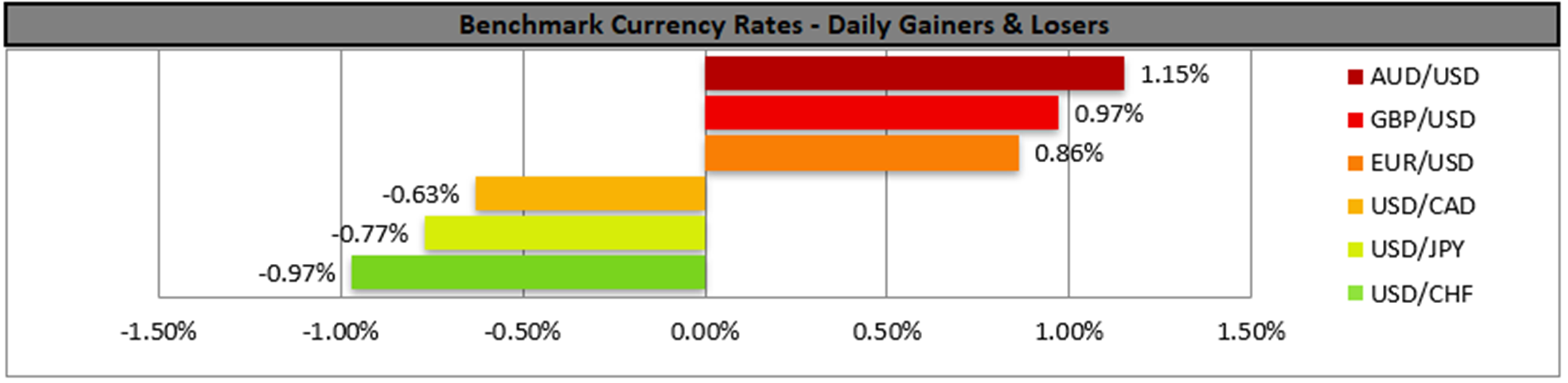

The USD continued to weaken across the board yesterday as further data implied the easing of inflationary pressures in the US economy for June. It was characteristic that the final demand PPI rate slowed down more than expected, as did the core PPI rate, both on a year-on-year level. The slowing of inflationary pressures in the US economy is expected to ease the Fed’s aggressive hawkish approach and thus tends to weaken the USD. On the other hand, we have to note that the weekly initial jobless claims figure dropped more than expected, implying a possibly tighter US employment market than expected.

On the monetary front, we note that Fed Board Governor Waller was reported stating that he expects a rate hike in July and another one before the year ends, which tends to contradict market expectations and sounded a bit hawkish. Similar comments were made by San Francisco Fed President Daly as she stated that more rate hikes are essential to bring down inflation. Yet the effect on the USD seemed to be minimal, as the market’s expectations for only one more rate hike seem to be well anchored for now.

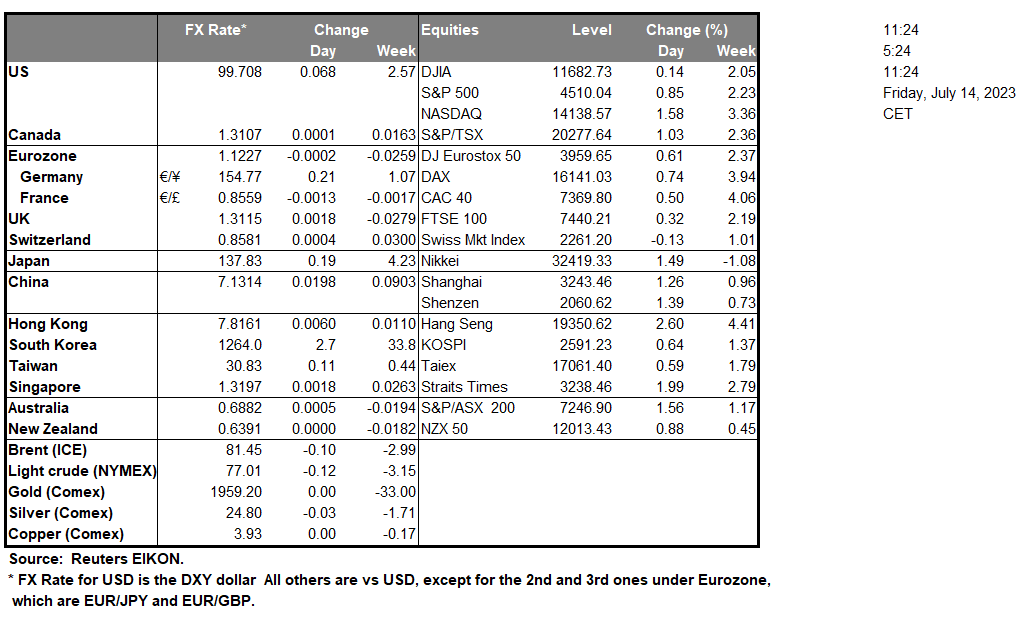

On the flip side, US stock markets sent some mixed signals yesterday as Dow Jones edged lower, while S&P 500 and Nasdaq ended their day in the greens. We expect market attention to turn towards the earnings releases today, especially the JP Morgan (#JPM), Wells Fargo (#WFC), and City Group (#C), all being big US banks. The releases are expected to also show a more general view of the US banking sector’s health.

As for precious metals, we note that gold seems about to end its best week since last April, benefitting from the USD’s weakening and we expect the negative correlation of the USD with gold to be present in the coming week as well. Oil prices also continued to be on the rise as worries for a tight supply side of the commodity and an improved demand outlook seem to provide the necessary boost to WTI’s price.

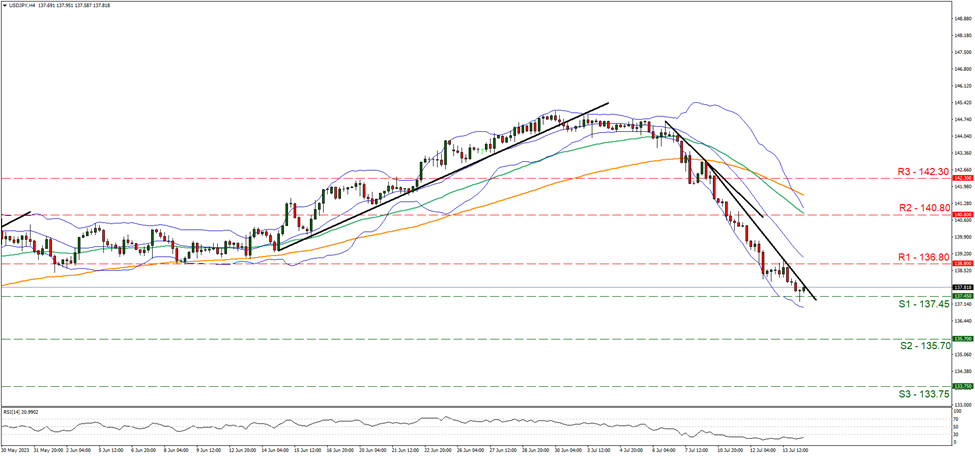

Starting with the JPY, USD maintained yet eased its downward motion, allowing for USD/JPY to find some support at the 137.45 (S1) level. We tend to maintain or bearish outlook given that the downward trendline was just shifted to the right, yet highlight the possibility of a stabilisation of the pair. The RSI indicator remains below the reading of 30, highlighting the bearish sentiment in the market, yet may also imply that the pair may be in oversold territory and thus set for a correction higher. Should the bears maintain control over the pair, we may see USD/JPY breaking the 137.45 (S1) support line and aim for the 135.70 (S2) support level. For a bullish outlook, we would require the pair to reverse direction, break the prementioned downward trendline in a first signal that the downward movement has been interrupted, breach the 136.80 (R1) resistance line and aim for the 140.80 (R2) resistance base.

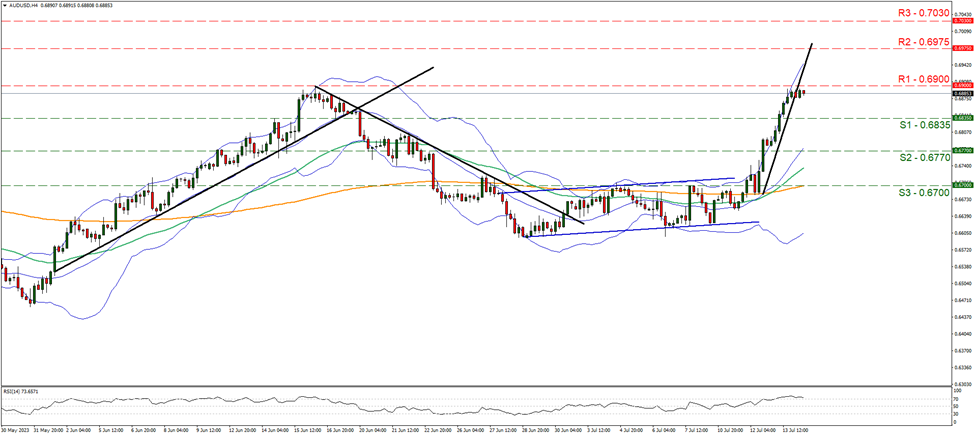

Against the AUD the greenback seems to have found more difficulties as AUD/USD looks as if it hit a ceiling at the 0.6900 (R1) resistance line. As the upward trendline has been broken we switch our bullish outlook temporarily in favour of a sideways motion bias, yet note that the RSI indicator remains above the reading of 70 implying that the bullish sentiment is still present and may push the pair higher. Should the bulls take over once again, we may see AUD/USD breaking the 0.6900 (R1) resistance line and aim for the 0.6975 (R2) resistance level. Should the bears take over, we may see AUD/USD dropping with the bears’ first target being the 0.6835 (S1) support line while even lower we note the 0.6770 (S2) support level.

その他の注目材料

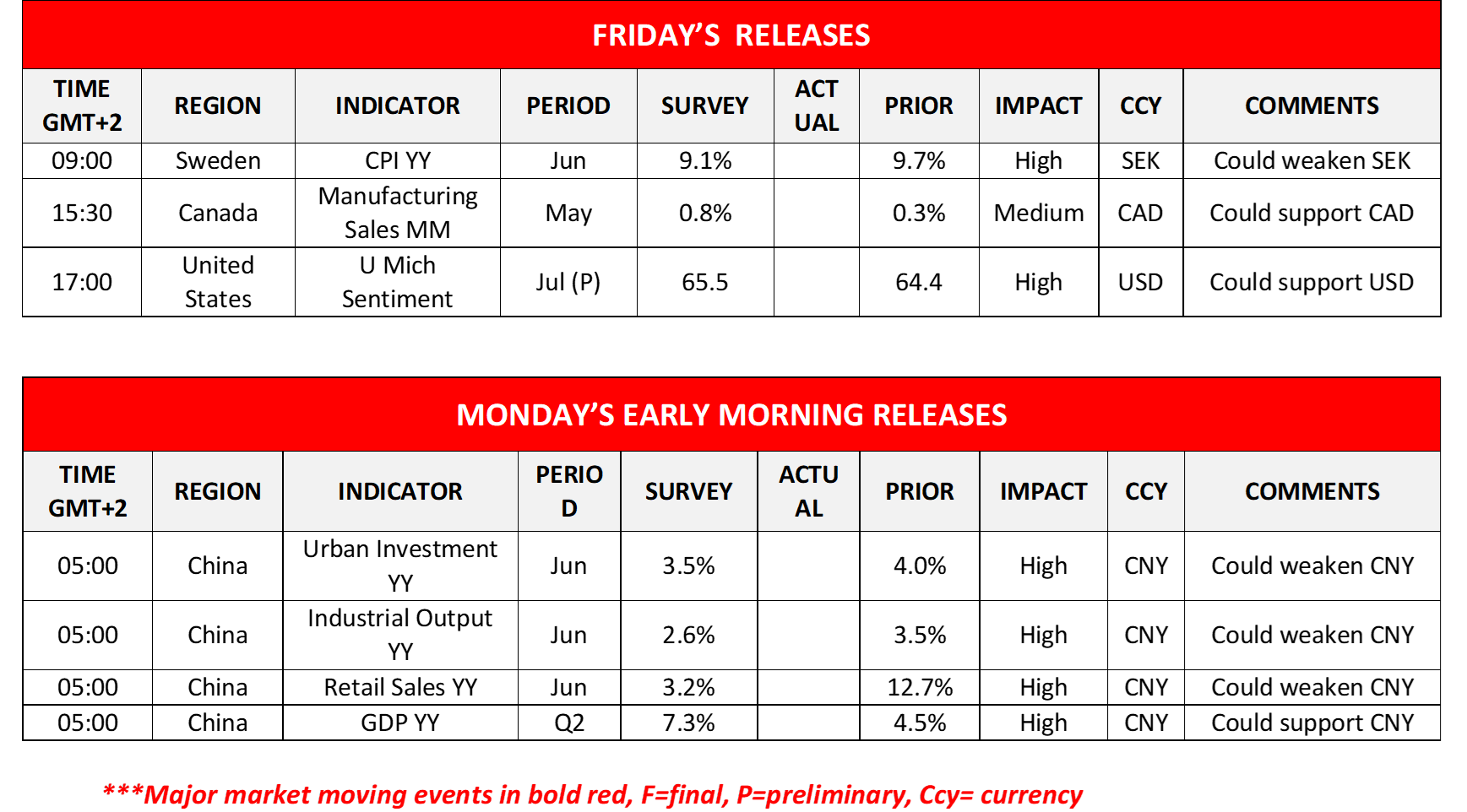

During today’s European session, we note the release of Sweden’s CPI rates for June, while in the American session, we note the release of Canada’s manufacturing sales for May and from the US the preliminary University of Michigan consumer sentiment for July. During Monday’s Asian session, we highlight the release from China of the Urban investment, retail sales and industrial output growth rates, all being for June as well as the GDP rate for Q2.

AUD/USD 4時間チャート

Support: 0.6835 (S1), 0.6770 (S2), 0.6700 (S3)

Resistance: 0.6900 (R1), 0.6975 (R2), 0.7030 (R3)

USD/JPY 4時間チャート

Support: 137.45 (S1), 135.70 (S2), 133.75 (S3)

Resistance: 136.80 (R1), 140.80 (R2), 142.30 (R3)

この記事に関する一般的な質問やコメントがある場合は、次のリサーチチームに直接メールを送信してください。research_team@ironfx.com

免責事項:

本情報は、投資助言や投資推奨ではなく、マーケティングの一環として提供されています。IronFXは、ここで参照またはリンクされている第三者によって提供されたいかなるデータまたは情報に対しても責任を負いません。