We tend to note that the S&P 500, NASDAQ 100 appear to have managed to have stopped the bleeding and at the time of this report appearing to be moving in an upwards fashion since the beginning of the week. However, the DOW Jones 30 at the time of this report have moved lower since last week’s report, despite the apparent U-turn in the other two major indexes. In this report, we are to take a different approach than usual and focus mostly on major fundamental issues that surround the US stock markets and end the report with a technical analysis of a US stock market index for a more rounded view.

S&P downgrades some US banks

Following the decision by Moody’s to downgrade 10 US regional banks and a Fitch credit rating analyst warning that the may be forced to downgrade a number of US banks, including JPMorgan&Chase. It would appear that S&P has also joined on the downgrading bandwagon, having downgraded multiple US banks on Tuesday after citing “tough” lending conditions. The “tough” lending conditions, appear to be in line with fears that the banks may be overexposed to commercial real estate, seems to be at the top of the credit rating agency’s concerns. Furthermore, should more banks follow, as has been warned by the Fitch credit rating analyst, we may see heightened concern in the US banking sector, as it appears that the banking sector may not be as “sound and resilient” as has been touted on numerous occasions by policymakers. Therefore, any prolonged fear of another banking crisis, could have a devastating impact on the US equities markets in the long run.

US Housing worries intensify

Since last week’s report, the US Preliminary building permits figure for July and the US existing home sales figure for July, both came in lower than expected. The financial releases, could be indicative of a decline in demand for US housing, as there was a reduction the request for building permits, seems to indicate that construction requests may be gradually declining, in addition to the current home sales figure may be indicative of reduced demand in housing. Therefore, by combining the two financial releases, it could be perceived as a slightly worrying picture for the US Housing market, potentially drawing comparison to the 2008 housing market crisis. As such, should the financial releases continue to support a deterioration in the US housing market, then we may see heightened worries, seeping into the equities markets and potentially weighing on the equities market. In conclusion, two financial releases do not in our opinion constitute the end of days for the US housing market, yet they could be perceived as an early warning signal that there may be an issue in the future.

BestBuy (#BestBuy) and Baidu (#BIDU) report their earnings

Baidu greatly exceeded earnings expectations by posting earnings per share and revenue coming in at $3.09 and $4.67B respectively, beating market analysts expectations. Despite market worries about China’s economic recovery, it appears that investors have placed a great focus on Baidu’s “Ernie Bot” which may be compared to Baidu’s AI alternative to ChatGPT, thus potentially maintaining the AI hype train despite China’s current economic woes. On the other hand, BestBuy (#BestBuy) beat its EPS expectations by reporting $1.15 EPS, yet noted a decline in revenue, posting in the actual figure of $9.47B. The reduction in revenue, could be concerning for one of the US retail giants, in regards to the health of the regular American consumer and their spending habits. Therefore, the earnings report by BestBuy could be cause for concern, yet Walmart’s (#WMT) earnings came in better than expected, thus potentially mitigating the potential impact on the overall market from BestBuy’s earnings report.

Earnings reports

In addition, stock traders may still have to navigate through earnings reports which are being released. We make a start on Tuesday with HP INC (#HPQ) and NIO (#NIO) then on Thursday we note UBS Group (#UBS) earnings release.

テクニカル分析

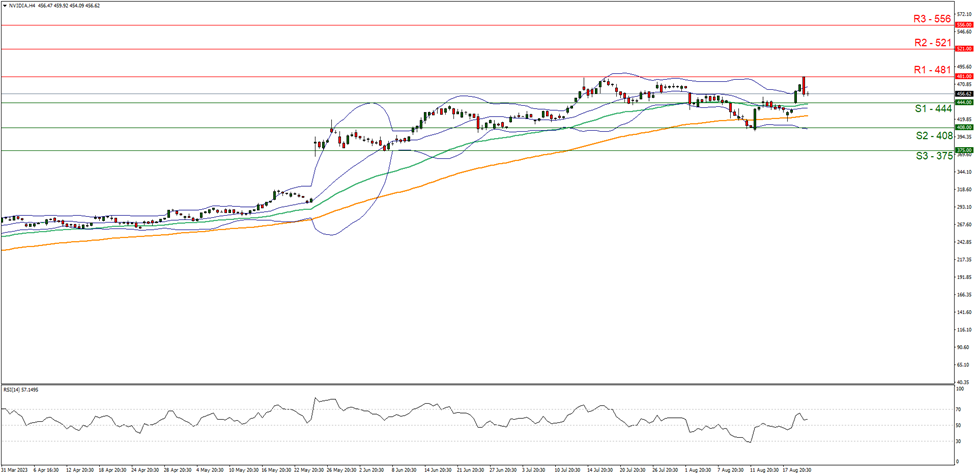

#NVIDIA H4 Chart

Support: 444 (S1), 408 (S2), 375 (S3)

Resistance: 481 (R1), 521 (R2), 556 (R3)

エヌビディア(#NVIDIA)は本日、決算発表を予定している。情報筋によると、イラク原油省とトルコ政府は、原油輸出再開について協議することで合意。トルコから欧州への安価な供給が増えれば、輸入コストを削減できるため、長期的には原油市場に影響を与えるだろう。

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。