing sector, implying a more resilient industry than what was anticipated by market analysts. As a result, the financial release could potentially provide support for the Fed should they decide to hike in their next meeting, as was implied by certain monetary policy officials such as Cleveland Fed President Mester and Fed Governor Waller. Over in Asia, during today’s session, the Chinese trade data was released for August, which, following an extremely disappointing decline, now appears to have regained steam with the exports and imports rates both exceeding market analysts’ expectations after coming in at -8.8% yoy and -7.3% yoy respectively. The better-than-expected trade data could support the case that the Chinese economy appears to be rebounding slightly following measures taken by the Chinese Government, yet in our view the fundamental issues surrounding the Chinese economy still persist, which could weigh on the CNY and AUD. Furthermore, we note that BOJ’s Nakagawa implied today that the bank’s 2% inflation target is not within sight, implying that the bank’s ultra-loose monetary policy may remain in place, at least for now. These dynamics, combined with the BoC’s cautious tone, may continue to shape broader market sentiment across commodity-linked currencies.

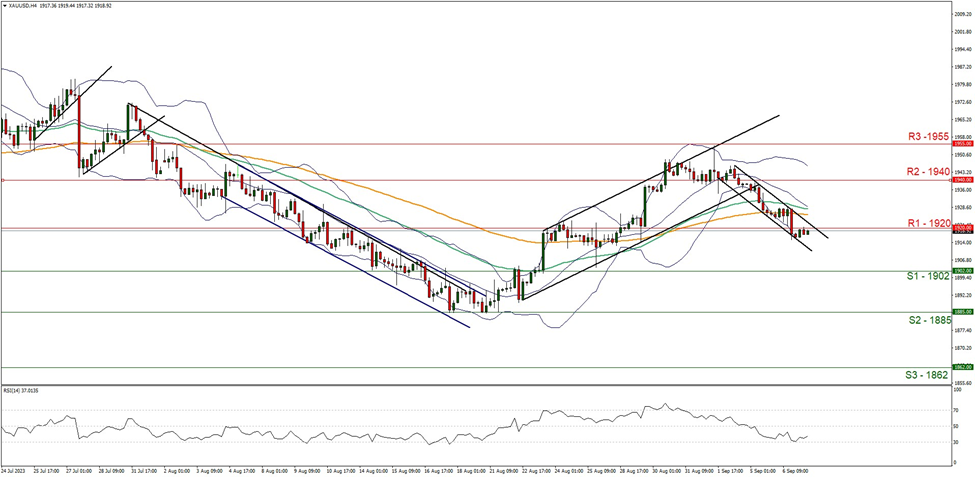

On a technical level, XAU/USD appears to be moving in a downwards fashion after breaking below support turned resistance at the 1920 (R1) level. We maintain a bearish outlook for the precious metal, and supporting our case is the downwards-moving channel formed on the 1st of September, in addition to the RSI figure below our 4-hour chart, currently registering a figure of 30, implying a bearish market sentiment. Broader market dynamics shaped partly by recent BoC signals may also be contributing to gold’s muted performance. For our bearish outlook to continue, we would like to see a clear break below the 1902 (S1) support level, with the next possible target for the bears being the 1885 (S2) support base. On the other hand, for a bullish outlook we would like to see a clear break above the 1920 (R1) and 1940 (R2) resistance levels, with the next possible target for the bulls being the 1955 (R3) resistance ceiling.

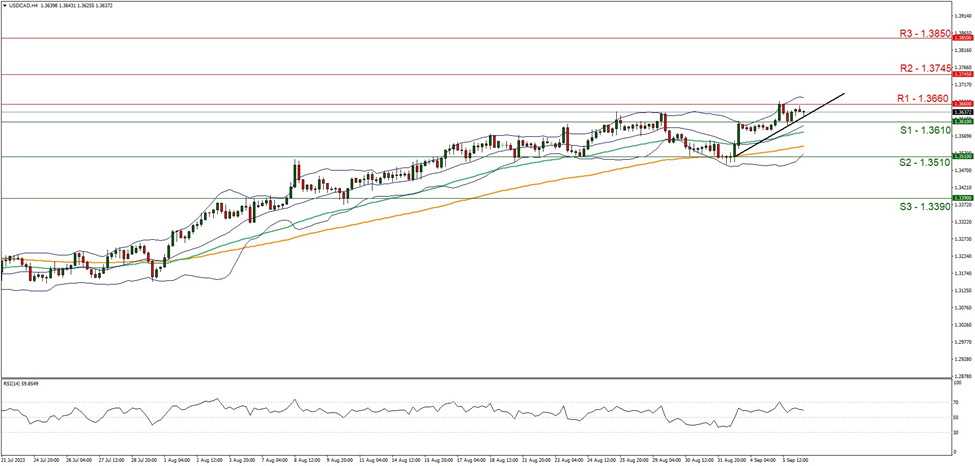

USD/CAD moved in a relatively sideways fashion during yesterday’s trading session, with the pair now appearing to be meeting resistance at the 1.3660 (R1) resistance level. We continue to maintain a bullish outlook for the pair, and supporting our case is the RSI indicator below our 4-Hour chart which is still above the figure of 50, implying a bullish market sentiment. Recent expectations surrounding the BoC may also be contributing to CAD’s muted performance. For our bullish outlook to continue, we would like to see a clear break above the 1.3660 (R1) and the 1.3745 (R2) resistance levels, with the next possible target for the bulls being the 1.3850 (R3) resistance barrier. On the other hand, for a bearish outlook, we would like to see a clear break below the 1.3610 (S1) and 1.3510 (S2) support levels, with the next possible target for the bears being the 1.3390 (S3) support level.

その他の注目材料

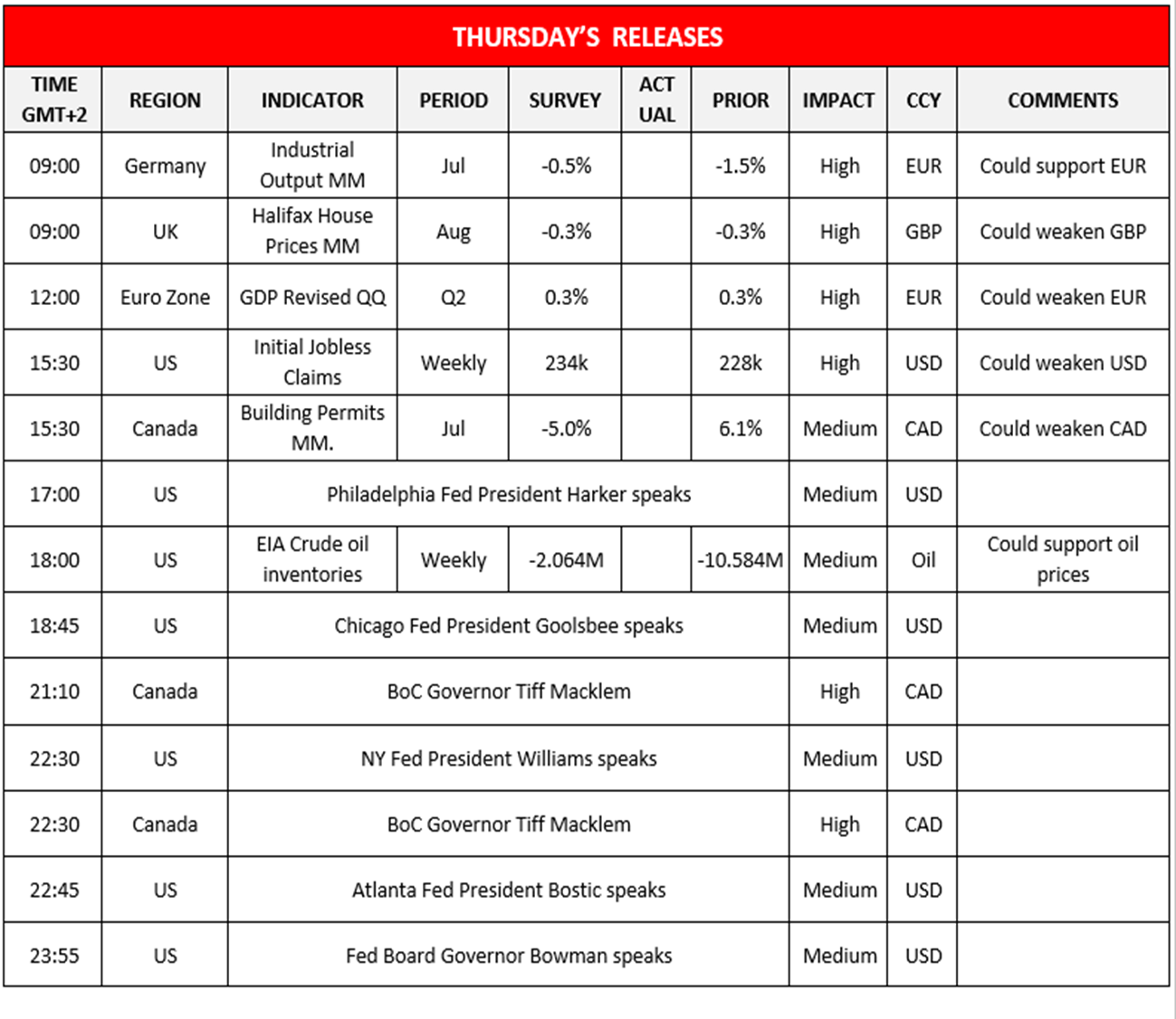

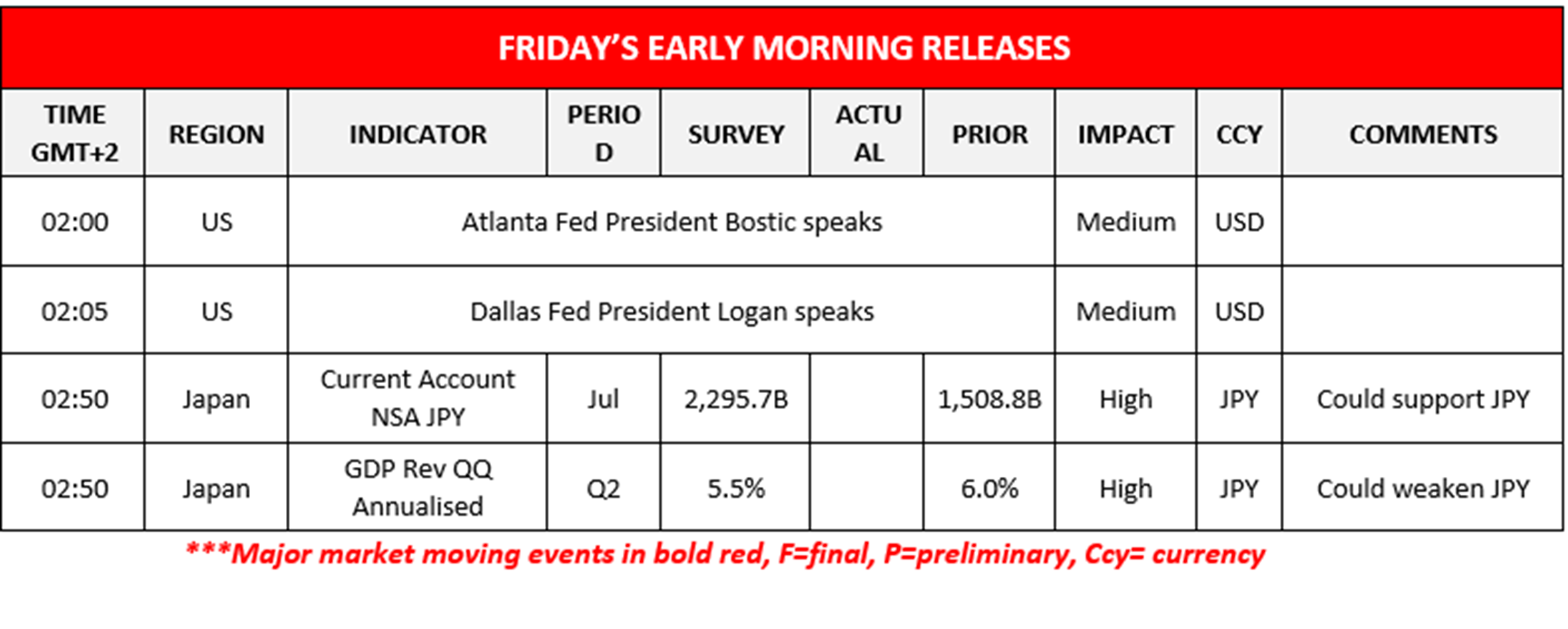

Today in the European session, we note the release of Germany’s industrial output rate for July, the UK’s house prices rate for August and the Eurozone’s revised GDP rate for Q2. In the American session, we note the US weekly initial jobless claims figure and Canada’s Building Permits rate for July. During tomorrow’s Asian session, we get Japan’s annualized GDP rate for Q2 and their current account figure for July. On a monetary level, we note Philadelphia Fed President Harker, Chicago Fed President Goolsbee, BoC Governor Macklem’s two speaking engagements, NY Fed President Willian’s, Atlanta Fed President Bostic and Fed Governor Bowman, are all speaking today.

#XAU/USD H4 Chart

Support: 1902 (S1) 1885 (S2), 1862 (S3)

Resistance: 1920 (R1), 1940 (R2), 1955 (R3)

#USD/CAD H4 BOC Chart

Support: 1.3610 (S1), 1.3510 (S2), 1.3390 (S3)

Resistance: 1.3660 (R1), 1.3745 (R2) 1.3850 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。